If you’re a Texas homeowner, understanding how much your property taxes can increase each year is helpful and essential. With rising home values across the state, many residents are left wondering how to protect themselves from unpredictable tax hikes. Fortunately, there are clear Texas property tax increase limits in place to prevent runaway tax bills, especially for those who qualify for exemptions like the homestead exemption and cap.

Staying informed about these protections isn’t just about saving money this year. It also sets you up for long-term tax stability. In 2023, local taxing units raised more than $81 billion in property taxes, making up 46% of the total tax revenue. This trend highlights the importance of knowing your rights under Texas property tax laws so you can take control of your property taxes before your bill arrives in the mail.

Understanding Texas Property Tax Increase Limits Through the Annual Appraisal Timeline

Every year, Texas property owners go through an appraisal process that determines how much they’ll owe in property taxes. While this timeline may seem routine, understanding how it works is key to navigating Texas property tax increase limits effectively. From understanding how your home’s market value is established to knowing when you can file a protest, each step protects you from unexpected spikes in your tax bill.

Property Value Determination Period

Each January, your County Appraisal District (CAD) begins the annual process of determining your property’s market value. This valuation serves as the foundation for your property tax bill. To do this, CADs rely on a mass appraisal approach that analyzes dozens of data points, not just comparable sales or market conditions.

They consider everything from your home’s size, age, and condition to lot characteristics, neighborhood trends, nearby amenities, recent upgrades, and even external factors like zoning changes or new construction in the area.

While it may feel impersonal, this system is designed to streamline valuations across thousands of properties. Still, it can result in inaccurate estimates that don’t reflect your home’s true market value, making it essential to understand your rights under Texas property tax laws and prepare to protest if needed.

Notice Distribution Schedule

Property owners receive their appraisal notices by April 1st or as soon as practical thereafter. This notice contains your property’s tax appraised value and information about your protest rights. If you disagree with the value, or even if you just want to ensure your tax bill is fair, this notice is your cue to begin the protest process.

Protest Filing Deadlines

The deadline for filing a protest is typically May 15th or 30 days after receiving your appraisal notice, whichever is later. If you miss this deadline, you’ll lose your right to protest this year’s tax appraised value. After filing, you’ll receive a Notice to Appear for an Appraisal Review Board (ARB) hearing where you can present your case.

Your case typically begins with an informal review by the County Appraisal District. If no resolution is reached, it proceeds to a formal hearing before the ARB, where you can present evidence. This multi-step process is why having an expert handle your case can make a major difference.

Understanding Property Value Protections

Now that you know how your property is appraised each year, it’s important to understand the safeguards that prevent excessive increases in your tax bill. Texas property tax increase limits are designed to protect homeowners from sudden spikes in taxable value, especially when market conditions cause home prices to rise rapidly.

These protections, which include exemption caps and specific value limits, are built into Texas property tax laws to ensure fairness and stability in the system. Knowing how they work can help you anticipate changes and avoid paying more than necessary.

Homestead Cap Protection

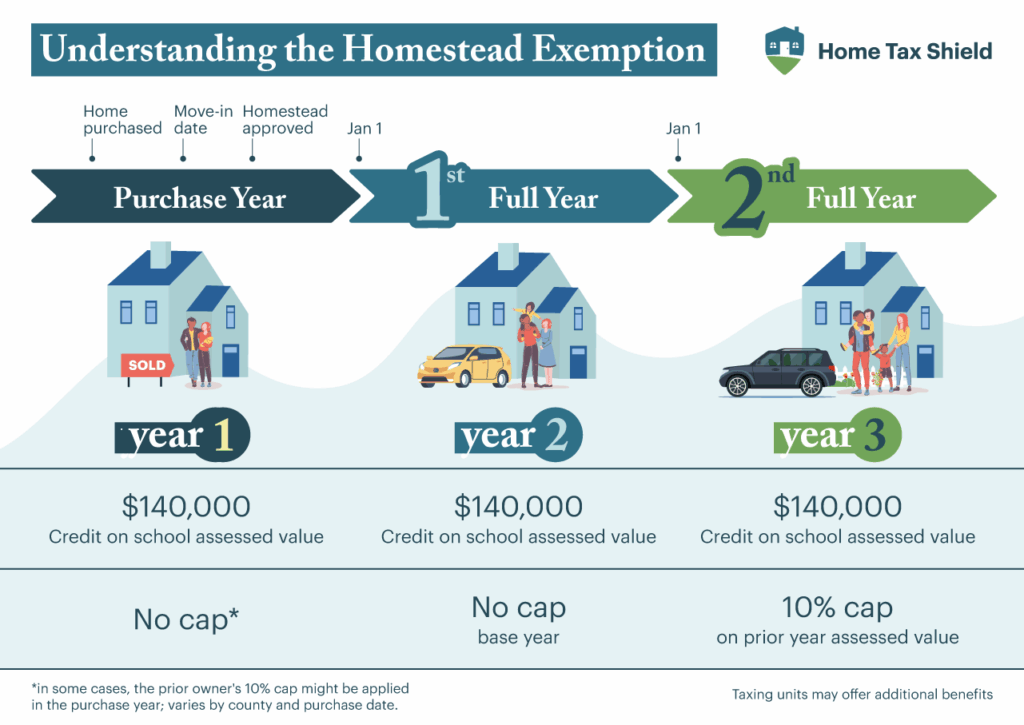

The 10% annual increase limit applies to properties with a homestead exemption. This cap means that even if your home’s market value increases dramatically, your taxable value can only rise by a maximum of 10% each year. This protection begins after the second full year you qualify for the homestead exemption.

Qualifying for Homestead Protection

To qualify for this property tax exemption in Texas, you must:

- Own and occupy the property as your primary residence

- Apply for the exemption with your county appraisal district

- Maintain the property as your primary residence

- Only claim one homestead exemption, even if you own multiple properties

While the homestead exemption provides valuable protection against future increases, it doesn’t affect your ability to file a protest. Your protest involves only the tax appraised value of your property, and you can still protest regardless of your exemption status.

The Impact of Property Improvements

When you make improvements to your property, such as adding a room or building a garage, these changes affect your tax appraised value differently than market value changes:

- New improvements aren’t subject to the 10% cap in their first year

- The cap only applies to your existing property

- Consider the potential tax impact before starting major improvements

By understanding these property value protections, particularly the homestead exemption and its 10% cap, you can better predict and plan for your annual property tax obligations.

While improvements may temporarily increase your tax burden beyond these protections, the long-term benefits of the homestead exemption often outweigh short-term tax impacts. Being strategic about when and how you make improvements can help you maximize these protections.

Other Common Property Tax Exemptions in Texas

While property value caps and the homestead exemption provide important protection, Texas offers several additional exemptions that can significantly reduce your tax burden. Here’s an overview of the most common:

- General Residence Homestead: Mentioned above, this exemption is available to all homeowners for their primary residence, providing a $140,000 exemption on the school district’s assessed value of the home.

- Age 65 or Older: Offers an additional $60,000 exemption for school taxes and establishes a permanent tax ceiling for school taxes.

- Disabled Persons: Similar benefits to the age 65 exemption, including the $60,000 school tax exemption and tax ceiling. Cannot be combined with the age 65 exemption.

- Disabled Veterans: Partial to full exemptions based on disability rating 100% disabled veterans receive a full exemption on their primary residence.

- Surviving Spouses: Special exemptions for surviving spouses of first responders killed in the line of duty or 100% disabled veterans.

Contact your local appraisal district to learn about qualification requirements and application deadlines for these exemptions. Many can be combined with your existing homestead exemption for maximum tax savings.

Tax Appraised Value, Tax Assessed Value, and Other Property Values

When it comes to Texas property tax laws, understanding how your home’s value is calculated can help you build a stronger protest. With so many different types of property values in play, it’s important to know which ones matter most for your tax bill and protest strategy.

Your tax appraised value is the number that matters most when protesting your property taxes. This county-derived value considers both tax equity value (the median tax appraised value of 10 similar homes) and tax sales value (the median of at least 3 comparable homes that sold in the prior year). This is the specific value you’ll challenge when you file a protest, as it forms the foundation of your tax calculation.

The tax assessed value is what’s actually used to calculate your property tax bill. It’s your tax appraised value minus any applicable exemptions or caps, such as the homestead exemption or the 10% annual increase limit. For example, if your tax appraised value is $350,000 and you qualify for a $140,000 homestead exemption, your tax assessed value would be $210,000.

While other values like market value, mortgage value, and insurance value serve important purposes in real estate transactions, they don’t directly impact your property tax calculation. Counties use their own methodology to determine tax appraised value, which may differ significantly from what your home might sell for or what a lender values it at.

Understanding this distinction is crucial for protest success. When you challenge your property taxes, your focus should be on demonstrating that your tax appraised value is too high by presenting alternative tax equity and tax sales evidence that supports a lower valuation.

When Caps Don’t Apply

The 10% cap is a great benefit for homeowners, but it doesn’t apply to all properties.

- Non-homestead properties, such as vacation homes and rental properties, are not protected by the 10% cap.

- Business properties are exempt from the 10% annual increase limitation.

- Agricultural land under special use valuation can exceed the 10% increase limit, with valuation changes often influenced by crop yields and market conditions.

- Properties that have changed ownership are subject to full market value assessment, potentially facing valuation increases that far exceed the 10% threshold.

Value Implementation Timeline

In Texas, property values are assessed annually, and the appraisal districts evaluate properties as of January 1st of each tax year. This timeline affects when changes in market value or new exemptions will impact your tax bill.

Once the appraisal district determines your property’s market value, it applies any applicable exemptions and caps to establish the assessed value, which is then used to calculate your property taxes for that year.

Final tax bills are typically mailed in October or early November, depending on your local tax office’s schedule. Be sure to review yours carefully to ensure all exemptions and caps were applied correctly.

Factors Behind Tax Bill Changes

Understanding what influences your property tax bill goes beyond just property values. The following three factors determine your final tax obligation.

Tax Rate Impact Analysis

Local taxing units, such as school districts and cities, set tax rates based on their budget requirements. Each unit calculates how much revenue it needs to provide essential public services like education, fire protection, and infrastructure maintenance.

If your property is assessed at $300,000 and the tax rate is 2.5%, your annual tax bill would be $7,500. Even if your property’s assessed value remains the same, changes in the tax rate can lead to fluctuations in your tax bill.

Local Government Budget Influence

Local governments rely heavily on property taxes to fund their budgets for essential public services. As funding needs evolve, so do tax rates. Understanding this relationship can help explain why your tax bill might change even when your property value remains stable.

For example, when local governments need to invest in new projects or face increased service demands, they might raise tax rates. Conversely, if budget needs decrease, rates may be lowered, resulting in a reduced tax burden for property owners.

Value Changes vs. Rate Changes

Two main factors can lead to changes in your tax bill:

- Appraisal adjustments: Changes in your property’s assessed value due to market conditions, improvements, or other factors

- Tax rate fluctuations: Changes in the percentage used to calculate your taxes, which can occur independently of property value changes

These elements can work together or offset each other. For instance, a decrease in your property’s assessed value might balance out an increase in the tax rate, resulting in little to no change in your taxes.

Protest Rights and Annual Reviews

While knowing how your taxes are calculated is important, it’s equally crucial to understand your rights when challenging assessments. Here’s what you need to know about protesting your property tax bill:

When to Challenge Increased Values

The time to challenge your property’s tax appraised value is when you receive your appraisal notice in spring. The ARB, comprised of a group of local citizens, hears property tax disputes. Your protest must be filed in writing, either using the Appraisal District’s form or through a simple letter stating your dissatisfaction.

Evidence Requirements

To build a strong property tax protest, it’s essential to provide objective, well-documented evidence that supports your claim that the market value is too high. Start by gathering recent sales data from comparable homes in your neighborhood, but keep in mind that simply pulling prices from online listings isn’t enough. The County Appraisal District adjusts for dozens of factors, so any comparables should be adjusted as well for size, age, condition, and location to be meaningful. Additionally, listings are not accepted as evidence.

If your home has issues that impact its value, such as foundation damage, a leaking roof, or outdated electrical systems, be sure to include contractor estimates, photos, or inspection reports that document those problems. These can help demonstrate that your home is worth less than what the CAD has estimated. A recent independent appraisal, such as one conducted for a mortgage refinance, can also serve as powerful evidence, especially if it was done close to the January 1 appraisal date.

Above all, stick to facts about the property itself. Avoid arguments about tax rates or comparisons to your neighbor’s value, as these won’t hold up in a formal hearing. Focusing solely on market value and supporting it with clear, credible documentation gives you the best chance of a successful protest.

The Benefits of Professional Assistance

Professional assistance can make the protest process more efficient and effective. Licensed professionals can provide:

- Expert Knowledge: Professionals understand Texas property tax laws and current market trends

- Proven Success: Tax professionals have experience gathering evidence and presenting successful cases

- Time Savings: Having an expert handle the details allows you to focus on other priorities while ensuring your protest is properly managed

Some protest companies advertise “no upfront fees,” but that often means they only work cases where they expect big wins. If your case seems too hard or not worth their time, they may quietly drop it. Look for services that charge a modest fee upfront, which guarantees your case is fully worked every year, every step of the way.

Planning for Future Increases

A proactive approach to property tax management can help you better prepare for and handle future tax obligations.

Understanding Assessment Cycles

In Texas, appraisal districts reassess properties at least once every three years, though many conduct yearly appraisals. Knowing your district’s assessment schedule helps you anticipate potential changes and prepare accordingly.

Documentation Requirements

Maintain these essential records for effective property tax management:

- Property Records: Keep documentation of any changes in ownership or significant improvements

- Exemption Applications: Track your exemption status and renewal requirements

- Assessment Notices: Save your annual notices to track value changes over time

Value Protection Strategies

Take these steps to protect yourself from unnecessary tax increases:

- Review Annually: Even if you’ve protested before, each year presents new opportunities to ensure a fair tax appraised value.

- Monitor Deadlines: Mark key dates for protests, exemption applications, and tax payments

- Keep Records: Maintain documentation of property conditions, repairs needed, and neighborhood sales

Protesting every year helps this year and keeps your taxable value from ballooning year after year. If you skip a protest, your future tax bills may rise faster because the valuation builds on itself. Annual protests create a long-term buffer against runaway taxes.

Take Control of Your Property Taxes

Navigating Texas property tax laws doesn’t have to be overwhelming. By understanding your rights, available exemptions, and protest opportunities, you can take steps to ensure you’re not paying more than your fair share. Property owners who stay informed about assessment methods and maintain proper documentation are better positioned to manage their tax obligations effectively.

Home Tax Shield offers expert assistance in navigating Texas property tax increase limits and other legalities. Our technology-driven approach combines local expertise with a streamlined process, handling the complexities of property tax protests on your behalf. We advocate for homeowners, ensuring you pay no more than your fair share while providing a simplified, transparent service that requires minimal effort from you. Sign up today and take the first step towards potentially reducing your property tax bill.