Key Takeaways

Houston homeowners can challenge their property tax appraisal with Harris County Appraisal District (HCAD) to potentially reduce their annual tax burden and ensure their tax bill stays as low as possible.

- Filing deadlines are May 15 or 30 days after receiving your notice, whichever is later.

- The process involves three options: online iFile system, iSettle negotiations, or traditional mail filing.

- After filing, you’ll need to gather supporting evidence like comparable sales data and property condition documentation, then participate in an informal hearing with HCAD appraisers, and potentially proceed to a formal Appraisal Review Board hearing if needed.

- While homeowners can handle protests themselves, professional services offer expertise, time savings, and access to comprehensive market data that individual homeowners typically cannot obtain on their own.

Houston property owners are facing unprecedented tax increases as Harris County approved a 10% property tax rate increase for fiscal year 2024-25, raising the rate from $0.35 to $0.39 per $100 of assessed value. With Harris County’s average rate at 1.77%—nearly double the national average of 0.90%—mastering the Houston tax protest process has never been more critical.

The good news? Many property tax protests result in reductions during the informal hearing process, and homeowners who successfully navigate the Houston tax protest system could save significant money annually. This comprehensive guide will walk you through Houston’s property tax protest process with the Harris County Appraisal District (HCAD), including deadlines, strategies, and proven methods for maximizing your savings.

Understanding Houston’s Property Tax Landscape

Houston operates within Harris County, where HCAD assesses approximately 1.9 million parcels of property in Houston and surrounding areas. The scale of potential opportunities is substantial, as many homeowners qualify for reductions but simply don’t know the process exists or how to navigate it effectively.

Property tax protests work because the appraisal process isn’t perfect. More than half of Texas homeowners report being surprised by their property tax bills, with many feeling their property tax assessments are higher than appropriate. The protest process provides a legal mechanism to ensure you’re only paying your fair share based on accurate tax appraised property valuations.

Understanding the local context matters significantly for Houston homeowners. Harris County’s rapid growth, diverse neighborhoods, and varying market conditions create situations where mass appraisal methods may not accurately capture individual property values, making a Houston tax protest essential.

How a Tax Protest in Houston Works with HCAD

When you receive your Notice of Appraised Value from HCAD, typically in April, you have the right to challenge that tax appraised value if you believe it’s too high or inaccurate. The protest process allows you to present evidence supporting a different market value for your property.

HCAD offers three distinct methods for filing your protest, each designed to accommodate different preferences and situations. The key is understanding which method best suits your circumstances and preparing appropriate evidence to support your case.

The protest system operates on the principle that all properties should be appraised fairly and uniformly. You have grounds for a successful protest if your property is valued higher than comparable properties in similar condition and location (unequal appraisal), or if the assigned market value exceeds what your property would realistically sell for in today’s market (overvaluation).

A Step-by-Step Guide to Filing Your Houston Property Tax Protest

Step 1: Review Your HCAD Notice Carefully

Your property tax value notice should have two unique numbers printed on the upper, right-hand side: your property account number and an iFile code number, unique to that particular property for this year only. If you plan to iFile, make sure the county sends these numbers and keep this notice handy to simplify the electronic filing process.

Examine your property details carefully, checking for errors in square footage, number of bedrooms, bathrooms, or other features. Appraisal districts commonly have outdated property information, and correcting these errors can immediately reduce your appraised value. Note that any errors are not part of the tax appraised value protest process, but correcting them alongside a protest can maximize your savings and ensure your tax bill is fair.

Step 2: Choose Your Filing Method

At this point, you need to decide whether to handle your protest yourself or engage professional representation. This is the ideal time to bring in professional help if you’re considering it, as they can file for you and manage the entire process from start to finish. It becomes much more difficult and less effective to engage professionals after you’ve already filed, so make this decision now.

If you choose to proceed on your own, HCAD offers three filing options:

Option 1: iFile Electronic System All property taxpayers can use HCAD’s iFile system at www.hcad.org/ifile for the quickest and most convenient way to file a protest. This system allows you to file online using your unique iFile code number.

Option 2: iSettle Online Negotiation HCAD encourages use of the iSettle system for homeowners. In this process, homeowners file their protest online and provide an opinion of their property’s market value. HCAD will review your suggested value and may offer a settlement.

Option 3: Traditional Mail Filing Submit your written protest using the form included with your appraisal notice or download Form 50-132 from the Texas Comptroller’s website.

Step 3: Meet the Critical Deadlines

The protest deadline is May 15 or 30 days after receiving your notice of appraised value, whichever provides more time. Extensions or exceptions to this deadline are extremely rare and typically only granted under very specific circumstances. Missing this deadline essentially means giving up your right to protest your property taxes until the following year—there are no second chances.

Step 4: Prepare Your Evidence

Strong evidence forms the foundation of successful protests. Gather recent sales data for comparable properties and contractor estimates for any major repairs, such as foundation or roof issues.

You can research basic comparable property information by visiting HCAD’s Information and Assistance Center at 13013 Northwest Freeway or online at www.hcad.org, though the public data available may be limited compared to the comprehensive market databases and detailed comparable analysis that tax professionals can access through specialized industry tools.

Step 5: Attend Your Hearings

The process typically begins with an informal meeting where the appraiser has authority to settle the protest if the evidence supports it. If no agreement is reached, your case proceeds to a formal Appraisal Review Board (ARB) hearing.

7 Proven Strategies for Houston Tax Protest Success

1. Leverage HCAD’s iSettle System Strategically

The iSettle system allows you to propose a specific value for your property. HCAD will review your suggestion along with market data and may offer a compromise value, potentially resolving your protest quickly without requiring a formal hearing. However, you may settle for a smaller reduction than you could achieve through the full hearing process with comprehensive evidence presentation.

2. Document Property Condition Issues Thoroughly

Houston’s climate can create unique property challenges including foundation issues, roof damage, and flood concerns. Document any problems with professional estimates and photographs to support arguments for reduced valuations.

3. Research Comparable Sales with Precision

Focus on truly comparable properties sold within the past year in your immediate area. When you can demonstrate that similar properties sold for less than your appraised value, this creates strong evidence for reduction. Professional tax consultants typically analyze properties using over 40 different data points including size, age, condition, location, lot features, construction quality, and numerous other factors—a level of detailed analysis that’s challenging for individual homeowners to replicate.

4. Understand What You Can and Cannot Protest

Property tax protests are specifically for challenging your property’s tax appraised market value. You cannot protest exemption denials or factual errors in property records through this process. Exemption issues must be addressed separately with HCAD, and factual errors (like incorrect square footage or number of bedrooms) require a separate correction process. Focus your protest evidence on proving your property’s market value should be lower.

5. Prepare for Multiple Hearing Levels

Start with the informal process but be prepared for formal ARB hearings if necessary. Treat all hearings with the same professionalism you would bring to a court proceeding—dress appropriately, arrive early, organize your evidence clearly, and present your case respectfully and factually without emotional appeals.

6. Consider Professional Representation

While you can represent yourself, property tax professionals understand HCAD’s processes and may have higher success rates. They handle all paperwork, evidence gathering, and hearing appearances on your behalf, making the entire process completely hands-off and stress-free while you focus on your daily life and business.

7. File Protests Annually

Annual filing provides the best long-term results. There are no drawbacks to filing an appeal, and market conditions change regularly, creating new opportunities for reductions each year. Importantly, each year’s final appraised value becomes the baseline for the following year’s assessment, so successful protests create compounding savings over time by establishing lower starting points for future appraisals.

The Houston Property Tax Protest Timeline

- January 1: Effective date for property appraisals

- March-April: HCAD mails Notice of Appraised Value

- May 15: Standard protest filing deadline (or 30 days after notice)

- June: Informal hearings typically scheduled

- July: Formal ARB hearings conducted

- August: Final values determined

- October: Tax bills mailed with final rates and values

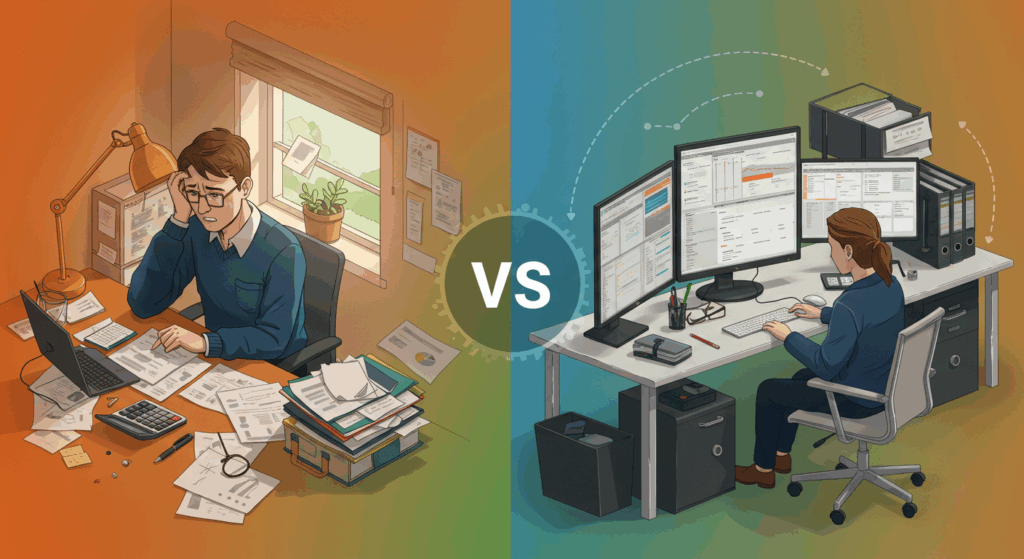

Professional vs. DIY: Making the Right Choice for Your Situation

DIY Protests Work Best When:

- You have time to research comparable sales and gather evidence

- Your property has clear valuation issues

- You’re comfortable presenting your case at hearings

- You want to maintain full control over the process

Professional Services Maximize Results Through:

- Time Efficiency: Professionals handle all research, paperwork, and hearing attendance, freeing up your valuable time

- Expert Market Analysis: Access to comprehensive comparable sales databases and sophisticated valuation tools unavailable to individual homeowners

- Proven Negotiation Skills: Years of experience working with HCAD appraisers and understanding what evidence resonates most effectively

- Annual Protection: Guaranteed filing every year ensures you never miss deadlines or opportunities for savings, with compounding benefits over time

Consider your available time, comfort level with the process, and the complexity of your property’s valuation when making this decision. Some homeowners start with DIY protests to learn the process and later transition to professional services for ongoing annual protection.

Maximizing Your Houston Tax Protest Savings

Proper preparation significantly impacts your protest outcome. The key to long-term savings lies in consistent annual protests rather than sporadic efforts, as property values and market conditions change regularly.

Recent developments show that property tax protest strategies work best when homeowners understand their local market conditions and maintain detailed records of their property’s characteristics and condition.

For Houston homeowners, staying informed about Harris County’s tax policies and HCAD’s specific procedures creates opportunities for ongoing tax savings that compound over time.

FAQ

Q: What is the deadline to file a property tax protest with HCAD? A: The deadline is May 15 or 30 days after receiving your Notice of Appraised Value, whichever is later.

Q: How much can I expect to save from a successful Houston property tax protest? A: Savings vary based on your property’s overvaluation and current tax rates, but successful protests commonly result in meaningful annual reductions. Texas law prohibits anyone from promising specific savings amounts upfront, as each property situation is unique. The only way to know your potential savings is to go through the complete protest process with proper evidence and analysis.

Q: Can HCAD raise my property value if I file a protest? A: No, Texas law prohibits appraisal districts from increasing your property’s appraised value during the protest process. There’s no downside risk to filing a protest.

Q: What’s the difference between iFile and iSettle with HCAD? A: iFile is HCAD’s electronic filing system for protests, while iSettle allows you to propose a specific value and negotiate directly with HCAD before formal hearings.

Q: Do I need an attorney to protest my Houston property taxes? A: No, you can represent yourself or hire a property tax specialist. Many homeowners successfully handle their own protests, while others prefer professional representation for convenience and expertise.

Take Action: Start Your Houston Tax Protest Process

Houston’s rising property taxes make protesting your appraisal more important than ever. Many Texas homeowners remain unaware they can protest their property tax evaluations, which means you now have the knowledge to potentially save hundreds or thousands of dollars annually through the Houston tax protest process.

Remember that successful property tax protests require preparation, proper timing, and quality evidence. Whether you choose to handle the process yourself or work with professionals, the key is taking action before the deadline.Home Tax Shield simplifies the entire Houston property tax protest process, handling everything from evidence gathering to ARB representation. Our local expertise with HCAD procedures and proven track record of success means you can focus on your life while we work to reduce your property taxes. Get started today and let our experienced team protect your property tax rights in Harris County.