Texas property tax law changes every few years. See the latest posts for the most up-to-date information.

Homeowners in Texas are facing a virtually unprecedented rise in their property tax bill. The steep surges in the amount due may be coming from multiple fronts: your home’s value is rising because of lots of demand in the market and the rising value of other homes in your neighborhood. Also, the tax rate your local district is charging for different levies may be changing, as city and county budgets manage the high cost of labor and materials for maintenance and growth projects.

When everyone on all sides of the property tax table is facing tight budgets, it can feel like there’s no solution or tax relief possible. Fortunately, Texas has established a few processes so homeowners can exercise their right to fair property taxes through filing exemptions and protesting potentially faulty property value assessments.

In this guide, we’ll take a closer look at how your property value and the effective tax rate can change over time—as well as what you can do about it.

How Do Residential Property Taxes Work in Texas?

Property taxes are determined and managed by your local tax appraisal district and local government. While the state establishes standard rules and processes that local governments must follow, local authorities can establish their own budgets, calculate property taxes, and manage the various procedures for filing exemptions, protesting taxes, and enforcing collection.

If you have questions about your own property taxes, you would ask officials in the Comptroller of Public Accounts office or your county tax assessor’s office.

Why Property Taxes Are So High in Texas Today

As we’ve already touched on, two major trends are causing high property taxes across many counties in the state:

- High budget demands: Texas doesn’t have a state income tax, so many local maintenance projects, services, and construction projects are funded entirely through property tax collections. City and county governments are facing a steep rise in costs for hired positions, labor, construction materials, and more, leading to an increase in many budgets.

- Turbulent real estate markets: Texas has seen some of the biggest demand in the housing market, resulting in increased house prices that far outstrip the national average. According to this analysis in Forbes, “In the statewide Texas housing market, the median sale price for a home rose by 19.2%, from $327,700 in May 2021 to $390,600 in May 2022.” Those sales prices have an effect on the estimated property values for both the sold homes themselves and the surrounding comparable properties. Homeowners without a homestead exemption can expect to see raised property values of 19.2% more in turn, or even higher for popular areas like Austin and Collin County; homeowners with a homestead exemption should also expect to see their property value assessments rise by the full 10% increase allowed.

Related: The Best Ways to Get Texas Property Tax Relief

Three Essential Components of Your Property Tax Bill That Cause It to Change Over Time

Now that you know why tax bills are increasing so much, you can examine each component of the tax bill calculations to see where those increases are coming from and what options you have to reduce your individual tax burden, so you pay a fair amount.

The basic equation is [your property’s assessed value] x [your effective property tax rate] = [the lump sum due for your property taxes]. If you have an escrow account, your lending company has been charging you approximately 1/12 of their estimated answer to that equation each month, holding that money in an account to pay your local district so you don’t face the bill in one lump sum. If they overestimated your bill, you’ll receive a refund or have a head start for next year’s taxes; if they underestimated, you may receive an additional bill for the difference.

These are the three main components local tax authorities use to calculate your final bill:

1. The Value of Your Property

This is one component of your tax bill that you have a lot of control over as a homeowner. Your tax appraisal district assesses your property individually on certain years and applies growth models to your home in other years. Some of the factors that weigh in on your home’s assessed value include:

- The exact model your district uses to assess properties, such as the sales model, the income model, or the replacement model. This is standardized across your area. If you have an agricultural property, you can file an exemption that requires your property to be assessed on a production model that can significantly reduce your total tax burden.

- Nearby features that affect the marketability of your property, such as burdensome easements, heavy-traffic roadways, eye sores, and other features (both good and bad)

- The selling price of comparable homes in your neighborhood

- Individual modifications and improvements you’ve made to your home

Any of these factors can make your property’s value rise or fall, though it will most frequently rise. The value is also made up of two numbers added together: the value of the land and the value of the structures on that land.

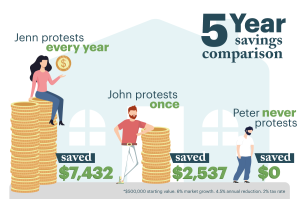

You can raise the property value by making improvements and upgrades. You can potentially lower the property value by protesting your property taxes each year. Also, you can “cap” the increase in property value your home sees each year by filing for a general resident homestead exemption.

2. The Tax Rate of Individual Levies

Your total effective tax rate is made up of multiple different levies. These include taxes for your local school district (which is often the biggest portion of your total tax rate), city government, county government, and junior colleges within the district’s geographic domain.

These individual levies encompass things such as county road maintenance, emergency responders (personnel and equipment), school building maintenance and staff, and more. As the budgets for these bodies rise or hold steady, the tax rates imposed within the district will also fluctuate.

Every residential property within the district’s zones will have the same individual levy rates. Even if your house is $300,000 and your neighbor’s house is worth $250,000, you will both pay the same rate for each levy. For example, suppose the school district tax for homes in your neighborhood or city is 0.75%. You will pay $2,250, and your neighbor will pay $1,875 — unless one or both of you have exemptions in place that alter your final tax bill.

3. Exemptions That Change Your Effective Tax Rate

This factor is all about the difference between ‘tax rate’ and ‘effective tax rate.’ While every homeowner initially faces the same levies and individual tax rates on those levies, filing exemptions can qualify you for reductions in the amount of your property’s value and add that reduction into the equation. Consider the previous example: your home is assessed at $300,000, and you face a school district levy of 0.75%. If you have filed a general resident homestead exemption, one of the benefits is a $40,000 reduction in your property value in this one part of the equation.

This doesn’t mean your property taxes are lowered by $40,000. Instead, only $260,000 of your $300,000 home will be charged school district taxes; instead of owing $2,250 for this portion, you instead owe $1,950, a $300 savings.

Different property tax exemptions qualify you for different reductions, which ultimately reduce your effective tax rate, or the final percentage of taxes owed compared to your home’s assessed value. The state average effective tax rate varies from year to year, but recent calculations place it at 1.69%.

Related: Ways to Cut the Tax Value of Your Property

What You Can Do If You Think the Assessed Value of Your Home Is Wrong

If you’re facing a high property tax bill and you think the final number is wrong, you can glance through the different components of that calculation — the assessed property value, the individual levies, and the exemptions you are entitled to — to uncover any mistakes.

While you can question the tax appraisal district and file a protest to correct any potential error, one of the most common routes to correcting your property tax bill is protesting the assessed value.

When you believe the appraisal district was too aggressive in raising the value or there are factors you think they left out of the calculations, you can file a form with your district (or have someone do so on your behalf) and begin the protest process.

How to Protest

The Texas Comptroller’s office has established a standard process and form for protestors to use to explain the problem and the correction they want. First, you file Form 50-132, Notice of Protest with your local office. You can often do this online through your county appraisal district’s website. Then, the office will reach out to you with a date, time, and place for a formal hearing, where you and the county assessor present your respective arguments to a review board.

Your county may also reach out for an informal discussion or lower your assessed value to some degree; you have the right to agree to the modified assessment or continue on to the full formal hearing and present your case for a more accurate amount.

Many homeowners choose to file a protest with help from a professional tax protest service to ensure their protest is complete and take the load off of their own shoulders. A protest service can do all the work of a protest for you, helping you gather evidence and taking on the hearings in your stead.

Ultimately, this evidence and the presentation at the hearing will lead to a decision by the board about what your tax payment truly amounts to, and this is the amount you’ll pay (although you can also file an appeal if you still disagree).

Fight for a Fair Tax Bill — Make Sure Your Home Isn’t Over-Valued by Your Tax Appraisal District

Protesting your property tax bill to ensure you’re paying a fair tax amount is your right as a homeowner, and Home Tax Shield is here to help support you. We can determine what your home’s assessed value should be and help manage the protest process on your behalf. Sign up today to be prepared for your 2023 property taxes.