Comparing Tax Relief in Houston, Harris County, and El Paso

Texas offers some of the most generous homestead exemptions in the country, but where you live can influence just how much you benefit. While the general residence homestead exemption is set at the state level, individual taxing units like counties, cities, and school districts can add their own layers of property tax exemptions.

For property owners in major metro areas like Houston, Harris County, and El Paso, the rules and savings from homestead exemptions in different Texas counties can vary widely. Add in options for disabled persons, disabled veterans, or a surviving spouse’s residence homestead, and it becomes even more critical to understand what your local appraisal district allows.

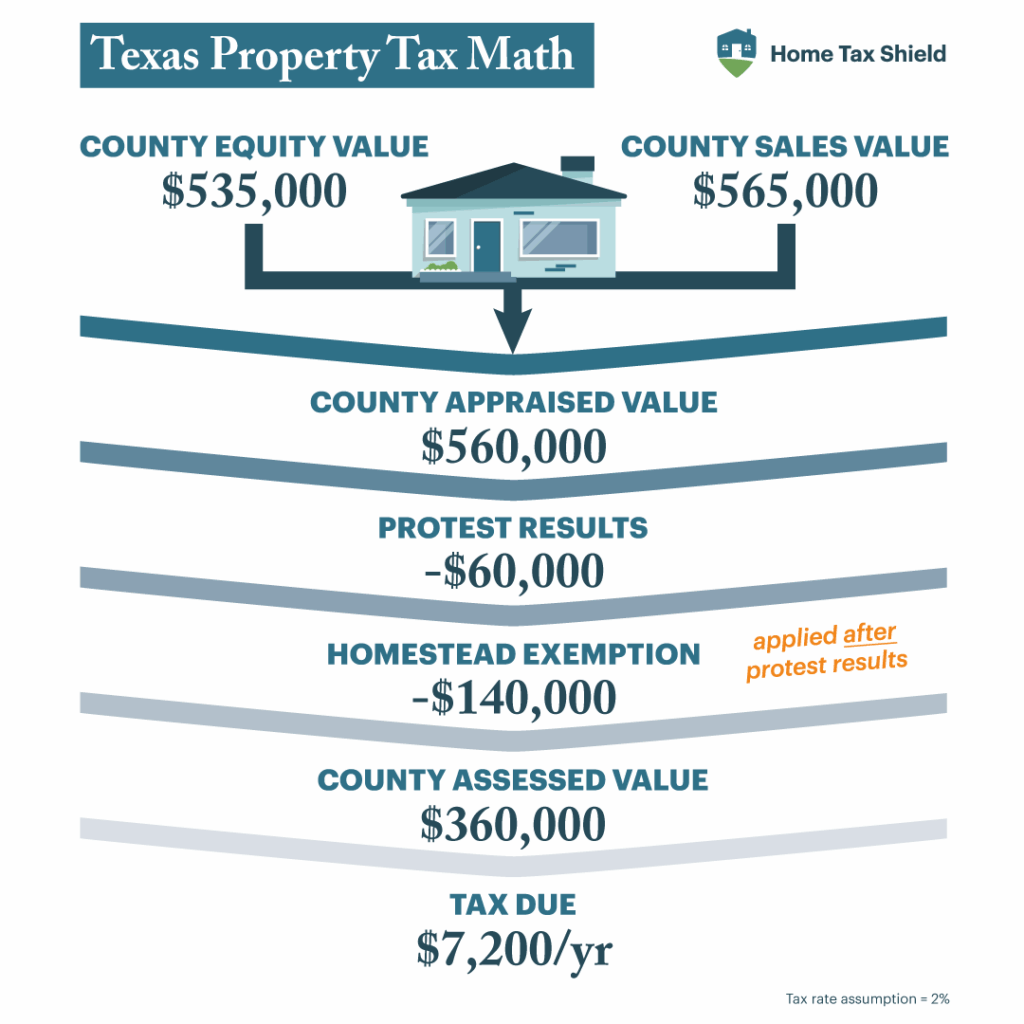

Even with homestead exemptions in place, many residence homestead owners still find their tax appraised value higher than expected. Exemptions reduce your final taxable value, but they don’t do anything to lower your tax appraised value. When your tax appraised value is off, you’re likely overpaying.

Fortunately, homeowners can protest that number and potentially secure bigger savings. With rising property values and regional differences in how counties apply optional exemptions, knowing both your rights and your options is the best way to manage your property taxes. Some homeowners look beyond exemptions and choose to work with the one of the best tax protest companies in Texas to make sure their property valuation and bill are truly fair.

How the General Residence Homestead Exemption Works in Texas

Navigating property taxes can be complex, but the homestead exemption in Texas offers significant relief to homeowners. This exemption reduces the taxable value of a homeowner’s primary residence, leading to substantial savings. Understanding the variations in homestead exemptions in different Texas counties helps maximize these benefits.

The Foundation of Property Tax Exemptions

At the state level, Texas provides a General Residence Homestead Exemption that applies to school district taxes. As of November 2025, this exemption allows homeowners to deduct $140,000 from their home’s appraised value when calculating school taxes.

Beyond this general exemption, local taxing units, including counties, cities, and special districts, may offer additional optional exemptions. These can be up to 20% of the home’s appraised value but must be at least $5,000, regardless of the percentage. For instance, if a city offers a 20% exemption on a home valued at $100,000, the homeowner would receive a $20,000 exemption.

Who Qualifies and What It Covers

To be eligible for the General Residence Homestead Exemption, an individual must own the property and use it as their principal residence. The property can be a separate structure, condominium, or manufactured home located on owned or leased land, provided the owner occupies it. Importantly, a homeowner can claim only one homestead exemption in Texas, ensuring that the benefit applies solely to their primary residence.

The exemption covers various property taxes levied by school districts and may extend to other taxing units that offer optional exemptions. However, it does not apply to taxes for other entities unless specified by local provisions. Homeowners should consult their local appraisal district to determine the specific exemptions available in their area.

Additional Options: Disabled Person, Disabled Veteran, and Surviving Spouse

Texas law provides additional exemptions for specific groups:

- Disabled Persons: Individuals under a disability for purposes of payment of disability benefits under the Federal Old-Age, Survivors, and Disability Insurance Program may qualify for an extra $60,000 exemption for school district taxes.

- Disabled Veterans: Veterans with a service-connected disability may be eligible for exemptions ranging from $5,000 to $60,000, depending on their disability rating. Those with a 100% disability rating or deemed unemployable may qualify for a total exemption of their residence homestead’s appraised value.

- Surviving Spouses: Unmarried surviving spouses of disabled veterans or members of the armed services killed in action may be entitled to continue or receive exemptions. For instance, the surviving spouse of a 100% disabled veteran can retain the total exemption if they do not remarry and continue to use the property as their primary residence.

Understanding these exemptions and their eligibility can help Texas homeowners effectively reduce their property tax burden.

Comparing Homestead Exemptions in Different Texas Counties

State property taxes are the starting point, but the way homestead exemptions in different Texas counties are applied varies dramatically at the local level. Each appraisal district has the authority to offer optional exemptions, and this creates key differences in how much property tax relief homeowners can receive.

Houston, Harris County, and El Paso are all governed by their own taxing units, and while some overlap exists, the fine print makes all the difference.

Houston vs. Harris County: City and County Layering

Houston is located within Harris County, but city and county tax policies operate separately. A residence homestead owner in Houston could receive multiple layers of exemption—one from the city and another from the county.

Harris County, for example, offers a 20% optional exemption on residence homesteads, with a $5,000 minimum. Meanwhile, the City of Houston adds an additional 20%, which significantly reduces the total appraised value for those who qualify.

In practice, a Houston homeowner might be eligible for a $140,000 school district exemption from the state, plus 20% from Harris County, and another 20% from the city. These local incentives mean Houston-area residents may enjoy one of the highest combined property tax exemption totals in the state if they know to apply. However, the process and paperwork must go through the Harris County chief appraiser, so the details and deadlines can trip up unprepared property owners.

El Paso: Lower Exemptions, Higher Burdens

El Paso’s taxing policies tend to be more conservative. While the state-mandated general residence homestead exemption applies, many taxing units in El Paso County offer less generous optional exemptions, if any at all. For example, El Paso ISD (Independent School District) provides the basic $140,000 school tax exemption but does not supplement it with substantial additional relief for disabled veterans, surviving spouses, or even disabled persons unless required by state law.

This difference in tax relief becomes apparent when comparing property taxes across counties. While Harris County homeowners may shave tens of thousands off their appraised value, El Paso residents often see smaller reductions, which means higher annual tax bills despite owning homes of comparable value. With fewer local exemptions, protesting becomes even more essential for El Paso residence homestead owners looking to control their tax year expenses.

Local Trends in Property Tax Exemptions and Their Impact

Across Texas, counties are becoming more aware of how property tax burdens impact long-term residents, especially heir property owners, retirees, and those living on disability benefits or federal old age survivors and disability insurance. In response, some governing bodies are voting to increase optional exemptions or expand eligibility.

Still, the application of exemptions isn’t automatic. Even if a homeowner is eligible, whether through disability awarded by the Social Security Administration or a disability percentage assigned by the Veterans Administration, they must complete the homestead exemption application, often submitting documents like a marriage license, purchase contract, or court record relating to ownership. This process differs from county to county.

Understanding these local nuances makes a difference. A homeowner in Dallas County may receive a different maximum exemption than someone in Harris or El Paso, simply due to local policy. The variations in homestead exemptions in different Texas counties directly impact how much you pay, which is why knowing how your specific taxing unit operates is key to minimizing your property taxes.

Exemptions Aren’t Enough—Why Protesting Your Property Tax Still Matters

While Texas property tax exemptions provide valuable relief, they don’t guarantee that your tax bill reflects your home’s true market value. Exemptions reduce the taxable portion of your property’s value, but if the initial tax appraised value is inflated, you could still be overpaying. This is where the importance of protesting your property tax assessment comes into play.

Exemptions Don’t Guarantee Fair Tax Bills

Exemptions lower the taxable value of your home but don’t address whether the original tax appraised value is accurate. For instance, if your home’s tax appraised value is set higher than its actual market value, even after applying exemptions, you may end up paying more in property taxes than necessary.

Even with the best homestead exemptions in different Texas counties, your property might still be overvalued by the appraisal district. Reviewing and protesting your property’s tax appraised value annually ensures that your tax liabilities are based on a fair and accurate assessment.

How a Property Tax Protest Can Lower Your Market Value

Protesting your property tax involves formally challenging the appraisal district’s valuation of your property. Professional tax protest professionals can present comprehensive evidence such as recent comparable sales, market trends analysis, and other factors to argue that your property’s market value is lower than assessed. A successful protest can result in a reduced tax appraised value, leading to lower property taxes. Moreover, a lower appraised value sets a precedent for future assessments, potentially providing ongoing tax savings.

Why Full-Service Protest Help Makes a Difference

Navigating the property tax protest process requires specialized knowledge of local property valuation methods and appeal procedures. Full-service property tax protest companies employ licensed experts who understand how to analyze your property against true market comparables, prepare compelling evidence for hearings, and effectively represent your interests at every stage of the protest process.

By leveraging their knowledge and experience, these professionals can effectively advocate for a fair assessment of your property’s value, maximizing your potential tax savings. Working with experts allows you to benefit from their understanding of how homestead exemptions in different Texas counties work alongside protest strategies to deliver maximum savings.

Want Real Savings? Pair Your Exemptions with a Protest

Property tax exemptions are a great start, but they only go so far. The real opportunity to save lies in combining your exemptions with a yearly protest of your home’s tax appraised value. Especially in high-growth areas like Houston, Harris County, and El Paso, where market shifts and local policy changes can drastically affect your tax bill, protesting gives you more control over what you pay.

Understanding the differences in homestead exemptions in different Texas counties is just the first step in property tax management. Professional protest services add the critical second layer of protection by ensuring your property’s base value is accurate before exemptions are even applied.

At Home Tax Shield, we believe every homeowner deserves a fair shot at lowering their property taxes. We take your protest through every step, from informal negotiation to formal hearings, no matter how complex the case. We charge a small upfront fee because it guarantees your home will get the full attention it deserves, even if the odds of a big win seem small. With our mix of expert advocacy and powerful data tools, we help Texans keep more of their money and finally gain peace of mind over their property tax bill. Sign up today to make sure your home’s value is accurate and your taxes are fair.