Utilities are an essential part of homeownership, but can they also be driving up your property taxes? It’s a fair question, especially for Texas homeowners trying to navigate rising costs and better understand what factors impact their property tax assessments. From solar energy systems to septic tanks, many wonder: does the type of utilities affect property taxes, or are other variables at play?

Solar panel installations alone grew over 35% last year according to market insights. With more Texans turning to renewable energy sources and off-grid solutions, this topic is more relevant than ever. Understanding how local governments determine property value and whether the type of utilities affect property taxes is the first step toward clarity. Property tax bills are primarily based on fair market value, and while utilities may contribute to that value, they’re rarely the deciding factor.

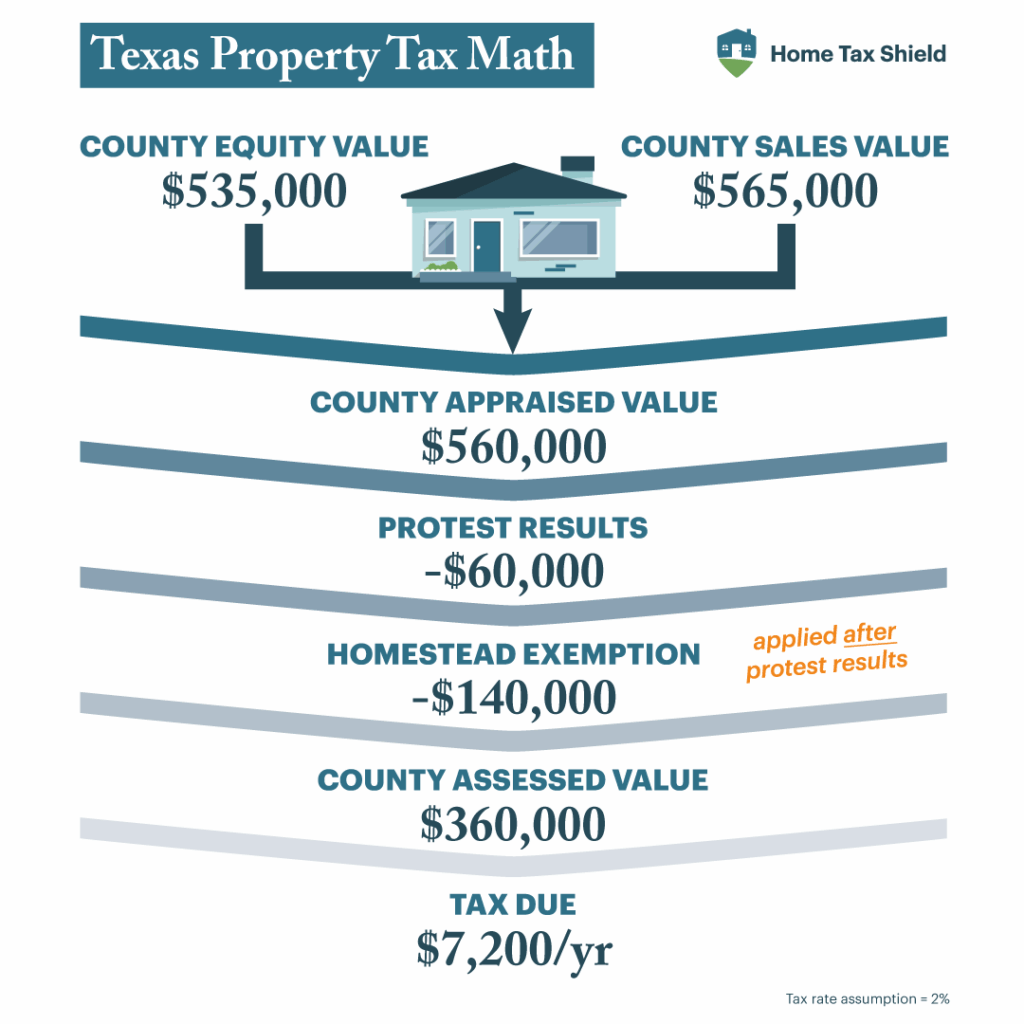

Property tax reductions in Texas typically occur when homeowners successfully protest their appraisal values. Most homeowners who fail to protest may miss opportunities for tax savings due to inaccuracies in mass appraisal data, rather than because of specific property features like water wells or electric lines.

How Does the Type of Utilities Affect Property Taxes?

While it’s easy to assume that certain utilities increase your tax bill, the reality is much simpler. The County Appraisal District (CAD) evaluates your property based on overall market value, not individual components or interior features. They typically don’t inventory or assess the types of utilities within your home during their appraisal process.

What the County Appraisal District Actually Looks At

Property taxes in Texas are based on the CAD’s estimate of your home’s fair market value as of January 1 each calendar year. CADs use mass appraisal systems to evaluate thousands of properties simultaneously. Their focus remains primarily on observable characteristics: square footage, lot size, age, location, condition, and notable exterior improvements that would be visible during a standard exterior inspection.

The appraisal district doesn’t enter your home to evaluate interior elements like plumbing systems, electrical configurations, or HVAC setups. Their methodology relies on exterior observations combined with public records and comparable sales data to determine value. Additionally, CADs typically don’t differentiate between homes on municipal utilities versus those with alternative systems unless these differences significantly impact comparable sales prices in your specific area. Let’s explore in detail how different utility types do or don’t affect property taxes in Texas.

When Utilities Might Actually Matter

Despite CADs not inspecting interiors, certain utility-related features can occasionally influence your property valuation. While most homeowners worry that the type of utilities affect property taxes significantly, only a few specific scenarios actually matter. Here’s what might actually make a difference:

Visible Exterior Installations

Solar panels mounted on your roof or property are visible from the exterior and could potentially impact valuation. However, Texas Tax Code Section 11.27 provides a partial exemption for renewable energy devices used for on-site energy production, which can help offset any potential increase.

Area-Specific Considerations

In rural areas where well water and septic systems are standard, these features typically won’t increase your tax burden—they’re considered appropriate for the property type. Conversely, if you have city utilities in an area where most properties use wells and septic systems, this distinction rarely affects valuation unless it significantly impacts sale prices in your specific market.

Taxable Value Exemptions

Some utility upgrades may qualify for special exemptions that reduce your taxable value. For example, certain renewable energy installations can receive partial exemptions under Texas law. These exemptions must be properly applied for and documented with your CAD.

Property Tax Assessment: What Really Drives Value

Understanding what actually influences your property tax bill helps put utility concerns in perspective. Despite common assumptions that the type of utilities affect property taxes, these other factors are what truly drive your tax appraised value:

Location and Market Comparables

Your property’s location and comparable sales in your neighborhood are the primary drivers of your tax appraised value. Two identical homes with the same utility setups can receive vastly different valuations based solely on their neighborhoods and recent nearby sales.

Observable Property Characteristics

CADs focus on what they can actually see and document: lot size, home square footage, number of bedrooms and bathrooms, garage spaces, exterior condition, and apparent age of the structure. These factors have a far greater impact on your valuation than whether you have a tankless water heater or smart home technology.

Recent Market Activity

CADs rely heavily on recent sales data to establish market value. If homes in your area are selling for premiums regardless of their utility setups, your valuation will likely reflect that market trend rather than your specific property features.

The Mass Appraisal Process Explained

To better understand why utilities rarely affect your tax bill, it helps to understand how mass appraisals actually work in Texas. The statistical modeling approach explains why the type of utilities affect property taxes far less than most homeowners believe.

Statistical Modeling vs. Individual Inspection

Mass appraisal systems rely on statistical modeling rather than detailed individual property inspections. CADs develop valuation models based on property characteristics that have demonstrated statistical correlation with sale prices in your area. These models are designed to predict market value based on broad property characteristics, not specific utility configurations.

Sales Ratio Studies

CADs regularly conduct sales ratio studies to test the accuracy of their valuation models. These studies compare recent sale prices to the CAD’s appraised values to determine if adjustments to the valuation model are needed. These ratio studies focus on broad patterns, not individual property features, making utility-specific impacts minimal.

Neighborhood Delineation

Properties are grouped into “neighborhoods” or market areas with similar characteristics and value influences. The definition of these areas greatly impacts your valuation, often more than any individual property feature. If your home is placed in an incorrect market area, this can have a much larger impact on your valuation than any utility-related feature.

Common Misconceptions About Property Tax Appraisals

Many homeowners have misconceptions about what drives their property taxes, leading to unnecessary concerns:

The Permit Myth

Some homeowners believe that pulling permits for utility upgrades automatically triggers a higher tax assessment. While permit data may be available to CADs, they typically don’t reassess properties based solely on permit activity unless it indicates significant new construction or property improvement visible from the exterior.

The Interior Upgrade Assumption

Many homeowners worry that modernizing interior utility systems like electrical panels or upgrading to tankless water heaters will increase their taxes. Since CADs don’t typically inspect interiors, these upgrades rarely impact your assessment unless they’re part of a comprehensive renovation that changes other observable aspects of your home.

The Equal Value Misconception

A common assumption is that spending $20,000 on utility upgrades automatically adds $20,000 to your tax appraised value. In reality, improvements rarely translate dollar-for-dollar to assessed value increases. Market demand, depreciation, and the overall condition of your property all affect how improvements impact value, if at all.

Why Property Tax Protests Matter More Than Utility Types

With Texas ranking among the top 10 states for highest property tax rates in the nation, homeowners need effective strategies to manage their tax burden. While many focus on how individual property features might affect their assessment, the reality, as we’ve discussed, is that the type of utilities in your home rarely drives significant tax increases. Instead, understanding and utilizing the protest process offers a much more direct path to potential savings. Here are three reasons why protests matter more than worrying about your utility setup:

Reason #1: Mass Appraisal Systems Have Limitations

The mass appraisal system CADs use is inherently limited. It can’t account for every unique aspect of your property, which creates opportunities for successful protests when your home has been incorrectly characterized or compared to inappropriate properties.

Reason #2: Valuation Inconsistencies Provide Protest Opportunities

If you notice homes similar to yours receiving lower valuations despite being comparable, this inconsistency presents strong grounds for protest. Professional property tax consultants are skilled at identifying these discrepancies that homeowners might miss.

Reason #3: Annual Protests Are Your Legal Right

Texas law allows you to protest your property valuation annually. The process starts with reviewing your appraisal notice and filing a protest with your local CAD. For those wondering how to protest property tax in Texas, you can file online, by mail, or in person before the deadline (typically May 15 or 30 days after receiving your notice).

Getting Professional Help: Beyond DIY Protests

When homeowners try to handle protests themselves, they often miss key opportunities for reductions that professionals routinely identify. According to recent analysis of property tax protest outcomes, professionally-represented homeowners typically achieve better results than those who self-represent.

While the DIY approach might seem cost-effective initially, the potential tax savings left on the table can far exceed professional fees over multiple years. For homeowners serious about minimizing their property tax burden, professional representation offers expertise that’s difficult to match through self-education alone.

Professional Analysis of Valuation Factors

Licensed property tax consultants analyze the actual factors CADs consider—comparable sales data, property classification, and neighborhood trends—to build compelling cases for reduction. Their expertise helps identify when properties have been incorrectly classified or compared to inappropriate sales data.

Understanding Mass Appraisal Systems

Tax professionals understand how CAD valuations work systemically and can pinpoint discrepancies that might otherwise go unnoticed. They know that interior utility systems aren’t typically factored into residential appraisals and can help correct valuation assumptions.

Representation Throughout the Process

Property tax experts know how to navigate both informal and formal hearings with CADs and Appraisal Review Boards. Their experience presents your case effectively at every stage, maximizing your chance of securing meaningful reductions that persist year after year.

The Bottom Line: Focus on Fair Market Value, Not Utilities

While it’s natural to wonder if your solar panels or well water might raise your tax bill, these features rarely drive property tax increases in Texas. Your tax appraised value is primarily based on your property’s market value as determined through comparable sales data and observable external characteristics. Before assuming the type of utilities affect property taxes on your home, consider pursuing a professional protest to ensure fair valuation.

The most effective way to ensure you’re not overpaying is to challenge inaccurate or inflated valuations through the protest process. Even if the value seems reasonable, the protest process is the only way to know for sure. Rather than worrying about specific utility types, focus on whether your property’s overall assessment fairly reflects its market value compared to similar properties in your area.At Home Tax Shield, we take your protest all the way through the process to ensure you’re never overpaying, no matter how your utilities are set up. With local experts and smart data analysis on your side, you’ll always know your property tax bill reflects what’s fair. Sign up today and take one big step toward smarter property tax savings.