Key Takeaways:

Texas property tax increase limits provide crucial protection against volatile market swings through multiple mechanisms.

- Homestead cap limits taxable value increases to 10% annually for primary residences

- New circuit breaker limitation caps non-homestead properties at 20% increases through 2026

- Current $100,000 homestead exemption may increase to $140,000 under proposed 2025 legislation

Both caps work independently of market value fluctuations to stabilize tax bills

Rising property values across Texas have left many homeowners wondering about protection against skyrocketing tax bills. While your home’s market value might surge 20% or more in a single year, the limit on property tax increase in Texas system provides essential safeguards through homestead caps and exemptions. Understanding these protections can save thousands of dollars annually and provide predictable tax planning for years ahead.

The Texas property tax system operates through multiple layers of protection designed to prevent sudden tax bill spikes. These include the traditional 10% homestead cap, new circuit breaker limitations for investment properties, and significant exemption amounts that reduce your taxable value before any caps apply.

How Does the Limit on Property Tax Increase in Texas Actually Work?

The foundation of property tax protection in Texas starts with understanding how limits interact with appraisals and exemptions. Tax Code Section 23.23(a) sets a limit on the amount of annual increase to a residence homestead’s appraised value to not exceed the lesser of the fair market value or a 10% increase from the previous year’s appraised value.

Here’s the critical distinction many homeowners miss: your county appraisal district still determines your property’s full market value each year. The homestead cap doesn’t change that number—it limits how much of that value can be used for tax calculations.

Consider this example from Austin’s booming real estate market: Your home was valued at $400,000 last year but appraises for $500,000 this year due to neighborhood development. Without protection, your assessed value jumps 25%. With the homestead cap, your assessed value can only increase to $440,000—a manageable 10% rise that provides significant tax savings.

The tax increase cap works by creating two separate values on your property record: tax appraised value (what the county appraisal district determines your home could sell for) and assessed value (what you actually pay taxes on after exemptions and caps). The assessed value represents the amount actually used for tax calculations, which may be significantly lower than tax appraised value in appreciating areas.

This protection becomes more valuable over time through compounding effects. After five years in a rapidly appreciating market, the difference between market value and capped taxable value can exceed $100,000, translating to thousands in annual tax savings.

What Recent Legislative Changes Expanded Tax Increase Protections?

Texas lawmakers recognized that homestead caps alone weren’t sufficient protection in today’s volatile real estate market. Beginning in 2024, real property valued at $5 million or less benefits from a 20 percent circuit breaker limitation on the net appraised value of the property used to calculate property taxes.

This circuit breaker limitation represents a significant expansion of the limit on property tax increase in Texas protections to non-homestead properties. Investment properties, second homes, and rental properties now receive their own version of appraisal limits, capping annual increases at 20% through 2026.

The 2025 legislative session has brought additional changes that could dramatically impact homeowner savings. Senate Bill 4, which increases the Homestead Exemption to $140,000, and $150,000 for seniors, builds on last session’s historic success. If approved by voters in November 2025, this constitutional amendment would provide an additional $40,000 in exemption value.

These changes work together to create multiple layers of protection:

- Primary residences: 10% annual cap plus up to $140,000 exemption (if SB4 passes)

- Investment properties: 20% annual cap for properties under $5 million

- Senior homeowners: Additional exemption amount and enhanced protections

- All properties: Right to protest appraised values annually

Property investors and people with more than one home will save on property taxes because the cap will curtail steep increases in the property’s tax bill. The average homeowner is expected to see nearly $500 in annual savings when combining exemption increases with tax rate compression measures.

What Are the Different Types of Appraisal Limits in Texas?

Texas now operates three distinct systems for limiting property tax increases, each serving different property types and ownership situations. Understanding which applies to your properties ensures you’re maximizing available protections.

Homestead Exemption and Cap

The traditional homestead protection remains the strongest for primary residences. For residence homesteads, the annual increase is limited to 10% more than the previous year’s appraised value (plus any new improvements). This cap takes effect January 1st following the year you qualify for the homestead exemption.

The exemption itself removes $100,000 from your home’s value when calculating school district taxes—typically the largest component of your tax bill. Combined with the 10% cap, homestead properties receive comprehensive protection against both absolute tax amounts and year-over-year increases.

Circuit Breaker Limitation for Non-Homestead Properties

The circuit breaker limitation addresses a long-standing gap in Texas property tax law. Previously, investment properties faced unlimited annual increases, leading to situations where rental property taxes doubled or tripled in hot markets.

Property owners don’t need to apply for circuit breaker protection—it automatically applies to eligible properties. The 20% cap applies to the net appraised value after accounting for any improvements or changes to the property.

Agricultural and Special Use Limitations

Agricultural properties operate under entirely different valuation methods that can provide even greater protection. These properties are taxed based on agricultural productivity value rather than market value, often resulting in dramatically lower tax obligations for qualifying land.

Why Does Tax Appraised Value Versus Assessed Value Matter for Your Tax Bill?

One of the most misunderstood aspects of limit on property tax increase in Texas laws involves the relationship between tax appraised value and assessed value. Per the Texas Property Tax Code, all taxable property must be valued at 100% of market value as of January 1 each year.

Your tax appraised value reflects what the county appraisal district believes your property could sell for under current conditions. This number can fluctuate significantly based on comparable sales, market demand, and neighborhood improvements. The tax appraised value appears on your notice as the starting point for all tax calculations.

Assessed value, however, represents the amount actually used to calculate your tax bill after exemptions and caps are applied. This is the net appraised value minus any exemption amounts and subject to applicable caps. It is the final value used to calculate your property taxes for each taxing unit. This distinction becomes crucial when protesting property taxes or planning tax strategies.

Consider two identical homes in the same neighborhood:

- Home A: Tax appraised value $500,000, assessed value $400,000 (protected by homestead cap and exemptions)

- Home B: Tax appraised value $500,000, assessed value $500,000 (no exemption filed)

Home A’s owner pays taxes on $400,000 while Home B’s owner pays on the full $500,000—a significant difference in annual tax liability.

The gap between tax appraised value and assessed value typically widens over time in appreciating markets. This creates both opportunities and risks. If you maintain homestead status, the growing gap represents increasing savings. However, if you lose homestead eligibility by moving or converting to rental use, your taxes jump to the full tax appraised value immediately.

How Do Real-World Examples Show Cap Protection Against Market Volatility?

Real-world examples demonstrate how limits on property tax increase in Texas regulations work across different market scenarios. These cases show both the benefits and limitations of current increase limits.

Scenario 1: Austin Tech Corridor Appreciation

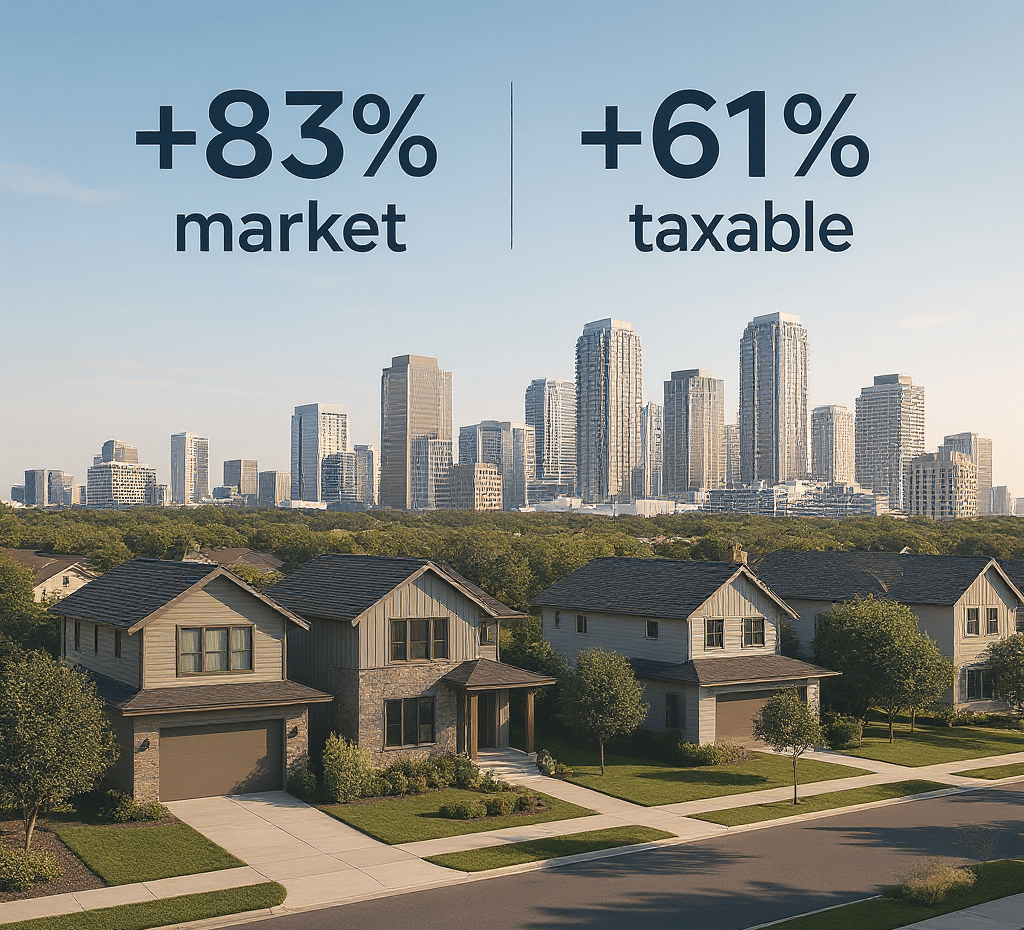

Sarah bought a home in East Austin for $300,000 in 2020. By 2025, similar homes sell for $550,000—an 83% increase over five years. Without protections, her taxes would have increased proportionally. With homestead exemption and cap:

- 2020: $300,000 assessed value

- 2021: $330,000 (10% cap applied)

- 2022: $363,000 (10% cap applied)

- 2023: $399,300 (10% cap applied)

- 2024: $439,230 (10% cap applied)

- 2025: $483,153 (10% cap applied)

Her assessed value increased only 61% while tax appraised value rose 83%. The exemption further reduces school district taxes by $100,000, creating substantial combined annual savings.

Scenario 2: Investment Property Protection

Mike owns a duplex purchased for $200,000 in 2023. The 2025 appraisal shows $280,000—a 40% increase. Under the new circuit breaker limitation:

- Without protection: Assessed value jumps to $280,000

- With circuit breaker: Assessed value capped at $240,000 (20% increase)

The $40,000 difference provides meaningful annual tax savings, making the rental property more financially viable.

Scenario 3: Senior Homeowner Stability

Robert, 68, has lived in his Dallas home for 15 years. His property has an over-65 exemption that freezes school district taxes at the amount paid in the year he first qualified under Tax Code Section 11.13(c). As property values increased substantially since 2018, his school district taxes remained completely stable—protection worth thousands annually.

These examples illustrate how different caps work together to create predictable tax obligations even in volatile markets.

How Can You Maximize Benefits by Combining Exemptions with Protest Strategies?

The most effective approach to minimizing property tax increases combines statutory protections with active tax management. While caps limit increases, regular property tax protests can reduce the baseline values those caps apply to.

Essential steps for maximum protection include filing all applicable exemptions immediately, understanding your specific cap type, monitoring appraisal notices carefully, and protesting annually regardless of caps.

The interaction between protests and caps often confuses homeowners. Property owners may find that they reduce their property’s market value through protesting but don’t see immediate tax bill reductions due to existing homestead caps.

Even when protests don’t immediately reduce your tax bill due to caps, they provide several strategic advantages including lower recorded tax appraised value for future years, protection if you lose exemption status, reduced baseline for calculating future cap increases, and better positioning if property values decline.

What Are Common Misconceptions About Texas Property Tax Limits?

Several myths persist about how limit on property tax increase in texas mechanisms work, leading to missed opportunities and poor planning decisions.

Myth 1: “Caps prevent all tax increases”

Reality: Caps will limit increases to specific percentages, but this cap is on school taxes only, and taxes can still rise annually. A 10% increase every year doubles your tax bill over seven years.

Myth 2: “Tax appraised value doesn’t matter if I have a cap”

Reality: Tax appraised value becomes your tax basis if you lose exemption status. High tax appraised values with low assessed values create significant exposure.

Myth 3: “I don’t need to protest if I have a cap”

Reality: Protesting reduces the tax appraised value baseline that future caps build from, creating compounding benefits over time.

Myth 4: “New construction always breaks the cap”

Reality: Tax Code Section 23.23(f) states a replacement structure for one rendered uninhabitable or unusable by a casualty, wind or water damage is also not considered a new improvement. In certain situations, many renovations don’t impact caps.

Understanding these distinctions helps homeowners make informed decisions about property tax exemptions and protest strategies.

What Changed for 2025 and What’s Coming Next?

The 2025 tax year brought several important changes to how limits on property tax increases work across Texas. Property owners should understand both immediate impacts and proposed future changes.

Implemented Changes for 2025: Circuit breaker limitations are now fully operational for non-homestead properties, enhanced verification requirements exist for homestead exemptions, and standardized online protest systems operate across major appraisal districts.

Pending Legislation: The Texas Senate unanimously passed Senate Bill 4 and Senate Joint Resolution 2 on February 13, 2025, with the implementing legislation for the amendment. If approved in November 2025, this constitutional amendment would increase homestead exemption to $140,000 for all qualifying homeowners, provide additional $10,000 exemption for seniors (total $150,000), and take effect January 1, 2026 for the 2026 tax year.

Travis County and Other Appraisal District Updates: Major appraisal districts have modernized their processes for 2025. By filing online, you will receive an immediate confirmation that your protest has been filed. Additionally, you will be able to upload comments and evidence related to your protest, review evidence from the appraisal district, and accept/decline any settlement offer through your online account.

These technological improvements make it easier to monitor your property’s status and ensure all available protections apply correctly. Understanding how to maximize homestead benefits becomes increasingly important as the system evolves.

Frequently Asked Questions

Q: How long do homestead caps take to go into effect?

The limitation does not go into effect until the January 1 of the following year the property qualifies for the exemption. If you buy a home and qualify for exemption in 2025, the cap protection starts January 1, 2026.

Q: Can I lose my homestead cap if I make improvements?

The cap remains in place, but new improvements add value on top of the capped amount. If your capped value is $300,000 and you add a $50,000 pool, your new taxable value becomes $350,000.

Q: Do circuit breaker limitations apply automatically?

Yes, property owners don’t need to apply for circuit breaker protection. It automatically applies to eligible non-homestead properties valued under $5 million.

Q: What happens to caps if property values decline?

Caps don’t prevent values from decreasing. If market conditions push your property’s tax appraised value below the capped amount, you’ll pay taxes on the lower appraised value.

Take Action to Maximize Your Property Tax Protections

Understanding the limits on property tax increases in Texas provides the foundation for effective tax planning, but knowledge alone doesn’t guarantee savings. The most successful homeowners combine available exemptions with professional property tax protest services to ensure they’re paying only their fair share.While exemptions and caps offer crucial protection, your tax appraised value is where it all starts—and that’s where professional guidance makes the biggest impact. Don’t let an inflated appraisal undermine the benefits of your homestead cap or exemptions. Get started with Home Tax Shield today to ensure your property’s appraised value accurately reflects its true worth and maximizes the protection your caps and exemptions provide.