Key Takeaways

Your home’s tax appraised value directly determines your property tax bill, while market value reflects what buyers will pay—and these numbers can differ significantly.

- Tax appraisals follow standardized formulas and may lag behind or exceed actual market conditions

- The 10% homestead cap protects primary residences from excessive annual increases, though market value can rise more

- Pending 2026 legislation could increase homestead exemptions to $140,000, offering additional tax relief if voters approve in November 2025

- Understanding the distinction empowers you to protest unfair valuations and potentially save thousands annually

When you receive your annual property tax notice, two different values might catch your attention—and the confusion between them could cost Texas homeowners thousands of dollars every year. Understanding the difference between tax appraised value vs market value isn’t just academic; it directly impacts how much you pay in property taxes and whether you’re getting a fair assessment.

Texas property taxes remain among the highest in the nation, with counties collecting an average of 1.81% of a property’s assessed fair market value as property tax per year—well above the national average. This reality makes understanding your home’s valuation more critical than ever, especially with pending legislative changes that could reshape exemptions starting in 2026.

What Is Tax Appraised Value in Texas?

Your tax appraised value represents the dollar amount your county appraisal district assigns to your property for tax purposes as of January 1 each year. According to the Texas Comptroller’s guidance on property valuation, Texas Tax Code Section 23.01 requires appraisal districts to value all taxable property at market value—but here’s where things get complicated.

Tax appraisal is a standardized, formula-based process that appraisal districts use to assess thousands of properties simultaneously. Appraisers consider factors like your property’s size, location, age, construction quality, and recent sales of similar homes in your area. However, these mass appraisal techniques cannot account for every unique characteristic of your specific property.

The appraisal district assigns this value without necessarily visiting your home or knowing about recent damage, structural issues, or other specific conditions that might lower your property’s actual worth. For Travis County homeowners in 2025, median market values reached $519,677, while median taxable values (after exemptions) stood at $401,879—illustrating how the tax appraised value serves as the foundation that exemptions then reduce to determine your actual tax burden.

How Does Market Value Differ From Tax Appraised Value?

Market value reflects what a willing buyer would actually pay for your property in the current real estate market under normal conditions. According to the Texas Comptroller, this figure emerges from real-world transactions where both buyers and sellers have complete information, reasonable time to negotiate, and neither party faces pressure to complete the deal.

While Texas law requires appraisers to assess properties at market value, the tax appraisal explained more accurately would be “the appraisal district’s estimate of market value.” These estimates don’t always align with actual market conditions for several reasons.

Appraisal districts rely on recent sales data, which creates a natural lag. If your neighborhood experienced rapid appreciation or decline in the past six months, your tax appraisal may not reflect those changes until the following year. Additionally, mass appraisal models use comparable properties to estimate values, but these comparisons may not account for your home’s unique features or deficiencies.

The market value vs appraised value distinction becomes especially important during periods of rapid market change. When home values surge quickly—as they did across Texas in recent years—tax appraisals often lag behind. Conversely, when markets cool, your tax appraisal may remain inflated compared to what buyers would actually pay.

How Are Tax Appraisals and Market Values Calculated?

Understanding the methodologies behind each valuation helps explain why tax appraised value vs market value differences occur so frequently.

Tax Appraisal Methodology

County appraisal districts use mass appraisal techniques defined by the Uniform Standards of Professional Appraisal Practice. These techniques involve three primary approaches:

The sales comparison approach examines recent sales of similar properties in your area, adjusting for differences in size, age, condition, and features. The cost approach calculates what it would cost to replace your property, minus depreciation. The income approach applies primarily to rental or commercial properties, estimating value based on potential income generation.

Appraisers gather data from multiple sources, including property sales records, building permits, and periodic field inspections. They then apply statistical models to estimate values for all properties in a given area. This process allows districts to appraise hundreds of thousands of properties annually, but it also means individual property characteristics may be overlooked or misrepresented.

Market Value Determination

True market value emerges through actual buyer-seller negotiations. Factors influencing market value include current economic conditions, mortgage interest rates, buyer demand in your specific neighborhood, your home’s condition and unique features, and recent comparable sales of truly similar properties.

Individual buyers consider factors that mass appraisal models cannot, such as specific location advantages, school district reputation, neighborhood aesthetics, and property condition details that affect livability and value.

Why Does the Difference Between Values Matter for Your Tax Bill?

The distinction between tax appraised value vs market value creates direct financial consequences for Texas homeowners. Your property tax bill calculation starts with your tax appraised value, not your home’s actual market value.

Consider this scenario: You purchased your home three years ago for $350,000, which reflected fair market value at the time. Due to rapid appreciation in your neighborhood, similar homes now sell for $420,000. However, the county appraisal district has assigned your home a tax appraised value of $435,000 for the current tax year.

Even though you have no intention of selling, you’re now responsible for property taxes based on this $435,000 valuation—$15,000 higher than current market value. At a combined tax rate of 1.8%, that $15,000 overvaluation costs you an extra $270 annually in property taxes.

Over ten years, this single year’s overvaluation could cost you $2,700—and that’s assuming you successfully protest in future years. Many homeowners don’t realize they’re overpaying or don’t understand they have the right to challenge unfair valuations.

The homestead exemption cap provides some protection for primary residences, limiting annual taxable value increases to 10% regardless of how much market value or appraised value rises. However, this cap doesn’t protect you from an initially inflated appraisal, and it doesn’t apply to second homes or rental properties.

What Legislative Changes Will Affect Tax Appraisals in 2026?

Texas homeowners should prepare for potentially significant changes to property tax exemptions depending on voter approval in November 2025.

Proposed Homestead Exemption Increase

Pending legislation proposes raising the mandatory school district homestead exemption from $100,000 to $140,000 for all qualifying homeowners. This $40,000 increase in exempt value would directly reduce taxable values for millions of Texas homesteads if voters approve the measure in November 2025.

The financial impact varies by property value and local tax rates. For example, a home with a $400,000 market value in an area with a 1.5% school tax rate would save $600 annually from the increased exemption. The savings scale proportionally with property values and tax rates.

Senior homeowners age 65 and older would benefit from an even larger exemption increase—from $110,000 to $150,000—under the proposed legislation.

Circuit Breaker Protection Extended

The 20% annual appraisal cap for non-homestead properties valued under $5 million was implemented for commercial, mineral and residential properties that don’t receive a homestead exemption.The cap on certain business properties’ value will expire in 2026 unless lawmakers and voters choose to keep it going. This protection helps owners of rental properties, second homes, and small commercial buildings manage tax bill volatility.

Verification Requirements

Recent legislation requires homeowners to verify their homestead exemption status at least once every five years. Appraisal districts began sending verification notices in 2024, with homeowners receiving notices based on when they initially claimed their exemption.

Failing to respond to verification requests results in loss of the exemption, which eliminates both the dollar exemption amount and the 10% cap protection. Property owners should respond promptly to any verification notices to maintain their exemption benefits.

Real-World Examples From Major Texas Counties

Travis County 2025 Appraisals

According to Travis Central Appraisal District’s official 2025 announcement, the Travis County appraisal roll increased 4.1% overall to $482 billion in 2025, representing a more moderate increase than previous years. Single-family residences saw an average 3.4% decline in market value, providing some relief after years of rapid appreciation.

With a median residential homestead market value of $519,677 and median taxable value of $401,879, Travis County homeowners benefit significantly from homestead exemptions and caps. However, homes without homestead protection face the full impact of appraisal increases.

Harris County 2025 Trends

Harris County property values showed mixed results in 2025, with Chief Appraiser Roland Altinger noting that while a large percentage of homes increased in value, a substantial percentage also decreased. This mixed market reflects Houston’s diverse neighborhoods and varying local market conditions.

Harris County homeowners should pay particular attention to their specific property’s valuation rather than assuming county-wide trends apply to their situation.

Dallas County Market Conditions

Dallas County residents face some of the highest property tax burdens in Texas, with property values and tax bills rising significantly in recent years. The county’s tax rate structure means homeowners pay substantial annual bills based on their appraised values.

County data demonstrates the value of actively challenging questionable appraisals, as homeowners who protest consistently achieve better outcomes than those who accept their initial valuations.

4 Common Misconceptions About Property Values

- You Should Compare Your Tax Appraisal to Your Neighbor’s Home

Many homeowners assume comparing their tax appraisal to their neighbor’s property provides useful information for protests. However, property tax protest professionals analyze dozens of different data points and adjust each one individually.

Your neighbor’s home may appear similar, but differences in square footage, lot size, construction quality, condition, and other factors affect valuation. Simply comparing unadjusted values without accounting for these differences can actually harm your protest case.

- Interior Renovations Always Increase Your Appraisal

Upgrading your kitchen or remodeling bathrooms doesn’t necessarily change your tax appraisal unless these renovations require a permit, add square footage, or substantially change your home’s classification. Appraisal districts generally don’t reassess based on interior cosmetic improvements.

However, additions that increase square footage, new in-ground pools, garage conversions, or detached garage construction typically do trigger appraisal increases, as these changes represent measurable value additions.

- Online Real Estate Estimates Are Accurate for Protests

Popular real estate websites provide automated home value estimates that many homeowners reference when evaluating their tax appraisals. However, these estimates are not accepted as evidence in Texas property tax protests and often prove inaccurate for individual properties.

Appraisal Review Boards require actual comparable sales data with proper adjustments, not algorithm-generated estimates. Relying on these websites for protest evidence will undermine your case rather than strengthen it.

- You Can’t Protest If Values Didn’t Increase

Even if your home’s tax appraised value remains unchanged from the previous year, you can still file a property tax protest if you believe the value is incorrect. As long as you can demonstrate your home is overvalued compared to market conditions, you have valid grounds for protest regardless of whether the appraisal increased. Protesting each year ensures your tax appraised stays as low as possible.

When Should You Protest Your Tax Appraisal?

The short answer: every year. Even if your tax appraised value seems reasonable or didn’t increase significantly, annual protesting ensures your property maintains the fairest possible valuation. Each year’s appraisal becomes the baseline for future increases under the homestead cap, making it crucial to keep that baseline as low as possible.

Protesting annually is particularly important because the only way to definitively know whether you’re paying your fair share is to have professionals review and contest your appraisal through the complete process. Many homeowners discover savings they never expected simply by challenging what appeared to be a reasonable valuation.

Working with experienced property tax professionals ensures you have expert representation at every stage, from evidence gathering to ARB hearings, maximizing your chances of achieving the fairest possible valuation.

You have especially strong grounds to protest when:

- Your tax appraised value exceeds your property’s current market value based on recent comparable sales in your neighborhood.

- Your property sustained significant damage from roof issues, foundation problems, or other structural concerns that the appraisal district hasn’t accounted for in their valuation.

- Your home sits near new negative influences like power lines, commercial properties, or other factors that should reduce value but aren’t reflected in your appraisal.

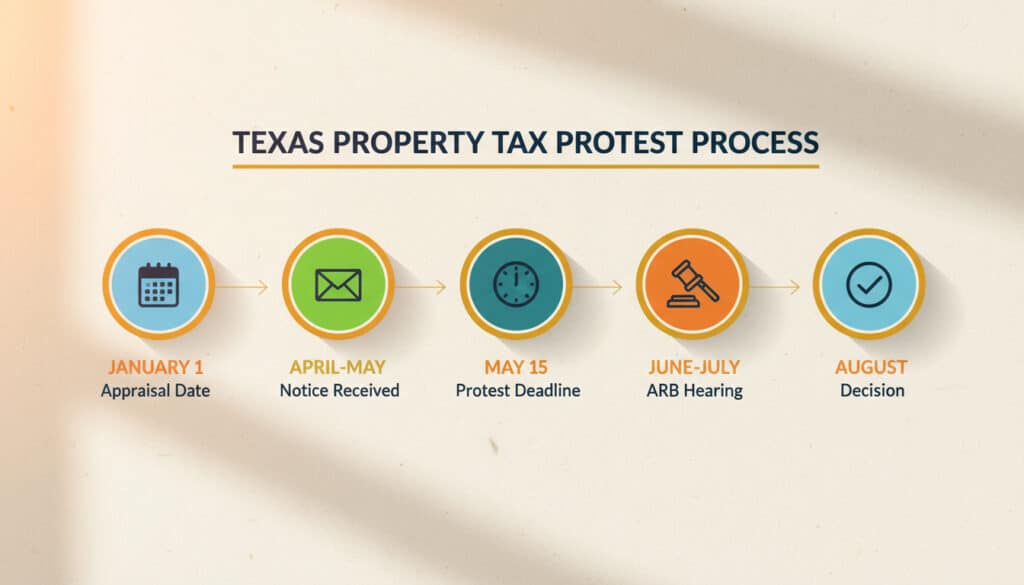

Important protest deadlines: The deadline to file a protest is typically May 15 or 30 days after receiving your Notice of Appraised Value, whichever comes later. Missing this deadline means waiting another year to challenge your valuation, which is why many homeowners file protests immediately upon receiving their appraisal notice rather than waiting to evaluate whether they have a strong case.

Travis County and other major appraisal districts now offer online protest filing systems, making the process more accessible. While the process still takes a considerable amount of time, property owners can upload evidence, review settlement offers, and attend hearings through digital platforms, eliminating some of the hassle.

What Is the Importance of Full Protest Representation?

When evaluating property tax protest services, understand that reputable companies never promise specific savings amounts. Under Texas law, it’s illegal to guarantee particular results, and any company making such promises should raise red flags. The actual savings depend on your individual property circumstances, market conditions, and Appraisal Review Board determinations.

The best property tax professionals commit to protesting every enrolled property through the complete process, rather than cherry-picking only cases that appear likely to win. This comprehensive approach serves homeowners better in several important ways.

Small reductions compound over time. Each year’s reduction becomes the base for calculating next year’s capped increase, meaning even modest savings multiply annually. A $5,000 reduction in your appraised value this year doesn’t just save you money now—it lowers the starting point for all future calculations under the 10% homestead cap.

Simply maintaining fair valuations prevents future problems. Even properties that don’t receive reductions benefit from establishing a record that their value was thoroughly reviewed and contested. This documented challenge can discourage inflated appraisals in subsequent years.

You deserve definitive answers. The only way to know with certainty whether your property is fairly valued is to go through the entire protest process with proper evidence and representation. Property tax professionals who abandon cases they perceive as difficult leave homeowners without answers about whether they’re truly paying their fair share.

Every property deserves a complete review. Professionals who only protest properties they think will win easily aren’t serving their clients’ best interests. Comprehensive representation means every enrolled property receives the same thorough analysis and advocacy, regardless of how challenging the case appears initially.

Understanding the Protest Process

Filing a protest initiates a formal dispute resolution process. Most appraisal districts offer an informal conference where you can meet with an appraiser to discuss your concerns before proceeding to a formal hearing. Many protests resolve at this stage.

If informal discussions don’t resolve your protest, your case proceeds to the Appraisal Review Board—an independent panel of local citizens who hear evidence from both you and the appraisal district. The ARB then determines whether your property’s value should be adjusted.

Successful protests require solid evidence. This typically includes recent comparable sales of truly similar properties with proper adjustments for differences, contractor estimates for needed repairs to roof or foundation issues, and/or recent professional appraisals.

Many homeowners choose to work with property tax professionals who understand appraisal methodologies, have access to comprehensive market data, and know how to present compelling cases to ARBs. Professional representation can potentially improve success rates, especially for homeowners unfamiliar with the protest process.

FAQ

What’s the main difference between market value and tax appraised value in Texas?

Market value represents what buyers would actually pay for your property in current market conditions, while tax appraised value is your county appraisal district’s standardized estimate of that value used to calculate property taxes. These figures frequently differ due to appraisal lag time, mass appraisal limitations, and unique property characteristics that automated models can’t capture.

Can my tax appraised value be higher than my home’s market value?

Yes, and this situation is quite common. Appraisal districts use mass appraisal techniques that may not reflect current market conditions or your specific property’s condition. When your tax appraisal exceeds market value, you have grounds to protest and potentially reduce your property tax bill.

How does the 10% homestead cap affect my tax appraised value?

The homestead cap limits annual increases in your taxable value to 10%, providing protection even when market values or appraised values rise more dramatically. However, this cap doesn’t protect you from an initially inflated appraisal, and it only applies to your primary residence, not to second homes or investment properties.

Will the proposed 2026 exemption changes affect my current tax bill?

The proposed increase in homestead exemptions from $100,000 to $140,000 requires voter approval in November 2025. If approved, the changes would take effect January 1, 2026, applying to the 2026 tax year. Your current tax bill for 2025 operates under existing exemption amounts.

Should I protest my tax appraisal every year?

Yes, annual protesting is the best practice for Texas homeowners. Even if your tax appraised value seems fair or didn’t increase significantly, protesting each year ensures you maintain the lowest possible baseline for future tax calculations. Small reductions compound over time under the 10% homestead cap, and the only way to know with certainty that you’re not overpaying is to have professionals analyze your valuation annually through a protest.

Take Control of Your Property Tax Burden

Understanding the difference between tax appraised value vs market value empowers you to identify overvaluations and take action to protect your finances. With Texas property taxes among the nation’s highest and pending legislative changes on the horizon, staying informed about your property’s valuation has never been more important.

Whether your county’s appraisal seems inflated, you’ve experienced property damage the district hasn’t recognized, or you simply want to ensure you’re paying only your fair share, professional assistance can make the difference between accepting an unfair valuation and securing meaningful savings.

Home Tax Shield specializes in helping Texas homeowners navigate the complex property tax landscape. Our experienced, licensed,and local professionals understand local market conditions, appraisal methodologies, and effective protest strategies across all major Texas counties. We commit to protesting every enrolled property through the complete process, because the only way to know if you’re getting a fair value is to thoroughly review and contest your appraisal each year. Get started with Home Tax Shield today to ensure your property tax bill reflects your home’s true value and protects your financial future.