The Texas House of Representatives and the Texas Senate have passed competing measures to deal with the looming property tax crisis. Both bills are designed to provide immediate tax relief. Still, they use different mechanisms: one wants to increase the property tax exemption amount, and the other wants to reduce the assessed value increase cap for homeowners with homestead exemptions. While either measure will significantly affect the amount you’ll pay in future property taxes, you won’t see those effects in your upcoming property tax bill.

Your Notice of Appraised Value—which notes your newly calculated home value, any exemptions that apply to your appraisal, and your anticipated property tax levies—may already be sitting on your countertop. All that’s left to do is protest your property value assessment and operate within the current property tax and protest rules. Here, we’ll explore the recently proposed changes in homestead exemptions that may impact your current property tax obligations. We’ll also explore what you can do to ensure you pay the fairest possible amount in property taxes for 2023.

What Taxes Do Texans Pay?

Texans face fewer taxes than residents in most other states. There is a federal personal income tax but no state income tax. Businesses don’t have many taxes beyond employment tax obligations. There is a local property tax but not a state-wide property tax, and—like most Americans see—there is a sales tax.

Related: What Taxes Do Homeowners Pay in Texas?

However, while there are fewer individual tax bills, the property tax rate is adjusted upward to provide needed funding. Texas has the seventh-highest average property tax rate at approximately 1.8%. These taxes are collected by local tax authorities and are used for local city or county expenses, school districts, and junior colleges.

Recent Changes in Property Taxes Every Resident Should Know

Texas property values increased to soaring heights throughout the pandemic, jeopardizing many people’s ability to buy new homes in their communities. At the same time, this spike in market value caused a slower but just as dramatic increase in assessed property values and property tax bills. This turned the red-hot real estate market into a problem for people who weren’t even in the market, as people were faced with skyrocketing bills and higher escrow payments than they could afford. Property tax collectors have seen a 20% increase in collected property tax revenue since 2017.

Some measures have been taken to direct combat the rising property tax bills. For example, a 2019 bill that was approved and turned into law set a cap on how much property tax revenue could increase yearly. Today, local governments can only increase the revenue collected through property taxes by 3.5% in a given year if they get voter approval. This cap replaced the 8% cap local tax entities had before 2019.

Other changes ironed out details regarding tax increases for school districts and other procedural, budgetary, and administrative norms. Over the past few decades, the property assessment and taxation process has become much more consistent. Other changes have focused squarely on property tax exemptions.

The Homestead Exemption for Property Taxes: Past, Present, and Future

Homestead exemptions are designed to reduce the property tax burden on homeowners and residents across the state. If a property owner qualifies for an exemption, then a certain amount of their property’s assessed value is not included in the calculation of certain property tax levies. The most popular exemptions include:

- The general resident homestead exemption

- Over-65 exemptions

- Exemptions for residents with disabilities

- Exemptions for veterans with disabilities

Each option offers a different degree of tax relief, and the last three fall under the umbrella of homestead exemptions; for example, if you are a homeowner over 65, you can get the benefits of both the general homestead exemption and the over-65 provision. While these measures won’t reduce your assessed market value as measured by your appraisal district, they will impact your value and the resulting tax bill obligations.

Past Changes to the Homestead Exemption

One of the most significant recent changes to the homestead exemption was the increase in the protected amount. Before 2021, qualifying homeowners could only exempt $25,000 of their home’s value from school district levies. Today, that amount is $40,000. This means a qualifying homeowner with a $250,000 home in a district with a 1.25% school district tax will save $500. More minor tax relief benefits exist depending on your county or city and the projects tax revenues go to, but this is the crucial benefit.

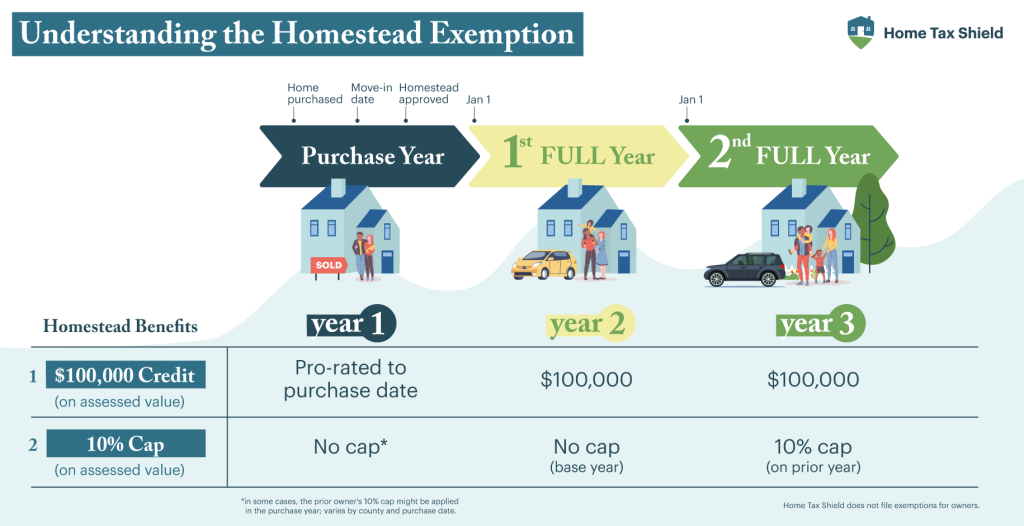

Current homestead exemptions also apply one more measure for saving homeowners money: a cap. Aside from any improvements made to the property, your home’s assessed value cannot increase by more than 10%. So that same homeowner with a $250,000 home won’t see their assessed value increase beyond $275,000 next year unless they make renovations.

Prospective Changes Being Debated

Both aspects of the homestead exemption are being considered. Under the House’s proposed change, the cap will change from 10% to 5%. House Bill 2, which the Texas House of Representatives recently passed, proposes to shrink the cap to stabilize property taxes over the years to come. It also wants to allocate $12 billion for school districts, facilitating lower property taxes without leaving schools lacking resources and funding. This is just one small but significant part of the House’s $17 billion package. Other changes include increased tax breaks for commercial owners.

The Texas Senate’s recently passed measures to address property exemptions from the other angle: exemption amounts. It would increase general resident exemptions from $40,000 to $70,000 while simultaneously increasing the over-65 exemption from $10,000 to $20,000, giving seniors on a potentially fixed income more tax relief.

Related: What Is the Texas Legislature Doing to Help Lower Property Taxes?

Now that both measures have passed, the state congress committees will assess the bills and attempt to create a compromise that both bodies can agree upon. However, there are some implications to both measures that can negatively impact homeowners. Under the terms of House Bill 2 and its reduced cap, for example, homeowners have more incentives to hold onto properties for longer, further squeezing the real estate market. This would lead to sharper increases for rental property owners and those not qualifying for a homestead exemption for a given year.

What You Need to Know About the Homestead Exemption Right Now

The future regarding property taxes and legislation intended to curb sharp spikes in property tax bills is uncertain. While the real estate market may be starting to stabilize and legislators are trying to mitigate financial concerns, that won’t help property owners who opened their Notice of Appraised Value and got sticker shock. These are the steps you can take right now to manage your property tax bill:

File for a Homestead Exemption as Soon as Possible

If you qualify for a homestead exemption, apply for one. Your county may or may not automatically have processes in place for this. Also, if you are eligible for a disability or over-65 exemption, ensure your property record reflects this. Again, some counties automatically track when homeowners become suitable for an over-65 provision, while others do not.

Check That Your Homestead Exemption (and Additional Exemptions) Are Still in Place

If you have previously qualified, make sure it’s still in place. Appraisal officials can make mistakes. Actively verifying the details on your property profile is essential for ensuring you get the tax protections you’re entitled to.

Protest Your Property’s Assessed Value and Any Inaccuracies on Your File

If you believe your property’s assessed value is inaccurate, now is the time to protest. While exemptions and property appraisal protests are separate, managing both aspects of your property tax obligations can lead to a lower property tax bill in the future. Most homeowners must file a Notice of Protest for the 2023 tax year by May 15th, or thirty days following the date on which your Notice of Appraised Value was sent.

Fight to Pay Fair Property Texas, Whether You Have a Homestead Exemption or Not

Staying on top of property taxes, pending homestead exemption legislation and the details of your assessment can help you proactively advocate for fair property tax bills. But you don’t have to do it alone. At Home Tax Shield, we help homeowners protest their property taxes. We can assess your property’s value to determine if your appraisal district may have miscalculated. Then we can handle the property protest process on your behalf. Sign up today to ensure you use every method possible to pay fair property taxes in 2023.