Texans of all ages and incomes across the state have seen an unprecedented increase in their property tax bills due to rising property appraisals. In just ten years, home prices have increased over 214%, and those steep increases have, in turn, affected appraisal values for taxation purposes. While this has been nerve-wracking for most taxpayers, seniors have seen substantial financial turmoil because they often live on fixed incomes and face more hardship in potentially selling and downsizing to a more affordable property.

The Texas Tax Code acknowledges this difficulty by providing additional tax relief measures for seniors, including the over-65 property tax exemption. Learn more about the benefits of applying for the over-65 property tax exemption, how it can lower your property taxes now and in the future, and what effects the pending property tax relief bill will have on your property tax payments. We’ll also explore other ways seniors can fight for a lower property tax bill.

What Are Property Tax Exemptions?

Property tax exemptions are provisions in the Texas Tax Code that shelter a portion of eligible properties’ values from specific property tax levies. Because Texas doesn’t have a state income tax, many local projects and expenses are funded by property taxes, and residents have levies such as:

- City taxes

- County taxes

- School district taxes (one of the most significant individual levies and the subject of most property tax exemptions)

- Junior and community college taxes

Local tax officials calculate residents’ property tax bills by multiplying their appraised property value by their effective tax rate. Tax exemptions remove a portion of the property value from those calculations. For example, the homestead exemption—one of the most common provisions for residences—removes $40,000 of a home’s value from determining a resident’s school district tax bill. If you live in a region with a 1% school district tax rate, a general homestead exemption will save you $400. Different homes will be eligible for various degrees of savings based on their local tax rates and other exemptions they may qualify for.

What Is the Over-65 Property Tax Exemption?

Seniors over 65 are eligible for additional property tax protections because they often live on a fixed income and need other tax relief to own their homes.

The Primary Benefit: A Supplemental $10,000 Exemption Against School District Taxes

If you qualify for an over-65 exemption, the main benefit is that your $40,000 general exemption increases to $50,000. Instead of saving $400 in a district with a 1% school district tax rate, eligible seniors have a savings of $500.

Additional Benefits of the Over-65 Exemption for Senior Residents

The yearly savings are the primary benefit of filing for an over 65 property tax exemption. However, it provides additional benefits over the long term that can be just as valuable, including:

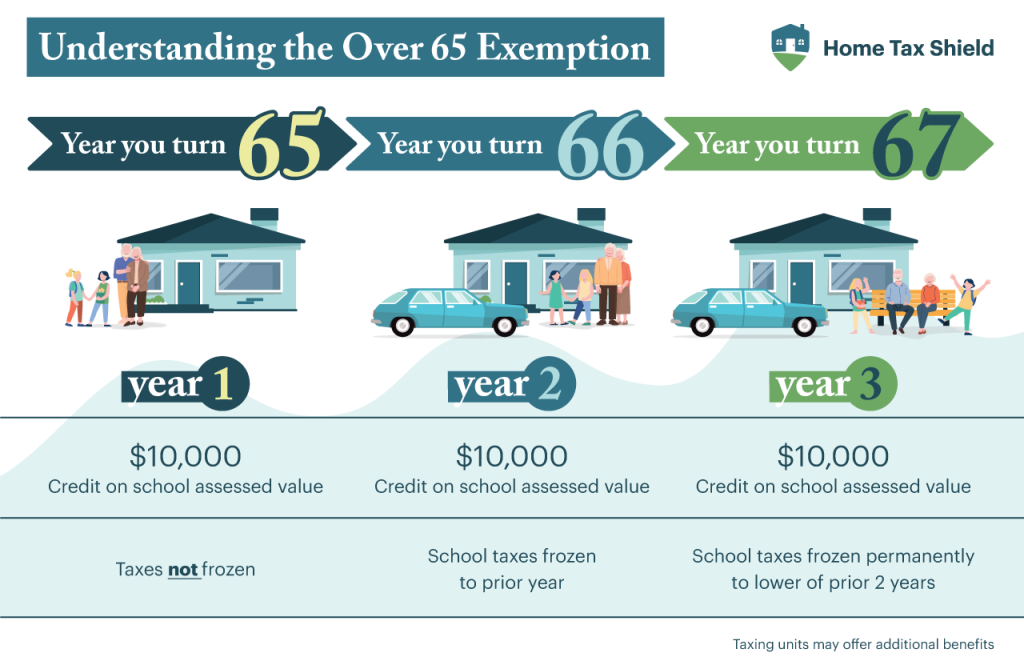

- Ceiling on school district taxes: Once you file the exemption, it establishes a cap on the school district-related taxes you are responsible for. This portion of your property taxes cannot increase beyond what you paid in the year you qualified for the exemption, except in specific circumstances (such as improvements or moving to a higher-valued property).

- Continued benefits for your surviving spouse: Your spouse remains eligible for your tax exemption and tax ceiling following your death, provided they are 55 or older and the property becomes or remains their primary residence.

- County-specific benefits: Depending on your county, you may also be eligible for tax limitations on levies for junior or county colleges in your region. Local government officials authorize this benefit on a county-by-county basis rather than a statewide provision.

- Mobile tax ceiling: If you move from one home to another home, you can take your tax ceiling benefit with you. The transfer is calculated as a percentage. For example, if you pay $200 in school district taxes but would be expected to pay $500 without the over-65 exemption, you pay 40% of this levy. If your next home has a school district tax of $750, you continue to pay only 40%: $300.

Will the Over-65 Exemption Change in the Upcoming Property Tax Relief Package?

The Texas legislature recently passed a property tax relief package to reduce homeowners’ monthly property tax bills. The most significant part of this package is increasing the general homestead exemption from $40,000 to $100,000. Unfortunately, the over-65 exemption will remain at an additional $10,000, increasing the total protected value for eligible seniors to $110,000.

However, there are some specific provisions for seniors. The tax relief package amends the previous exemption increase (which went from $25,000 to $40,000) to give seniors, disabled residents, and other residents on a fixed income the savings they missed out on in the past year due to issues in how the previous legislation was written. If you were given only some of the tax savings you were due for 2022, then the legislation may provide you with the money you’re owed from previous years.

Suppose voters pass this tax relief passage in the general election this November. In that case, eligible over-65 homeowners can see savings of approximately $1,100 or greater, depending on the school district tax in your area.

Related: What is a Homestead Exemption in Texas?

How to File for This Exemption

The over-65 exemption is often considered a supplement to the general residence homestead exemption, a separate measure protecting a more significant portion of eligible property values from school district taxes. If you qualify for the over-65 provisions, you also qualify for a homestead exemption, bringing your property’s total protected value up to $50,000 in 2023.

To receive this exemption, you can apply for the exemption from your county-level appraisal district any time in the year you become 65 (or in subsequent years if you have just learned about the exemption). These applications can be filled out and submitted online or via the mail for most counties. The county will approve or deny your application. If your application is approved, the exemptions will automatically be applied to your property tax bill in that year and all subsequent years.

Homeowners that have already qualified for the general residential homestead exemption and have communicated their year of birth to the county will automatically be given the exemption. Still, you will want to perform your due diligence or hire professional property experts to ensure you receive the maximum possible exemptions for your circumstances.

Related: Should You Protest Your Property Taxes Yourself? Or Hire a Pro?

Frequently Asked Questions About the Over 65 Property Tax Exemption in Texas

If this is your first time hearing about the over 65 property tax exemption, we’re here to help answer your questions and ensure you have everything you need to receive the exemption successfully. Here are some of the most frequently asked questions about the exemption:

Can You Transfer Your Tax Ceiling Under This Exemption to Your New Property?

Yes! You can transfer your school district tax ceiling under the exemption from your current residence to your new primary dwelling, whether in the same tax district or not. If you are moving to a new county, you need a certificate from your appraisal district’s chief appraiser. When you file for your residence homestead exemptions, this will be filed with your new tax district.

What if You Make Improvements to Your Property?

New improvements or additions to your property will not affect your $10,000 exemption. However, it may raise your school district tax ceiling based on the value your additions generated for the property.

You’ve Filed for the Over-65 Exemption—What Else Can You Do to Reduce Your Home’s Property Taxes?

While filing for the exemption grants you approximately $500 in savings if your local area has a 1% school district tax (with $100 coming directly from the over-65 provision), those savings pale compared to rising property values and the taxes that go with them. However, every property owner in Texas can protest their property taxes and fight for a lower bill.

What does this process look like?

First, it’s important to note that this process happens in the spring. While you receive your property tax bill every year in the fall, the ‘property tax protest’ process is protesting your property’s appraised value, which is calculated as of the first of the year and then finalized in the appraisal district roll in the late spring and early summer of every year.

In April, homeowners with an appreciating home value receive a Notice of Appraised Value, which notes your home’s currently appraised value and the home’s effective appraised value, which can be substantially lower if protected by the homestead exemption cap.

Suppose you believe the appraised value is inaccurate. In that case, you can protest it by filing a form, submitting it to the local appraisal district, and presenting your argument in a hearing in front of an appraisal review board (ARB). Some of the most common reasons why your appraised value may be wrong include:

- It’s unfairly comparing your property to recently sold properties in your neighborhood with significant upgrades and remodeling.

- Your home may have easements, eyesores, or unique considerations that the county appraiser should have accounted for.

These reasons can be valid arguments for why your appraisal district should lower your current appraised value.

Suppose you know your appraisal is inaccurate, but you’re overwhelmed by gathering evidence, negotiating with the appraiser, or presenting arguments in a formal hearing. In that case, you can appoint a representative to act on your behalf. Property tax services can assess your home’s value, collect evidence about comparable properties in your neighborhood, and present a solid argument on your behalf to get you the most savings possible.

Protest Your Property Taxes for Even More Property Tax Relief

If you’re 65 or older, you’re entitled to additional property tax relief on your primary residence beyond the standard general homestead exemption. At Home Tax Shield, we can also protest your property taxes on your behalf to ensure your taxes are calculated fairly and accurately. Contact us today to see how easy fighting for the lowest possible tax bill can be.