Texas-Sized Property Taxes: What’s Going On?

As homeowners, plenty of things are out of our control, like storm damage or who buys the house next door. But, thankfully, we’re not powerless when it comes to the hot-button issue of property taxes. The majority of Texas counties have seen a dramatic increase in their property tax bills, but as a Texas homeowner, you have the right to protest the county’s proposed value. In a nutshell, protesting means that homeowners can dispute the appraised value placed on their property to their local appraisal district in hopes of a tax bill reduction.

Every October, Texans open their property tax bills, which usually illicit moments of shock and awe. There is a multitude of reasons for rising property taxes, but the main drivers are 1. We don’t have a state income tax, and 2. Our booming real estate demand and values.

Let’s start with state income tax – or in Texas’s case, the lack thereof. As a matter of fact, we’re one of the nine US states without one. But we aren’t off Scott-free. Our property taxes make up for state income tax revenue. The state doesn’t set property tax rates, collect taxes or settle disputes – that’s up to your local district. Your district relies heavily on funds from your property and state sales taxes to ensure communities run smoothly.

According to a PwC trends report, Texas has two of the country’s top ten real estate markets. People are still flocking to cities where the cost of living, lifestyle, and job opportunities are highly sought after. Although the real estate market is leveling off in many parts of Texas, we still outperform many other states. It’s good news for Texas economically, but it can be a gut punch regarding the cost of homes and the corresponding property taxes that follow.

What Is Protesting and Does It Actually Work?

Simply put, protesting your tax bill means you disagree with the appraiser’s assessment of your property, and you’d like to file an official protest with the county appraisal district. The goal is to ensure your property isn’t overvalued and you’re not overpaying for your property taxes.

Unfortunately, many Texans don’t realize they can do something about their property tax bill, or even if they know it, they don’t think it’s worth the effort to protest. Every homeowner in Texas has the right to protest their tax bill in front of the appraisal review board, or ARB, as they’re known. Protesting can lead to an average 3-5% decrease in property taxes. It’s not guaranteed, but many homeowners leave money on the table by not protesting.

Even if your protest doesn’t accomplish the exact outcome you were looking for, you may still receive a partial reduction. Any reduction is better than no reduction, and one thing is for certain: if you don’t protest, you’re guaranteed not to receive a reduction.

Protesting Resources

Know Your Numbers

Every protest starts with a property tax bill that’s higher than what homeowners expect to see. The appraisal placed on your property is formulated based on what your local appraiser deems accurate and fair. This article can help you understand how your appraisals and assessments affect your taxes and, ultimately, your wallet.

Read the article here.

What You Need to Know About Taxes and What to Do About Them

Protesting your property taxes might seem equal parts empowering and terrifying. However, familiarizing yourself with what you’re paying for, what impacts your taxes, and what you can do about it will help you formulate a protesting plan.

Read the article here.

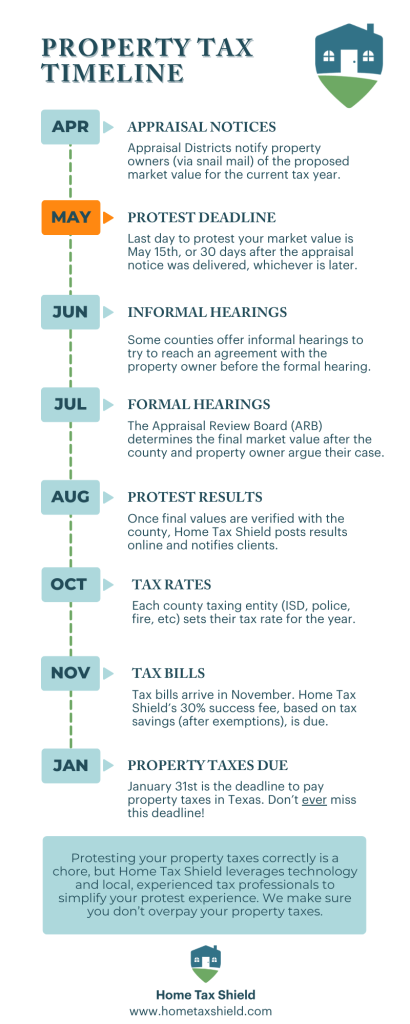

The Life Cycle of a Protest

As we mentioned earlier, every Texan has the right to protest their property taxes. What happens from when you receive your bill to the resolution of your protest? The comptroller’s website has plenty of helpful information that explains how the process works.

Read the article here.

You Got Your Tax Bill. Now What?

Do a Review

Mistakes can happen, even on your tax bill. You’ll need to ensure you’re taking advantage of every exemption, which may change based on where you live, your status, or legislation. The general homestead exemption, disabled veterans exemption, and the over-65 exemption are the most common exemptions. It’s up to the homeowners to make sure these exemptions are applied.

Weigh Your Options

Option one is accepting your tax bill and paying it without further action.

Option two is to take steps to reduce your taxes by protesting. Even if you’re unsure of your property’s value, the county appraiser’s estimation may be inaccurate or unfair. Your home’s appraised value is based on mass property evaluations, not on your individual property, so you may have a case if you believe your home’s estimated value is not reflective of your distinct property.

For example, roof and foundation issues are common issues that lower your home’s value. If your home has suffered damages due to weather events, fire, or other natural causes, your property may not be in the same condition as your neighbors’ properties. Perhaps your property is nearby a new cell tower or high-traffic roadway. These are the types of issues that can lower your property value without necessarily being recognized by the county appraiser.

The Pros and Cons of Protesting: What, How, Who, and Why

The protesting process can seem confusing, maddening, and time-consuming. Moreover, property taxes are a legislative moving target, even if you’re an expert. There’s a lot to keep track of between rising and falling real estate markets and tax rates.

What Can You Protest?

Here’s a breakdown of what can be protested to the ARB. Although there are other circumstances where you can protest, these are the most common:

- The value the appraisal district placed on your property is too high or is unequally appraised.

- The appraisal district failed to provide you with the required notices.

- There are errors in the appraisal records regarding your property.

How to Protest If You Want to Do It Yourself

There are several factors you should consider if you’re considering protesting property taxes yourself. Knowing how much time you must spend on the protesting process – which can last for a few months – is a good place to start. Here’s a very general outline of what protesting entails.

- Collect all the necessary documentation and evidence stating why you feel there’s an error. This can include photos, engineering reports, property surveys, market data and comparables, etc. Be sure to adjust the comparables data to reflect your specific property, as your property will have unique features and considerations that likely prevent an apples-to-apples property comparison.

- File a form 50-132, Notice of Protest, by May 15th, to your local tax appraisal district.

- If applicable, attend an informal meeting to negotiate with your local appraiser.

- Attend multiple ARB (Appraisal Review Board) hearings. Again, you must be prepared with all your documents proving their incorrect appraisal.

- Appeal the ARB’s decision if you still disagree.

Here’s the caveat: you’ll need to repeat this process yearly. On average, you can expect to spend 6-12 hours over the span of a few months, plus the costs incurred for collecting and printing documents.

Protesting With a Professional

You can also hire a property tax company to protest your tax bill on your behalf every year. Why is this a good idea? Three resources that are in high demand but short supply for most people:

- Time

- Money

- Expertise

Hiring property tax professionals can save you on all three, plus some sanity. Professionals also have a significantly higher success rate than those who protest on their own. Unless you’re familiar with the complexities of lowering your tax bill every year, your time may be better spent enjoying your home instead of fighting for it.

As we mentioned earlier, homeowners can see an average tax reduction between 3-5%. The accrued savings add up as long as you protest annually. Most homeowners don’t have the expertise to properly research all the variables affecting the fair value of their homes, have access to MLS and pertinent data, or to understand what the ARB wants to see before they rule in your favor. However, understanding things like the most current laws and real-time market analysis with adjusted comparable data can affect your outcome.

Hiring a tax-protesting company assures that your property will be represented annually for as long as you want. You can hire experienced property tax-protesting professionals who specialize in balancing a fair valuation and what owners should pay.

Leverage Protesting: It’s Your Right

Simply put, protesting can save you money. It’s the peace of mind of knowing that you’re proactively pursuing a fair tax valuation on your home. Additionally, if you receive a reduction after protesting, your taxes will be based on the lesser amount the following years, leading to compounding savings. Here are a few more resources about protesting that may help clarify your rights as a property owner in Texas.

Are you on the fence about protesting your taxes? We’ve outlined what you should consider about protesting to move forward confidently.

Read the blog here.

What You Need to Know About Your Texas Property Tax Protest

Understandably, there are a lot of questions surrounding protesting your taxes. We have resources that explain what many homeowners want to know, including how exemptions are impacted, and what happens to future taxes if you get a reduction.

Should You Protest Your Property Taxes Yourself? Or Hire a Pro?

Deciding to protest your property taxes is only one piece of the puzzle. Only you can decide if having professional representation or doing it yourself is better. Read the following considerations to know what makes the most sense for you and your property.

Read the blog