Homeowners can significantly lower property taxes in Texas through strategic exemptions, annual protests, and professional representation.

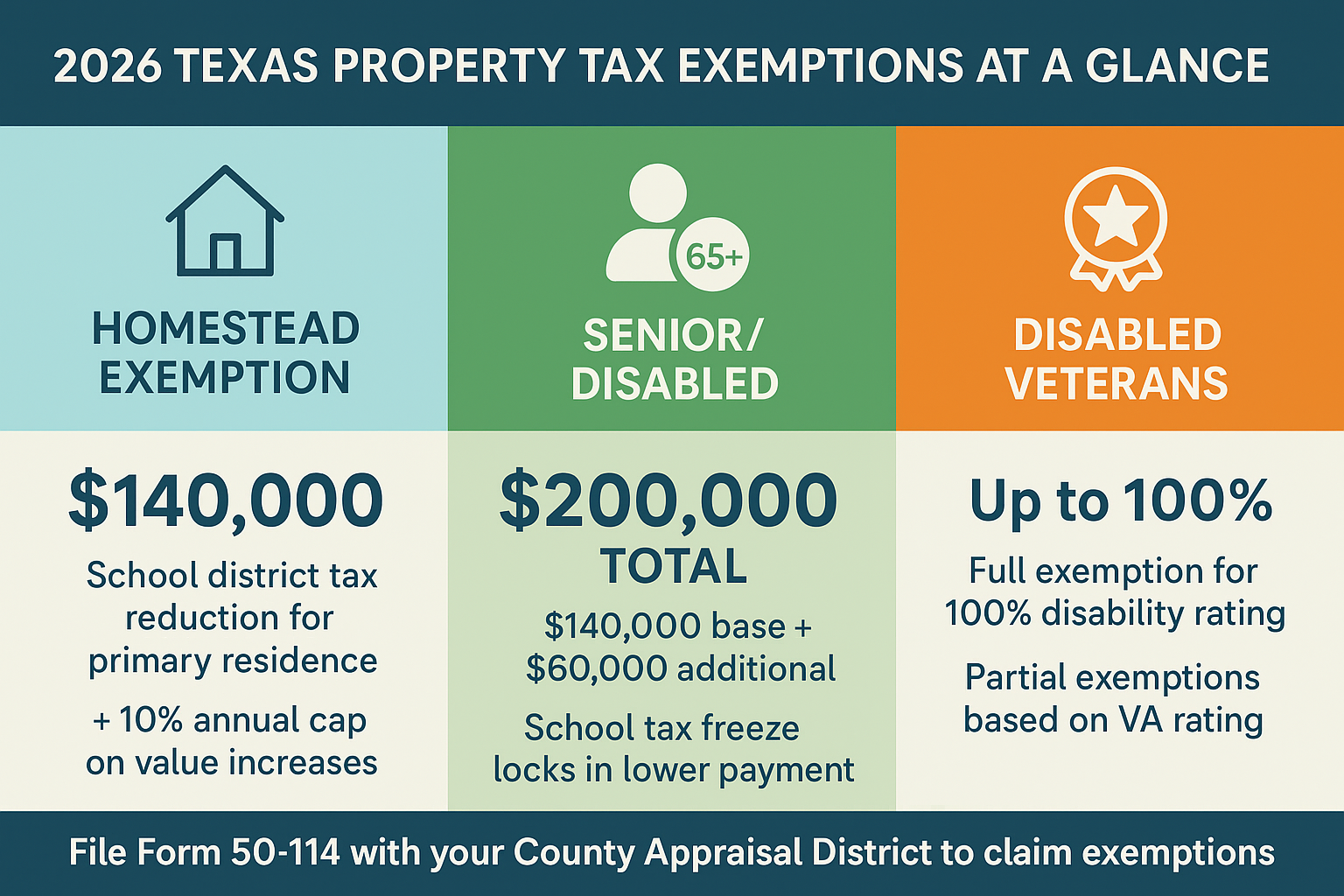

- The new $140,000 homestead exemption removes more of your home’s value from school district taxation than ever before

- Seniors and disabled homeowners now qualify for a combined $200,000 exemption, potentially eliminating school taxes entirely

- Annual property tax protests offer a risk-free opportunity to ensure you’re paying only what’s fair

- Professional representation achieves higher success rates while saving homeowners time and stress

Start by filing for every exemption you qualify for, then protest your property’s market value annually to maximize savings.

Texas homeowners face some of the highest property taxes in the nation, with the average effective rate reaching approximately 1.63% compared to the national average of 0.90%. Without a state income tax, local governments rely heavily on property taxes to fund schools, roads, and emergency services. Understanding how to lower property taxes in Texas has become essential for protecting your household budget and ensuring you never pay more than your fair share.

Recent legislative changes, including constitutional amendments passed by voters in November 2025, have dramatically expanded tax relief options. Whether you’re a first-time homeowner or have lived in your residence for decades, the right combination of exemptions and protest strategies can save you hundreds or thousands of dollars annually.

What Changed with Texas Property Tax Laws in November 2025?

Texas voters approved historic property tax relief in November 2025, increasing homestead exemptions and committing $51 billion to tax cuts over two years.

According to the Texas Tribune, the state’s property tax relief package represents one of the largest in American history. These changes took effect for the 2025 tax year, meaning homeowners see benefits on bills due January 31, 2026.

How Much Did the Homestead Exemption Increase?

Proposition 13 raised the mandatory homestead exemption for school district property taxes from $100,000 to $140,000. Every homeowner with a primary residence now has $140,000 of their home’s value completely exempt from school taxes. For the typical Texas home valued around $302,000, this translates to approximately $490 in annual savings on school property taxes alone.

What Are the New Benefits for Seniors and Disabled Homeowners?

Proposition 11 increased the additional exemption for homeowners age 65 or older and those with disabilities from $10,000 to $60,000. Combined with the standard homestead exemption, eligible seniors and disabled homeowners can now claim a total exemption of $200,000, as confirmed by Ballotpedia.

For seniors with homes assessed at $200,000 or less, the new combined exemption eliminates school district property taxes entirely. Those with higher-valued homes pay school taxes only on the portion exceeding $200,000.

How Are Texas Property Taxes Calculated?

Your Texas property tax equals your home’s market value, minus exemptions, multiplied by local tax rates.

The formula is straightforward:

(Property Market Value – Exemptions) × Tax Rate = Annual Property Tax

Your County Appraisal District (CAD) determines your property’s market value each January 1st using mass appraisal methods that evaluate thousands of properties simultaneously. While efficient, this approach frequently results in individual properties being overvalued due to inaccurate data, outdated comparisons, or failure to account for property-specific conditions like foundation issues or roof damage.

Tax rates come from multiple local entities. School districts typically represent the largest share, often accounting for half or more of your total bill. Counties, cities, and special districts each add their own rates to fund local services.

What Property Tax Exemptions Can Texas Homeowners Claim?

Texas offers multiple exemptions that reduce your taxable value, with the homestead exemption providing the largest benefit for most homeowners.

Taking advantage of every exemption you qualify for is the foundation of any strategy to lower property taxes in Texas. Exemptions reduce your taxable value before the tax rate is applied, creating immediate and ongoing savings.

What Does the General Homestead Exemption Provide?

The homestead exemption is available to any homeowner who occupies their property as a primary residence. Current benefits include:

- $140,000 reduction in value for school district tax calculations

- 10% annual cap preventing taxable value from increasing more than 10% yearly

- Optional local exemptions of up to 20% from cities, counties, and other taxing units

- $3,000 exemption in counties collecting farm-to-market or flood control taxes

The 10% cap protects homeowners in rapidly appreciating markets. Even if your home’s market value jumps 25% in a single year, your taxable value can only increase by 10%.

What Additional Exemptions Do Seniors and Disabled Homeowners Receive?

Homeowners age 65 or older, or those meeting disability criteria, qualify for enhanced benefits through Texas property tax exemptions:

- Additional $60,000 exemption for school district taxes (on top of the $140,000 base)

- School tax freeze that permanently locks your school taxes at the amount paid in your qualifying year

- Optional local exemptions of at least $3,000 from other taxing units

- Tax deferral options allowing postponement of payments without penalty

What Exemptions Are Available to Disabled Veterans?

Veterans with service-connected disabilities receive exemptions based on their disability rating from the U.S. Veterans Administration. Benefits range from partial exemptions of $5,000 to $12,000 for lower disability ratings, up to 100% exemption of the entire property value for veterans rated totally disabled or unemployable.

How Do You Protest Your Property Tax Appraisal in Texas?

File Form 50-132 by May 15 or within 30 days of receiving your appraisal notice, then present evidence that your property’s market value is too high.

While exemptions provide guaranteed savings, protesting your property taxes offers an additional opportunity to reduce your tax burden by challenging your property’s tax appraised value. The Texas Comptroller confirms that every property owner has the legal right to protest.

Why Should You Protest Every Year?

Annual protesting provides several advantages that compound over time:

- Mass appraisal limitations mean many properties are overvalued even without dramatic increases

- Successful protests establish lower baseline values that benefit you for years

- Appraisal districts cannot increase your value during a protest hearing, eliminating downside risk

- Even modest reductions of a few thousand dollars translate to meaningful savings

According to KSAT San Antonio, the Bexar Appraisal District settles approximately 90% of protests through informal conferences, with most homeowners receiving some reduction in their tax appraised value.

What Evidence Do You Need for a Successful Protest?

Strong evidence demonstrating your property is overvalued includes:

- Comparable (and properly adjusted) sales data from similar properties that sold for less than your appraised value

- Property condition documentation including professional repair estimates for issues like roof damage or foundation problems

The appraisal district bears the burden of proving their valuation is correct. When you present credible evidence of overvaluation, the burden shifts to them.

The 5 Best Ways to Lower Property Taxes in Texas

Combine exemptions with annual protests and professional representation for maximum savings.

- File for every exemption you qualify for – Apply with your county appraisal district using Form 50-114 for homestead exemptions. Don’t assume exemptions are automatic.

- Protest your market value annually – Consistent protesting prevents gradual overvaluation and ensures your assessed value reflects true market conditions.

- Check your property records for errors – Review your appraisal district’s data to ensure square footage, room counts, and property features are accurate. Contact the CAD directly to correct factual errors.

- Document property condition issues – Obtain professional estimates for roof damage, foundation problems, or other conditions affecting market value.

- Seek professional representation – Licensed tax professionals with local expertise often achieve better results than self-representation, particularly for formal ARB hearings.

Should You Protest Property Taxes Yourself or Hire a Professional?

DIY protesting works for homeowners with access to necessary data who are willing to invest significant time in research and preparation. Professional representation can make the process effortless and stress free.

Protesting yourself costs nothing beyond your time, but it does require 6-12 hours researching comparable sales, gathering evidence, and preparing your case. Some of the information you’ll need isn’t publicly available. Data from popular real estate websites is not reliable and will not be accepted by the ARB. In addition to accurate data, you’ll want to ensure you’re comfortable with formal proceedings since ARB hearings follow specific procedures where county appraisers have significant experience advantages.

Professional representation brings overall expertise that may result in larger reductions. Licensed property tax professionals have deep market knowledge, access to comprehensive sales databases, and experience presenting cases effectively.

Frequently Asked Questions About Lowering Texas Property Taxes

Can I lower my property taxes if I already have a homestead exemption?

Yes. Exemptions and protests work together as complementary strategies. Your homestead exemption reduces the taxable portion of your home’s value, while protesting challenges the market value itself. Both should be used annually for maximum savings.

Should I protest if my property value decreased this year?

Yes. Even when market values decline, appraisal districts sometimes fail to reduce their valuations accordingly. Protesting ensures your assessed value reflects current market conditions rather than outdated assumptions.

Do I need to reapply for my homestead exemption every year?

No. Homestead exemptions remain in effect indefinitely once approved. However, a 2023 law requires appraisal districts to verify eligibility every five years. Respond promptly to verification notices to avoid losing your exemption.

What happens if I miss the May 15 protest deadline?

Missing the deadline means you cannot protest your appraisal for that tax year and must wait until the following year. Set calendar reminders well before the deadline to prevent this costly oversight.

Can my property value increase if I file a protest?

No. Texas law prohibits appraisal review boards from increasing your property value during a protest hearing. This makes protesting completely risk-free with only potential upside.

How much can I realistically save by protesting?

No company or individual can legally promise specific savings before going through the entire protest process. The only way to know if your property’s tax appraised value is fair is to actually protest it and review the evidence for your specific property. Some homeowners achieve modest reductions in their appraised value while others with significantly overvalued properties see larger adjustments. Be wary of any company that guarantees savings upfront, as they cannot know the outcome without completing the work. The real value of protesting lies in getting a definitive answer about whether your tax appraised value is accurate. Successful protests also compound over time, as reductions establish lower baseline values that benefit you in future tax years.

Take Control of Your Texas Property Tax Bill

Texas property taxes will continue to be a significant expense, but you have more control than you might realize. The November 2025 amendments provide historic relief through increased exemptions, and your right to protest ensures you never have to accept an unfair valuation.

Start by confirming you’ve filed for every exemption you qualify for, including the new $140,000 homestead exemption and enhanced senior or disability benefits. Then commit to protesting your property’s market value annually, either independently or with professional assistance.

Home Tax Shield makes the property tax protest process simple and stress-free, with experienced professionals who handle everything from filing to hearings. With an 83% success rate and fees 40% lower than many competitors, you can rest assured experts are fighting to ensure you pay only what’s fair. Find your property and get started in just minutes.