Texas property tax law changes every few years. See the latest posts for the most up-to-date information.

Property tax bills have been rising across Texas, but understanding the mechanics behind the statements can help you decide how to approach the issue. For example, although rates cannot be raised over 3% without a vote, property tax rates have increased. In 2020, homeowners saw tax rates of 1.49% (Dallas), 1.85% (Fort Worth), and 1.48% (Houston). In the past year, those same homeowners faced property tax rates of 2.22%, 2.26%, and 2.13%, respectively.

Property values themselves—the other half of the equation—have also increased, with the Texas property tax appraisal increase limit doing little to stop them. While there’s not much that individual taxpayers can do about the percentage rates, there is something you can do to protect your wallet from rising appraisal values.

In this article, we look at the Texas property tax appraisal increase limits, including how much it has helped property owners in the past and how recent changes can increase those savings. We’ll also look at some strategies you can use to decrease your property tax bill further.

How Texas Property Tax Appraisal Increase Limits Work

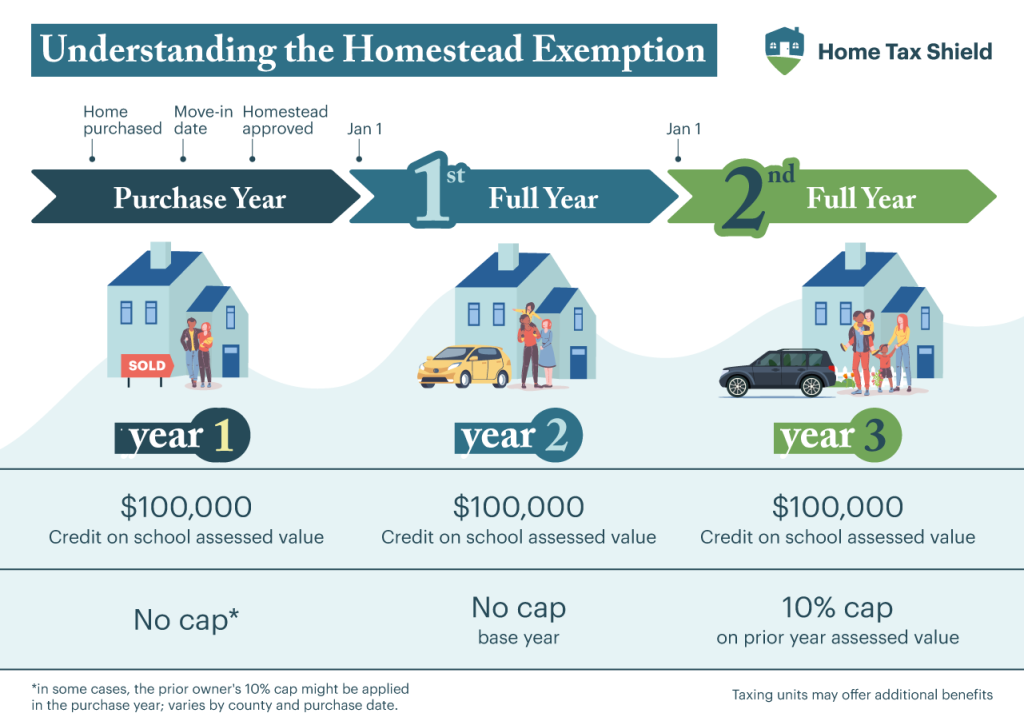

A homestead exemption is the primary mechanism homeowners can use to limit property tax appraisal increases. By filing this exemption on an eligible primary residence, you can:

- Exempt $40,000 of your home’s value from school district taxes (saving yourself approximately $400)

- Cap your home’s taxable value increase at 10% per year

Let’s zoom in on that second provision. Your local appraisal district will appraise your home’s market value every year. For example, your home may have been valued at $200,000 when you bought it two years ago, $240,000 last year, and $300,000 this year.

Related: How the New Texas Property Tax Legislation Will Impact Your Property Tax Bill

The exemption cap doesn’t directly alter the appraisal value itself. Instead, it limits how local tax assessors can assess your property’s value and calculate your tax bill. In that same example scenario, your estimated value two years ago would be $200,000, but it would only increase to $220,000 the next year and a maximum increase of $242,000 this year. If your property’s tax rate is 2%, having the exemption in place results in a $58,000 difference and $1,160 saved.

Recent Changes to Texas Property Tax Appraisal Increase Limits

In past years, that cap only applied to homesteaded properties. However, through recently passed legislation, Texas will begin a three-year pilot program that places a 20% cap on non-homesteaded properties. This means second homes, rental properties, and other eligible properties won’t be able to have their taxable value increase more than 20% each year. This cap will significantly curb increases in tax bills, allowing property owners to budget more effectively. In addition, legislation still to be voted on would increase the homestead exemption from $40,000 to $100,000.

Types of Federal, State, and Local Taxes

Across the country, there is a laundry list of services to fund, students to support, potholes to fill, and communities to keep safe, all with money collected via taxes. While the U.S. tax system has many complexities — different taxes are paid at different times; some are deducted from paychecks, and others are levied at cash registers — the basics are pretty simple. Here are the seven taxes paid by Americans:

Income Taxes

Income taxes are charged at the local, state, and federal levels. Income tax structures are varied, and the amount paid is based on several factors, such as marital status and total income. In Texas, there is no personal income tax.

Sales Taxes

Sales taxes are levied on goods and services purchased. Typically, these taxes are calculated as a percentage. In Texas, the state sales and use tax rate is 6.25%. On top of that, Texas cities and counties can impose an additional sales and use tax of up to 2% for a combined maximum rate of 8.25%.

Excise Taxes

Like sales taxes, excise taxes are charged on goods — a specific set of them. Gasoline, liquor, beer, and cigarettes typically incur an excise tax when purchased.

Payroll Taxes

There are two payroll taxes: Social Security and Medicare. Both employees and employers pay both taxes. Tax amounts are deducted directly from a worker’s paycheck, and the totals can be tracked via paystubs.

Estate Taxes

The IRS defines an estate tax as “a tax on your right to transfer property at your death.” This controversial tax, often considered a death penalty, is levied on items like cash, stocks, and real estate. Fortunately, many Americans avoid this tax, as estates falling below a reasonably high threshold are exempt from paying.

Gift Taxes

Similar to estate taxes, gift taxes are incurred when something of value is transferred. The difference is gift taxes involve two individuals who are alive. Additionally, exemption levels are far lower with the gift tax, as any value greater than $15,000 in 2021 and $16,000 in 2022 is taxable.

Property Taxes

Property taxes are taxes paid by an individual on owned property. Typically noted as a percentage, these taxes are assessed based on the property’s appraised market value. In Texas, property taxes are assessed locally, not by the state.

These taxes include several individual levies on the city and county level, including school district taxes, road maintenance and construction taxes, and emergency services or government administration. Because Texas does not have a state income tax, property taxes are much higher than in many other areas of the country, and protesting them can yield significant savings.

Related: How to Protest Property Tax in Texas

Reliance on revenues collected from property taxes varies from state to state. Because Texas does not have a state income tax, the revenue collected from property taxes carries a heavier burden when funding local libraries, emergency medical services, and transportation infrastructure. So, how are property taxes in Texas determined?

Variation in Property Tax Rates by Texas County

An advantage of Texas giving its local-level authorities the power to regulate property taxes is that each community levies the taxes required to meet its specific funding needs. On the flip side, however, is that without state oversight, rates vary widely from county to county — and even from city to city within a county — effectively penalizing residents of particular locales. According to the Tax Foundation, relative to your local community, higher property taxes are typically paid in places with higher housing prices.

Related: Homeownership in Texas: Mortgage Payments, Taxes, and Home Values

This variation makes the Texas property tax appraisal increase limit even more critical for those with the highest rates. As a case study, let’s look at two specific counties out of the 254 total counties in Texas. We’ll represent one of the highest and lowest property tax burdens and then compare that to the overall state average.

- Fort Bend County — As reported by the Fort Bend Independent, the average homeowner here has a median property price of around $250,000 and pays more than $5,500 in property taxes, based on an average effective tax rate of 2.22%.

- Borden County — On the opposite end of the spectrum, the average yearly property tax bill here is almost as low as $350 thanks to a median property value of around $105,000 and an average effective property tax rate of 0.34%. It’s interesting to note the population in Borden County is approximated at only 600, which suggests the need for services and the dollars needed to fund available services is less.

- Texas Average (based on available 2019 data) — Landing “in the middle,” the state median home value is $172,500, with an effective real estate tax rate of approximately 1.8% for an annual property tax bill of $3,099.

Why Understanding Property Tax Is Essential

Property taxes cover a wide range in Texas—from as little as $350 owed to a bill of over $15,000. Unfortunately, many heads of households blindly pay the bill when it’s received without pausing to ask, “Is this how much I should be paying?” or “How can I lower my property tax bill?”

If there’s one easy-to-understand takeaway, it’s this: Yes, a percentage limit on yearly appraisal increases is an instrument to protect homeowners. However, because appraisal values have a compounding effect over time, it’s essential to ensure you’re paying a fair property tax from day one. And even if you’re unsure whether you’re overpaying, it’s worthwhile to protest your assessment and your bill.

Combine the Texas Property Tax Appraisal Increase Limits With a Property Tax Protest

Whether you have a homestead exemption or can start benefiting from the pilot program, don’t rely on protections on your assessment value. Letting your appraisal value climb too high can jeopardize your finances in the future if you lose your exemption or if the pilot program isn’t continued. Instead, we recommend that every property owner protest their appraised value yearly to keep it in check.

In this process, you or a representative file a protest form, provide a countervaluation, and present evidence to support your argument in front of an appraisal review board. The process can stretch several weeks, but it can significantly reduce the yearly appraisal increases your property faces. This, in turn, can lower your property taxes or ensure you don’t face a sudden jump in property taxes if the protective cap falls away.

Choose the Tax Professionals That Will Save You Money

As you can see, the county-specific intricacies across the great state of Texas add a lot of complexity to understanding the ins and outs of property taxes. Knowing about the Texas property tax appraisal increase limit is a good start; however, executing a successful protest of your provided assessment on your own is an entirely separate can of worms. This means there’s a good chance that you, as a homeowner, are paying more in property taxes than you need to. And, like most, you probably have no idea where to begin in pursuit of protesting your appraisal.

If you are thinking of trying to fight on your own behalf, you’ll need to acquire, analyze, and adjust market data; choose the correct comparables; submit evidence to the county; negotiate with a licensed appraiser; and attend review board meetings. This can require hours and hours over multiple months—every year. Talk about overwhelming.

At Home Tax Shield, our team of local, experienced professionals takes your home through the entire process. Our data-driven, AI-powered technology monitors your property and local real estate market to ensure a fair tax value each year, giving you more money in your pocket and the peace of mind to rest easy. Sign up today and lower your taxes in one easy step.