Texas flood victims have multiple pathways to property tax relief through disaster exemptions and strategic annual protests.

- Immediate Relief Available: Properties with 15%+ flood damage qualify for temporary exemptions ranging from 15% to 100% of improvement value

- Critical Deadline Approaching: October 20, 2025 deadline for disaster exemption applications in affected counties

- Long-term Strategy Opportunity: Annual property tax protests can address ongoing flood-related value impacts for years beyond the disaster

- Federal Benefits Included: IRS extended tax deadlines to February 2026, plus casualty loss deductions for uninsured flood damage

Property owners in the 30 declared disaster counties must act quickly to secure both immediate disaster relief and plan ongoing protest strategies for maximum tax savings.

The devastating Texas floods of July 4, 2025, forever changed the landscape of Central Texas, claiming well over 100 lives and causing billions in property damage across 30 counties. For homeowners still dealing with the aftermath of this catastrophic event, understanding how these Texas floods may impact property taxes becomes crucial for financial recovery.

The relationship between flood damage and property tax obligations creates both immediate relief opportunities through disaster exemptions and long-term planning considerations through annual property tax protests that can significantly affect your tax burden for years to come.

When Governor Greg Abbott issued the disaster declaration on July 6, 2025, it triggered specific property tax relief mechanisms designed to help flood victims. These relief options work alongside traditional property tax protest rights to create multiple pathways for reducing your tax obligations. Understanding both immediate disaster relief and ongoing protest opportunities ensures you maximize available savings during this challenging recovery period.

What Immediate Tax Relief Is Available After Texas Floods?

The Texas Property Tax Code provides specific relief for properties damaged in governor-declared disasters through temporary disaster exemptions under Section 11.35. This relief applies to properties in the 30 counties included in Governor Abbott’s disaster declaration: Bandera, Bexar, Burnet, Caldwell, Coke, Comal, Concho, Edwards, Gillespie, Guadalupe, Hamilton, Kendall, Kerr, Kimble, Kinney, Lampasas, Llano, Mason, McCulloch, Menard, Real, Reeves, San Saba, Schleicher, Sutton, Tom Green, Travis, Uvalde, and Williamson counties.

To qualify for a temporary disaster exemption, your property must have sustained damage equivalent to at least 15% of the improvement value. The chief appraiser in your county determines qualification and assigns a damage assessment rating based on the physical damage your property sustained. This assessment directly determines the percentage of your property value that becomes temporarily exempt from taxation.

The damage assessment follows a structured four-level system that considers both structural damage and flood-specific indicators like waterline height. For flood victims, documenting the high-water mark inside structures becomes critical evidence that can significantly impact your exemption level and potential savings.

Property owners must apply for this temporary exemption no later than 105 days after the governor declares the disaster area. For most Central Texas counties affected by the July 2025 floods, this deadline falls on October 20, 2025. Missing this deadline means forfeiting access to this valuable relief program.

How Do Damage Assessment Levels Determine Your Tax Relief?

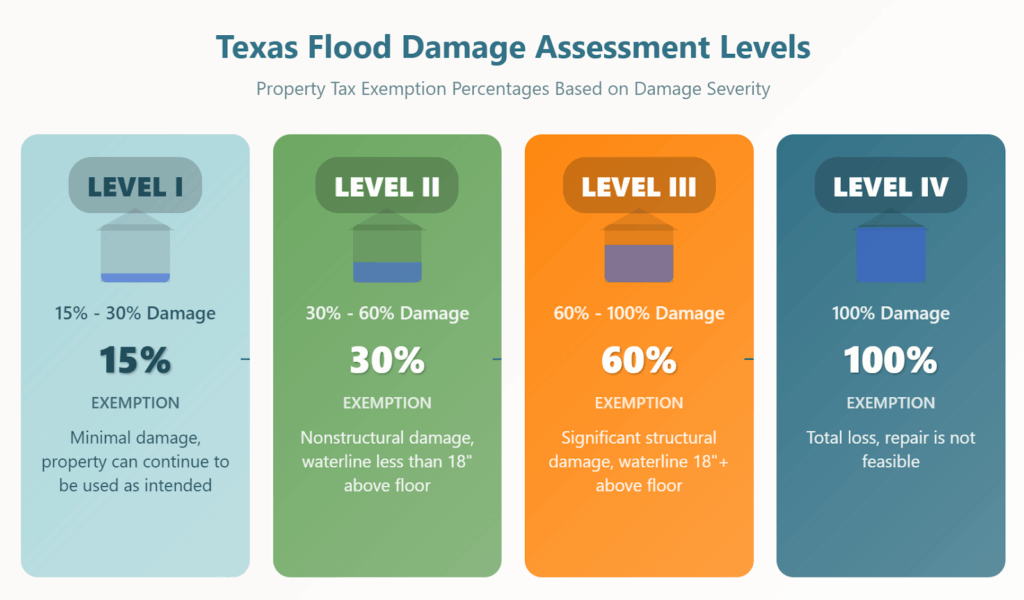

The temporary disaster exemption system uses four distinct damage levels, each corresponding to specific exemption percentages. Understanding these levels helps flood victims properly document their damage and maximize their potential relief. Keep in mind that these exemptions expire on January 1 of the first tax year in which the property is reappraised.

Level I (15% to 30% damage): Properties with minimal damage that can continue to be used as intended receive a 15% exemption on the improvement value. This level typically applies to properties with minor flooding that required cleanup but no major structural repairs.

Level II (30% to 60% damage): Properties with nonstructural damage and waterlines less than 18 inches above the floor receive a 30% exemption. This category often includes homes with damaged flooring, lower cabinets, and appliances, but minimal structural impact.

Level III (60% to 100% damage): Properties with significant structural damage and waterlines 18 inches or higher above the floor qualify for a 60% exemption. This level typically applies to homes requiring extensive renovation, including wall replacement, electrical system updates, and major structural repairs.

Level IV (100% damage): Properties deemed a total loss, where repair is not feasible, receive a 100% exemption on improvement value. This complete exemption applies to properties so severely damaged that demolition and rebuilding become the only viable option.

The exemption calculation multiplies the improvement value by the assigned percentage, then prorates this amount based on the days remaining in the tax year after the disaster declaration date. For properties damaged in the July 2025 floods, this proration significantly impacts the final exemption amount.

What Documentation Do You Need for Disaster Tax Relief?

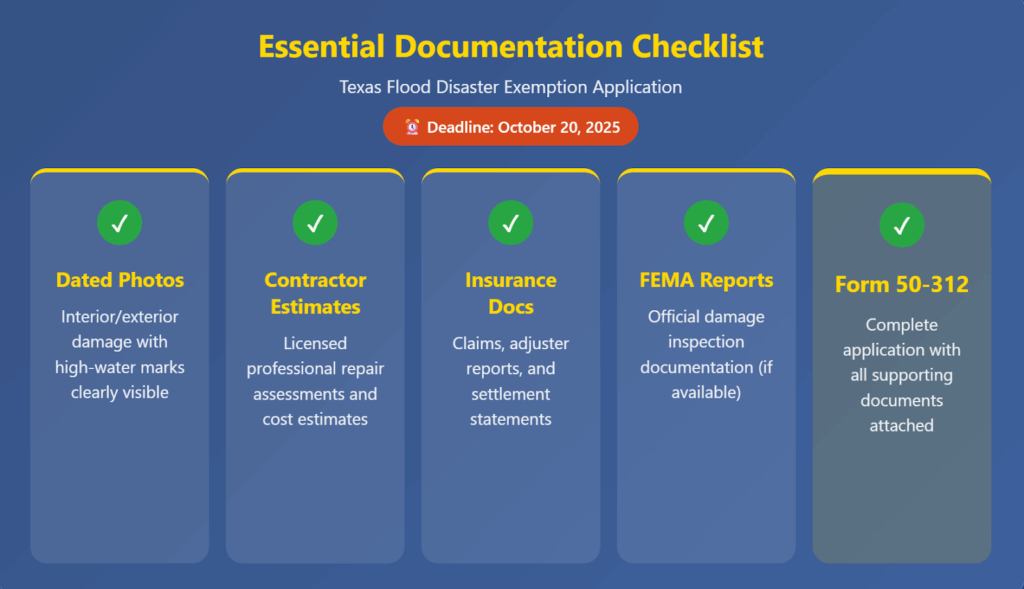

Successful disaster exemption applications require comprehensive documentation that clearly demonstrates both the extent of damage and its impact on property value. The burden of proof rests entirely on the property owner, making thorough documentation essential for maximizing relief.

Photographic evidence forms the foundation of strong disaster exemption applications. Take dated photographs of all damage, paying special attention to high-water marks inside structures. These waterline measurements directly influence whether you qualify for Level II or Level III status, potentially doubling your exemption percentage.

Professional contractor estimates provide crucial supporting evidence for your damage assessment. Licensed contractors can document structural damage, estimate repair costs, and provide written assessments of the work required to restore your property. These professional opinions carry significant weight when chief appraisers review exemption applications.

Insurance documentation, including claim forms, adjuster reports, and settlement statements, provides additional verification of damage extent. FEMA inspection reports, if available, offer another layer of professional damage assessment that strengthens your application.

Complete and submit Form 50-312 along with all supporting documentation to your county appraisal district before the October 20, 2025 deadline. After submission, the chief appraiser has five days to issue a written notice of approval, modification, or denial of your application.

How Can Property Tax Protests Help Flood Victims Long-Term?

While disaster exemptions provide immediate relief for 2025, annual property tax protests offer ongoing opportunities to address how Texas floods impact property taxes over multiple years. Flood damage often creates lasting effects on property values that extend well beyond the initial disaster year.

Properties affected by flooding may experience reduced market values due to disclosed flood history, updated flood zone designations, or ongoing structural concerns. These factors can justify lower market value determinations in future property tax assessments, making annual protests a valuable strategy for flood-affected homeowners.

The protest process allows you to present evidence showing how flood damage continues to impact your property’s market value. Gathering strong evidence for protests becomes particularly important for flood victims who can document lasting effects on their property’s marketability and value.

Professional repair estimates for ongoing issues, updated flood insurance requirements, and comparable sales data from properties with similar flood histories all provide compelling evidence for annual protests. The key lies in demonstrating how the flood event continues to affect your property’s market value beyond the initial disaster year.

What Federal Tax Relief Applies to Texas Flood Victims?

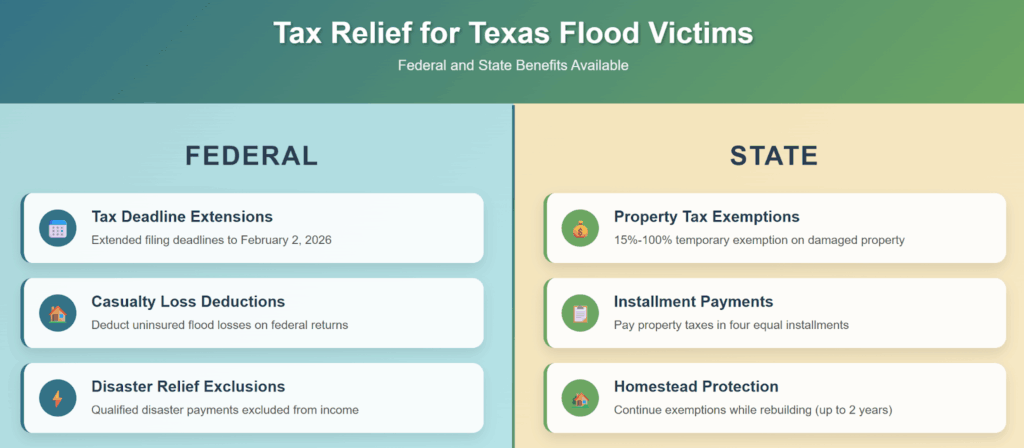

In addition to state property tax relief, flood victims in affected Texas counties benefit from federal tax relief measures. The IRS announced extended deadlines for taxpayers in Burnet, Kendall, Kerr, Kimble, Menard, San Saba, Tom Green, Travis, and Williamson counties, extending various federal tax deadlines to February 2, 2026.

Federal disaster casualty loss deductions allow flood victims to deduct uninsured property losses on their federal income tax returns. Taxpayers can claim these losses either for the year the disaster occurred (2025) or the prior year (2024), potentially generating immediate refunds when claiming losses on 2024 returns.

The combination of state property tax relief and federal income tax benefits provides multiple layers of tax relief for flood victims. Understanding both programs ensures you maximize available relief during your recovery process.

Federal relief workers and volunteers assisting in the disaster area also qualify for tax relief, recognizing the broader community impact of the flooding event and recovery efforts.

4 Essential Steps for Maximizing Flood-Related Tax Relief

Property owners affected by the Texas floods can maximize their tax relief by following these strategic steps that address both immediate and long-term tax implications.

Step 1: Document Everything Immediately

Photograph all damage with dated images, paying special attention to high-water marks inside structures. Measure and document waterline heights, as these measurements directly determine your disaster exemption level. Collect all professional assessments, insurance reports, and contractor estimates as they become available.

Step 2: Apply for Disaster Exemption Before the Deadline

Submit Form 50-312 with comprehensive supporting documentation to your county appraisal district before October 20, 2025. Include all photographic evidence, professional estimates, insurance documentation, and any FEMA reports. Missing this deadline forfeits access to valuable immediate tax relief.

Step 3: Plan for Annual Property Tax Protests

Flood damage often creates ongoing effects on property values that justify lower assessments in future years. Understanding protest deadlines and procedures helps ensure you can address these long-term value impacts effectively.

Step 4: Maintain Detailed Records for Future Use

Keep comprehensive records of all flood-related expenses, repairs, and ongoing issues. These records support both disaster exemption applications and future property tax protests, creating a complete documentation trail for tax relief purposes.

How Do Homestead Exemptions Work with Disaster Relief?

Homestead exemptions continue to provide important benefits for flood victims, even when properties become temporarily uninhabitable. Texas law allows homeowners to maintain their homestead exemption while rebuilding after disaster damage, providing continuity of tax benefits during the recovery process.

If your home was rendered uninhabitable by flooding, you can continue receiving your regular homestead exemption for up to two years while rebuilding, provided you intend to return to the property as your primary residence. This protection prevents the loss of valuable exemption benefits during extended reconstruction periods.

The combination of disaster exemptions and maintained homestead benefits provides significant tax relief for flood victims. Understanding how homestead cap values work with disaster relief ensures you maximize all available benefits during recovery.

The homestead exemption continuation provisions become particularly valuable for properties requiring substantial rebuilding. These protections recognize that disaster recovery often requires extended timeframes and help maintain tax stability during challenging periods.

What Long-Term Market Value Impacts Should You Consider?

Texas floods create lasting effects on property values that extend well beyond immediate physical damage. Understanding these long-term impacts helps property owners plan effective strategies for managing ongoing tax obligations and market value determinations.

Properties with disclosed flood history often experience reduced market appeal and lower sale prices compared to similar properties without flood damage. This market reality can justify lower tax assessments in future years, making annual protests a valuable long-term strategy for affected homeowners.

Updated flood zone designations following major flood events can affect property values and insurance requirements. Properties newly designated as high-risk flood zones may experience reduced market values due to increased insurance costs and buyer concerns about future flooding risks.

The cumulative effect of these long-term impacts often justifies ongoing property tax protests that address how Texas floods continue to affect property values years after the initial event. Building strong protest cases requires understanding these broader market implications and their effect on fair market value determinations.

When Should You Consider Professional Property Tax Help?

The complexity of disaster relief programs combined with ongoing property tax obligations creates challenges that often benefit from professional assistance. While disaster exemption applications require careful documentation and attention to detail, the long-term property tax implications of flood damage often present the greatest opportunity for ongoing savings.

This is where property tax protest professionals become invaluable. Flood-affected properties may experience reduced market values for years due to disclosed flood history, updated flood zone designations, or ongoing structural concerns that justify lower assessments in annual protests.

Professional property tax consultants provide access to comprehensive market data, sophisticated analysis tools, and proven strategies for addressing flood-related value impacts. Their expertise in presenting flood-related evidence to appraisal districts often results in better outcomes than individual property owners can achieve working alone.

The investment in professional property tax protest services often pays for itself through increased tax savings year after year. Consider professional help for your ongoing property tax management if you want to ensure that flood-related value impacts are properly addressed in future assessments, maximizing your long-term tax relief beyond the initial disaster exemption period.

Frequently Asked Questions

What is the deadline to apply for flood-related property tax relief in Texas?

Property owners in the 30 declared disaster counties must submit disaster exemption applications by October 20, 2025. This deadline is exactly 105 days after Governor Abbott’s disaster declaration and applies to all counties initially included in the July 6, 2025 declaration and the amended disaster proclamation to include more Texas counties on July 22, 2025..

Can I still protest my property taxes if I receive a disaster exemption?

Yes, disaster exemptions and annual property tax protests serve different purposes and can be used together. Disaster exemptions provide immediate relief for 2025, while protests can address ongoing market value impacts in future years.

How much can I save through disaster exemptions?

Savings depend on your damage assessment level and property value. Level I provides a 15% exemption on improvements, Level II provides a 30% exemption, Level III provides a 60% exemption, and Level IV provides a 100% exemption. The actual savings calculation includes proration based on days remaining in the tax year.

What if my property wasn’t in the original disaster declaration?

Only properties in the 30 counties included in Governor Abbott’s disaster declaration qualify for temporary exemptions. However, all property owners retain the right to protest their annual assessments regardless of disaster declaration status.

Do I need professional help to apply for disaster relief?

While property owners can apply independently, the complexity of documentation requirements and potential for significant savings often makes professional assistance valuable. The application requires comprehensive evidence and precise documentation to maximize relief. Property tax protest companies like Home Tax Shield can help, but the homeowner will have to file.

Take Action on Your Property Tax Relief Today

The devastating 2025 Texas floods created unprecedented challenges for Central Texas homeowners, but they also opened important pathways for property tax relief. Understanding how these floods impact property taxes through immediate disaster exemptions and long-term protest strategies ensures that you can navigate the complex recovery process while minimizing your tax burden.

The October 20, 2025 deadline for disaster exemption applications approaches quickly, making immediate action essential for flood victims seeking relief. Combined with strategic annual property tax protests, these relief mechanisms provide comprehensive tools for managing your property tax obligations during and after recovery.

Whether you choose to handle these processes independently or seek professional assistance, taking action now can protect your financial interests and ensure you access all available relief programs. The property tax relief opportunities are only in place temporarily, so act soon to ensure you can benefit from these exemptions.

For expert guidance on maximizing your property tax relief after flood damage, Home Tax Shield provides help and assistance. Even if you are not a current client, please use the chat feature on our website if you have any questions or need advice on how to help homeowners achieve fair valuations while maximizing available relief opportunities.