High property taxes have been a big concern for homeowners across Texas in recent years. The average homeowner faced an annual property tax bill of $3,797 in recent years—and that’s after tax relief measures like exemptions on school district taxes and caps on increased property values for homesteads. As bills kept climbing due to increased appreciation and other market forces, many Texas homeowners faced bills outside their budget. To provide more effective tax relief, the state legislature recently passed three measures to increase savings opportunities for homeowners and more general property owners.

The passed and signed legislation will be on the ballot on November 7, 2023, for citizens to consider. If a simple majority approves it, the new legislation will retroactively apply to the 2023 property tax bills this autumn. Before that date arrives, learn more about how the new legislation will impact property tax bills across the state. We’ll take a closer look at what the legislation changes and some new measures it puts into place. We’ll also explore some common scenarios, calculate the likely savings, and how you can save even more by protesting your property taxes every year.

The Biggest Takeaways From the Recently Passed Texas Property Tax Legislation

The recently passed property tax relief package is comprised of three different bills, and they contain multiple further adjustments to existing norms for calculating and funding school district taxes, how county tax offices will assess properties for tax purposes, and how much tax relief other property owners can look forward to. These are the three most significant elements that will have a direct impact on property tax bills in the future:

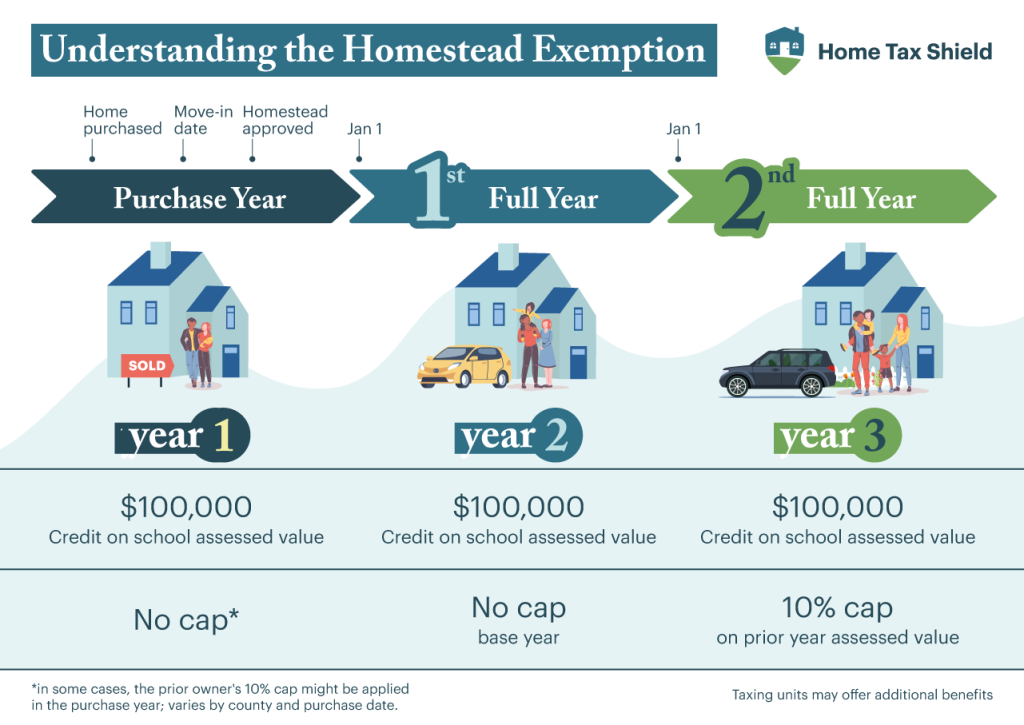

1. The Homestead Exemption Will Increase to $100,000

Homesteaded properties receive a school district tax exemption on the first $40,000 of the property’s value. If voters approve the House Joint Resolution 2, the legislation will raise that exemption amount to $100,000. While each city and county sets its levies and tax rates, many areas across Texas have a school district tax rate that hovers around 1%. That means homesteaded properties currently save around $400. Under the new terms, those savings increase to $1,000 a year.

2. There Will Be a Cap on Increased Values for Non-Homesteaded Properties

A unique advantage of Texas’s homestead exemption was the cap: property valuations could only reflect a maximum property value increase of 10%. So, while the appraised value of a $250,000 home might climb to $300,000 over a single year (a 20% increase), tax officials can only calculate the property’s tax bill at a maximum assessed value of $275,000 (a 10% increase). The $25,000 difference would be marked as a homestead cap loss (which goes away over time), and the property owner gets tax relief via that $25,000 reduction; because Texas has an average effective property tax rate of 1.8%, that’s a savings of approximately $450.

Currently, this form of tax relief is only available to homeowners who have filed a homestead exemption for their primary residence.

However, under the new legislation, other properties will be eligible for a 20% cap. Mineral properties, commercial properties, non-primary residences, investment properties, and different property types that are less than $5 million will only be able to increase a maximum of 20% in value every year—at least for property tax calculation purposes. This experimental program will only last through 2026 unless the legislature creates new laws to extend it.

Related: How Property Taxes Affect Mortgage Payments

3. Appraisal Boards Will Have Some Elected Members

If you protest your property taxes and continue through the entire process, you or your representative will likely present your argument in front of an appraisal review board (ARB). This board will hear your views about why your taxes are inaccurately high, and a county appraisal representative will present an argument about why they believe their appraisal was correct. The ARB makes a final ruling on the disputed property value.

If the tax relief package is passed, at least three members of the appraisal district’s board of directors will need to be elected by local voters, who will hold the position for four-year terms. This measure ensures members stay accountable to voters and local property owners.

Putting the Legislation Into Practice: Two Property Scenarios to Consider

These measures promise significant savings to homeowners and general property owners across the state. Let’s dive into the numbers in more detail so you can see the potential impacts on your property taxes.

You Are a New Homeowner and Own a $300,000 Primary Residence with a 1.25% School District Tax Rate and a 2% Total Tax Rate

- If you do not have a homestead exemption, your property tax bill will be $6,000.

- If you have the exemption on your property, your tax bill will be $5,500, with a $500 savings.

- If the resolution gets a majority vote in November, your tax bill will be $4,800, now with $1,250 saved.

In the subsequent year, you can realize even more savings because of the traditional homestead cap. Suppose your home is appraised at $375,000, or a 25% increase. Here’s what those numbers might look like:

- No homestead exemption: $7,500

- The current homestead exemption terms: Your home’s assessed value cannot exceed $330,000, and the appraised value exceeded that. Between that reduction and the school district tax savings, you would have a tax bill of $6,100.

- The new homestead exemption terms: Your home’s assessed value cannot exceed $330,000. Between that reduction and the school district tax savings, you would have a tax bill of $5,250.

If the following year also has an appraisal value increase of more than 10%, you’ll see even more savings.

Why You Still Need to Protest Your Property Taxes

While the assessed value matters most for your property tax bill in a given year, that appraised value is still on record. If you sell your home or become ineligible for the exemption, that protection is gone, and your appraised value becomes your assessed value for tax purposes. Protesting to stop that appraisal value from inflating will protect you in the future.

It’s just as critical to protest your appraised property value in years when it’s less than 10% or is hovering just slightly above 10%. Mistakes happen; if that appraised number is too high, that directly increases your taxes.

Related: What Is the Difference Between the Appraised Value and the Market Value of Homes?

You Own a $300,000 Property With a 1.25% School District Tax Rate and a 2% Total Tax Rate

If you have a property that’s not eligible for homestead exemption, you have an opportunity for long-term savings. In the current year, you pay $6,000 in this scenario. But, if, like our example above, the appraised value increases by 25%, your assessed value for tax purposes can be at most $360,000. That’s a $15,000 difference from $375,000, which saves you $300.

You save even more if there’s another 25% appraised value increase in the subsequent year. Without the legislation, your property’s taxable value would be $468,750. With the new 20%, the taxable value is $432,000—a $36,750 difference and a savings of $735.

Why You Still Need to Protest Your Property Taxes

There are two key reasons why protesting your property taxes will continue to be as vital under the new legislation as it is currently:

- The 20% cap is just a short-term program. If it’s not extended or renewed, your assessed value is no longer sheltered, and your appraised value will impact your tax bill again more directly. Don’t let it creep out of control during the three-year program.

- A 20% annual increase is still very high. The cap may take the edge off skyrocketing property values, but that’s not enough. Diligently protesting your property taxes ensures the appraised value stays as fair and accurate as possible.

Lower Your Property Tax Bill Even Further—Start Protesting Your Property Taxes With Home Tax Shield

The recently passed legislation can create savings for property owners who have felt the pressure of increased property values and tax bills over the past few years. However, they only impact the assessed values that county tax officials use and provide higher savings from school district taxes. They don’t directly help reduce your property’s appraised value every year.

To keep your home’s appraised value accurate (and, in turn, lower your property taxes more effectively), you must protest your property taxes in the spring. You or a representative can file a protest notice, provide evidence supporting your countervaluation, and ensure the value doesn’t climb too high without being controlled.

At Home Tax Shield, we help homeowners protest their property taxes every year. We can measure your home’s value, file the notice, communicate with your appraisal district on your behalf, and follow the process to get you the maximum possible savings. Sign up today to make sure you’re ready for future tax years.