Similar Texas homes often have different property tax bills due to complex assessment systems, legislative changes, and timing factors. November 2025’s historic constitutional amendments raised homestead exemptions to $140,000, with seniors and disabled homeowners receiving total exemptions of $200,000. Annual protests help identify overassessments and reduce your burden.

- Complex algorithms consider 40+ factors, making simple neighbor comparisons unreliable

- November 2025 constitutional amendments brought $140K homestead exemptions and $200K total exemptions for seniors/disabled

- Purchase timing affects your tax base compared to long-time neighbors

- Professional analysis determines if differences indicate actual assessment errors

You and your neighbors live in nearly identical homes. Same school district, same HOA dues, even similar landscaping. So why does your property tax bill arrive with a number that’s hundreds or even thousands of dollars higher than theirs? With Texas experiencing significant property tax increases averaging 27% from 2019 to 2024, this frustrating scenario affects more homeowners than ever.

Understanding why these disparities occur – and what you can do about them – requires examining how the complex Texas property tax system actually works. While apparent differences aren’t always errors, they’re always worth investigating through Texas’s property tax protest process to ensure you’re paying only your fair share.

How are Property Taxes Calculated in Texas in 2025?

Texas property taxes operate through a sophisticated system where multiple factors combine to determine your final bill. The basic formula seems simple: your property’s tax appraised value multiplied by your local tax rate equals your taxes owed. However, the reality involves complex calculations that can create significant variations between seemingly similar properties.

Your local County Appraisal District (CAD) determines your property’s market value as of January 1st each year using mass appraisal methods. These automated systems analyze thousands of properties simultaneously, applying standardized formulas based on factors like square footage, lot size, age, construction quality, and neighborhood characteristics.

The November 2025 constitutional amendments represent the most significant property tax changes in Texas history. Texas voters approved all 17 constitutional amendments, including Proposition 13 which increased the homestead exemption from $100,000 to $140,000 for school district taxes. Proposition 11 raised the additional exemption for homeowners aged 65 or older or disabled from $10,000 to $60,000, creating a combined $200,000 total exemption for qualifying homeowners.

These changes mean a homestead property valued at $400,000 now pays school district taxes as if valued at $260,000, while qualifying seniors and disabled homeowners pay taxes as if valued at $200,000. The typical Texas homeowner will save approximately $490 annually, with seniors saving even more through the enhanced exemptions.

Why Do Similar Homes Have Different Property Tax Bills?

The answer lies in the complexity of mass appraisal systems and the numerous variables that affect property valuations. Unlike individual appraisals conducted for mortgage purposes, mass appraisal systems must value thousands of properties efficiently using standardized methodologies.

County appraisal districts use mass appraisal systems that consider multiple factors like square footage, lot characteristics, construction quality, age, and location. However, proper property comparison analysis – the kind used by tax protest professionals – requires examining and adjusting for over 40 different data points to ensure accurate comparisons between properties.

This complexity means you cannot simply look at your neighbor’s tax bill and assume an error exists. Two homes that appear identical may have subtle but significant differences that justify different valuations. Perhaps your neighbor’s home has a smaller lot, different construction quality, or was built in a different year. Maybe their property has easements or structural issues that affect its market value.

The sophistication of these adjustment systems is precisely why professional property tax protest services prove so valuable. They have access to detailed property data and understand how to properly analyze whether apparent discrepancies represent actual assessment errors.

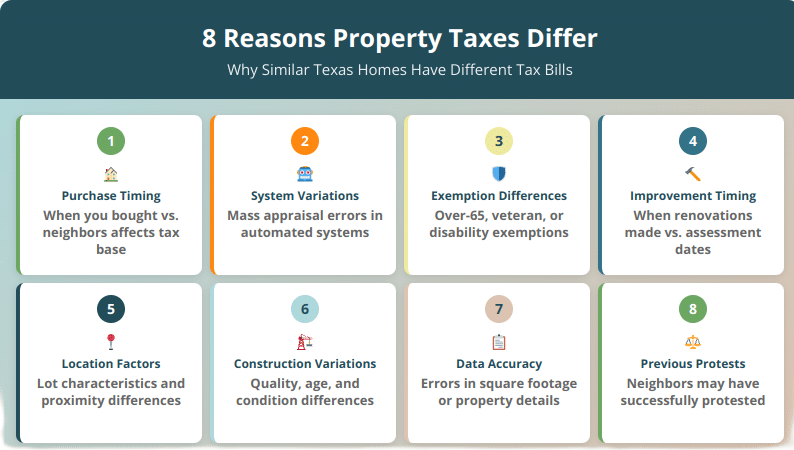

What Are the 8 Main Reasons for Property Tax Differences?

1. Purchase Timing and Assessment Base Differences

When you purchased your home versus when your neighbors bought theirs can significantly impact your tax burden. Properties purchased during different market cycles may have different baseline assessments that affect future valuations.

The homestead exemption’s 10% annual increase cap only protects homesteaded properties from dramatic jumps, but this protection builds over time. A neighbor who’s owned their home for 15 years benefits from cumulative protection that a recent buyer doesn’t enjoy. This timing factor can create substantial differences in effective tax rates between similar properties.

2. Mass Appraisal System Variations

Despite sophisticated methodologies, mass appraisal systems aren’t perfect. With thousands of properties to assess annually, even small errors in data input or methodology application can result in significant valuation differences. Statistics show approximately 83% of homes in America are unfairly overassessed and paying too much annually.

These system limitations explain why Texas law provides extensive property tax protest rights and why annual protests prove so valuable for identifying and correcting assessment errors.

3. Exemption Status Differences

Not all homeowners claim the exemptions they’re entitled to receive. With the November 2025 constitutional amendments, these differences became even more significant. Your neighbor might benefit from additional exemptions beyond the basic $140,000 homestead exemption, such as:

- Over-65 exemption: Now provides an additional $60,000 exemption (total $200,000) plus freezes school district tax amounts

- Disabled person exemption: Also provides the additional $60,000 exemption (total $200,000) for qualifying disabled homeowners

- Disabled veteran exemptions: Can provide partial or complete property tax exemptions based on disability rating

- Surviving spouse exemptions: Enhanced through Proposition 7 for surviving spouses of veterans who died from service-connected conditions

- Fire reconstruction exemption: New temporary exemption for homes completely destroyed by fire

These exemptions can create substantial differences in effective tax rates between otherwise similar properties, with qualifying seniors and disabled homeowners potentially paying zero school district taxes.

4. Property Improvement Timing

When improvements are made relative to assessment dates significantly affects property valuations. A neighbor who completed renovations after January 1st won’t see those improvements reflected in the current year’s assessment, while improvements completed before the assessment date will increase property values.

Major improvements that typically affect assessments include additions that increase square footage, new garages or detached structures, and permanent fixtures like in-ground pools. Interior renovations like kitchen upgrades or new flooring generally don’t impact assessments unless they fundamentally change the property’s characteristics.

5. Lot and Location Factors

Even properties on the same street can have different valuations based on specific lot characteristics. Corner lots, properties with unusual shapes, or homes with different relationships to amenities or nuisances can justify different assessments.

Factors like proximity to power lines, flood zones, or busy streets can negatively impact property values, while access to parks, better school zones within the district, or premium lot positions can increase values. These location-specific factors are legitimate reasons for valuation differences.

6. Construction and Condition Variations

Properties that appear similar may have different construction quality, ages, or condition issues that affect their market values. A home with foundation problems, roof damage, or other structural issues should be assessed lower than an identical home in excellent condition.

However, these condition factors must be properly documented and considered in the assessment. If your property has issues that aren’t reflected in its valuation, this provides grounds for a successful protest.

7. Data Accuracy Issues

Sometimes property tax differences result from simple data errors in appraisal district records. Incorrect square footage, wrong number of bedrooms or bathrooms, or outdated property characteristics can all lead to inaccurate assessments.

Regular review of your property’s appraisal card information helps identify these errors early. While data corrections don’t require formal protests, they demonstrate the importance of verifying assessment accuracy annually.

8. Previous Protest Success

Perhaps the most significant factor: your neighbor may have been successfully protesting their property taxes for years while you haven’t. Annual protests that achieve even modest reductions compound over time, creating substantial savings compared to properties that haven’t been protested.

This factor alone explains many property tax disparities and highlights why consistent annual protests prove so valuable for long-term tax management.

How Do the November 2025 Constitutional Amendments Affect Tax Disparities?

The November 2025 constitutional amendments represent the largest property tax relief package in Texas history, but they affect different properties differently. The increased $140,000 homestead exemption provides substantial relief for homesteaded properties but doesn’t help rental properties or commercial real estate.

The enhanced senior and disabled exemptions create even larger disparities between different homeowner categories. Roughly half of seniors and disabled homeowners in major counties will pay zero school district property taxes due to their $200,000 combined exemptions, while younger homeowners still face the full tax burden on values above $140,000.

Business owners also benefit from increased personal property exemptions, with the threshold rising from $2,500 to $125,000. This creates additional disparities between residential and commercial property tax burdens.

Understanding these constitutional changes helps explain why some neighbors might see dramatically different impacts from recent reforms, particularly based on their age, disability status, and property’s homestead qualification.

What Should You Do If Your Taxes Are Higher Than Neighbors’?

If you discover your property taxes significantly exceed those of similar neighboring properties, resist the urge to assume an error exists. The mass appraisal system’s complexity means many legitimate factors could explain these differences.

Instead, take a systematic approach to investigating potential issues:

First, gather information carefully. Request detailed appraisal information from your County Appraisal District and review your property’s assessment data for obvious errors. Compare not just tax amounts but also assessed values, exemption status, and property characteristics.

Second, understand the limitations of informal comparisons. Remember that property tax protest professionals consider over 40 data points when valuing properties. Apparent similarities between homes may mask significant differences that justify different valuations.

Third, consider professional analysis. Property tax protest companies have access to comprehensive property databases and understand how to properly adjust comparable sales data to identify legitimate assessment errors.

Fourth, file annual protests regardless. Even if your taxes aren’t dramatically higher than neighbors’, annual protests help ensure your assessments remain fair and accurate. The protest process provides valuable protection against assessment errors and helps build long-term tax savings.

Professional property tax services offer particular value because they understand the sophisticated methodology required to properly analyze property tax assessments. They can determine whether apparent disparities represent actual overassessment errors or result from legitimate valuation differences.

Are Property Tax Disparities Always Errors?

Not necessarily. The sophisticated nature of mass appraisal systems means many apparent disparities between similar properties have legitimate explanations. However, the system’s complexity also creates opportunities for errors that only careful analysis can identify.

The key is understanding that assessment accuracy often requires professional evaluation. Successful property tax protests depend on presenting compelling evidence that demonstrates assessment errors or inequities, not simply pointing to neighbors with lower tax bills.

This is why Texas law provides extensive protest rights and protections. The system recognizes that mass appraisal methods, while necessary for efficiency, require oversight to ensure fairness and accuracy.

Annual protests serve as a crucial check on assessment accuracy, providing homeowners the opportunity to present evidence about their property’s specific characteristics and market conditions. Even if protests don’t always result in reductions, they help ensure assessments remain within reasonable bounds.

Frequently Asked Questions

Q: Can the appraisal district raise my property value during a protest? A: No. Texas law prohibits appraisal districts from increasing your property value during the protest process. The worst outcome is that your value remains the same.

Q: Do I need to pay my property taxes while protesting? A: Yes. You must pay your property taxes by January 31st even if you’re protesting or appealing a protest. If your protest succeeds, you’ll receive a refund for any overpayment.

Q: How long does the property tax protest process take? A: The process typically runs from April through July, with informal hearings in June and formal ARB hearings in July. Final determinations are usually made by August.

Q: Will filing a protest affect my ability to sell my home? A: No. Filing a property tax protest has no impact on your home’s marketability or actual market value. It’s simply an administrative process for ensuring fair taxation.

Q: What’s the success rate for property tax protests in Texas? A: Success rates vary by county and protest quality, but many counties see 40-60% of protests receiving some reduction. Professional representation typically improves success rates significantly.

Take Control of Your Property Tax Burden

The November 2025 constitutional amendments provide historic relief for many homeowners, but they also create new complexities in the tax calculation process. Annual property tax protests remain the most effective tool for ensuring fair taxation and protecting against assessment errors.

Don’t let property tax disparities frustrate you without taking action. Whether your taxes seem higher than neighbors’ or you simply want to ensure fair treatment, annual protests provide valuable protection and potential savings. Ready to take control of your property tax burden? Contact Home Tax Shield today to discover how professional property tax protest services can help ensure you’re paying only your fair share.