Texas property tax law changes every few years. See the latest posts for the most up-to-date information.

Texas property taxes are the bane of existence for most Texans. After all, the state has some of the highest rates in the country— the 7th highest, to be exact. The trend of increases in property taxes might only worsen in the coming years.

Most Texas homeowners were in for a big surprise when they received their 2022 assessed property value. Appraisal districts valued homes much higher than they had last year.

To put things into perspective, here is the current state of most residential properties in Texas.

Residential appraisals went up by 15%-30% in Harris County. On the other hand, Bexar County’s appraised home value went up 28%, while Dallas County saw a 24% increase.

Although Texans voted for an increase in homestead exemption from $25,000 to $40,000 in May this year, property taxes are still expensive for Texas property owners. That’s because property taxes are based on the appraised property value. If the value goes up, as it has this year, then most property owners should expect their tax bills to increase.

Why is Texas Property Tax so High?

Property owners in other states will feel the pinch of increased tax rates, but not as much as Texans. Here in Texas, the state government relies on only two types of taxes to fund critical local projects like schools, salaries of police officers and firefighters, road servicing, park maintenance, and libraries.

Other states, such as neighboring Louisiana, have state income tax protecting owners from the high property tax bills. This dependency on property taxes means Texas property owners pay a higher price.

Although we have ongoing proposed legislation to reduce property taxes or at least do something about them, it’s still a long way to go.

If there is a way to reduce the tax bill, most homeowners want to jump on that opportunity. Fortunately, there is an option: property tax protest.

What is a Property Tax Protest?

A property tax protest is a process you undertake to have your home’s appraised value reduced. Generally, appraisal districts perform appraisals based on the market value of properties as of January 1.

This appraised value forms the basis of how much you pay for taxes. However, this number is not the final taxable property value. When you receive your tax bill, you’ll see two key numbers. The appraisal district values the market value, and the appraised value is subject to property taxes after exemptions. The latter can not increase by more than 10% from last year’s appraised value.

Let’s give you an example.

Assume your home’s market value was $586,000 and the appraised value $367,156 in 2021. Imagine that in 2022, your home’s market value will increase to $657,700. According to Texas laws, a home’s appraised value can not increase more than 10% from the previous year’s value. So, the maximum appraised value of your home can be no more than $403,817.6 in 2022. (2021 appraised home value + 10% increase). This approach applies even when the market value increases by more than 10%.

When we talk of protesting your taxes, we mean getting the appraisal district to lower the market value($657,700).

If you look at the market value, you’ll notice that the appraised value is significantly lower than the market value. In such a situation, is there a need to still protest the appraised market value even when it looks like it does nothing to lower your tax bill?

Yes. If you fail to protest, the county appraisal district will keep increasing your appraised property tax value, subject to the 10% rule each year. At some point, your taxable property value will be at par with the market value, and your property taxes, by this time, will be through the roof.

So, protesting taxes right now might not make as much sense by just looking at those figures, but it goes a long way in lowering your tax bill, even in future years.

When there’s no significant gap between the market value and the property’s appraised value, protesting taxes will likely lead to a lowered tax bill. The only prerequisite is to make a strong case with solid evidence.

Related: How to Present the Best Case at Your Texas Property Tax Hearing

Should You Protest Property Taxes Yourself or Hire a Professional?

We’ve already ascertained the benefits of protesting your Texas property taxes. But should you go at it alone or leave the matter to tax experts? It all comes down to whether you’re willing to invest the intense time commitment needed to see the tax protest from start to finish.

You can take on the tax protest process if you have ample time. However, it can be a strenuous activity that occupies your time with meetings, collecting evidence, and filing documents. This is not ideal or convenient for most property owners.

Homeowners find it more beneficial to hire a tax professional. Many people find the protest process either intimidating or too time-consuming, which is all true.

In addition, other homeowners feel that the outcome of a property tax protest will be more successful if they rely on a professional. Again, this is true to a large extent. Most tax experts have filed hundreds if not thousands of Texas tax protests.

They know which type of evidence persuades the appraisal review board and clearly understand all the deadlines and any information that will help your property tax case. Tax experts will also have the resources to gather evidence, such as accurate market comps and recent property sales data.

Before you decide to protest property taxes on your own, here is how the process looks.

What is the Process of Protesting Texas Property Taxes?

Protesting property taxes involves several steps you need to follow to the letter to increase your chances of winning the protest case.

Here are all the critical steps you need to be aware of:

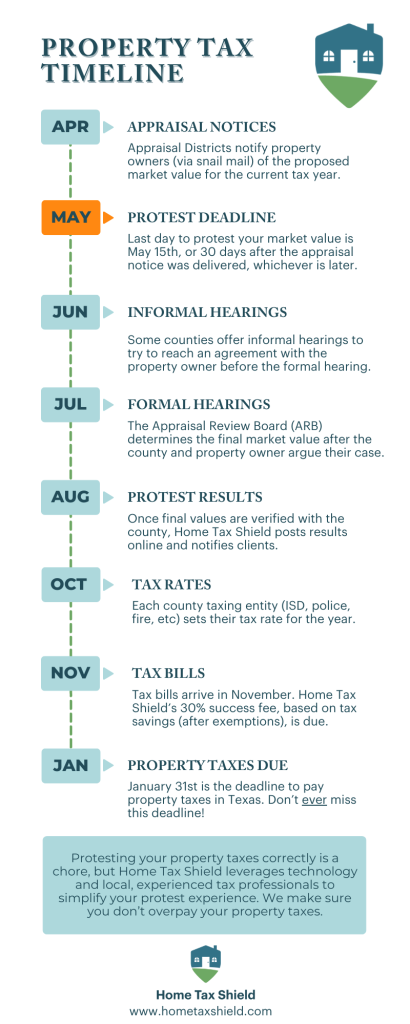

Typically, you should receive a notice by May 1 or April 1 if your property’s appraised value increases.

- If you feel the indicated value does not reflect your property value, you must file a protest with your appraisal district. The deadline is no later than May 15 or 30 days after the appraisal district mailed the Notice of Appraised Value.

- You’ll have three options for filing the notice of protest: online, in-person, or by mail.

- Most appraisal districts will have a form 50-132 on their website, a notice of protest. The protest application should include the person claiming an ownership interest in the property (you in this case), the property in question, and a written dissatisfaction with the appraised property value.

- The appraisal district will first try to resolve the protest with you informally. However, you’re responsible for requesting the informal meeting with the appraisal district.

- If you don’t agree in the informal meeting, you move to a hearing with the Appraisal Review Board(ARB). Usually, the ARB will send you a notice of the hearing 15 days before with specific info on the date, time, and location

- In addition, ARB will send a copy of their adopted procedure. The board will also let you know you can request more information on the data, formula, and schedules the chief appraiser will present at the hearing.

- Hearings begin around May 1.

- The ARB will listen to the appraisal district facts on how they arrived at the appraisal. You will also present your findings and why you consider the appraisal district’s valuation of your home as unfair and inaccurate.

- Based on the evidence presented, the ARB will decide to either lower your home’s appraised value or make no changes to the indicated home value.

- If you disagree with the ARB’s decision, you can appeal your case to the state district court or the State Office of Administrative Hearings(SOAH).

Related: Texas Property Tax Protest Process: What You Need to Know

There’s Never Been a Better Time to Get the Help of a Property Tax Expert

You can tell from the steps above that protesting taxes is no easy feat. The time investment is enormous, and you must meet all the deadlines for meetings, filing your protests, and attending hearings.

Hiring a property tax professional can help if you don’t have the time to dedicate to the process. The main benefit of working with such a company is how they take over the process. For example, a professional tax company will help you in:

Gathering Evidence

To increase your chances of winning the protest, you must gather copious amounts of evidence. This evidence will come from housing market data, house sale prices, individual property characteristics, pictures of foundational issues, damages, cost repair estimates, etc.

A property tax company takes care of collecting and gathering all these and making the evidence ready for a hearing.

Handling the Hearings

Texas laws allow agents to attend hearings in place of property owners. With a property tax company, you don’t have to take time off your busy schedule.

An agent from the company can attend the hearing to present evidence and argue your case. More importantly, the property tax experts ensure that the evidence is factual and accurate. This contradicts the emotional arguments a property owner might bring to the hearing because of ownership biases.

Simply put, a property tax professional takes over the whole protest making the process stress-free for you. You no longer have to worry about deadlines, gathering evidence, or attending lengthy hearings. The professional tax company will be working behind the scenes to ensure you pay fair property taxes currently and in the future.

We Make Protesting Property Taxes Easy for Texas Property Owners

Home Tax Shield works with hundreds of Texan property owners annually to reduce their tax bills. We rely on sophisticated technology and professional tax experts to help you lower your property taxes. All it takes to start is a one-step signup process that won’t take more than 3 minutes.

Don’t overpay your property taxes. Try Home Tax Shield today for a stress-free process of protesting property taxes.