Most Texas homeowners leave thousands on the table during property tax protests due to avoidable mistakes and outdated strategies.

- Missing deadlines or using weak comparable properties can kill your savings potential.

- Professional representation typically achieves higher success rates and larger savings than DIY approaches.

- The $140,000 homestead exemption provides additional savings opportunities.

Start your protest early and focus on data-driven evidence rather than emotional appeals for maximum impact.

Your property tax bill just arrived, and once again, it’s higher than you expected. If you’re like most Texas homeowners, you’re probably wondering whether it’s worth fighting or if you should just accept what the county says your home is worth. Texas has some of the highest property tax rates in the country, with homeowners paying an average of 1.36% of their home’s assessed value. Recent legislative changes have increased the homestead exemption to $140,000 for school district taxes, which helps, but many homeowners are still overpaying.

What most people don’t realize is that many homes are unfairly overassessed, leading to an excess of $1,346 in taxes every year. With the typical Texas home valued around $302,000, even a small overassessment can cost you hundreds annually. However, you have the right to challenge that assessment, and when you maximize your property tax protest savings through smart strategies, you can keep significantly more money in your pocket.

Whether you’re considering protesting for the first time or you’ve tried before without much success, learning how to maximize property tax protest savings starts with understanding what really works.

What Does It Really Mean to Maximize Property Tax Protest Savings?

When we talk about maximizing your savings during a property tax protest, we’re not just talking about getting any reduction. We’re talking about getting the biggest, fairest reduction possible based on your property’s true market value. Maximizing property tax protest savings means understanding how to save on property taxes through multiple approaches.

If your home’s tax appraised value is assessed at $400,000 but it’s really worth $350,000, that $50,000 difference translates to roughly $680 in annual tax savings at Texas’s average rate. Over ten years, that’s nearly $7,000 back in your pocket. Now multiply that by the fact that you should be protesting every single year, and you start to see why the right tax protest strategies can have a life-changing impact on your finances.

The key is approaching your protest with the same level of preparation and strategy that the county uses to set your value in the first place. Counties use sophisticated data analysis, market trends, and comparable properties to determine what they think your home is worth. To get more from protest proceedings, you need to meet them on that same level with equally strong evidence and analysis.

The 7 Most Costly Mistakes That Kill Your Property Tax Savings

Most property tax protests fail not because homeowners don’t have valid cases, but because they make preventable mistakes that undermine their entire effort. Here are the biggest savings-killers we see year after year:

1. Missing the Filing Deadline

Deadlines can sneak up on you, which is why missing them is the ultimate mistake. In Texas, you have until May 15 or 30 days after receiving your notice, whichever is later, to file your protest. Miss this deadline, and you’re stuck with whatever value the county assigned, no matter how unfair it might be. Understanding the proper timeline is vital for success.

2. Using Weak or Inappropriate Comparable Properties

Property comparison is where a lot of DIY protests fall apart. You can’t just compare your house to your neighbor’s. Property tax protest professionals analyze over 40 different data points when comparing properties, and they make adjustments for every difference. Using comps that aren’t truly similar or failing to make proper adjustments for differences in size, age, condition, and features will sink your case.

3. Getting Emotional Instead of Factual

High property taxes are frustrating, and it’s easy to get worked up during a hearing. But telling the review board that “these taxes are killing me” or “this is unfair” won’t lower your assessment. The board can only consider objective, factual evidence about your property’s value, not your personal financial situation or feelings about tax rates. Learning what to include in your protest can make all the difference in your outcome.

4. Accepting the First Settlement Offer

Many homeowners get excited when the county offers any reduction at all and immediately accept it. This snap decision is often a mistake. Counties sometimes offer small reductions early in the process to close cases quickly. If you have solid evidence that your property is overvalued, don’t be afraid to push for a fair adjustment that truly reflects your home’s market value.

5. Bringing Incomplete or Disorganized Evidence

Showing up to your hearing with a stack of random papers won’t impress anyone. You need organized, relevant documentation that clearly supports your case. Consider properly adjusted comparable sales, repair estimates, supporting photos of any condition issues, and clear calculations showing how you arrived at your proposed value.

6. Not Understanding Which Protest Method to Use

There are several ways to challenge your tax appraised value, such as market value, unequal appraisal, and the income approach for rental properties. Many homeowners don’t realize they can use multiple approaches or don’t choose the strongest strategy for their specific situation. Sometimes the best approach isn’t arguing that your home’s tax appraised value is too high but showing that similar properties in your area are assessed at lower values.

7. Trying to Go It Alone Without Expertise

DIY might be the costliest mistake of all. Property tax law is complicated, and the county has professional appraisers representing their side. Going up against experts without the same level of knowledge and preparation puts you at a significant disadvantage from the start. The learning curve is steep, and one mistake can cost you thousands in potential savings.

Advanced Strategies to Maximize Your Property Tax Protest Savings

Now that we’ve covered what not to do, let’s talk about the tax protest strategies that actually work. Professional property tax consultants use these approaches to consistently maximize property tax protest savings for their clients.

Market Value Analysis

This approach is the most common, where you argue that your property’s tax appraised value is higher than what it would actually sell for as of Jan 1st of that year. The key is using recent, comparable sales from the previous year and making accurate adjustments for any differences between those properties and yours. You need at least three to five strong comparables that sold closest to January 1st of the tax year – ideally from the six months before January 1st. Sales from closer to the valuation date carry the most weight, and you need to know how to adjust for differences in square footage, lot size, age, condition, and features.

Equity or Unequal Appraisal Method

Even if your home might actually be worth what the county says it’s worth, you can still get a reduction if similar properties in your area are assessed at lower values. This approach focuses on fairness, arguing that your property should be valued consistently with others like it. This strategy requires a detailed analysis of how the county has valued other properties in your neighborhood and market area.

Income Approach for Investment Properties

If you own rental property that offers five or more units, you might be able to argue that the county has overestimated the income potential, leading to an inflated assessment. This method requires documenting actual rental income, operating expenses, and market rental rates to show what the property is really worth as an investment.

The Condition and Economic Factors Approach

Sometimes properties have specific issues that affect their market value but aren’t reflected in the county’s assessment, like foundation/roof repairs or other factors that would impact what a buyer would pay.

The Technology and Experience Advantage: How Data Science Supports Expert Analysis

The most effective approach to maximizing property tax protest savings combines advanced technology with deep local expertise. Rather than replacing human judgment, sophisticated data analysis tools enhance what experienced professionals can accomplish.

Traditional comparable analysis has always relied on experienced appraisers who understand local markets, property characteristics, and county-specific preferences. These professionals know which arguments resonate with different appraisal review boards and how to present evidence most effectively. However, even the most experienced professionals are limited by the amount of data they can manually process and analyze.

Modern data science and technology tools can analyze thousands of properties simultaneously, identifying potential comparable properties and market patterns that might not be immediately obvious. This technology can spot properties that share subtle similarities – specific neighborhood micro-markets, unique architectural features, or market trends that affect value. It can also help identify the most relevant comparable sales and suggest appropriate adjustments for differences between properties.

When you combine this comprehensive data analysis with the expertise of local licensed professionals who have decades of experience, you get the best possible approach. The technology ensures no relevant data is missed, while experienced professionals know how to interpret that data, present it persuasively, and navigate the specific procedures of each county.

This combination of technology and property tax protest experience can make the difference between a modest reduction and substantial savings. The data analysis is more comprehensive, but it’s the human expertise that knows how to turn that data into winning arguments at hearings.

Professional vs DIY: Which Path Maximizes Your Savings?

One of the biggest decisions you’ll face is whether to handle your protest yourself or hire professional help. Here’s an honest comparison to help you decide:

| Factor | DIY Approach | Professional Representation |

| Time Investment | Hours of research, prep, and hearing attendance | Minimal – professionals handle everything |

| Success Rate | Success rates depend on time investment, evidence, and presentation skill | High success rates with experienced firms |

| Cost | “Free” but significant time investment | Upfront fee, plus contingency fee based on percentage of savings achieved |

| Expertise Level | Limited to your research ability and understanding of tax code | Professionals with years of experience |

| Data Access | Public records and basic online tools | Professional databases and AI analysis tools |

| Hearing Representation | You attend and present your case | Professional represents you |

| Annual Consistency | Must repeat process each year | Automatic annual representation |

| Stress Level | High – unfamiliar process and procedures | Low – professionals handle everything |

While the DIY approach might seem “free,” the significantly lower success rates and smaller average savings mean you often leave more money on the table than you save by not hiring help. Choosing the right professional representation can make the difference between a small reduction and maximum savings.

Timeline and Process to Maximize Your Protest Success

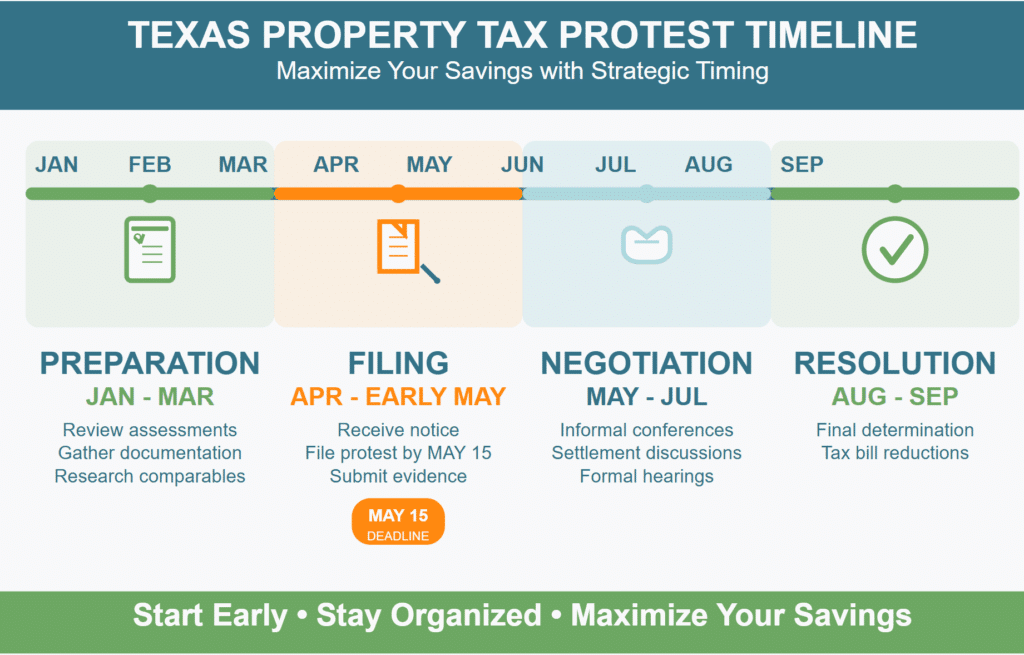

Whether you decide to go the DIY route or hire professional help, understanding the timeline is essential for maximizing your property tax protest savings:

January-March: Preparation Phase

- Review your previous year’s assessment and tax bill

- Start gathering documentation of any property issues or needed repairs

- Research recent sales in your area from previous year

- If hiring professionals, this is the ideal time to sign up

April-Early May: Filing Phase

- Receive your Notice of Appraised Value

- File your protest by the deadline (May 15 or 30 days from notice)

- Request informal conference if available

- Submit initial evidence

May-July: Negotiation Phase

- Attend informal conference if requested

- Engage in settlement discussions

- Attend formal hearing if necessary

- Present your evidence and arguments

August-November: Resolution Phase

- Receive final determination

- Apply any reductions to your tax bill

- Receive tax bill in November after tax rates are finalized

The key to success is starting early and being prepared at each step. The counties have all year to prepare their cases, so you should give yourself the same advantage.

Frequently Asked Questions

Q: How much can I realistically save through a property tax protest? A: No one can give you a specific savings number – a full protest is the only way to find out how much you can save. That said, successful protests can achieve meaningful reductions of your tax appraised value. The actual amount varies based on your property’s specific situation. It’s essential to understand that even modest reductions compound over time when you protest consistently each year.

Q: Should I protest every year, even if I won last year? A: Absolutely. Each year’s assessment is independent, and property values are constantly changing. Even if you received a reduction last year, your property’s tax appraised value might be overassessed again this year. Consistent annual protesting often leads to compound savings over time.

Q: Will protesting my taxes hurt my property’s market value? A: No, protesting your taxes has no impact on what your property is actually worth on the market. Buyers often see lower tax assessments as a positive, since it means lower carrying costs for them.

Q: What happens if I miss the filing deadline? A: Unfortunately, if you miss the deadline, you’re generally stuck with that year’s assessment. There are very limited exceptions for military service or other extraordinary circumstances, but these are rare and difficult to qualify for. Filing online can help ensure you don’t miss important deadlines, but the key is starting early in the process.

Start Maximizing Your Property Tax Savings Today

Property taxes are likely your second-largest expense after your mortgage, and most Texas homeowners are paying more than they should. The strategies we’ve covered can help you maximize your property tax protest savings, but they require either significant time investment to do yourself or the expertise of professionals who live and breathe this stuff every day.

At Home Tax Shield, our experienced, licensed tax professionals use data science and technology tools to enhance their deep market knowledge and ensure you’re getting the most comprehensive representation possible. With an 83% success rate in reducing property taxes, we’re committed to protesting every property, every year, with a 100% attempt rate because we believe every homeowner deserves to know if they’re getting a fair assessment. Our upfront fee structure ensures we take every case through the entire process, regardless of the likelihood of savings.Whether you save money or not, you’ll have the peace of mind that comes from knowing a seasoned expert fought for every penny possible and can tell you with certainty whether your property taxes are fair. Get started with your property tax protest and see how much you could be saving.