Texas homeowners who follow property tax planning in Texas save significantly more than those who react only during protest season.

- Offseason preparation maximizes protest success rates and identifies year-round money-saving opportunities.

- Annual planning cycles compound savings through systematic exemption management and strategic value monitoring.

- Professional representation combined with strategic timing delivers optimal long-term tax reduction results.

- Year-round record-keeping and market awareness create sustainable tax savings strategies that build wealth over time.

Texas homeowners are losing thousands of dollars annually due to poor property tax planning in Texas. Many homes are unfairly overassessed, with property owners paying an average of $1,346 too much each year. While Texas has one of the highest average property tax rates in the country, homeowners who understand strategic property tax planning can dramatically reduce their annual burden.

Most Texas homeowners approach property taxes reactively, scrambling during protest season without a comprehensive strategy. This reactive approach leaves money on the table and misses critical opportunities for long-term savings. Effective property tax planning requires a year-round approach that maximizes every available strategy to reduce taxes long term.

Why Do Most Texas Homeowners Fail at Property Tax Planning?

The majority of Texas homeowners operate under a fundamental misunderstanding about property tax management. They view the annual appraisal notice as the starting point for action, when successful property tax planning actually begins the moment protest season ends.

Traditional approaches focus solely on the protest filing deadline, treating property tax reduction as a single annual event rather than an ongoing financial strategy. This mindset costs homeowners because it ignores the compounding benefits of systematic planning, proper documentation, good timing, and an effective protest cycle strategy that builds value over multiple years.

Many homeowners also fail to recognize that property tax planning extends beyond filing protests. Strategic exemption management, market monitoring, home improvement timing, and documentation systems all contribute to sustainable tax reduction. Without this comprehensive approach, homeowners miss opportunities that could save thousands over time.

What’s a Strategic Property Tax Planning Framework?

Successful property tax planning in Texas follows a framework that aligns actions with optimal timing throughout the year. This approach ensures homeowners maximize every opportunity to reduce taxes long term while building sustainable savings strategies.

Understanding Your Annual Property Tax Cycle

The Texas property tax cycle operates on predictable timelines that strategic planners use to their advantage. Understanding these cycles allows homeowners to plan for property taxes with precision and maximize their results.

January through March is the assessment period when county appraisal districts establish property values for the tax year. During this phase, smart homeowners focus on property condition documentation, market research compilation, and preparation for potential protests. This period also offers the best opportunity for home improvement, as renovations completed after January 1st avoid inclusion in the current year’s assessment.

April through May marks notice review and protest filing season. Property owners receive their Notice of Appraised Value and must decide whether to file protests by May 15th or within 30 days of notice receipt, whichever provides more time. Strategic planners use this period to compare their prepared documentation against official appraisals and make informed protest decisions.

June through August encompasses protest hearings and final documentation submission. This phase requires homeowners to present their cases effectively, whether through self-representation or professional assistance. The quality of preparation during previous months directly impacts success during this critical period.

September through December provides the best window for offseason preparation and strategic planning for the following year. This often-overlooked period offers the greatest opportunity for proactive property tax planning, including market monitoring, documentation organization, exemption status verification, and developing a comprehensive protest cycle strategy for the following year.

What Are Year-Round Property Tax Planning Strategies?

Effective property tax planning requires different strategies during each phase of the annual cycle to maximize savings opportunities. The following approaches ensure homeowners maintain proactive control over their property tax obligations throughout the year rather than scrambling during deadline periods.

Offseason Preparation (September-December)

The most successful property tax planning occurs during the offseason when homeowners can focus on preparation without deadline pressure. This period offers unique advantages for building sustainable tax reduction strategies.

Market monitoring and comparable research during the offseason provides insights for future protests. Property owners should track neighborhood sales, identify market trends, and document changing conditions that might affect their property’s valuation. This research requires time and attention that’s difficult to provide during a busy protest season.

Documentation organization ensures homeowners have comprehensive evidence ready when needed. Successful planners create filing systems for property records, maintenance receipts, improvement documentation, and market research. They also photograph property conditions annually to create historical records that support future protests.

Exemption status review prevents oversights that could cost hundreds in unnecessary taxes. Homeowners should verify that all eligible exemptions remain properly applied, check for new exemption opportunities, and ensure their records accurately reflect their current situation. This review often reveals missed opportunities for additional savings.

Home improvement timing considerations allow homeowners to maximize the impact of upgrades while minimizing tax consequences. Strategic planners time major improvements to occur after January 1st when possible, ensuring that investment in their property doesn’t immediately trigger higher assessments.

Assessment Season Strategy (January-March)

The assessment period requires focused attention on positioning your property for favorable valuation. Strategic homeowners use this time to influence the factors that appraisal districts consider when establishing property values.

Property condition documentation during this period provides evidence for potential protests. Homeowners should photograph any issues that might affect value, obtain repair estimates for needed work, and document any factors that distinguish their property from typical comparable sales in the area.

Market trend analysis helps homeowners understand broader conditions that might affect their property’s assessment. Consider tracking local sales volumes, price trends, and market conditions that may support arguments for lower valuations.

Professional consultation timing ensures homeowners have expert guidance available when critical decisions must be made. Many successful property tax planners establish relationships with professionals during the offseason, allowing for seamless collaboration when assessment notices arrive.

Protest Filing and Hearing Strategy (April-August)

The formal protest process is the culmination of strategies developed throughout the year. Success during this period depends heavily on the quality of preparation completed during previous months.

Strategic protest filing decisions should be based on a comprehensive analysis rather than emotional reactions to increased values. Homeowners must evaluate their evidence strength, consider their goals, and determine whether professional representation offers advantages for their specific situation.

Evidence compilation and presentation require organized, compelling documentation that supports clear arguments for value reduction. The most successful cases present adjusted comparable sales, document property-specific factors, and demonstrate clear discrepancies in the appraisal district’s assessment.

Essential Property Tax Planning Checklist

This checklist ensures homeowners never miss critical deadlines or opportunities that could cost hundreds in unnecessary taxes. Use this comprehensive framework to organize your property tax planning activities and maintain consistent progress toward long-term savings goals.

Monthly Planning Tasks

- January: Document property condition, photograph any issues, research recent comparable sales

- February: Compile repair estimates, organize documentation,

- March: Finalize protest preparation materials, review market conditions, consider professional consultation

- April: Review appraisal notice, compare to prepared research

- May: File protests, submit initial evidence, schedule informal meetings

- June-July: Attend hearings, present evidence, negotiate settlements

- August: Finalize protest outcomes, document results for future reference

- September: Begin next year’s planning cycle, organize records, assess strategy effectiveness

- October: Monitor tax bill accuracy, verify exemption applications, plan home improvements

- November: Research market trends, update property documentation, evaluate whether you’ve had any exemption changes

- December: Complete annual planning review, prepare for next assessment cycle

Annual Review Requirements

- Verify all eligible exemptions remain properly applied

- Update property condition documentation and photographs

- Review and organize maintenance and improvement records

- Assess protest strategy effectiveness and adjust approach

- Update market research and comparable sales information

- Evaluate professional representation needs for the following year

Documentation Management

- Maintain comprehensive property files with all relevant records

- Organize improvement receipts and maintenance documentation chronologically

- Keep digital and physical copies of all important documents

- Update property photographs annually to show current conditions

- Store market research and comparable sales data systematically

Professional Consultation Touchpoints

- Assessment review when notices arrive in April

- Annual planning review to evaluate effectiveness and adjust approach

What Are Long-Term Tax Reduction Strategies?

Building sustainable property tax savings requires strategies that compound benefits over multiple years rather than seeking one-time reductions. The following approaches create lasting value by establishing lower baseline assessments and optimizing exemption benefits that continue saving money annually.

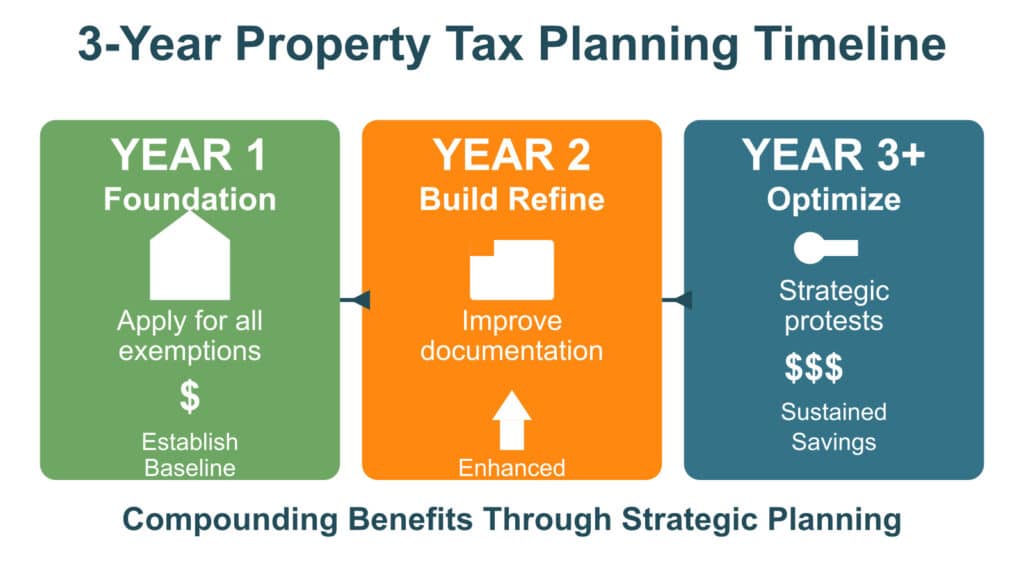

Multi-Year Planning Timeline

| Year | Primary Goals | Key Actions | Expected Outcomes |

| Year 1 | Establish foundation, maximize exemptions | Apply for all eligible exemptions, begin systematic documentation, file strategic protests | Foundation for ongoing savings through proper exemption application |

| Year 2 | Build on baseline, refine strategy | Continue annual protests, improve documentation quality, monitor market trends | Enhanced protest effectiveness through better preparation |

| Year 3+ | Optimize and maintain | Maintain systematic approach, adapt to market changes, leverage accumulated evidence in each year’s protest | Sustained savings with strengthened protest cases |

Exemption Optimization Strategy

The foundation of successful property tax planning lies in maximizing all available exemptions. Texas offers numerous opportunities that many homeowners overlook or fail to optimize.

Homestead exemption timing no longer requires waiting until January 1st following a home purchase. Recent legislative changes allow homeowners to apply for homestead exemptions immediately upon purchasing their primary residence, rather than waiting until the following tax year. This change can save new homeowners significant money in their first year of ownership.

Age 65+ planning considerations require advance preparation to maximize benefits. Homeowners approaching 65 should understand that the over-65 exemption provides additional tax savings and establishes a ceiling on school district taxes that remains in effect for life. Strategic planning around this milestone can result in substantial long-term savings.

Disabled veteran benefits offer some of the most significant exemption opportunities available. Veterans with disability ratings from the Department of Veterans Affairs may qualify for substantial property tax reductions. Texas provides exemptions ranging from $5,000 for 10-29% disability ratings up to complete exemption from all property taxes for 100% disabled veterans.

Agricultural exemption opportunities apply to properties with qualifying agricultural use, but contrary to popular belief, there is no statewide minimum acreage requirement under the Texas Property Tax Code. However, individual county appraisal districts establish their own minimum acreage guidelines, with most counties requiring at least 10 acres of qualifying agricultural land. The land must have been used for agricultural purposes for at least five of the past seven years and continue in agricultural use, such as crop production, livestock grazing, beekeeping, or timber production. Some activities like beekeeping may qualify with as few as 5 acres in certain counties, while traditional livestock operations typically require the standard 10-acre minimum. Property owners should contact their local county appraisal district to verify specific requirements, as these standards can vary significantly based on local conditions and agricultural intensity standards for their area.

Strategic Home Improvement Timing

Understanding how property improvements affect assessments allows homeowners to maximize their investment while minimizing tax consequences. Strategic timing of improvements can impact long-term property tax obligations.

Impact on assessments varies depending on the type and timing of improvements. Interior renovations like kitchen and bathroom upgrades typically don’t affect property tax assessments unless they add square footage or a permit was filed. Improvements that add square footage, such as room additions, garage conversions, or pool installations, will increase assessed values.

Post-January 1st advantage provides an opportunity for homeowners planning major improvements. Since county appraisal districts assess properties as of January 1st each year, improvements completed after this date won’t affect the current year’s assessment. This timing strategy allows homeowners to enjoy improvements immediately while deferring any tax impact until the following year.

Market value vs assessment considerations require homeowners to understand the difference between market value and tax assessed value. Improvements that enhance livability and personal enjoyment may provide value that exceeds their impact on tax assessments, particularly when timed appropriately.

What Are Advanced Property Tax Planning Techniques?

These advanced techniques provide advantages for homeowners serious about maximizing their long-term tax reduction potential.

Market Monitoring and Data Collection

Property tax planning requires ongoing market awareness and data collection. Homeowners who maintain comprehensive market intelligence position themselves for greater success in protest situations and long-term planning.

Comparable sales tracking involves monitoring all sales in your neighborhood and similar areas to understand market trends and identify properties that support lower valuations. Effective tracking includes sale prices, property characteristics, sale dates, and special circumstances that might affect comparability.

Neighborhood trend analysis helps homeowners understand broader factors affecting property values in their area. Consider monitoring new construction, zoning changes, infrastructure developments, and economic factors that could impact future assessments.

Assessment pattern recognition allows experienced planners to identify how their local appraisal district approaches valuations and where opportunities might exist for successful protests.

Professional Partnership Strategy

The decision to work with property tax professionals requires careful consideration of costs, benefits, and individual circumstances. Strategic homeowners evaluate these relationships as long-term partnerships rather than single-year transactions.

When to engage professionals depends on property value, potential savings, time availability, and comfort with the protest process. Generally, properties with higher values, complex characteristics, or homeowners with limited time benefit most from professional representation.

Cost-benefit analysis should consider both immediate savings and long-term value. While professional services require upfront investment, successful protests establish lower baseline values that compound savings over multiple years. The most effective professionals also provide guidance that helps homeowners plan for property taxes more effectively.

Long-term relationship building allows homeowners to benefit from professionals who understand their property history, market area, and individual circumstances. These relationships often become more valuable over time as professionals develop deeper insights into specific properties and local market conditions.

What Are Common Property Tax Planning Mistakes to Avoid?

Reactive-only approaches are the most costly mistake homeowners make in property tax planning. Waiting until appraisal notices arrive to begin thinking about property taxes eliminates most opportunities for strategic planning and preparation. This approach also creates unnecessary stress and often results in poor decision-making under deadline pressure.

Inadequate documentation undermines even the strongest protest cases. Many homeowners fail to maintain comprehensive records or wait until protest season to begin gathering evidence. The most successful protesters build documentation systems throughout the year and maintain detailed records of property conditions, improvements, and market research.

Ignoring market changes prevents homeowners from recognizing new opportunities or threats to their property tax situation. Market conditions change constantly, and factors that affect property values today may not apply next year. Strategic planners monitor these changes and adjust their approaches accordingly.

Frequently Asked Questions

How early should I start planning for next year’s property tax protest?

Effective property tax planning should begin immediately after receiving your current year’s tax bill, typically in October. This timing allows you to evaluate your protest results, begin market research for the following year, and start building documentation during the offseason when you have more time and less pressure.

What records should I keep year-round for property tax planning?

Maintain comprehensive files including all property improvement receipts, maintenance records, repair estimates, photographs of property conditions, market research, comparable sales data, and copies of all correspondence with appraisal districts. Organize these records chronologically and update them regularly throughout the year.

When is the best time to make home improvements to minimize tax impact?

Plan major improvements for completion after January 1st when possible, since appraisal districts assess properties as of this date each year. This timing allows you to enjoy improvements immediately while deferring any tax impact until the following year’s assessment cycle.

Take Control of Your Property Tax Future

Property tax planning in Texas offers homeowners powerful tools to reduce taxes long term and build sustainable savings strategies. Successful homeowners understand that effective planning requires year-round attention, systematic documentation, and strategic timing of decisions and actions.

Recent legislative changes, including increased homestead exemptions and expanded relief programs, provide additional opportunities for homeowners who understand how to maximize available benefits. However, these changes also underscore the importance of staying informed and maintaining proactive planning approaches.Your property tax burden doesn’t have to increase indefinitely. By implementing the strategies outlined in this guide and maintaining a systematic approach to plan for property taxes, you can take control of your annual obligations and build long-term wealth through sustained tax savings. Contact Home Tax Shield today to learn how professional property tax planning can help you achieve optimal results and maximize your savings potential.