Texas property tax law changes every few years. See the latest posts for the most up-to-date information.

One of your most important rights as a taxpayer is your right to protest the appraisal review board (ARB). You may protest if you disagree with the appraisal district value or any of the appraisal district’s actions concerning your property.

If you are dissatisfied with the ARB’s findings, you have the right to appeal the ARB’s decision. Depending on the facts and type of property, you may be able to appeal to the state district court in the county in which your property is located; to an independent arbitrator; or to the State Office of Administrative Hearings (SOAH).”

– Texas State Comptroller’s Office

We have all heard the old saying that the only two certainties in life are death and taxes. Well, when it comes to property taxes in Texas, they aren’t so certain after all. You don’t have to accept the property’s appraised value: you have a thirty-day window in which you can protest it and potentially reduce your tax debt.

This begs the question: when does a Texas property tax protest have to be resolved – and how can you do it?

When Does A Texas Property Tax Protest Have to be Resolved?

Understandably, many homeowners contemplating protesting their property tax appraisal have several common questions. But before we address those questions, it is essential to first understand how your property value is determined.

How is My Tax Bill Calculated?

In Texas, property taxes are determined at the county rather than the state level. Two factors impact the taxes: the taxable value of your property and the local tax rate.

To determine the taxable value of your property, a county tax appraiser will work to determine a market value for your home. The term ‘market value’ refers to the amount they feel your home would sell for on the open market, based on the price of comparable homes that have been sold in the area recently.

Related: How to Protest Property Tax in Texas

Texas has 254 counties, and each county has its own tax rate. In Bexar County, for example, the tax rate is 1.97%, so if your home has an assessed value of $250,000, you will owe $4,925 in property taxes.

So you’ve decided to protest your tax rates – now what?

When to Appeal Your Property Tax

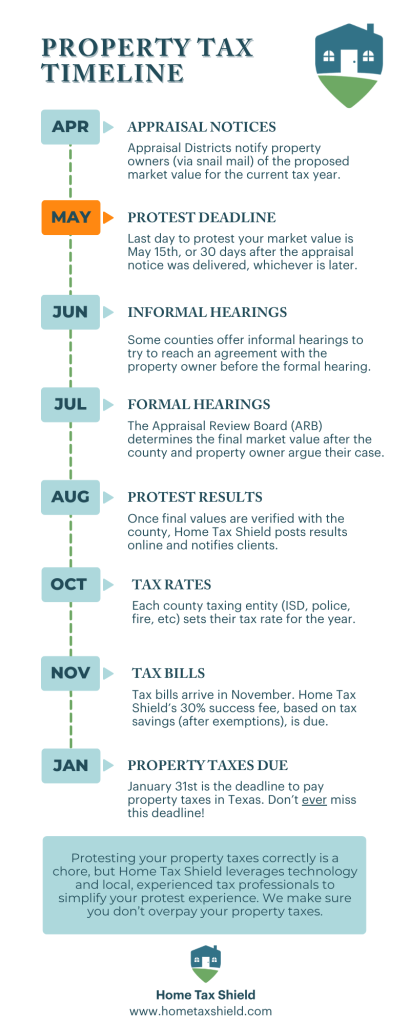

First, it is essential to find the answer to one of the most important questions in the process: when does a Texas property tax protest have to be resolved? For all counties in Texas, appeals filed before May 15 must be accepted. If your appraisal was mailed to you after April 15, you have 30 days from the date of mailing to file an appeal.

With this settled, you can move forward confidently on a solid timeline.

How to Prepare Your Property Tax Appeal

There are a few approaches that you can take to protest your property taxes.

The first is to go to the appraisal district and ask them to provide you with the evidence that went into determining your property’s assessed value. This should include the addresses and values of the comparable homes in the area. Once you have this information, you can research each property and begin making your case for why your property is not comparable to these.

Another approach is to put together a case that shows the current condition of your home and an estimated amount of any potential repairs. Be sure to include photos and estimates from contractors.

Alternatively, you can work with a local realtor and have them gather comparable sales in your area to support your claim. It is important to include home sales that extend a fairly long way back. For example, if your tax assessment comes out in February 2022, you should have your realtor pull the comparable listings dating back to January 1, 2021. Once you have the data for comparable sales in your area, you’ll need to adjust that information based on your square footage, the year your home was built, additional structures on your property, etc.

Are There Any Potential Risks Involved With Protesting My Property Taxes?

One of the biggest concerns that homeowners have when it comes to fighting their property taxes is fear that their home’s value will decrease if they are able to determine a lower assessed value. If they intend to sell their home in the next year, some might worry that it will be harder to get top dollar if the assessed tax value is lower than the amount they want to list their home for.

The good news is that recent sales determine your home’s value in the area for similar properties. The assessed value of your home ultimately has nothing to do with the sales value. It may actually benefit you more since you will be paying lower taxes on the sale as well.

Related: Texas Property Tax Appeal Steps

Another common concern homeowners have is whether protesting their property tax could backfire and cause their taxes to increase as a result. In fact, the appraisal district does not have the authority to raise your assessed value due to your property tax protest.

How to Protest Your Property Tax in Texas

Every state has its own property tax laws and processes. In Texas, you need to follow these four steps.

Step 1 – File a Protest

The first thing you need to do is file a protest with the appraisal district. You must complete this as soon as you receive your tax assessment notice because you only have thirty days to do so.

You can do this by heading over to your county’s website and browsing the property tax resource section. There you will find a form called a Texas Property Tax Appeal. Fill out the form and submit it to the appraisal district. When you do this, be sure to indicate why you are protesting your property tax assessment.

Step 2 – Request Your Property’s Record Card

Every property in your county will have a record card that the appraisal district has assessed. It is within your rights to request this card so that you can verify the property details that the county has on file for your home. It is important to obtain this information so that you can determine whether there are any discrepancies between what the appraisal district has listed for your property and what it actually contains. The record card will list lot size, home size, property features, and amenities.

Requesting a copy of your record card will need to be done in person at the appraisal district’s office, and you may have to pay a small fee. Have the basic details of your property with you when you go. In many counties, you can also access this information online.

Discrepancies in your record card provide a powerful case to protest your assessed value. It is more common than you might think for the appraisal district to have misinformation regarding property details, especially when it comes to home improvements and land improvements that will affect a home’s value.

Step 3 – Determine Your Property’s Real Value

Spend some time working with your local realtor to determine comparable sales in your area dating back to the first of the prior year. Gather data on these listings to make a case for why your home should be valued at a lower amount. Meet with contractors, take photos of repair work that needs to be done, and determine a total dollar amount of the necessary repairs.

When it comes to granting reductions in property tax assessments, most appraisal districts categorize them into four different approaches: Sales Comparison Approach, Income Approach, Cost Approach, and in some cases, Uniform and Equal Approach. Research these four approaches and determine which one is the best for you. Be sure to adjust the data to fit your property details.

Step 4 – The Legal Process

After the district appraisal office has received your request, they will notify you of the date and time for an informal hearing. When you appear for your hearing, you will meet with a staff appraiser from the district appraisal office to hear your plea for a reduction in taxes.

This hearing is relatively short (15 or so minutes), and the appraiser will let you know whether they can make an adjustment and lower your assessment. If they can adjust, they will present you with an offer of a lower assessed value and a revised tax amount. The majority of property tax protests are handled with an informal hearing.

In more complex cases, an appraisal review board hearing or formal ARB hearing may take place. Three appraisal review board members, a staff appraiser from the appraisal district, a hearing clerk, and the property owner or their agent may be present. The property owner and the district’s appraiser will present evidence to support their claims on the property’s actual market value. Because the ARP hearing is at a different time, you may need to participate in two separate hearings.

Once both sides have presented their cases, the board will conclude. Their decision is not open for negotiation. Although it is final, you may appeal their decision by filing a lawsuit against the county appraisal district in Texas district court. Always keep the timeline in mind – make sure you have answered the question: when does a Texas property tax protest have to be resolved?

Should You Seek the Help of a Professional?

While it is possible to protest your property taxes on your own, professional help is available. An experienced property professional can work with you to build a case to improve the likelihood of walking away with a reduced tax bill.

There are several advantages of working with a professional. Firstly, the hassle, headache, and stress that comes with protesting your property taxes are diminished. It just takes a few minutes of your time to provide some basic information so that your professional team can get started. You can relax and sit back while professionals do all the work.

Secondly, the decision of a property tax appeal is only valid for the year in question. With a professional team behind you, you’ll not have to worry about when to file your Texas property tax protest each year – the experts will prepare everything for you in plenty of time.

Is Working with a Professional Expensive?

At Home Tax Shield, we have some of the lowest rates in the industry. Our annual fee is $30, and we will retain 30% of your tax savings. Working with us offers a much higher success rate than protesting taxes on your own, and we can typically get you a much higher reduction in taxes.

Head over to our website to hear first-hand from our clients how Home Tax Shield has helped them save each year.