Texas homeowners who know how to protest property taxes effectively can save thousands annually.

- High success rates: Many protests succeed at informal hearings statewide

- Significant savings: Average savings vary depending on county, with statewide average exceeding $600. While no one can tell you how much you’ll save by protesting, any savings will compound over time.

- Critical deadline: Must file by May 15 or within 30 days of receiving your notice

Filing early and preparing strong evidence gives you the best chance at meaningful tax reductions.

Texas homeowners face some of the highest property tax rates in the nation. Many homeowners struggle with growing tax bills that can exceed their mortgage payments. Fortunately, there are two main strategies for reducing your property tax burden: filing for exemptions and protesting your property’s tax appraised value.

This comprehensive guide focuses on how to protest property taxes in Texas through the formal protest process, which offers the most significant potential for savings. Understanding the step-by-step approach to challenging your property’s market value can help you secure fair tax assessments year after year. Whether you choose to handle the process yourself or work with experts, knowing these fundamentals puts you in control of your property tax future.

Why Should You Protest Your Property Taxes in Texas?

The property tax protest process exists because appraisal districts make mistakes. With millions of properties to evaluate annually, mass appraisal systems rely on algorithms and general assumptions that don’t account for your property’s unique characteristics. Analysis shows that more than half of Texas homes could benefit from protests due to overvaluation. While specific success rates vary by county, participation remains relatively low across Texas.

Texas law requires appraisal districts to appraise property at its market value as of January 1st each year. However, these valuations often reflect peak market conditions or fail to account for property-specific issues like needed repairs, outdated features, or neighborhood changes. When you protest your property taxes, you’re exercising your legal right to ensure your home isn’t overvalued compared to similar properties in your area.

The financial impact can be substantial. Successful protesters can save annually. The most experienced professional services achieve success rates exceeding 80%. Even modest reductions compound over time, as protesting annually helps keep your baseline assessment lower for future years. Even modest reductions compound over time, as protesting annually helps keep your baseline assessment lower for future years.

What Are the Key Deadlines for Filing a Property Tax Protest?

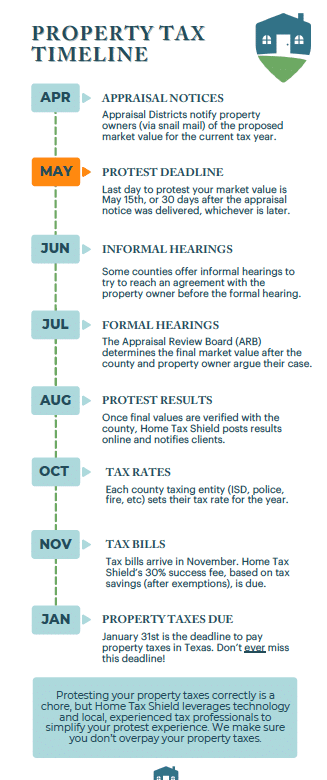

Timing is everything when learning how to protest property taxes in Texas successfully. Missing deadlines eliminates your opportunity for tax savings until the following year. Here’s the essential timeline every homeowner should know:

- April Notice Period: Most appraisal districts mail Notice of Appraised Value letters between early April and May 1st. For homestead properties, districts must send notices by April 1st when possible. Review your notice immediately upon receipt and compare the tax appraised value to previous years and recent sales in your neighborhood.

- May 15th Filing Deadline: You must file your Notice of Protest by May 15th or within 30 days of receiving your appraisal notice, whichever date is later. The 30-day period begins when the appraisal district mails your notice, not when you receive it. Filing early provides more time for evidence gathering and preparation.

- June Through July Hearings: Appraisal Review Board (ARB) hearings typically occur during these months. Most districts offer informal meetings first, where many protests are resolved. If informal negotiations fail, you’ll proceed to a formal ARB hearing.

- August Results Period: ARB decisions are typically finalized and verified with counties during August. If you’re unsatisfied with the ARB’s decision, you have limited time to appeal to the district court or request binding arbitration. The specific deadline varies by county, so check with your local appraisal district.

- November Tax Bills: Your final tax bill reflects any successful protest outcomes. Property tax payments are due by January 31st of the following year.

Note: The dates mentioned here are not set in stone and can vary slightly. Always check with your county appraisal district to stay informed of the exact dates.

Should You File a Property Tax Protest Yourself or Hire a Professional?

One of the biggest decisions when learning how to protest property taxes in Texas is whether to handle the process yourself or work with an experienced representative. Both approaches can be effective, but the right choice depends on your comfort level, the complexity of your property, and how much time you can commit.

DIY Property Tax Protests: What to Expect

Filing on your own can work well if you’re motivated to prepare evidence and learn the system. Many homeowners are able to file a property tax protest and resolve their case in informal hearings. Doing it yourself can mean:

- No service fees — you keep the full amount of any reduction.

- Direct involvement — you control how your case is presented.

- Deeper understanding — you gain insight into how your property is valued.

But there are challenges too. DIY protesting often requires:

- Hours of research to find comparable property data.

- Learning appraisal district methods that can be complex.

- Showing up personally at hearings or arranging representation.

- Limited access to real estate data, which can make building a strong case difficult.

When Professional Tax Protest Help Makes Sense

Seeking professional tax protest help may be the better path if your situation is more complicated or if you simply don’t have the bandwidth to manage the process. This is especially true for unique properties, higher value homes, or if you’re pursuing a Texas protest appeal after an initial decision.

Professionals offer:

- Specialized knowledge of local appraisal practices and valuation methods.

- Access to detailed market data and advanced analysis tools (professionals analyze and adjust sales comps by over 40 data points to ensure they will serve as accurate and effective evidence at your hearing).

- Representation from start to finish, including filing paperwork and attending hearings. The best services employ experienced professionals who actually show up to hearings, unlike many competitors who often fail to appear.

- Multi-county experience, which gives them insight into strategies that work across Texas. Top providers maintain experienced, local, and licensed professionals with decades of expertise in Texas property tax law.

The best professional services typically charge a small fee to cover the cost of the entire process, as well as a percentage of the savings you receive from a successful protest. This upfront fee structure is crucial because it ensures the company will protest every single property, regardless of whether they think they can win.

Companies that charge no upfront fees often cherry-pick only the cases they believe will succeed, leaving homeowners without representation when they need it most. This ensures the company will see your protest through to the end (the only way to know what you can truly save). Many homeowners find the trade-off worthwhile for the peace of mind that comes with a complete, well-prepared protest.

How Do You Gather Compelling Evidence for Your Protest?

Successfully learning how to protest property taxes in Texas requires assembling persuasive evidence that demonstrates your property’s market value is lower than the appraisal district’s assessment. The quality and relevance of your evidence directly impact your chances of securing a reduction.

Essential Types of Evidence

Comparable Sales Analysis: The most powerful evidence involves recent sales of similar properties in your area. However, raw comparable data isn’t sufficient. You must adjust for differences in lot size, square footage, age, condition, and features. Properties should be within your immediate neighborhood and sold within the past year for maximum relevance.

Property Condition Documentation: Document any issues that affect your home’s value, such as foundation problems or roof damage. Obtain repair estimates from licensed contractors to quantify the impact on market value.

Independent Appraisal Reports: If you’ve recently had your home appraised for refinancing or other purposes, this professional opinion of value can support your protest. However, ensure the appraisal date is recent and the appraiser is licensed in Texas.

Market Trend Analysis: Gather data showing declining property values or sales trends in your specific neighborhood. This evidence is particularly effective if your area has experienced job losses, increased crime, or infrastructure problems affecting property values.

Where to Find Reliable Data

Access to accurate comparable sales data presents the biggest challenge for DIY protesters. In Texas, sold property data is protected information accessible only to licensed real estate professionals. Consider these strategies:

- Contact a local real estate agent for comparable sales reports

- Use online platforms that provide property data and estimates

- Review public records for recent sales in your subdivision

- Check your appraisal district’s website for property information

Most appraisal districts provide their evidence, including comparable properties, to protesters after filing. This information helps you understand their valuation methodology and identify potential weaknesses in their case.

What Is the Step-by-Step Process to File Your Protest?

Understanding how to protest property taxes in Texas requires following a specific sequence of actions within strict deadlines. Here’s the detailed process from initial filing through final resolution:

Step 1: File Your Notice of Protest

Most Texas counties now offer multiple filing options to accommodate different preferences and technological capabilities:

Online Filing (Recommended): Major counties, including Harris, Dallas, Travis, and Tarrant, offer electronic filing systems. Online filing provides immediate confirmation, allows document uploads, and enables ongoing case management through web portals. You’ll need your property owner ID and PIN from your appraisal notice.

Mail Filing: Send your completed Form 50-132 Notice of Protest to your county appraisal district. Allow extra time for mail delivery to ensure your protest arrives before the deadline.

In-Person Filing: Visit your appraisal district office during business hours to file your protest directly. This option provides immediate receipt confirmation and allows you to ask questions about the process.

Email Filing: Some counties accept protests via email, though this method typically requires manual processing and may involve delays during peak filing periods.

Step 2: Prepare for Informal Meetings

After filing your protest, most appraisal districts offer informal conferences with staff appraisers. These meetings resolve many disputes, so this is often your best opportunity for a quick resolution.

Organize your evidence clearly and bring multiple copies for the appraiser’s review. Present your strongest arguments first and be prepared to negotiate. Many protesters accept partial reductions during informal meetings rather than proceeding to formal hearings.

Step 3: Attend Formal ARB Hearings

If informal meetings don’t resolve your protest, you’ll receive notice of your formal ARB hearing at least 15 days in advance. The hearing process includes:

- Opening statements from both you and the appraisal district representative

- Evidence presentation where you present your case and cross-examine district witnesses

- Questioning period where ARB members ask clarifying questions

- Closing arguments summarizing your position and requested value reduction

- Decision announcement with written confirmation mailed within 30 days

Treat ARB hearings professionally, arrive early with organized materials, and present facts rather than emotional arguments. The board’s decision applies only to the current tax year, so successful protesters typically repeat the process annually.

How Can You Present Your Case Effectively?

Learning how to protest property taxes in Texas successfully requires mastering the art of persuasive case presentation. Whether you’re in an informal meeting or formal ARB hearing, your presentation strategy significantly impacts your outcome.

Organizing Your Evidence for Maximum Impact

Structure your evidence presentation logically, leading with your strongest arguments. Create a simple one-page summary showing your requested value reduction and primary supporting reasons. Follow this with detailed evidence organized in clear sections:

Market Value Evidence: Present adjusted comparable sales that support your requested value. Clearly explain how you adjusted for differences in size, age, condition, and features. Visual aids like charts or maps help ARB members understand your analysis.

Property-Specific Issues: Document any problems that affect your home’s value but may not be apparent to the appraisal district. Include professional repair estimates, photographs, and contractor statements quantifying the impact on market value.

Unequal Appraisal Evidence: Show how similar properties in your neighborhood are appraised at lower values relative to their characteristics. This “equal and uniform” argument can be particularly effective when properties are clearly comparable.

Common Presentation Mistakes to Avoid

Successful protesters avoid these frequent pitfalls that weaken their cases:

Emotional Appeals: ARB members base decisions on facts and market data, not personal financial hardships or feelings about tax fairness. Focus on objective evidence that demonstrates overvaluation.

Inadequate Comparable Property Analysis: Simply showing that nearby homes sold for less isn’t sufficient. You must adjust for differences in size, condition, features, and sale timing to create valid comparisons.

Poor Organization: Disorganized presentations confuse ARB members and waste valuable hearing time. Use clear labels, logical sequences, and professional formatting for all materials.

Ignoring District Evidence: Review the appraisal district’s evidence carefully and prepare responses to their strongest arguments. Anticipating their case allows you to address weaknesses proactively.

What Happens After Your Protest Decision?

Understanding the post-hearing process completes your knowledge of how to protest property taxes in Texas effectively. The ARB’s decision triggers several possible outcomes and potential next steps.

Understanding Your ARB Decision

The ARB will announce their decision at the conclusion of your hearing, followed by written confirmation within approximately 30 days. Possible outcomes include:

Full Reduction: The ARB accepts your requested value, resulting in maximum tax savings for the current year.

Partial Reduction: The ARB grants some reduction but less than requested. Many protesters accept partial reductions as meaningful savings.

No Change: The ARB maintains the original appraised value. This doesn’t necessarily mean your case was weak. ARB decisions can be subjective and sometimes inconsistent.

Appeal Options Beyond the ARB

If you’re unsatisfied with the ARB’s decision, Texas law provides several appeal mechanisms:

District Court Appeal: Any ARB decision can be appealed to the state district court in your county. Court appeals require legal procedures, potential attorney fees, and partial tax payment before the delinquency date.

Binding Arbitration: For residential homesteads valued under $5 million, binding arbitration offers a faster, less expensive alternative to court appeals. Arbitration decisions are final and cannot be further appealed.

State Office of Administrative Hearings (SOAH): Certain protest types may qualify for SOAH appeals, which provide administrative law judge review of ARB decisions.

Each appeal option has specific deadlines, fees, and procedural requirements. Consider the potential costs versus expected benefits before pursuing appeals beyond the ARB level.

Why Choose Professional Property Tax Services?

While DIY protests can certainly be successful, professional property tax services offer distinct advantages for homeowners who prefer expert representation. Understanding when to seek tax protest help ensures you make the best decision for your specific situation.

Quality professional services often cost significantly less than you might expect. The leading providers typically charge 40% less than many competitors while delivering superior results through experienced representation and advanced technology. Professional services excel in complex scenarios involving unique properties, multiple holdings, or situations requiring sophisticated valuation analysis. They also provide valuable time savings for busy homeowners who cannot dedicate the hours necessary for thorough protest preparation.

The key is choosing the right professional service provider. Look for companies with transparent fee structures, proven track records in your county, and commitment to representing every filed protest rather than cherry-picking only the easiest cases.

Frequently Asked Questions

How much can I expect to save by protesting my property taxes in Texas? Savings vary widely based on your property’s overvaluation and the strength of your evidence, and no one can tell you what you may save until you’ve gone through the protest process. Statewide data shows average savings of $606 for successful protesters, depending on the county and property value. The actual tax savings depend on your local tax rates, typically ranging from 2–3% of your home’s value annually.

Can I protest my property taxes every year? Yes, you have the right to protest annually. Many successful protesters make this an annual practice, as it helps maintain fair valuations and prevents cumulative overassessment over time.

What if I miss the May 15th deadline to file a property tax protest? Late protests may, in extremely rare circumstances, be accepted for “good cause,” but the ARB determines what constitutes valid reasons. Military deployment, serious illness, or not receiving proper notice may qualify. Assume, however, that there are no second chances. Missing the deadline means missing your opportunity to protest for the year. Additionally, late protests are never allowed after the ARB approves the appraisal records in July.

Do I need to pay my property taxes while my protest is pending? No, you don’t need to pay current-year taxes while your protest is pending. However, if you appeal an ARB decision to court or arbitration, you must pay a specified portion of disputed taxes before the delinquency date.

Can I protest if I disagree with my exemptions? Yes, you can protest exemption denials or incorrect exemption applications using the same process. Exemption protests are often easier to win when you have proper documentation supporting your eligibility.

Take Control of Your Property Tax Future

Protesting your property taxes in Texas empowers you to challenge unfair assessments and achieve meaningful tax savings year after year. Whether you choose the DIY approach or prefer professional representation for peace of mind, the key is taking action before the deadline passes.Home Tax Shield combines the best of both approaches: professional expertise with technology that maximizes your chances of success. Our experienced team understands exactly how to protest property taxes in Texas effectively, handling every aspect of the process while you focus on your daily life. Get started today and let us help you secure the fair property tax assessment you deserve.