Texas homeowners are one step closer to significant property tax relief after Governor Greg Abbott signed three major bills into law on June 16, 2025. The legislation promises to deliver substantial savings for homeowners, seniors, and businesses across the Lone Star State. However, there’s one crucial step remaining before these benefits become reality—Texas voters must approve the measures in November 2025.

While these new exemptions represent significant progress, they work best when combined with other property tax strategies. Smart homeowners understand that even with enhanced exemptions, challenging excessive property appraisals remains one of the most effective ways to keep tax bills manageable. The new legislation provides automatic relief, but annual property tax protests can address specific valuation issues that exemptions alone cannot resolve.

The signing ceremony in Denton marked the culmination of months of legislative work, with Abbott declaring the package would provide “truly unprecedented” property tax relief. The three bills target different aspects of property taxation, from increasing homestead exemptions to providing additional relief for seniors and disabled homeowners.

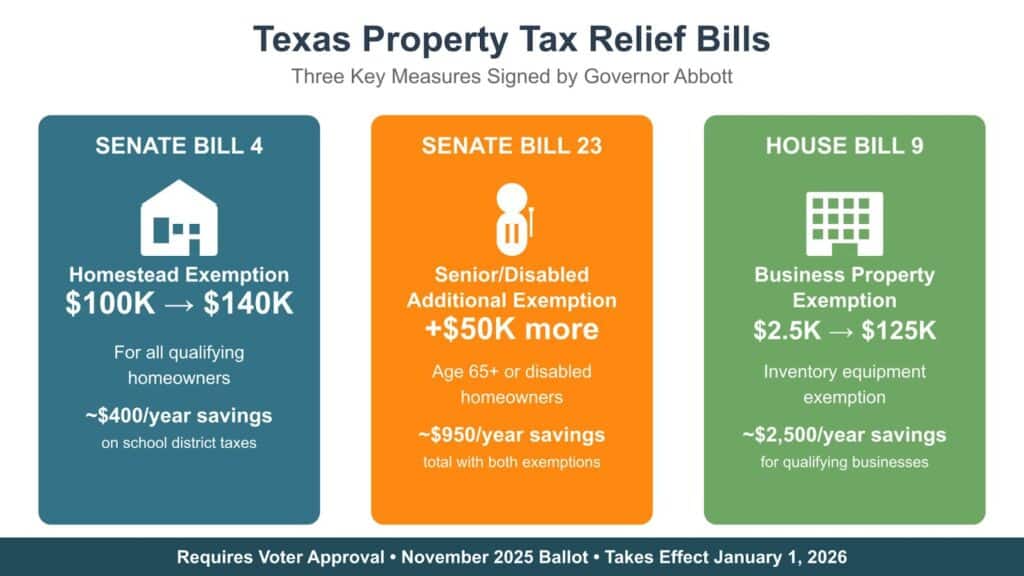

The Three Bills Explained: What Each One Does

Understanding the new property tax legislation requires examining each bill individually, as they target different groups and provide varying levels of relief. Here’s what Texas homeowners need to know about each piece of legislation:

Senate Bill 4: Raising the Homestead Exemption

Senate Bill 4 represents the cornerstone of the property tax relief package. This legislation would increase the mandatory school district homestead exemption from the current $100,000 to $140,000. The increase applies specifically to school district taxes, which typically represent the largest portion of a homeowner’s property tax bill.

For context, the homestead exemption has seen dramatic growth in recent years. When Abbott first became governor, the exemption was just $15,000. The current $100,000 exemption was approved by voters in 2023, representing more than a six-fold increase from the original amount.

Senate Bill 23: Enhanced Relief for Seniors and Disabled Homeowners

Senate Bill 23 provides targeted relief for Texas’s most vulnerable homeowners. The bill would increase the additional homestead exemption for homeowners who are 65 years or older, or who have disabilities, from $10,000 to $60,000. When combined with the general homestead exemption, this would create a total exemption of $200,000 for qualifying homeowners.

This provision recognizes the unique financial challenges facing seniors on fixed incomes and disabled homeowners who may have limited earning capacity. The enhanced exemption could provide substantial relief for households that need it most.

House Bill 9: Business Property Tax Relief

House Bill 9 addresses concerns from the business community by dramatically increasing the business personal property tax exemption. The legislation would raise the exemption from the current $2,500 to $125,000, providing significant relief for small and medium-sized businesses across Texas.

This change affects taxes on business inventory and equipment, such as computers, machinery, and specialized vehicles. Texas is one of the few states that taxes business inventory, making this relief particularly valuable for companies operating in the state.

Who Benefits and How Much You Could Save

The financial impact of these bills varies significantly depending on your circumstances, property value, and local tax rates. Understanding the potential savings can help homeowners appreciate the magnitude of this relief package.

Average Homeowner Savings

For the typical Texas homeowner, the combination of these measures could result in substantial annual savings. WalletHub data shows that Texas has one of the highest property tax burdens in the nation, making relief particularly valuable for residents.

The $40,000 increase in the homestead exemption alone would save homeowners approximately $400 annually in areas with a 1% school district tax rate. When combined with other tax compression measures included in the state budget, average homeowners could see total savings of nearly $500 per year.

Enhanced Savings for Seniors and Disabled Homeowners

The benefits for seniors and disabled homeowners are even more substantial. With the additional $50,000 exemption provided by Senate Bill 23, these homeowners could see annual savings approaching $1,000 when combined with the general homestead exemption increase.

The enhanced exemptions recognize the unique financial challenges facing seniors on fixed incomes and disabled homeowners who may have limited earning capacity, providing targeted relief where it’s needed most.

Business Community Relief

Small businesses would see dramatic relief under House Bill 9. The increase from $2,500 to $125,000 in the business personal property exemption could save qualifying businesses thousands of dollars annually. Senator Paul Bettencourt’s office estimates that business owners could save an average of $2,499 per year under the new exemption levels.

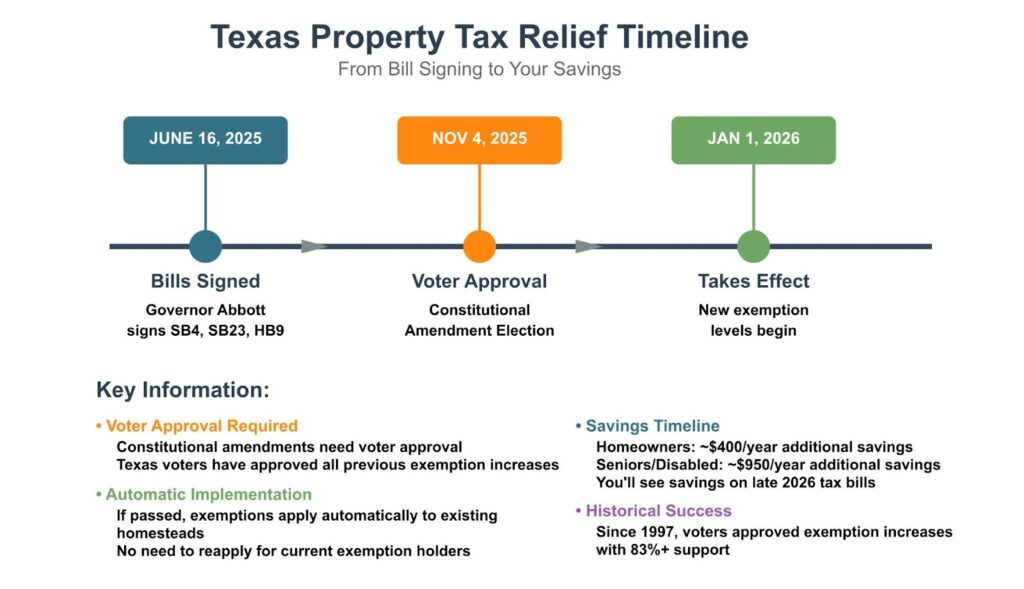

Timeline: From Signing to Your Savings

Understanding when these benefits would take effect is crucial for homeowners planning their finances. The timeline involves several key steps and potential implementation dates.

The Voter Approval Process

The most immediate hurdle is voter approval. Because these changes require amendments to the Texas Constitution, they must be approved by voters in a statewide election. The measures will appear on the November 4, 2025 ballot alongside other constitutional amendments.

Historically, Texas voters have strongly supported property tax relief measures. Since 1997, voters have approved four amendments to increase the homestead exemption, each with at least 83% support. The largest previous increase was from $40,000 to $100,000 in 2023, which passed overwhelmingly.

Implementation Timeline

If approved by voters in November 2025, the new exemption levels would take effect on January 1, 2026, applying to the 2026 tax year. This means homeowners wouldn’t see the benefits reflected in their tax bills until they receive their 2026 property tax statements in late 2026.

The timing aligns with the standard property tax cycle, where assessments are made as of January 1st each year, and tax bills are typically issued in the fall based on those assessments.

Budget Considerations and Funding

The state has allocated significant funds to ensure school districts don’t lose revenue due to the increased exemptions. Abbott noted that Texas is spending approximately $51 billion on property tax relief over the next two years, calling it the largest percentage of any state budget devoted to tax relief in American history.

How This Builds on Previous Texas Property Tax Relief

The 2025 legislation represents the latest chapter in an ongoing effort to address Texas’s high property tax burden. Understanding this context helps illuminate the significance of the current measures.

The 2023 Relief Package Foundation

The current bills build upon the substantial relief package approved in 2023, which increased the homestead exemption to $100,000 and provided additional tax rate compression. That package represented the largest property tax cut in Texas history at the time, providing more than $18 billion in relief.

The 2023 measures also included important provisions like the “circuit breaker” program, which caps annual appraisal increases at 20% for non-homestead properties valued under $5 million. This temporary program runs through 2026 and could be extended based on legislative review.

Cumulative Impact of Recent Reforms

When combined with previous reforms, Texas homeowners have seen unprecedented relief from property tax burden. The homestead exemption has increased by more than 900% since Abbott took office, providing cumulative savings that compound year after year.

The state has also implemented tighter limits on how much local governments can raise property taxes, requiring voter approval for increases above certain thresholds. These structural reforms work alongside exemption increases to provide comprehensive relief.

The Voter Approval Process: What You Need to Know

Understanding the November 2025 election is crucial for homeowners who want to see these benefits become reality. The process involves constitutional amendments that require specific voter action.

Constitutional Amendment Requirements

Texas law requires constitutional amendments for changes to property tax exemptions, ensuring that such significant fiscal policy changes receive direct voter approval. The three bills will appear as separate propositions on the November ballot, allowing voters to approve or reject each measure individually.

Ballot language will clearly explain what each proposition does and its fiscal impact. Voters will see straightforward descriptions of the exemption increases and their expected benefits for different groups of homeowners.

Campaign and Public Education Efforts

Supporters of the measures are expected to conduct extensive public education campaigns leading up to the election. Given the strong historical support for property tax relief in Texas, proponents are optimistic about passage.

However, some fiscal watchdog groups have expressed concerns about the long-term budget implications of such substantial tax cuts. These voices may organize opposition campaigns, though historically, property tax relief measures have enjoyed broad bipartisan support among Texas voters.

What Happens if Measures Fail

If voters reject any of the measures, those specific provisions would not take effect, but other approved measures would still be implemented. The bills are structured to be severable, meaning the failure of one wouldn’t affect the others.

However, given Texas’s track record of supporting property tax relief and the broad legislative support these measures received, most political observers expect strong voter approval.

Questions About Long-Term Sustainability

While the immediate benefits are clear, some analysts have raised questions about the long-term fiscal sustainability of such substantial tax cuts. Understanding these concerns provides important context for voters.

Budget Impact Analysis

The Texas Tribune reports that lawmakers plan to spend $51 billion on property tax cuts over the next two years. This represents a massive commitment of state resources, funded largely by recent budget surpluses.

State budget analysts note that these surpluses resulted from exceptional economic growth and federal COVID-19 relief funds, sources that may not be available in future budget cycles. This raises questions about the state’s ability to maintain such high levels of tax relief spending.

Revenue Replacement Challenges

Critics argue that while the state can afford these cuts now, future economic downturns could force difficult choices between maintaining tax relief and funding essential services. The state would need to find alternative revenue sources or reduce spending to maintain the relief levels.

Supporters counter that the strong Texas economy and continued population growth provide a solid foundation for maintaining these policies. They also note that property tax relief can stimulate economic activity, potentially generating replacement revenue through other sources.

Local Government Impact

School districts and local governments will receive state funding to replace revenue lost through exemption increases. However, some local officials worry about becoming overly dependent on state funding for basic operations, potentially reducing local fiscal autonomy.

The state has committed to “hold harmless” provisions ensuring that school districts don’t lose funding due to exemption increases, but long-term funding mechanisms remain a subject of ongoing discussion.

How to Prepare and What Homeowners Should Know

Texas homeowners can take several steps to prepare for potential implementation of these measures and maximize their property tax savings.

Ensuring Exemption Eligibility

The enhanced homestead exemptions only benefit homeowners who have properly filed for and maintained their exemptions. Understanding homestead exemption requirements is crucial for maximizing potential savings.

Homeowners should verify their current exemption status with their county appraisal district and ensure all paperwork is current and accurate. Those who haven’t filed for exemptions should do so immediately to position themselves for future benefits.

Special Considerations for Seniors

Homeowners approaching age 65 should understand how the enhanced exemptions for seniors work and plan accordingly. The over-65 exemption provides not just additional exemption amounts but also freezes school district taxes at the level when the exemption first applies.

This means timing can be important for maximizing benefits, and seniors should consider consulting with property tax professionals to optimize their exemption strategy.

Continuing Protest Rights

Even with enhanced exemptions, homeowners retain the right to protest their property appraisals annually. The homestead cap limits taxable value increases to 10% per year, but protesting excessive appraisals can provide additional savings.

Property owners should understand that exemptions and protest rights work together to provide comprehensive property tax relief. The exemptions provide automatic savings, while protests address specific assessment issues.

Your Path to Property Tax Savings

The new Texas property tax relief bills represent a potentially transformative opportunity for homeowners across the state. With the possibility of saving hundreds or even thousands of dollars annually, understanding these measures and voting in November 2025 is crucial for anyone concerned about property tax costs.

While the immediate focus is on voter approval, homeowners should also ensure they’re positioned to maximize all available property tax relief options. This includes maintaining proper exemption filings, understanding assessment processes, and staying informed about additional relief opportunities.

For homeowners seeking to optimize their property tax strategy beyond exemptions, professional representation can ensure you’re getting the maximum possible relief. Home Tax Shield helps Texas homeowners navigate the complex property tax landscape and fight for fair valuations every year. Our experienced professionals handle all the research, paperwork, and protest hearings, taking the burden off your shoulders while working to ensure your tax bill is as low and fair as possible. Contact us today to get started and let us handle the complexities while you enjoy the savings.

Frequently Asked Questions

Q: When will I see these savings on my tax bill? A: If voters approve the measures in November 2025, the new exemption levels would take effect January 1, 2026, and appear on tax bills issued in late 2026.

Q: Do I need to reapply for exemptions to get the increased amounts? A: No, if you already have valid homestead or over-65 exemptions, the increased amounts will be applied automatically if the measures pass.

Q: What happens if only some of the measures pass? A: Each bill is separate, so voters could approve some measures while rejecting others. Any approved measures would take effect as scheduled.

Q: Will these changes affect my homestead cap benefits? A: The homestead cap limiting annual taxable value increases to 10% would continue unchanged. These protections work alongside exemptions to provide comprehensive relief.

Q: Are there any income limits for these exemptions? A: No, the homestead exemptions have no income limits. Any qualifying homeowner can benefit regardless of household income levels.Q: How do these changes compare to other states’ property tax relief? A: Texas would have among the most generous homestead exemptions in the nation if these measures pass, particularly for seniors and disabled homeowners.