Texas property tax law changes every few years. See the latest posts for the most up-to-date information.

How Texas Homestead Exemptions Can Reduce Your Property Tax Bill

Texas property taxes have risen so high that they’re no longer in many residents’ budgets. Local governments rely on property taxes for everything from county roads to city libraries, mainly because there is no state income tax; the funds for local services and infrastructure come primarily from property taxes. In an effort to balance these competing needs, Texas put two provisions into place this year: a significant cut to school district taxes for property owners who are disabled or older than 65 and a minor reduction for general homeowners who primarily reside in their Texas home. Learn more about how you can access those benefits and other savings through homestead exemptions in Texas. This guide will discuss homestead exemptions, how they work, and the benefits they provide for your property tax bill each year.

What Are Homestead Exemptions in Texas?

Homestead exemptions exempt a portion of your residential property’s assessed value from property tax calculations — provided the property is your primary homestead. Property investors, for example, cannot qualify for a homestead exemption for a property they rent out to tenants. These exemptions reduce homeowners’ property tax bills by hundreds or thousands of dollars annually.

There are two homestead exemptions available for many Texan homeowners:

- General Residence Homestead Exemption

- Inherited Residence Homestead Exemption

General Residence Homestead Exemption

General homeowners who primarily reside at a specific property can apply for a homestead exemption for that property. Under Tax Code Section 11.13(b), $40,000 of the property’s assessed value is exempt from the school district tax portion of property taxes. For example, if you have a home valued at $250,000 and a property tax rate of 2% — 1% of which goes to your local school district — your initial property tax bill would be $5,000. With this homestead exemption, your tax bill goes down to $4,600; that $40,000 exemption removes $400.

Note: Local governments determine property tax rates and levies. Each county may have a different school district and total property tax rates. Other homeowners in different areas will see additional tax bill reductions.

Along with the $40,000 exclusion, homestead exemptions may also protect up to 20% of the property value from being included in tax calculations (though local governments decide on the exact percentage). This provision can also exempt homeowners from a further $3,000 if the local government collects taxes for maintaining farm-to-market roads or flood control measures.

Inherited Residence Homestead Exemption

This measure allows inheritors of a homestead to retain the benefits of a homestead exemption. The heir and applicant must provide an ownership document, and any non-applicant heirs with some degree of ownership of the property must provide an affidavit authorizing the application.

Additional Property Exemptions You May Qualify For

Along with homestead exemptions, some property owners can seek additional relief from high property taxes through other forms of tax assistance. These include:

- Property tax discounts for people age 65 or older or disabled persons

- Provisions for surviving spouses of first responders killed in the line of duty

- Partial or complete property tax reductions for disabled veterans (or their surviving spouses)

- Agricultural land taxation functions as a different way of calculating a property’s assessed value rather than being a formal exemption

Depending on your unique circumstances, you may qualify for multiple simultaneous forms of tax relief.

How Is Your Property Tax Bill Calculated?

Property taxes are more complicated than multiplying your home’s value by a fixed percentage each year. First, counties or local tax authorities assess your property at least once every three years. Each year in between those assessments, the assessed value of your home is adjusted based on demand in the local market, price factors and sales in your neighborhood, and improvements you’ve made to your property. Generally, this number increases each year, especially if you’re in an in-demand area of Texas.

The property tax rate in your area also fluctuates. It comprises multiple levies — including the school district, local college, city, and county taxes. The revenue a local government needs to raise to meet its budget goals can increase yearly based on general costs and new initiatives. However, it generally can’t increase by more than three and a half percent without a vote.

Exemptions often apply to just one of the tax levies, such as school district taxes, rather than all the taxes making up your tax rate as a whole. Tax authorities often “itemize” the different levies when calculating tax bills to ensure the exemptions are applied correctly.

3 Ways a Homestead Exemption Reduces Your Property Taxes (Now and Over Time)

Earlier, we looked at how a homestead exemption generally operates to reduce the property taxes of qualifying homeowners. Let’s examine those benefits in greater depth:

$40,000 Exemption for School District Taxes

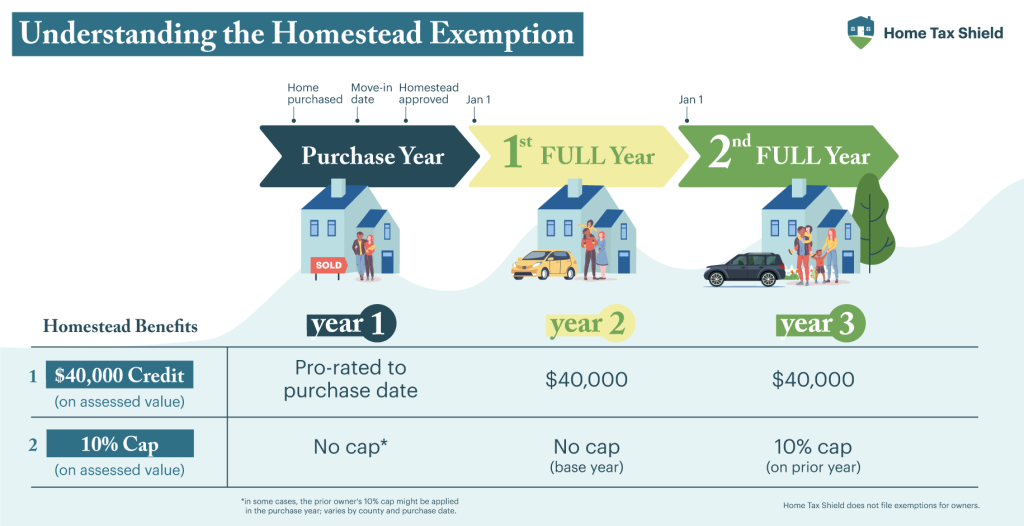

In previous years, homeowners received a $25,000 exemption from the school district portion of their property tax rates. Beginning in 2022, that exemption amount grew to $40,000. Independent school district (ISD) taxes can be between 1% and 1.5% in many Texas counties. As a result, this exemption reduces homeowners between $400 ($40,000 x 1%) and $600 ($40,000 x 1.5%).

Local Exemptions and Benefits

Depending on the specific ordinances and operations of your local government, you may also be eligible for the following:

- An exemption of up to 20% of your home’s value and no less than $5,000; this exemption is decided on a government-by-government level.

- A $3,000 exemption if your local area has farm-to-market roads or flood control measures

10% Cap on Assessed Home Value Increases

According to Tax Code Section 23.23, homesteads with a homestead exemption cannot have property value increases of more than 10% each year, excluding increases due to property improvements. For example, suppose your home is assessed at $300,000 in Year One, and you don’t make any improvements. In that case, the property value cannot be greater than $330,000 in Year Two. This controls for potentially high increases without negatively affecting the property’s market value; the market value is entirely separate from the assessed or taxable value of the property.

The value of having homestead exemptions grows the longer you have the property. Let’s examine how property values could change over multiple years with and without a property exemption. Suppose you live in a very in-demand area where the assessed value of residences increases 20% each year:

Without a homestead exemption:

- Year 1: $300,000

- Year 2: $360,000

- Year 3: $432,000

- Year 4: $519,400

- Year 5: $622,080

With a homestead exemption, capping increases at 10%:

- Year 1: $300,000

- Year 2: $330,000

- Year 3: $363,000

- Year 4: $399,300

- Year 5: $439,230

Home Tax Shield Is Here to Help You Fight for Lower Taxes

If you want to start saving more money on property taxes, strategies such as applying for exemptions and protesting your property tax bills can help. Turn to Home Tax Shield to learn more about managing the process and fighting for fair property tax bills.