Being a homeowner in Texas offers several financial advantages. It protects against rapid rent increases: Texas doesn’t have a legal cap on rental rate increases, and even smaller communities like Waco, Texas, saw rent prices increase by over 30% from 2020 to 2022. It’s a good investment vehicle, as the principal portion of the monthly mortgage payment turns into equity in the home.

But with property tax bills across the state rapidly rising with sharp increases (even for property owners who stayed put and didn’t move to a new home or make massive renovations to their properties), it can feel like investing in a home has diminishing returns. However, homeowners eligible for a homestead exemption have property tax protection that can translate into significant savings on the annual bill.

Learn more about what a homestead exemption is, its benefits, and the details of the 10% homestead exemption cap it grants. We dive into the details so you can navigate the next property tax season with more insight.

What Is a Homestead Exemption?

The Texas Comptroller’s Office establishes different provisions that remove part of a property’s value from tax calculations. Some exemptions are for agricultural land, general homeowners, and homeowners with disabilities or ages over 65 years. A residence homestead exemption gives homeowners tax relief for their primary residence, provided they qualify.

The Tax Protections It Offers to Homeowners

The key tax benefits of this exemption include the following:

- Reduction in School District Tax Obligations: A levy for school districts is part of almost every homeowner’s effective property tax rate, often making up approximately half the tax rate. Homestead exemptions remove $40,000 of a property’s value from that tax calculation. For example, if your home is worth $200,000 and your local school district tax rate is 0.95%, then you would only pay $1,520 for this levy — a savings of $380.

- Local Exemptions: Local tax districts such as counties or cities can opt to provide a further exemption of between $5,000 and no more than 20% of a property’s value.

- County Exemptions: $3,000 of a property’s value is removed from tax calculations in counties that collect farm-to-market or flood control taxes.

These line items add significant savings for qualifying homeowners who file for their homestead exemption. Homeowners can save even more with the homestead cap on property tax increases. This provision prevents local tax districts from increasing the appraised value of a home by more than 10% except to account for direct property improvements.

Who Is Eligible for a Homestead Exemption?

Not every property owner is eligible for a homestead exemption. The property you want to file the exemption for must be your primary residence to qualify. Specifically, that means:

- A person or persons must own the home, not an LLC or other corporation.

- The property must be the individual’s principal residence on January 1st of the applicable tax year.

- The home must be a qualifying type of property, including conventional single-family properties, condominiums, manufactured homes on leased land, and estates of up to 20 acres (provided the property is used for residential purposes)..

What Is the Process for Getting (and Keeping) a Homestead Exemption?

Getting and maintaining a homestead exemption is reasonably straightforward. To get the exemption, homeowners must:

- Fill out the form (an Application for Residential Homestead Exemption) to the property’s local tax appraisal district. Homeowners must also supply documentation, such as a driver’s license or other accepted form of ID, with the property listed as the principal residence. Be aware that if the license or ID does not have the correct address, the application will be turned down. For more complex circumstances, such as inheriting a property, applicants must provide the previous owner’s death certificate, an affidavit, and other supporting documents to demonstrate ownership.

- Submit the form to the appraisal district that oversees the area where the property is located.

- You will receive confirmation that your application has been accepted and will receive the exemption.

Throughout the process, the chief appraiser may ask for additional documentation, depending on your circumstances.

Keeping your homestead exemption is even simpler. Once you receive it, you should not have to reapply year after year. Exceptions may include moving to a new property, changing circumstances that impact your qualifications, refinancing, or sending a new application to the chief appraisal. You can verify that your homestead exemption is still in effect online or on your appraised property value notice.

- Online: Your local appraisal district website will have a profile page for each residential property in its records. This page will list what exemptions apply to the property.

- On Paper: If your property’s appraised value increases in a given year, you must receive a Notice of Appraised Value. This document will show the new deal and what exemptions apply to the property.

Related: How Values and Tax Rates Change Over Time

The 10% Homestead Exemption Cap: Deeper Insights

Earlier, we mentioned one of the benefits of a homestead exemption: a 10% cap on the increases in your property’s appraised value. This artificially limits how high your local tax district can increase its assessment of your home’s property value so it cannot grow by more than 10% due to market factors or improvements in the area. If you have a homestead exemption in place and your home was assessed at $250,000 last, its value cannot be appraised at more than $275,000 this year. This cap helps homeowners save money when their neighborhood, city, or county sees significant increases in property value in the market.

However, it doesn’t mean your property’s appraised value will always increase by 10%. If your local tax district calculates that your’ home’s value only grew by 7%, the appraisal will reflect that. Your appraisal district must use the lower amount of either (i) your home’s appraised value increase or (ii) the 10% allowed maximum.

Why This Matters to Texas Residents Now More Than Ever

Texas homeowners are still seeing the effects of a red-hot real estate market over the past few years. Some properties saw properties jump in value by 20% each year or even double from 2019 to 2022. While this benefited homeowners who sold their properties for a significant profit, it jeopardized the budgets of homeowners who didn’t move.

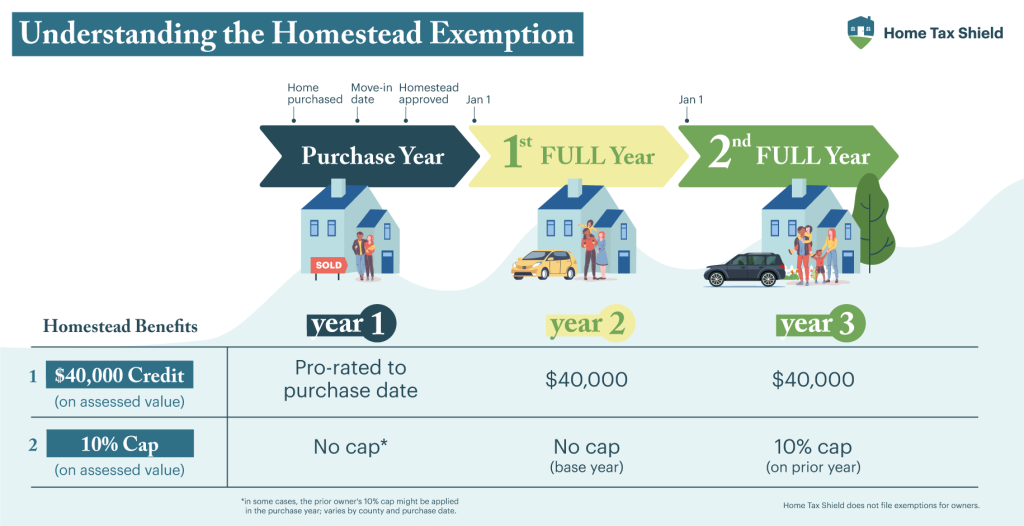

A homestead exemption allows you to start stabilizing the property taxes you’ll see each year, although it can take almost 2 years for the cap to kick in. The first full year is the “base year,” after which the 10% cap goes into effect. So if you purchased in March 2022, 2023 will be the base year and 2024 taxes can only rise 10% from 2023 taxes.

Appraisal districts also benefit from the cap, allowing them to forecast changes better and simplifying the appraisal process.

Long-Term Benefits of the 10% Homestead Exemption Cap

The benefits of a 10% homestead exemption cap go even more profound than just savings from year to year. The long-term protection operates similarly to the compound interest investors see in the market. Let’s look at an example. Suppose you purchased

a home currently appraised at $250,000 in a neighborhood that will see a 20% increase in property values over the next few years and an average effective tax rate of 2%. Your base taxes will be established in year one, with a cap in the following years.

- Year One: Your home’s appraised value goes up the first year as scheduled and is now $300,000. This is your base year, and you’ll pay $6,000 in taxes this year.

- Year Two: Your 10% cap goes into effect. With the cap, your property’s value is now $330,000, and your taxes will be $6,600. Without the cap, your property’s value would be $360,000, with a tax bill of $7,200.

- Year Three: With the 10% cap, your home is appraised at $363,000, with a tax bill of $7,260. Without it, your home would be appraised at $432,000, and you would owe $8,640 in taxes.

In year three alone, you save $1,380. This doesn’t even account for how a homestead exemption lowers your effective tax rate by removing a portion of your home’s value from school district taxes and other local levies!

Exceptions to the 10% Cap

Some exceptions to the cap do apply. If you make improvements to your property — such as building an addition, installing a swimming pool, or replacing the siding — this can increase your property’s value outside the bounds stipulated by the 10% cap. Newly built and recently purchased homes also won’t have the long-term protections of a 10% cap immediately. If you buy a new home, apply for your homestead exemption immediately to start getting benefits for the next tax bill.

Related: Understanding Your Texas Property Tax Bill

Home Tax Shield Is Here to Help Homeowners Fight for Fair Property Taxes

Filing a homestead exemption is just one step you can take to make sure your property taxes stay as low as possible. If you don’t think the appraisal district applied for your homestead exemption correctly or disagree with your home’s appraised value, you can file a protest form and argue for a lower value.

Home Tax Shield is here to help you file the form, provide supporting evidence, and manage the entire protest process. Sign up today, and we’ll start fighting for your potential tax savings! Our process begins with independently assessing your home’s value based on your property and local market conditions. Then we’ll negotiate on your behalf so you can rest easy without navigating the process independently.