Property tax exemptions in Texas can save homeowners thousands annually by reducing the taxable value of your property before tax calculations.

- Homestead exemptions remove $140,000 from your property’s taxable value for school taxes and include a 10% annual increase cap for predictable tax bills.

- Senior and disability exemptions provide additional savings plus tax ceiling protections that freeze certain taxes at current levels permanently.

- Veteran disability exemptions offer scaled benefits from $5,000 reductions up to complete tax exemption for 100% disabled veterans.

- Most exemptions require one-time applications through your local appraisal district and remain active until your circumstances change. As of 2023, the Homestead exemption requires verification every five years.

Apply for all qualifying exemptions immediately and consider protesting your property’s appraised value if it seems too high for additional savings.

Property tax exemptions in Texas represent one of the most effective ways homeowners can reduce their annual tax burden, potentially saving thousands of dollars each year. With Texas homeowners experiencing substantial average savings from recent property tax relief measures, understanding available exemptions has never been more crucial for protecting your financial well-being.

Property tax exemptions remove a portion of your home’s tax appraised value from taxation calculations, directly reducing the amount you owe. Unlike deductions that reduce taxable income, exemptions provide dollar-for-dollar savings on your property tax bill. Most exemptions are available at the state level, though local jurisdictions often provide additional relief options for qualifying homeowners.

The key to maximizing your tax savings lies in understanding which exemptions you qualify for and ensuring you’ve properly applied for them through your local appraisal district. Beyond exemptions, homeowners should also understand their rights regarding property appraisals and when challenging your property’s tax appraised value might provide additional savings.

Understanding How Property Tax Exemptions in Texas Work

Property tax exemptions in Texas function by reducing the taxable value of your property rather than changing the tax rate itself. When your county appraisal district determines your property’s market value, exemptions allow you to subtract specific amounts before calculating your final tax bill.

For example, if your home has a market value of $300,000 and you qualify for the homestead exemption, you’ll receive a $140,000 reduction from your school district taxes (paying taxes on only $160,000 for school purposes). Your county may provide an additional $3,000 exemption if they collect farm-to-market or flood control taxes. Other taxing entities like your city or special districts may choose to offer their own optional exemptions of up to 20% of your property’s value, but this varies by jurisdiction.

In Texas, homestead exemptions require a one-time application that remains in effect indefinitely. However, Senate Bill 1801, which took effect September 1, 2023, now requires Texas appraisal districts to verify homestead exemption eligibility at least once every five years. Property owners scheduled for reverification will receive notices from their appraisal district with instructions on how to complete the process, and failure to respond could result in loss of the exemption.

Understanding the cumulative effect of multiple exemptions is crucial for homeowners who may qualify for several programs simultaneously. However, some exemptions cannot be combined, and certain jurisdictions may limit the total exemption amount regardless of how many programs you qualify for.

The Homestead Exemption: Your Primary Tax-Saving Tool

The homestead exemption serves as the foundation of property tax relief for most homeowners across the United States. This exemption applies to your primary residence – the property where you live for the majority of the year and maintain as your principal place of residence.

In Texas, the current homestead exemption removes $140,000 from your property’s taxable value from school taxes for most homeowners and $200,000 for seniors and people with disabilities. The homestead exemption typically provides the largest single reduction in your property tax bill, making it essential for every homeowner to understand and apply for this benefit.

Beyond the immediate tax savings, Texas homestead exemptions include additional protections such as a 10% cap on annual appraisal increases. This cap prevents your property’s taxable value from rising by more than 10% each year, providing predictable tax bills even in rapidly appreciating real estate markets. The compound effect of these protections can result in thousands of dollars in savings over time.

To qualify for a homestead exemption, you must own the property, use it as your primary residence, and typically hold a driver’s license or state identification showing the property address. The application process requires submitting documentation to your local appraisal district, and once approved, the exemption remains in effect but requires periodic verification as mentioned above.

Senior Citizen Property Tax Exemptions

Senior citizens face unique financial challenges when it comes to property taxes, particularly those living on fixed incomes who may struggle with rising tax bills. Most states recognize this challenge by offering specialized exemptions for homeowners aged 65 and older, providing additional relief beyond standard homestead exemptions.

Senior exemptions typically take two forms: additional dollar amounts removed from taxable value and tax ceiling provisions that freeze certain portions of your tax bill. The tax ceiling feature proves particularly valuable, as it prevents school district taxes from exceeding the amount you paid in your first or second qualifying year (whichever is lower), regardless of future appraisal increases.

Many jurisdictions allow senior exemptions to transfer to surviving spouses under specific conditions. If your spouse was 55 or older when you passed away and continues to live in the home, they may maintain the exemption benefits you established. This provision helps protect surviving spouses from sudden tax increases during an already difficult time.

Disability Property Tax Exemptions

Texas offers two distinct types of disability exemptions: one for disabled veterans and another for disabled persons who qualify under Social Security disability programs. Understanding the difference between these programs is crucial for determining your eligibility and potential savings.

Non-Veteran Disability Exemptions

Homeowners with qualifying disabilities can access property tax exemptions in Texas that are designed to reduce the financial burden of homeownership for those facing additional medical expenses and potential income limitations. To qualify for disability exemptions, a person must meet the definition of “disabled” outlined in the Federal Old-Age, Survivors and Disability Insurance Program administered by the Social Security Administration.

Texas provides a $60,000 additional school tax exemption for disabled persons, which is added to the standard $140,000 homestead exemption for a total of $200,000. This exemption also includes a tax ceiling feature that prevents your school district taxes from increasing as long as you own and live in the home, providing long-term financial protection similar to senior citizen exemption benefits.

The application process requires documentation from the Social Security Administration confirming your disability status, proof of property ownership, and residency verification. You can apply for the disabled person exemption at any time after qualifying, and if you apply within a year of becoming disabled, the exemption will be applied retroactively.

Veteran Disability Exemptions

Disabled veterans have access to separate and often more comprehensive exemption programs. These veteran exemptions are tied to VA disability ratings, with amounts ranging from $5,000 for 10-29% disability ratings up to complete tax exemption for 100% disabled veterans. Unlike the disabled person exemption which only applies to residence homestead property, the disabled veteran exemption can be applied to any one property the disabled veteran owns.

The application processes, benefit amounts, and qualifying criteria differ significantly between these two exemption types. Understanding all available Texas property tax exemptions and checking with your local appraisal district about combination rules ensures you maximize your potential savings.

Agricultural and Special Use Exemptions

Property owners with agricultural land, timber properties, or wildlife management areas may qualify for specialized exemptions that significantly reduce their tax burden. These exemptions recognize the public benefit provided by agricultural activities and encourage the preservation of open space and farming operations.

Agricultural exemptions typically require minimum acreage requirements, proof of agricultural income, and documentation of qualifying activities. The exemption applies a different valuation methodology, taxing the land based on its agricultural productivity rather than its potential development value. This approach can result in substantial savings for qualifying property owners.

Wildlife management and timber exemptions follow similar principles, requiring documentation of qualifying activities and meeting specific management criteria. These programs often require management plans approved by state agencies and periodic reporting to maintain eligibility.

The application process for agricultural exemptions requires detailed documentation of farming activities, income records, and proof of compliance with state and local agricultural requirements. Annual renewals are typically required, with inspections possible to verify continued qualifying use.

5 Essential Steps to Maximize Your Exemption Benefits

- Research All Available Programs: Contact your local appraisal district to obtain a complete list of exemptions available in your area, as local jurisdictions often offer programs beyond state-mandated exemptions.

- Gather Required Documentation: Collect necessary paperwork including identification, proof of ownership, disability determinations, military service records, and any other documentation required for your qualifying exemptions.

- Apply Early and Completely: Submit applications well before deadlines with all required documentation to avoid processing delays that could affect your current tax year benefits.

- Monitor Exemption Status: Regularly verify that your exemptions remain in effect by reviewing your annual tax statements and property records maintained by your local appraisal district.

- Understand Renewal Requirements: Some exemptions require annual renewal while others remain in effect indefinitely, so establish a system to track renewal deadlines and maintain qualifying status.

Following these essential steps systematically ensures you capture all available exemption benefits while avoiding common pitfalls that delay or prevent approval. The time invested in proper research and application preparation pays dividends through years of reduced property tax bills and financial peace of mind.

Common Mistakes to Avoid When Applying for Exemptions

Many homeowners make critical errors when applying for property tax exemptions in Texas, and these errors can delay approval or result in missed savings opportunities. Understanding common mistakes helps ensure successful applications and maximum benefit realization.

- Incomplete applications represent the most frequent cause of exemption delays. Missing documentation, incorrect information, or failure to sign required forms can result in automatic denial or significant processing delays. Taking time to carefully review application requirements and double-check all submitted materials prevents these costly errors.

- Missing application deadlines eliminates exemption eligibility for the current tax year in most jurisdictions. While some areas allow retroactive applications for certain exemptions, others strictly enforce deadline requirements. Establishing reminder systems and submitting applications well before deadlines protects your eligibility.

- Failing to notify your appraisal district of changed circumstances can result in exemption loss or even penalties. Changes in marital status, disability status, property ownership, or primary residence location must be reported promptly to maintain exemption eligibility and avoid potential legal issues.

The Financial Impact of Property Tax Exemptions in Texas

Property tax exemptions provide immediate and long-term financial benefits that extend far beyond the initial tax savings. Understanding the cumulative impact of these programs helps homeowners appreciate their true value and motivates proper application and maintenance.

Long-term benefits include protection against rapid tax increases and predictable housing costs that support retirement planning and fixed-income budgeting. Homestead exemption caps prevent dramatic tax increases even when property values rise rapidly, providing stability that helps homeowners remain in their homes throughout changing economic conditions.

The compound effect of exemptions becomes particularly valuable over time, as annual savings can be invested or used to improve your property. This multiplier effect means that exemption benefits extend beyond simple tax reduction to support overall financial health and wealth building.

Staying Current with Exemption Changes

Property tax exemption programs frequently evolve through legislative changes, voter initiatives, and policy updates that can affect your eligibility or benefit amounts. Staying informed about these changes ensures you maintain maximum exemption benefits and don’t miss new opportunities for tax relief.

Legislative sessions often bring significant changes to exemption programs, with recent examples including substantial increases in homestead exemption amounts and expanded eligibility criteria for certain programs. Following legislative developments helps you anticipate changes and prepare for application requirements or benefit adjustments.

Beyond Exemptions: Additional Property Tax Relief Options

While exemptions provide substantial property tax relief, other strategies can further reduce your annual tax burden and ensure you’re paying fair property taxes. Understanding these additional options creates a comprehensive approach to property tax management.

- Property tax deferrals allow qualifying homeowners to postpone tax payments while maintaining homeownership, typically available to seniors and disabled individuals facing financial hardship. These programs prevent tax foreclosure while preserving your equity, though interest typically accrues on deferred amounts.

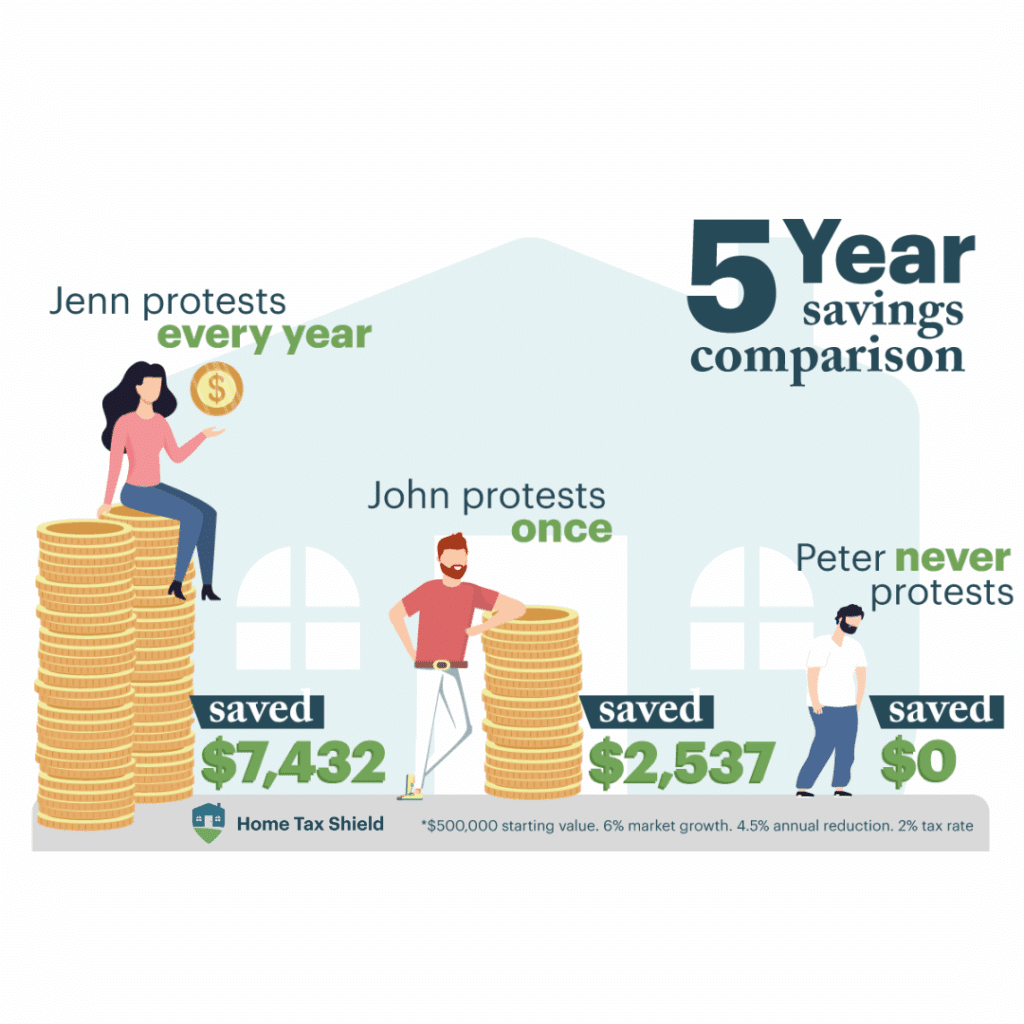

- Property tax protests provide another avenue for relief by challenging your property’s appraised value when you believe it exceeds fair market value. Successful protests reduce your taxable value and provide savings that compound over time through exemption caps and future appraisal calculations.

- Payment plans and hardship programs offer temporary relief for homeowners experiencing financial difficulties, preventing penalty accumulation and foreclosure while allowing time to resolve financial challenges. These programs recognize that temporary setbacks shouldn’t result in permanent housing loss.

Avoiding these common mistakes requires attention to detail and proactive communication with your appraisal district. When in doubt, contact your local appraisal office for guidance rather than making assumptions that could jeopardize your exemption benefits. Taking a careful, methodical approach to exemption applications and maintenance protects your financial interests and ensures continued tax relief.

Secure Your Property Tax Savings Today

Property tax exemptions offer substantial financial relief for qualifying homeowners, providing both immediate savings and long-term protection against rising tax bills. From homestead exemptions that benefit all qualifying homeowners to specialized programs for seniors, veterans, and disabled individuals, these programs recognize the diverse needs of property owners while supporting housing affordability and stability.

The key to maximizing exemption benefits lies in understanding available programs, meeting application requirements, and maintaining eligibility over time. With proper planning and attention to detail, most homeowners can achieve significant property tax savings that support their overall financial health and homeownership goals. Taking action to secure these benefits requires minimal effort but provides lasting financial rewards.

While exemptions provide substantial relief, ensuring your property is fairly appraised represents another crucial component of property tax management. Home Tax Shield specializes in helping Texas homeowners navigate the property tax protest process to ensure fair tax appraisals year after year. Get started with Home Tax Shield today to protect your property tax investment and ensure you’re paying only your fair share.

Frequently Asked Questions

Q: Do I need to reapply for property tax exemptions every year? A: Most exemptions remain in effect once approved until your circumstances change, though some jurisdictions require periodic renewals. Check with your local appraisal district for specific renewal requirements.

Q: Can I qualify for multiple property tax exemptions simultaneously? A: Yes, many homeowners qualify for multiple exemptions such as homestead and senior or disability exemptions. However, some jurisdictions limit total exemption amounts or restrict certain combinations.

Q: What happens to my exemptions if I move to a new home? A: Exemptions typically don’t transfer automatically to new properties. You’ll need to reapply through your new jurisdiction’s appraisal district, though some programs allow benefit transfers under specific conditions.

Q: How long does the exemption application process typically take? A: Processing times vary by jurisdiction but typically range from 30-90 days. Submitting complete applications early in the year helps ensure processing before tax bills are finalized.Q: Can property tax exemptions be applied retroactively if I missed the deadline? A: Some exemptions allow retroactive application for limited periods, while others strictly enforce deadlines. Contact your appraisal district immediately if you’ve missed a deadline to explore available options.