Texas homeowners can significantly reduce their property tax burden by working with qualified professionals who understand the protest process.

- Licensed property tax consultants handle everything from filing protests to attending hearings, freeing up your time for other priorities

- Research shows roughly half of all Texas property tax protests result in reductions, with successful homeowners saving hundreds annually

- The best Texas property tax consultants charge reasonable fees, maintain transparent processes, and protest every property they represent

- Focus on firms with proven track records, local expertise, and commitment to getting you a fair valuation rather than overpromising specific savings

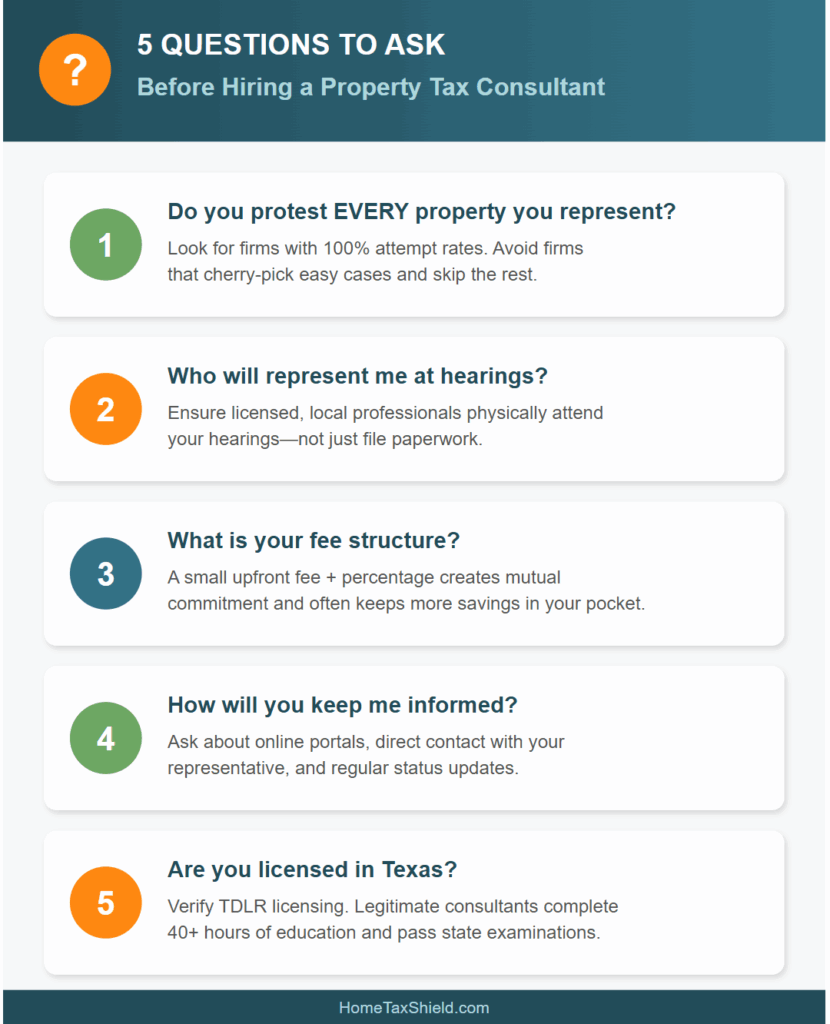

Before signing with any firm, verify their licensing status, fee structure, and whether they actually attend hearings on your behalf.

Every spring, Texas homeowners face the annual ritual of opening their Notice of Appraised Value and discovering their property’s tax appraised value has increased yet again. While Texas remains one of only nine states without a personal income tax, that benefit comes with a tradeoff: property taxes here rank among the highest in the nation. Finding the best Texas property tax consultants can mean the difference between overpaying year after year and ensuring you only pay your fair share.

The good news is that Texas law provides every property owner the right to challenge their tax appraised value through the protest process. According to Texas Comptroller data, property owners who file protests achieve reductions in the majority of cases, with successful homeowners saving hundreds of dollars annually. Those savings compound over time, as each reduction lowers the baseline appraisers use the following year to calculate your property’s value.

What Are the Best Texas Property Tax Consultants and What Do They Do?

A property tax consultant is a professional who assists property owners with challenging their tax appraised value through the formal protest process. These experts handle everything from compiling property information to presenting arguments before Appraisal Review Boards. Unlike accountants or general tax preparers, property tax consultants specialize exclusively in property valuation disputes and Texas property tax law.

The Texas Department of Licensing and Regulation requires property tax consultants to complete at least 40 hours of classroom education covering tax laws, appraisal methods, and ethics, plus pass an examination before practicing. This licensing ensures that professionals representing you have demonstrated knowledge of Texas tax regulations and ethical standards. When searching for the best Texas property tax consultants, verifying TDLR licensing should be your first step.

What Services Do Property Tax Consultants Provide?

Property tax consultants offer comprehensive services throughout the entire protest cycle. They begin by analyzing your property’s current tax appraised value against market conditions and comparable properties in your area. From there, they compile evidence packages using sales data, equity comparisons, and detailed market analysis to build a compelling case for a fair valuation.

Perhaps the most valuable service these professionals provide is representation at hearings. Rather than taking time off work to navigate an unfamiliar process, you can trust that an experienced advocate is presenting your case. Top property tax firms handle informal negotiations with appraisers, formal hearings before the Appraisal Review Board, and even binding arbitration when necessary. The firms that deliver the best results employ licensed, local professionals who physically attend every hearing and know the specific practices of your county’s appraisal district.

Why Should Texas Homeowners Work with Property Tax Consultants?

Managing property taxes involves more than just reading your tax statement once a year. The Texas property tax protest process follows strict deadlines and requires specific documentation that must be properly formatted and adjusted according to appraisal district standards. Missing a deadline or presenting inadequate evidence can forfeit your right to a reduction for the entire year.

Professional consultants bring market expertise that individual homeowners simply cannot replicate. They have access to databases of comparable sales that are not publicly available, understand how to make dozens of proper adjustments for property differences, and know what arguments carry weight with local appraisal districts.

The Time and Expertise Factor

A thorough property tax protest requires significant time spread across several months. This includes researching comparable properties, gathering market data (after finding a reliable source), preparing evidence packets, filing paperwork by deadlines, and attending hearings during business hours. For most working homeowners, dedicating this time is impractical.

Property tax consultants who work in this field full-time develop relationships with local appraisal district staff and understand the nuances of each county’s processes. They also stay current on legislative changes that affect property valuations.

The November 2025 constitutional amendments, for example, increased the homestead exemption from $100,000 to $140,000, while senior and disabled exemptions jumped from $10,000 to $60,000. According to Ballotpedia’s analysis, the owner of a typical Texas home valued at $302,000 saves approximately $490 annually on school property taxes under these new exemptions.

What Factors Should You Consider When Choosing Top Tax Consultants in Texas?

Not all property tax firms operate the same way, and the differences can significantly impact both your experience and your results. Evaluating potential partners across several key dimensions helps ensure you select the best Texas property tax consultants for your specific situation.

Licensing and Professional Credentials

As mentioned above, Texas law requires property tax consultants to be licensed through TDLR. Attorneys and CPAs are exempt from registration but must still meet professional standards. Always verify that anyone representing your property tax interests holds appropriate credentials.

Beyond basic licensing, look for firms that employ experienced, local professionals with deep knowledge of your specific county. Some of the most effective consultants have spent decades working in property tax, giving them insider knowledge of how valuations are determined and what arguments resonate with local appraisal review boards.

Fee Structures and Transparency

Property tax firms generally charge fees in one of three ways: flat annual fees, percentage of savings, or a combination approach. Understanding these structures helps you compare options effectively.

- Contingency-only firms charge nothing upfront and take a percentage of any tax savings achieved

- Flat-fee firms charge a set annual amount regardless of outcome

- Combination firms charge a modest upfront fee plus a percentage of savings

Here’s what many homeowners don’t realize: the fee structure often determines whether a firm will actually complete your protest. Contingency-only firms only get paid when they achieve savings, which sounds appealing at first. But consider what that means in practice: if a firm reviews your property and doesn’t see an obvious opportunity for a large reduction, they have no financial reason to invest time preparing evidence, researching comparables, or showing up at your hearing. Your protest may be filed on paper but never actually pursued.

A combination approach with a small upfront fee changes this dynamic. When you pay that fee, however nominal, it creates a mutual commitment. The firm has accepted payment to do a job, and that job is to take your property through the entire protest process and get you an answer about whether your tax appraised value is fair. Without that commitment, you may never know if you’re being overtaxed. Additionally, firms using this model typically charge a lower percentage of savings, meaning more of your reduction stays in your pocket rather than going to the consultant.

Does the Firm Protest Every Property?

Beyond the fee structure, there’s a simple question that cuts through the noise: does the firm protest every property they represent? As we discussed, contingency-only pricing can incentivize cherry-picking, but even firms with combination fees may be selective about which cases they actively pursue. A 100% attempt rate means the firm takes every client’s property through the complete protest process, regardless of the perceived outcome. This commitment ensures you receive a definitive answer about whether your tax appraised value is fair, even if the final result is no change.

That answer has real value. Even modest reductions compound over time, and every time you argue down your property’s tax appraised value, you’re lowering the baseline that appraisers use the following year to calculate your new value. Protesting annually, whether you expect significant savings or not, keeps that baseline as low as possible and prevents your tax appraised value from drifting upward unchecked.

Why You Should Protest Every Year

Keeping your baseline low is one reason to protest annually, but there’s another equally important factor: every property is unique. Your home has over 40 data points affecting its valuation, from square footage and lot size to construction type and neighborhood characteristics. Mass appraisal systems used by counties simply cannot account for all these individual factors. The appraiser isn’t walking through your home each year; they’re applying broad formulas across thousands of properties.

This means the appraisal district’s number may not reflect true market conditions for your specific property, even in years when the increase seems reasonable or your value stays flat. Many homeowners only consider protesting when their tax appraised value jumps dramatically, but this approach misses the point. A value that looks modest on paper could still be higher than what the data supports for your particular home. Annual protesting ensures your tax appraised value stays as accurate as possible, year after year.

Local Market Knowledge

Texas has 254 counties, each with its own appraisal district, processes, and quirks. Property tax firms that focus on specific regions develop deeper expertise and stronger relationships than those spread thin across the entire state. Ask potential consultants about their experience in your specific county. The best firms employ professionals who know the local market intimately and have established working relationships with appraisal district staff.

What Questions Should You Ask Before Hiring Property Tax Firms?

Preparing the right questions helps you identify legitimate professionals and avoid firms that overpromise.

Questions About Process and Representation

Ask whether the firm will actually attend hearings on your behalf or simply file paperwork. Some lower-cost providers file protests but never follow through with representation, leaving homeowners to either accept whatever value the district assigns. Experienced, licensed professionals who show up at your county’s appraisal district make a significant difference in outcomes.

Find out how the firm gathers evidence and what data sources they use. Top tax consultants in Texas invest in technology and databases that provide comprehensive market analysis rather than relying solely on publicly available information.

Questions About Communication and Expectations

Understand how and when you’ll receive updates about your protest status. Will you have access to an online portal? Can you reach your representative directly with questions? Clear communication throughout the process reduces anxiety and ensures you stay informed.

Be extremely cautious of any firm that promises specific savings amounts. No legitimate consultant can guarantee outcomes because the final decision rests with the appraisal district and Appraisal Review Board. In fact, it is against Texas law to promise specific tax savings. What a quality firm can promise is their commitment to take your property through the entire protest process and fight for a fair valuation.

What Red Flags Should You Watch for When Evaluating Who Can Help Lower Property Tax?

Protecting yourself from unscrupulous operators requires awareness of common warning signs in this industry.

Overpromising Savings

Any firm that claims they can guarantee specific dollar amounts in savings should raise immediate concerns. Property valuations depend on numerous factors including market conditions and comparable sales data. Ethical property tax firms set realistic expectations rather than inflating promises to win your business. If it sounds too good to be true, it probably is.

No Upfront Fee With No Real Service

While contingency-only pricing sounds attractive, understand what it often means in practice. As mentioned above, if a firm only gets paid when they save you money, they have an economic incentive to focus resources on properties with obvious reduction potential and ignore cases that require more effort.

The math makes this even clearer: a firm charging a lower contingency percentage actually needs larger wins to cover their costs. For example, if a firm needs to earn $100 to make a case worthwhile and charges 25%, they need to deliver at least $400 in savings before your property becomes profitable for them. A firm charging 50% only needs $200 in savings to hit that same threshold.

This means the “better deal” of a lower percentage often translates to even more selective case-picking, with firms passing on any property that doesn’t promise a substantial reduction. Many simply don’t protest properties where they don’t see an easy, large win, meaning you never learn whether your valuation was actually fair. You deserve to know the answer, regardless of the outcome.

Lack of Transparency

Request clear information about the firm’s fee structure and process. How exactly will they handle your protest? Who will represent you at hearings? What happens if no reduction is achieved? If they can’t or won’t provide straightforward answers to these basic questions, consider that a significant warning sign. The best Texas property tax consultants welcome questions and provide detailed information about how they operate.

Frequently Asked Questions About Texas Property Tax Consultants

Who Can Help Lower Property Tax in Texas?

Several types of professionals can assist with property tax protests. Licensed property tax consultants, attorneys, CPAs, and real estate professionals with appropriate credentials all have authority to represent property owners. The key is ensuring whoever you work with has specific experience with challenging tax appraised values rather than general tax knowledge.

How Much Do Property Tax Consultants Charge?

Fees vary significantly across the industry. Contingency percentages typically range from 25% to 50% of first-year tax savings. The best value often comes from combination pricing with a small annual fee plus a lower savings percentage, as this ensures the firm is committed to completing your protest while keeping more of your savings in your pocket.

Can My Tax Appraised Value Be Raised if I Protest?

No. Texas law prohibits appraisal districts from raising your value at informal or formal hearings as retaliation for protesting. The worst outcome of a protest is no change. This means there is no downside risk to filing an annual protest.

Take Control of Your Property Tax Bill Today

Property taxes represent one of the largest ongoing expenses of Texas homeownership, yet many Texans pay more than necessary simply because they don’t protest. Whether your tax appraised value increased dramatically or remained relatively flat, protesting annually is the only way to ensure you’re paying a fair amount.

Working with qualified professionals removes the complexity and time commitment while often achieving better results than self-representation. When searching for the best Texas property tax consultants, prioritize licensing, transparency, local expertise, and commitment to protesting every property they represent through the entire process.

Home Tax Shield combines technology with experienced, local tax professionals who attend every hearing and fight for fair valuations year after year. With fees 40% below industry average and an 83% success rate, you can sign up in minutes and trust that your property taxes are in expert hands.