Texas property tax assessments contain critical information that directly impacts your annual tax bill, but many homeowners struggle to interpret the complex documents they receive each spring.

- Assessment notices include property details, current and previous values, exemptions, and taxing entity information

- Common errors in square footage, bedroom counts, and missing exemptions can be corrected through your appraisal district

- Understanding each section helps you verify factual accuracy and evaluate whether your property’s appraised value reflects fair market conditions

- Missing correction and protest deadlines means accepting potentially incorrect assessments for an entire year

Every Texas homeowner should master reading their assessment notice to ensure fair taxation and maximize potential savings.

Receiving your annual property tax assessment notice in the mail can feel overwhelming. The document contains numerous sections, codes, and values that seem designed to confuse rather than inform. However, learning how to decode your Texas property tax assessment guide is one of the most valuable skills you can develop as a homeowner.

Your property tax assessment serves as the foundation for your annual tax bill, determining exactly how much you’ll owe to various local taxing entities. With few exceptions, Tax Code Section 23.01 requires appraisal districts to appraise taxable property at market value as of Jan. 1, making these assessments critically important for your financial planning. Understanding each section of this document empowers you to spot errors for correction, verify accuracy, and potentially save thousands of dollars through proper exemptions and tax appraised value challenges.

What Is a Texas Property Tax Assessment Notice?

Your Texas property tax assessment guide begins with understanding the document itself. The official term for what many homeowners call their “assessment” is actually the “Notice of Appraised Value.” This document serves as your county appraisal district’s formal notification of your property’s estimated value for tax purposes.

Tax Code Section 25.19 requires a chief appraiser to send property owners a notice of appraised value by: April 1, or as soon thereafter as practicable for a single-family residence; or May 1, or as soon thereafter as practicable for any other property. The timing ensures homeowners receive adequate notice before tax rates are set and bills are calculated.

This notice differs significantly from your actual property tax bill, which arrives in October. As clearly stated on assessment notices, “This is NOT a tax bill. Do NOT pay from this notice.” The assessment notice shows your property’s appraised value – what the county believes your property is worth. Your tax bill shows your assessed value – the actual amount subject to taxation after exemptions are applied. Understanding this distinction prevents confusion when comparing the two documents.

The assessment notice also includes protest information and deadlines, making it your opportunity to challenge the valuation before it becomes final. Once you receive your actual tax bill notice Texas residents get in fall, the protest window has typically closed for that tax year.

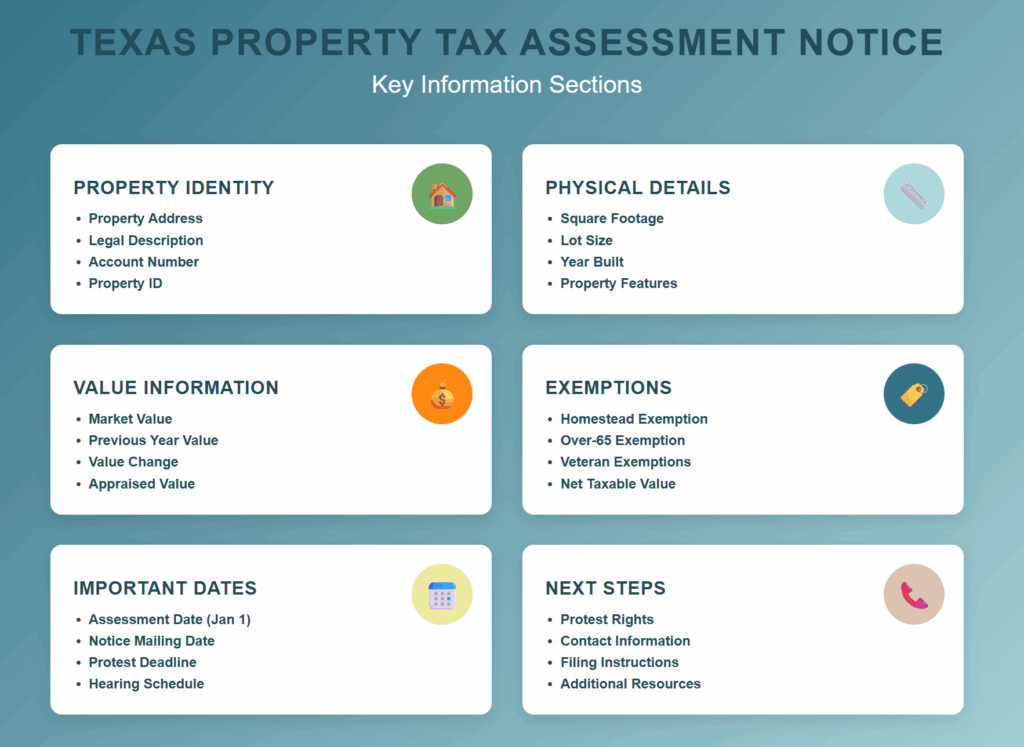

Understanding Your Property Tax Assessment Components

Modern Texas property tax assessment notices contain several standardized sections, though the exact layout varies by county. Learning to navigate these sections systematically ensures you don’t miss important information or potential errors. While each county’s notice looks slightly different, the basic structure and required information remains consistent across Texas.

Property Identification Section

The top portion of your assessment notice contains critical identifying information that establishes which property the assessment covers. This section typically includes your account number, which serves as the primary identifier your appraisal district uses for all correspondence and records.

Your account number often begins with a letter followed by numbers (such as R00000 for residential properties, M00000 for mobile homes, or P00000 for personal property). This number appears on all future correspondence, so keep it readily accessible for phone calls or online inquiries.

The property identification section also lists the legal description of your property, your mailing address, and the property’s physical address if different. Verify this information carefully, as errors here can cause notices to be mailed to wrong addresses or create confusion about which property is being assessed.

Value Breakdown Section

The heart of any Texas property tax assessment guide focuses on the value breakdown section, which shows how your property’s worth has been calculated. This section typically presents information in a table format comparing current year values to previous year values.

You’ll find your property’s total market value, which represents the appraisal district’s estimate of what your property would sell for under current market conditions. The market value of a residence homestead shall be determined solely on the basis of the property’s value as a residence homestead, regardless of whether the residential use of the property by the owner is considered to be the highest and best use of the property.

The value breakdown often separates land value from improvement value, showing how much of your property’s worth comes from the lot itself versus the structures and improvements on it. Some counties also show a five-year comparison, helping you understand long-term trends in your property’s tax appraised value.

If your property qualifies for a homestead exemption, you’ll see both your tax appraised value and your assessed value. The homestead cap may limit annual increases to 10%, even if your appraised value increased more significantly.

Exemptions and Tax Code Information

This section details any exemptions currently applied to your property and explains relevant tax code limitations. Common exemptions include the general homestead exemption, over-65 exemptions, disabled veteran exemptions, and agricultural exemptions.

With a homestead exemption, the first $140,000 of your property’s value is removed from calculating the amount you owe for school district taxes. The exemption section shows exactly which exemptions you’re receiving and their dollar value impact on your assessment.

You’ll also find information about tax code limitations that may apply to your property. For properties that don’t qualify as your primary residence (such as rental properties, vacation homes, or commercial real estate), Texas law limits how much the appraised value can increase each year.

From 2024 through 2026, these non-homestead properties cannot have their appraised values increased by more than 20% annually, with certain exceptions. This “circuit breaker” provision helps protect property owners from dramatic year-over-year tax increases on investment and commercial properties.

Taxing Units Section

Your assessment notice lists all local taxing entities that will collect property taxes from your property. More than 4,796 local taxing units in Texas — school districts, cities, counties and various special districts — assess property tax to fund local public services.

Common taxing units include your county, school district, city (if you live within city limits), and various special districts such as hospital districts, community college districts, or municipal utility districts. Each entity sets its own tax rate, which will be multiplied by your property’s taxable value to determine your portion of their budget.

The notice may include contact information for each taxing unit, which becomes valuable if you have questions about specific services or want to understand how your tax dollars are being used.

What Are Some Red Flags That Signal Assessment Problems?

While systematic annual review is important for all homeowners, certain situations signal immediate assessment problems that require urgent attention. These red flags often indicate significant errors or valuation issues that can cost thousands if left unaddressed.

Dramatic value spikes without explanation represent the most common red flag. If your property value increased 25% or more while similar homes in your neighborhood saw modest increases, investigate immediately. This often indicates data errors, incorrect improvements being recorded, or misclassification of your property type.

Assessment higher than recent purchase price should raise immediate concerns. If you bought your home within the past year for significantly less than your new assessment, and no major improvements were made, this suggests the appraisal district hasn’t properly considered actual market data for your specific property. Texas law requires appraisals to reflect market value, making significant deviations from recent sales prices particularly problematic.

Incorrect property type classification can dramatically inflate your assessment. If your single-family residence appears classified as commercial property, or your modest home shows up as luxury property, contact your appraisal district immediately. These errors often result from data entry mistakes during property transfers or permit filings.

Missing major damage or depreciation signals valuation problems when your property has suffered significant damage from storms, flooding, or structural issues that occurred before January 1, but your assessment doesn’t reflect the reduced condition.

Neighborhood misclassification becomes apparent when your property appears grouped with homes in significantly different areas or school districts. Properties sometimes get incorrectly associated with higher-value neighborhoods during boundary changes or data system updates.

When you identify these red flags, document them immediately and contact your appraisal district to understand how the valuation was determined. For factual errors like incorrect property classification or missing damage documentation, contact your appraisal district directly to request correction forms rather than filing a protest.

Valuation issues like dramatic value spikes or assessments exceeding recent purchase prices, on the other hand, provide the strongest grounds for successful property tax protests and typically benefit from professional assistance to ensure maximum correction.

What Are Key Texas Property Tax Assessment Deadlines and Timeline Information?

Understanding the timeline surrounding your assessment notice is crucial for protecting your rights and potentially reducing your tax burden. Property owners who disagree with the tax appraised value in the notice may use the Property Owner’s Notice of Protest included with the notice to file a protest with the ARB.

The protest deadline represents the most critical date for challenging your property’s tax appraised value. You must file your protest by May 15 or 30 days after the appraisal district mailed your notice, whichever is later. Missing this deadline means accepting the appraised value as final for that tax year.

Mark your calendar immediately upon receiving your notice, as late submissions are almost never accepted. Many homeowners discover value discrepancies months later when reviewing their actual tax bills, but by then the protest window has closed.

For factual errors in property details, there is no standard deadline for requesting corrections. In Travis county, it’s January. In general, counties only schedule visits during certain months. Errors can be addressed by contacting your appraisal district directly for direction on next steps. It’s best to address any errors as soon as you discover them to ensure accurate calculations for your current tax year.

The assessment notice itself typically arrives between April 1 and May 1, depending on your property type and county size. Residential homesteads generally receive notices earlier than commercial properties, giving homeowners more time to review and potentially take action.

After the protest deadline passes, appraisal review boards begin hearing cases through the summer months. Your actual tax bill arrives in October, showing the final amounts due based on the completed assessment and protest process.

When Should You Question Your Assessment?

Every Texas homeowner should consider questioning their assessment annually, regardless of whether obvious red flags appear. Property tax assessments require careful scrutiny each year to ensure fair valuation, and even modest reductions compound into significant savings over time. As a property owner, you have the legal right to challenge your assessment, and the process has become increasingly accessible through professional services that handle the work on your behalf.

The key principle behind annual assessment review is simple: mass appraisal systems, while sophisticated, cannot account for every unique characteristic and market nuance affecting your specific property. What appears to be a “reasonable” assessment may still exceed your property’s true market value when examined closely by experienced professionals who understand local market conditions and appraisal methodologies.

Certain situations provide particularly strong grounds for questioning your assessment. Sudden, unexplained value jumps often indicate assessment errors or market misunderstanding. If your property increased significantly while similar homes in your neighborhood increased at a much lower rate, investigate the reasoning behind your specific increase.

Recent market downturns provide additional grounds for assessment challenges. If market conditions have softened since the January 1 valuation date, your assessment may not reflect current reality. Property condition changes also warrant challenges when damage or deterioration hasn’t been reflected in your valuation.

Even without dramatic changes or obvious errors, the annual protest process serves as your opportunity to ensure the appraisal district’s valuation methodology accurately captures your property’s market position. Professional property tax services can handle this review process entirely, making it a hands-off way to protect against overpayment while preserving your time and energy for other priorities.

Remember that any reduction in your property’s appraised value creates compounding benefits over time, as lower base valuations typically result in smaller increases in subsequent years. This makes annual assessment review a valuable long-term wealth preservation strategy for Texas homeowners.

7 Essential Items to Verify on Your Texas Property Tax Assessment

Creating a systematic approach to reviewing your assessment ensures you don’t overlook critical details that could impact your tax bill. These seven verification steps form the foundation of any thorough Texas property tax assessment guide.

- Property Details Accuracy: Confirm square footage, lot size, bedroom and bathroom counts, and year built match your property’s actual characteristics. Contact your appraisal district to request correction forms for any factual errors.

- Exemption Application: Verify all eligible exemptions appear on your assessment and show correct dollar amounts. Texas property tax exemptions can provide substantial savings when properly applied.

- Previous Year Comparison: Review how your current assessment compares to previous years and whether increases align with local market trends. Dramatic increases may warrant further investigation.

- Homestead Cap Application: If you qualify for homestead exemption, ensure the 10% annual increase cap has been properly applied to your taxable value, even if your appraised value increased more substantially.

- Property Classification: Confirm your property is classified correctly (residential, commercial, agricultural) and that any special use valuations have been applied appropriately.

- Improvement Documentation: Check that recent additions or improvements are accurately reflected without overstating their impact on total property value.

- Market Value Assessment: After confirming all factual details are correct, evaluate whether your property’s appraised value aligns with current market conditions and comparable properties, considering the complex methodology appraisers use rather than simple neighbor-to-neighbor comparisons.

This verification checklist provides a systematic approach to reviewing your assessment notice each year. By checking each element methodically, you ensure that both factual details and valuation estimates receive proper scrutiny before your protest deadline arrives.

Frequently Asked Questions

Q: What’s the difference between appraised value and assessed value on my Texas property tax assessment?

A: Appraised value is the county’s estimate of your property’s market worth, while assessed value is the amount actually subject to taxation after exemptions are applied. Your tax bill is calculated using the assessed value. It’s important to note that many counties use different terminology to indicate different values, so you may want to clarify with your specific county.

Q: How often does Texas require property to be reappraised?

A: Texas law requires appraisal districts to reappraise all property in their jurisdictions at least once every three years, though many counties conduct annual appraisals to keep valuations current with market conditions.

Q: Can I protest my assessment if I disagree with the value?

A: Yes, you have the legal right to protest your assessment by May 15 or 30 days after receiving your notice, whichever is later. The protest process allows you to present evidence that your property is overvalued.

Q: What happens if I find errors in my property details on the assessment? A: Contact your appraisal district immediately to request correction forms for factual errors like wrong square footage or bedroom counts. These corrections are handled separately from value protests and often require simple paperwork rather than a formal hearing.

Take Control of Your Property Tax Assessment

Reading your Texas property tax assessment notice is just the first step in managing your property tax burden effectively. Once you understand the document and identify potential issues, you can take action to ensure you’re paying your fair share rather than subsidizing gaps in the mass appraisal system.

The assessment review process empowers homeowners to participate actively in determining their tax burden rather than passively accepting whatever valuation the county assigns. Understanding how to challenge a property tax assessment provides you with tools to address overvaluations that could cost thousands over time, while factual errors can often be corrected through simple administrative processes.

Many Texas homeowners discover that professionally managing their property tax assessments yields significant long-term savings. The combination of annual assessment review, error correction, exemption optimization, and strategic value protests can compound into substantial tax savings over the years you own your property.

Remember that your assessment notice is not just an informational document—it’s your annual opportunity to ensure fair taxation. Property value research and systematic review of your assessment can identify both correctable errors and value discrepancies that might otherwise go unnoticed until they’ve cost you hundreds or thousands in unnecessary taxes.

The Texas property tax system is complex, but homeowners who take time to understand their assessments often find opportunities for savings that make the effort worthwhile. Whether you handle the review process yourself or work with professionals, the key is approaching your assessment systematically and understanding the different pathways for addressing various types of issues.For homeowners seeking expert assistance with assessment review and property tax management, Home Tax Shield combines technology with experienced local tax professionals to ensure you’re never paying more than your fair share. Get started with Home Tax Shield and take control of your property taxes today.