Texas homeowners can reduce their property tax bills by appealing tax appraisal values through a structured protest process.

- File by the deadline: Submit Form 50-132 by May 15 or within 30 days of receiving your appraisal notice.

- Gather strong evidence: Collect comparable sales data, repair estimates, and documentation of property condition issues.

- Attend hearings: Present your case at informal meetings and formal ARB hearings to dispute overvaluations.

- Consider professional help: Property tax services often achieve better results than self-representation and handle the entire process.

Texan property owners are receiving incredibly high property tax bills, with Texas having among the highest property taxes in the nation and homeowners paying a median of $2,275 annually. Each fall, property tax bills are sent out by local tax assessors based on market values determined months earlier. But the property tax process doesn’t start when you receive your bill in October. Instead, the appraisal district calculates your property’s market value as of January 1st, and you receive notice of the appraised value in the spring.

It’s too late to protest or appeal the amount when you open your property tax bill in the fall. Instead, you need to know how to appeal property taxes in Texas in the spring while you can still dispute the appraisal district’s valuation of your home.

This comprehensive guide will discuss how to appeal property taxes by disputing the appraisal value. When you keep this number fair and accurate, you can see a reduced bill in the fall and build on those savings over the years.

Why Should You Know How to Appeal Property Taxes in Texas?

The right of property owners to appeal their property taxes is established in the state constitution. You have the right to fair taxation and to protest the appraisal district’s decisions if you believe the appraisal value is unfair or inaccurate. Learning how to appeal property taxes in Texas and completing the protest steps every year offers you significant benefits:

- Don’t rely on just your homestead exemption: Eligible primary residences can have a homestead exemption, which caps the taxable assessment value of your home. If your home is appraised at more than 10% above last year’s rate, the county tax assessors can only consider a maximum 10% increase. But homestead exemptions aren’t always permanent. Don’t let your tax appraised value skyrocket behind the scenes; your taxes will be based on that high appraisal value if the exemption disappears, ensuring a 10% increase per year.

- Keep the tax appraised value low on non-homesteaded properties: If you have a second home, a rental property, or commercial property, it won’t be eligible for a homestead exemption. Appealing the tax appraised value directly affects your tax bill’s total. By law, filing an appeal will never increase your property’s value; it can only lower it.

- Protesting benefits the whole neighborhood: When your property’s tax appraised value goes down due to your appeal, your neighbors can use your lowered number as evidence for why their home’s tax appraised value should go down. In turn, you can use their numbers. Year after year, this cooperative approach reduces bills for the whole neighborhood.

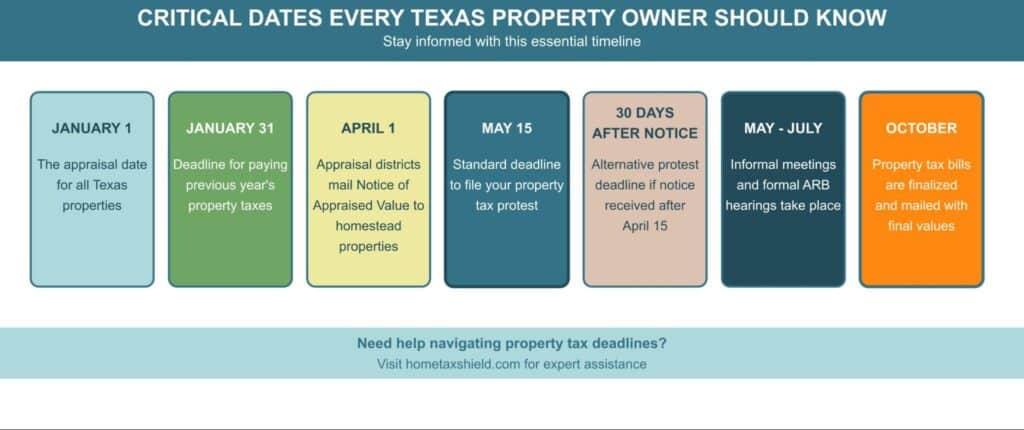

Which Dates Are Important in the Texas Property Tax Protest Calendar?

Successfully appealing property taxes in Texas requires understanding the annual timeline that governs the entire process. Missing key dates can cost you the opportunity to reduce your tax burden for an entire year.

Here are the critical dates every Texas property owner should know:

January 1: The tax appraisal date for all Texas properties. Your home’s condition, improvements, and market factors as of this date determine your tax appraised value for the year.

January 31: Typical deadline for paying the previous year’s property taxes, though some counties offer early payment discounts or installment options.

April 1: Deadline (or as soon as possible thereafter) for appraisal districts to mail Notice of Appraised Value letters to homestead properties (May 1 for non-homestead properties).

May 15: Standard deadline to file your property tax protest. This is your last chance to dispute your tax appraised value for the current tax year.

30 Days After Notice: If you receive your appraisal notice after April 15, you have 30 days from the mail date (not receipt date) to file your protest.

May through July: Informal meetings and formal ARB hearings take place during this period.

July 20: Most ARB hearings must be completed by this date, though some districts may extend deadlines.

October: Property tax bills are mailed based on the final tax appraised values after all protests are resolved.

Understanding this timeline helps you prepare early and ensures you don’t miss critical deadlines that could affect your property tax protest success.

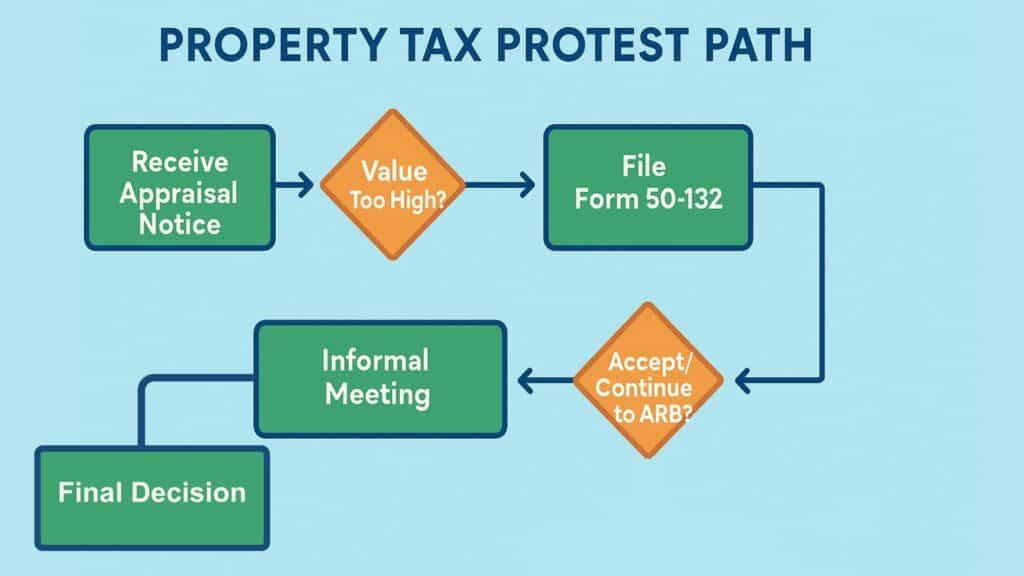

How Do You Appeal Property Taxes in Texas?: The Complete Guide

The Texas Comptroller outlines the basic steps of appealing property taxes, and individual counties or municipal governments manage and oversee the appeals. Before diving into the process, it’s important to decide whether you’ll handle the appeal yourself or hire professional representation. This decision matters because property tax companies cannot join your case after the initial protest deadline, so choosing professional help must happen early in the process.

If you want to appeal your property taxes on your own, stay vigilant in the spring and follow these protest steps:

Step 1: File a Form 50-132 Notice of Protest

Whether you receive a Notice of Appraised Value in the mail or check your new tax appraised value online, you might see the figure and think it’s wildly inaccurate. Even if it’s off by just a few thousand dollars or looks fairly reasonable, appealing the amount matters for your final tax bill.

File an appeal with your local county and appraisal district. Typically, this form and instructions are included with your appraised value notice but can also be readily found online. It’s essential to file the appeal by the due date. In Texas, all counties are required to accept requests until May 15th, or 30 days after the notice is sent.

Complete and Submit Form 50-132 to Your Local Appraisal District

Download a copy of Form 50-132, Notice of Protest, or request a paper copy from your local government. Most Texas counties now offer multiple filing options:

- Online filing: The fastest and most convenient method, available in most major counties

- Mail submission: Send completed forms via certified mail with return receipt

- In-person filing: Drop off forms at your local appraisal district office

- Email submission: Some districts accept electronic submissions

When completing the form, add your personal and property details, explain your reason for protest, and specify how you want the hearing process to proceed. For residential properties, checking “incorrect appraised value and/or unequal appraisal” preserves your full appeal rights and allows you to present the widest range of evidence.

Do Research to Support Your Countervaluation

You’ll need to support your case for a lower appraised home value with compelling evidence. Here are several effective approaches:

- Gather comparable sales data: Every Texan has a right to fair and equal taxation. Find comparable houses in your neighborhood with similar lot sizes and square footage, and compare their appraisals. However, you must adjust comparables for differences between properties. Simply comparing raw values (or using unreliable website data to draw your comparisons) can hurt your case. Tax protest professionals with licensed access to property databases can generate reports on this data, filter them to include only comparable homes, adjust the values based on a wide variety of key property factors, and present summaries to guide appeal efforts.

- Document property condition issues: Perhaps your home’s condition isn’t reflected in the county’s appraisal. Is your home older than most homes in your neighborhood? Does it need significant repairs? Get estimates! Those hard numbers from contractors for structural work, foundation repairs, or roof replacement are excellent evidence for your protest. However, note that cosmetic improvements like paint or landscaping don’t typically affect appraisal values.

Step 2: Keep an Eye Out for Counteroffers and Hearing Information

Your appraisal district will reach out via email, text, or letter to confirm a hearing date. You may also receive a counteroffer through their online portal or by mail. If the appraisal district thinks your protest is reasonable, they may lower your tax appraised value to your requested amount or offer a “middle ground” value. You can choose whether to accept this amount or continue to the hearing to pursue a lower value.

Many counties now provide online portals where you can track your protest status, review the district’s evidence, and respond to settlement offers electronically.

Step 3: Schedule a Meeting With the Appraisal District

Before the formal hearing, you or the appraiser may request an informal meeting. This opportunity allows you to discuss the particulars of your property and the evidence on both sides. Many property tax cases are resolved during this informal process, helping property owners avoid the need for formal hearings.

During the informal meeting, be prepared to present your evidence clearly and professionally. Many property owners find success at this stage, avoiding the need for a formal hearing.

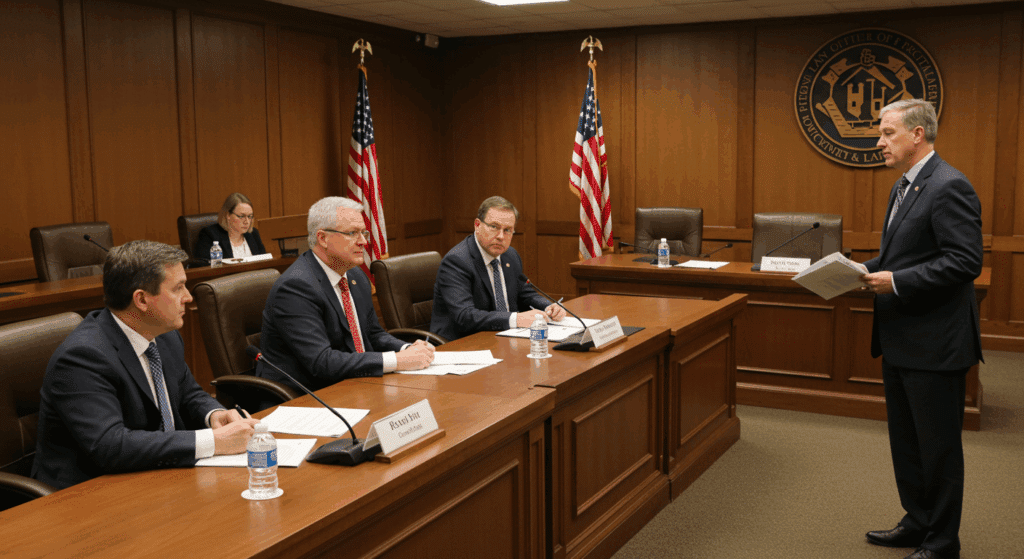

Step 4: Show Up at Your Hearing With Plenty of Documentation

Show up at your formal ARB hearing with time to spare, and be ready to present your case in front of the appraiser (who will present their arguments), the appraisal review board (that will make a final decision), and a potential audience of other property owners waiting to make their case.

To support your case, bring plenty of copies of your evidence, including professional repair estimates, supporting photographs, adjusted comparables, and additional information. Prepare at least five copies: one for each of the three ARB members, one for the district representative, and one for yourself.

The hearing typically lasts 15 to 30 minutes, and you should stick to factual evidence rather than emotional arguments. The ARB cannot control tax rates or district budgets; they can only determine fair market value based on the evidence presented.

At the end of the hearing, the appraisal review board will determine your new appraisal value. If you are still unsatisfied with the amount, there are additional appeal options available.

What Are Advanced Appeal Options Beyond the ARB?

If you’re dissatisfied with your ARB results, Texas law provides some additional appeal pathways:

- District Court Appeal: You can appeal any ARB decision to the state district court in the county where your property is located. This option is available for all property types and protest grounds.

- State Office of Administrative Hearings (SOAH): For properties valued over $1 million by the ARB, you may appeal to SOAH, which can be faster and less expensive than the district court.

- Binding Arbitration: Available for market value and unequal appraisal determinations, arbitration can be a cost-effective alternative to court proceedings.

Each appeal option has specific deadlines, fees, and requirements. You typically have 60 days from receiving the ARB’s written order to file further appeals, and you must pay your disputed taxes before the delinquency date.

How Do You Appeal Property Taxes in Texas Using a Representative?

If navigating the process seems overwhelming or time-consuming, there are two ways you can still appeal your property taxes without directly managing each step:

#1: Appoint a Representative

By filing Form 50-162, Appointment of Agent for Property Tax Matters, you can designate someone else as your representative. They can file the protest form on your behalf and present arguments. This is a valuable option if you or a family member doesn’t speak English, won’t be able to take time off to attend the hearing, or has health issues that can interfere with your ability to participate fully.

#2: Hire a Professional Service to Represent You and Handle the Entire Process

Professional property tax services can manage the entire process for you and potentially achieve better results than self-representation. Leading services combine technology with experienced, licensed professionals who average 18-22 years in the industry. The best companies protest every property regardless of the perceived chance of success.

Depending on the company you choose, they can:

- File the protest form and manage all deadlines

- Use sophisticated data analysis to calculate what your property’s market value should be based on local data and records

- Manage communications with the appraisal district through online portals

- Provide experienced, local, and licensed professionals to represent you in hearings

- Manage the process every year for maximum cumulative savings

Choosing a company with proven technology, experienced professionals, and a track record of success can secure larger reductions due to their knowledge of valuation methods, legal requirements, and negotiation experience. That said, it’s difficult for a property tax protest professional to join the process after the initial protest deadline, so it’s important to make this decision early in the protest calendar.

Essential Tips for a Successful Property Tax Appeal

Based on current best practices and recent changes to Texas property tax law, here are key strategies for success:

- Start early: Begin gathering evidence as soon as you receive your appraisal notice. Don’t wait until the deadline approaches.

- Focus on January 1st conditions: Remember that your property is appraised based on its condition on January 1st. Improvements or damage after that date shouldn’t affect the current year’s appraisal.

- Use proper comparable sales: Ensure any comparable properties are truly similar and make appropriate adjustments for differences in size, age, condition, and location. Property tax protest professionals analyze sales comps by over 40 factors.

- Document everything: Take photos, keep receipts, and maintain records of any property issues or repairs needed.

- Be professional: Stick to facts and avoid emotional arguments about your financial situation or opinions about tax policy.

- Consider the long-term impact: Successful protests create a lower baseline for future appraisals, leading to compounding savings over time.

Frequently Asked Questions

Q: What happens if I miss the May 15th deadline to file my protest? A: In almost every case, you lose your right to protest for that tax year. While Texas law technically allows late protests for “good cause,” these exceptions are extremely rare and difficult to prove. Once the ARB approves the appraisal records (typically in July), no late protests are accepted under any circumstances. Missing the deadline means you’ll pay the full assessed amount for that year, which is why it’s critical to file your protest on time.

Q: Can I protest my property taxes every year? A: Yes, and you should. You can file a protest annually regardless of whether you think your appraisal looks reasonable or not. Every year brings different market conditions, and protesting annually ensures your tax appraised value stays as low as possible. This creates compounding savings over time, as each successful protest establishes a lower baseline for future years. Many savvy property owners make protesting an automatic annual practice to maximize their long-term tax savings.

Q: Will protesting my taxes ever result in a higher appraisal value? A: No, Texas law prohibits the ARB from increasing your property value as a result of your protest. The worst case scenario is that your value remains unchanged.

Q: How long does the entire protest process take? A: From filing your initial protest to receiving a final determination typically takes 2–4 months. Most informal meetings occur within 4–6 weeks of filing, and formal hearings are usually scheduled within 6–8 weeks.

Take Control of Your Property Tax Bill Today

At Home Tax Shield, we combine cutting-edge technology with experienced local tax professionals to help homeowners across Texas achieve an 83% success rate in reducing property taxes. Our data-driven approach and human expertise ensure every property gets the attention it deserves, at a cost that’s 40% less than traditional services. We handle Form 50-132 filing, evidence preparation, and representation at hearings, ensuring you get the best possible outcome. Get started today to protect your property tax rights and potentially save hundreds on your annual tax bill.