Key Takeaways

Texas homeowners can minimize property tax increases after renovations through strategic planning, proper documentation, and annual tax protests, potentially saving thousands despite value-adding improvements.

Property tax impact from Texas remodels depends on timing and strategy

- Structural changes and permitted work trigger tax increases, while ordinary maintenance typically doesn’t

- The 10% homestead cap doesn’t protect against new improvement values being added at 100%

- Strategic timing, thorough documentation, and annual protests help minimize long-term tax burden

- Smart homeowners understand tax implications before breaking ground on major renovations

Does Remodeling Your Home Increase Property Taxes in Texas?

The relationship between home renovations and property taxes in Texas isn’t always straightforward. Understanding how County Appraisal Districts evaluate improvements helps you make informed decisions before starting any project.

According to Texas Tax Code Section 23.23, the appraised value for a homeowner who qualifies for a homestead exemption may not increase more than 10 percent per year. However, this protection doesn’t extend to new improvements added to your property.

Tax Code Section 23.23(e) defines a new improvement as an improvement to a residence homestead made after the most recent appraisal that increases the property’s market value and was not included in its appraised value for the preceding tax year. Critically, it does not include repairs to or ordinary maintenance of an existing structure, the grounds or another property feature.

This distinction between improvements and maintenance determines whether your remodel will immediately impact your property tax bill. A kitchen renovation that requires permits and adds square footage counts as an improvement, while replacing worn countertops or fixing a leaky faucet qualifies as maintenance.

Understanding How the Homestead Cap Works With Remodels

Many Texas homeowners mistakenly believe their homestead exemption fully protects them from tax increases after renovations. The reality involves more nuance.

Tax Code Section 11.13(b) currently requires school districts to provide a $100,000 exemption on a residence homestead, which removes that amount from your home’s taxable value for school district taxes. Additionally, your homestead exemption caps annual increases in your taxable value at 10%, regardless of market conditions.

However, pending voter approval in November 2025, this exemption may increase to $140,000 for all homeowners and up to $200,000 for homeowners aged 65 or older or with disabilities. These proposed changes, if approved, would apply retroactively to 2025 tax bills.

The 10% cap has important limitations when you make improvements. Consider this scenario: your home has a tax appraised value of $250,000. Without improvements, next year’s maximum assessment would be $275,000 (the 10% increase). But if you complete a $50,000 addition, the appraisal district adds that full $50,000 value on top of your capped amount, making your new assessed value $325,000.

This represents a 20% jump, even though your homestead cap theoretically limits increases to 10%. The mathematics work differently once improvements enter the equation. Your previous year’s value, plus 10%, plus the full improvement value equals your new tax appraised value.

What Types of Remodels Affect Property Taxes?

Not every home project triggers higher property taxes. Understanding which renovations attract scrutiny from appraisal districts helps you plan strategically.

Projects That Typically Increase Property Taxes

Structural additions represent the most significant tax trigger. Room additions, second-story expansions, and garage conversions all add square footage. Since square footage directly factors into property valuations, these projects almost always increase your tax appraised value.

In-ground pools can add substantial value, especially in neighborhoods where pools are desirable amenities. Research indicates that well-maintained pools in Texas can increase a home’s value by 5% to 8%, depending on factors like location, design, and condition.

Finished basements and attics increase livable space without changing the home’s footprint. These projects add bedrooms, bathrooms, or entertainment areas that boost market value and trigger reassessments.

Major kitchen and bathroom renovations that require permits and significantly upgrade the home’s condition typically result in higher tax appraised values. Complete gut renovations with high-end finishes signal increased value to appraisers.

Detached structures like workshops, sheds, or guest houses add assessable value. Even substantial pergolas or covered patios can sometimes trigger reassessment if they require permits.

Projects That Typically Don’t Increase Property Taxes

Repairs to or ordinary maintenance of an existing structure, the grounds or another property feature do not qualify as new improvements under Texas tax code. These essential projects keep your home in good condition without adding market value beyond what’s already expected.

Interior remodels that don’t add square footage typically generate less dramatic tax increases. Upgrading a kitchen with new cabinets and countertops enhances aesthetics without fundamentally changing the home’s structure or adding features that significantly alter the tax appraised value.

Energy-efficient upgrades such as new windows, insulation, or HVAC systems improve performance and reduce utility costs. While they may add some value, they typically don’t prompt immediate significant tax increases unless they’re part of a larger renovation requiring multiple permits.

Landscaping improvements enhance curb appeal but rarely result in significant property tax increases. Trees, plants, irrigation systems, and decorative elements don’t add assessable square footage or substantially change the home’s structure.

Minor repairs and replacements keep your home functional. Fixing leaky faucets, replacing damaged drywall, repairing decks, or updating light fixtures maintain existing value rather than adding new value.

Strategic Planning: 5 Ways to Minimize Property Tax Impact

Smart homeowners don’t wait until after completion to think about property taxes. These proactive strategies help minimize the financial impact of your remodel.

1. Time Your Improvements Strategically

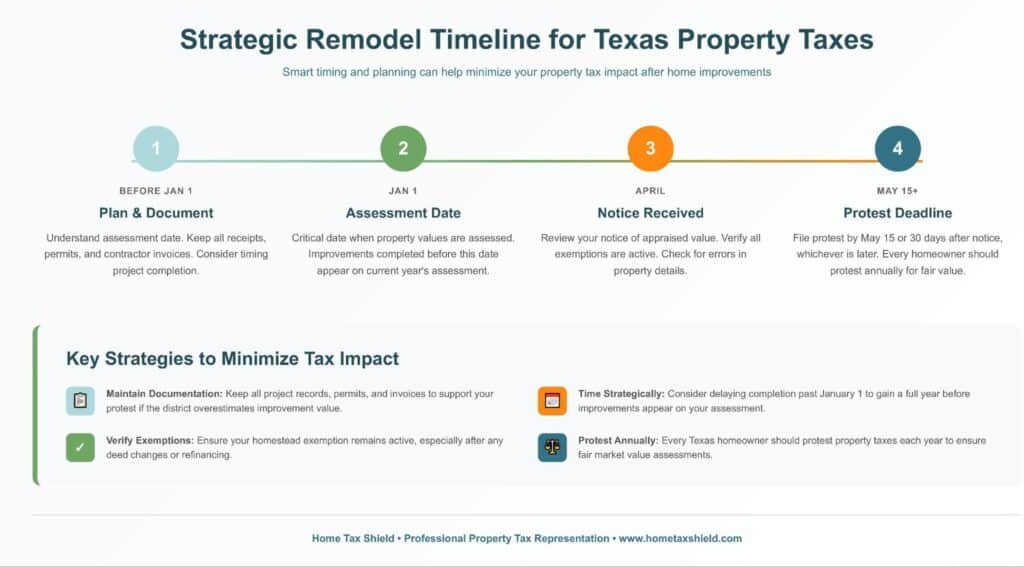

Property values are assessed as of January 1 each year. This assessment date creates planning opportunities. If you can delay project completion until after January 1, you gain an entire year before the improvement appears on your assessment.

Conversely, if you’re already mid-project as December approaches, you might accelerate completion to finish before January 1. This prevents partial improvements from being assessed while still incomplete, though you’ll face the full reassessment that tax year.

2. Maintain Detailed Documentation

Comprehensive records become invaluable when protesting your post-remodel tax appraised value. Keep all receipts, permits, and contractor invoices. These documents establish the actual cost and scope of your improvements. If the appraisal district overestimates the value added, your documentation provides proof of actual investment.

Create a project journal noting what work was performed, when, and by whom. This timeline helps establish whether improvements were completed before or after the January 1 assessment date, which can be crucial for determining which tax year reflects the changes.

3. Understand What Appraisers Actually See

County Appraisal Districts don’t conduct interior inspections of homes. Appraisers rely on building permits, exterior evaluations, and mass appraisal data to determine property values.

When planning your remodel, understand that permitted work becomes part of the public record. The appraisal district reviews building permits to identify new improvements, making permitted projects the primary trigger for tax appraised value increases.

Highly visible exterior improvements like new garages, covered patios, or second-story additions typically generate more immediate assessment attention than interior upgrades. Interior renovations impact your tax appraised value based on permit information and standard valuation models rather than the specific finishes you choose, since appraisers won’t inspect your actual selections.

4. Apply for All Eligible Exemptions

Before and after any major remodel, verify that all your eligible exemptions remain properly filed. Your homestead exemption and any age-related or disability exemptions provide crucial tax relief that becomes even more important as your assessed value increases.

Veterans with service-connected disabilities qualify for substantial exemptions based on their disability rating. Homeowners over 65 receive additional school tax exemptions and can freeze their school tax amounts. Disabled homeowners can qualify for exemptions even without receiving Social Security disability benefits, as long as they meet the medical definition of disability.

5. Protest Your Tax Appraised Value Annually

Annual property tax protests provide your opportunity to ensure a fair tax appraised value every year. This is always essential, but it becomes especially important after a major remodel when appraisers are incorporating your improvements into their valuation models. Consistent annual protests help prevent incorrect assumptions from becoming entrenched in appraisal district records and ensure your tax appraised value accurately reflects your property’s true market value.

The Property Tax Protest Process After a Remodel

Understanding how to effectively challenge your post-remodel tax appraised value protects you from overpaying.

Preparing Your Protest Evidence

Build a comprehensive case that addresses both the improvement value and overall market value. Start by obtaining comparable sales data for similar homes in your neighborhood, particularly those with similar upgrades. Use reliable sources such as your County Appraisal District records, MLS data through a licensed real estate professional, or official public records. Popular real estate websites like Zillow, Redfin, or Realtor.com are not considered reliable sources by appraisal review boards and will not be accepted as evidence in your protest.

Make adjustments for differences between your property and the comparables. If a comparable home has a larger lot, better location, or additional features your home lacks, calculate dollar adjustments for these differences. Property tax protest strategies that include detailed comparable analysis tend to achieve better results.

Include your project documentation showing actual costs. If you spent $40,000 on a kitchen remodel but the district added $60,000 to your value, this discrepancy deserves explanation. Market value improvements don’t always match dollar-for-dollar investment, but significant differences warrant scrutiny.

If gathering and analyzing this evidence feels overwhelming, property tax protest professionals handle all of this research and documentation for you. They have access to reliable data sources, understand how to properly adjust comparables, and know exactly what evidence the appraisal review board expects to see.

Filing Your Protest

The deadline for filing protests typically falls on May 15 or 30 days after receiving your notice of appraised value, whichever comes later. Download Form 50-132, Notice of Protest, from the Texas Comptroller’s website or request it from your local appraisal district.

Complete all sections accurately, clearly stating you’re protesting the market value. Request an informal hearing before the formal Appraisal Review Board hearing, as many disputes resolve during these informal sessions.

Working With Professional Representation

Many homeowners find that professional property tax representation saves significant time and stress. Experienced, licensed local representatives understand how appraisers value improvements and handle all the research, documentation, and hearing preparation on your behalf.

The best property tax firms charge a small upfront fee plus a percentage of savings achieved. This structure ensures your property receives complete representation through the entire protest process, regardless of the outcome.

The upfront fee creates a commitment to fully protest your home and determine whether you’re getting a fair value, while the success-based portion motivates the firm to maximize your savings. Firms with no upfront fees often only pursue cases where they see guaranteed reductions, potentially leaving many properties unrepresented.

Understanding the Long-Term Impact of Remodels on Property Taxes

The initial tax increase from a major remodel represents just the beginning of its long-term impact on your property taxes.

Compounding Effect of Higher Baselines

Once the appraisal district adds your improvement value to your property’s tax appraised value, that higher value becomes the new baseline for all future calculations. Even with the 10% homestead cap, 10% of a larger number means higher annual increases.

Consider a home originally assessed at $250,000. After a $75,000 renovation, the tax appraised value jumps to $325,000. Next year, the 10% cap allows an increase to $357,500, while the pre-renovation trajectory would have topped out at $275,000. That’s an $82,500 difference in assessed value after just one year.

This gap widens every subsequent year. By year five, the assessment difference could exceed $100,000, translating to $2,000 or more in additional annual taxes at typical Texas rates.

When Selling or Losing Exemptions

The homestead cap only applies to your home’s taxable value while you maintain the exemption. If you sell your home or it otherwise loses its exemption status, the value jumps to the full appraised amount immediately.

New owners don’t inherit your capped value. They face the full appraised amount from day one, which can affect buyer interest and complicate sale negotiations.

Planning for Future Tax Increases

Realistic budgeting accounts for inevitable tax increases after major improvements. At a 2% effective tax rate, a $50,000 increase in assessed value means $1,000 more in annual property taxes. Over a 30-year mortgage period, that’s $30,000 in additional taxes before accounting for further increases.

This doesn’t mean you shouldn’t remodel. It means you should make informed decisions about which improvements provide enough value to justify both the construction cost and the ongoing tax obligation.

Common Mistakes to Avoid After Remodeling

Forgetting to Update Your Homestead Exemption

Certain changes to your property require updating your homestead exemption. Adding your spouse to the deed, refinancing into a living trust, or other title changes can inadvertently cancel your exemption.

Without an active homestead exemption, you lose both the value reduction and the 10% annual cap. Verify your exemption status annually when you receive your notice of appraised value.

Not Understanding the Difference Between Errors and Overvaluation

If your appraisal district has incorrect information about your property, such as errors in square footage, number of bedrooms or bathrooms, or other characteristics, these should be corrected directly with your County Appraisal District. Contact them for information on how to fix these types of errors.

Protesting is for when you believe the tax appraised value is too high, unfair, or when you want to ensure the lowest possible value year after year, regardless of the amount. It is not for correcting factual errors in property records.

Neglecting Annual Protest Opportunities

Every Texas homeowner should protest their property taxes annually to ensure fair market value assessments. Market conditions change, new sales data emerges, and the relative value of your improvements may shift over time. Annual protests ensure your tax appraised value reflects current market reality rather than outdated assumptions or inflated valuations.

5 Key Facts Every Texas Homeowner Should Know About Remodeling and Property Taxes

Understanding these essential points can save you thousands over the life of your home ownership:

- The 10% homestead cap doesn’t protect against new improvement values. While your base property value can only increase 10% annually with a homestead exemption, the full value of new improvements gets added on top of this capped amount, potentially resulting in assessment increases exceeding 10%.

- Ordinary maintenance doesn’t count as taxable improvements. Repairs and routine maintenance that keep your home in its current condition don’t trigger reassessment. This includes interior painting, fixture replacements, and minor repairs.

- January 1 is the critical assessment date. Property values are assessed as of January 1 each year. Strategic timing of project completion relative to this date can delay tax increases by an entire year.

- Not all improvements add equal value to assessments. Interior renovations that aren’t visible from outside typically generate smaller assessment increases than exterior additions or improvements visible during drive-by evaluations.

- The best protest firms use an upfront fee plus success-based model. This structure ensures complete representation through the entire process. The upfront fee guarantees your property gets fully protested to determine fair value, while the percentage of savings motivates maximum results. As mentioned above, firms with no upfront fees often only pursue guaranteed wins, leaving many properties unrepresented.

Frequently Asked Questions

How much will my property taxes increase after a remodel in Texas?

The increase depends on the improvement’s impact on your home’s market value. If the appraisal district adds $50,000 to your assessed value and your local tax rate is 2%, you’ll pay approximately $1,000 more in annual property taxes. The homestead cap doesn’t apply to new improvement values, so the entire increase could happen in one year.

Do I have to tell the appraisal district about my remodel?

You’re not legally required to report improvements to the appraisal district. However, they’ll discover permitted work through building department records and may notice unpermitted external work during routine neighborhood surveys.

Can I deduct remodel costs from my property taxes in Texas?

Texas doesn’t offer tax deductions for renovation costs. However, maintaining detailed records of your improvement costs helps when protesting your tax appraised value. If the district significantly overestimates the value your improvements added, documentation of actual costs provides supporting evidence.

Should I protest my property taxes every year after remodeling?

Yes. Every Texas homeowner should protest annually to ensure fair market value assessments. This is especially important after major renovations when appraisers are incorporating improvements into valuations and may overestimate the added value.

Take Control of Your Property Taxes After Remodeling

Home improvements enhance your living space and potentially increase your home’s value, but they also trigger property tax reassessments that can significantly impact your long-term housing costs. The strategies in this guide help you minimize that impact through careful planning, strategic timing, and consistent advocacy.

Understanding how appraisal districts value improvements, maintaining detailed documentation, and protesting your tax appraised value annually all contribute to keeping your property taxes as low as legally possible. The homestead exemption and 10% cap provide valuable protection, but they don’t eliminate the need for active property tax management.

Whether you’re planning a major renovation or just completed one, professional property tax services can help ensure you’re not overpaying. Home Tax Shield’s experienced team handles the entire protest process, from gathering evidence to presenting your case before the appraisal review board, helping Texas homeowners achieve fair tax appraised values and maximize their savings year after year.