Companies that protest property taxes deliver measurable results for Texas homeowners through professional expertise and market knowledge.

- Professional firms typically achieve higher success rates than DIY protests due to specialized knowledge and data access

- These companies handle complex procedures efficiently while saving homeowners significant time and stress throughout the process

- They provide ongoing annual protection that builds cumulative savings over multiple years

- The hybrid fee structure ensures comprehensive representation regardless of potential outcome size

For most Texas property owners, hiring a reputable protest company offers better long-term outcomes than self-filing.

Texas property owners face some of the highest property tax rates in the nation, making annual tax bills a significant household expense. With home values increasing 21.7% nationally between 2014-2018 and 2019-2023, many homeowners find themselves questioning whether their tax assessments accurately reflect fair market value. This uncertainty has led to increased interest in property tax protest services, but many homeowners wonder whether companies that protest property taxes actually deliver meaningful results.

The property tax protest process in Texas allows homeowners to challenge their county appraisal district’s valuation, potentially reducing their annual tax burden. While property owners can handle protests independently, professional protest companies are specialists in navigating this complex system. The best firms combine market expertise, procedural knowledge, and dedicated resources to advocate for accurate property valuations on behalf of homeowners.

What Are Companies That Protest Property Taxes?

Companies that protest property taxes are specialized service providers that represent property owners in challenging county appraisal district valuations. These firms must employ licensed professionals who understand Texas property tax law, local market conditions, and the procedural requirements for successful protests.

How These Companies Serve as Your Advocate

Professional tax protest companies serve as intermediaries between homeowners and county appraisal districts. They analyze property assessments, gather supporting evidence, file necessary paperwork, and represent clients during both informal negotiations and formal hearings. Their primary goal involves ensuring that property owners pay taxes based on accurate, fair market valuations rather than inflated tax appraised values.

These companies typically focus on residential properties, though many also handle commercial and investment properties. They maintain databases of comparable sales, understand local market trends, and have established relationships with county appraisal offices. This combination of resources and expertise allows them to build compelling cases for property value reductions.

Legal Foundation and Recognition

The legitimacy of these services stems from Texas property tax law, which explicitly grants property owners the right to protest their tax appraised value. County appraisal districts must provide opportunities for property owners to challenge their tax appraised value, making professional representation a recognized and accepted practice within the system.

How Do Tax Protest Firms Work?

Licensed tax protest professionals follow a systematic approach designed to maximize the likelihood of successful outcomes. These professionals represent the core of how tax protest firms work, using specialized knowledge and proven procedures to challenge county appraisals. The process begins when property owners receive their Notice of Appraised Value, typically arriving between April and May each year.

Initial Property Analysis and Market Research

Professional firms start by analyzing the property’s assessed value against the prior year’s market conditions and comparable sales data. They examine factors such as property characteristics, neighborhood trends, and recent sales of similar properties to identify potential overvaluations. This analysis requires access to multiple listing service data, county records, and proprietary databases that individual homeowners typically cannot access.

Filing and Documentation Process

Once the analysis identifies grounds for protest, the company files the formal protest paperwork with the appropriate county appraisal district. Texas law requires protests to be filed by May 15th or within 30 days of receiving the notice, whichever is later. Missing this deadline forfeits the right to protest until the following year.

Negotiation and Hearing Representation

The protest process typically involves two phases: informal negotiations and formal hearings. During informal meetings, company representatives present evidence directly to county appraisers, often resolving cases without proceeding to formal hearings. When informal negotiations prove unsuccessful, the case advances to the Appraisal Review Board (ARB) for a formal hearing.

Throughout this process, professional companies handle all communication, documentation, and representation responsibilities. Property owners receive updates on their case status but generally do not need to attend meetings or hearings personally. This approach allows homeowners to pursue tax reductions without disrupting their daily schedules or learning complex procedural requirements.

Do Property Tax Protest Companies Actually Deliver Results?

Evidence suggests that reputable property tax protest companies consistently deliver positive outcomes for their clients. Professional representation often achieves favorable results for homeowners, with successful protests creating cumulative benefits that extend beyond immediate savings. Companies that protest property taxes help homeowners achieve better long-term results through expert knowledge of valuation methods and systematic approach to evidence presentation.

The effectiveness of professional protest companies stems from several key advantages. These firms possess specialized knowledge of property valuation methods, understand local market dynamics, and maintain current databases of comparable and equity sales. They also have experience presenting evidence in formats that appraisal review boards find compelling and persuasive.

Companies that protest property taxes typically approach protests with greater objectivity than individual homeowners. While property owners may focus on personal circumstances or emotional attachments, professional firms base their arguments on market data and technical analysis. This objective approach often resonates more effectively with appraisal review boards, who must make decisions based on factual evidence rather than personal considerations.

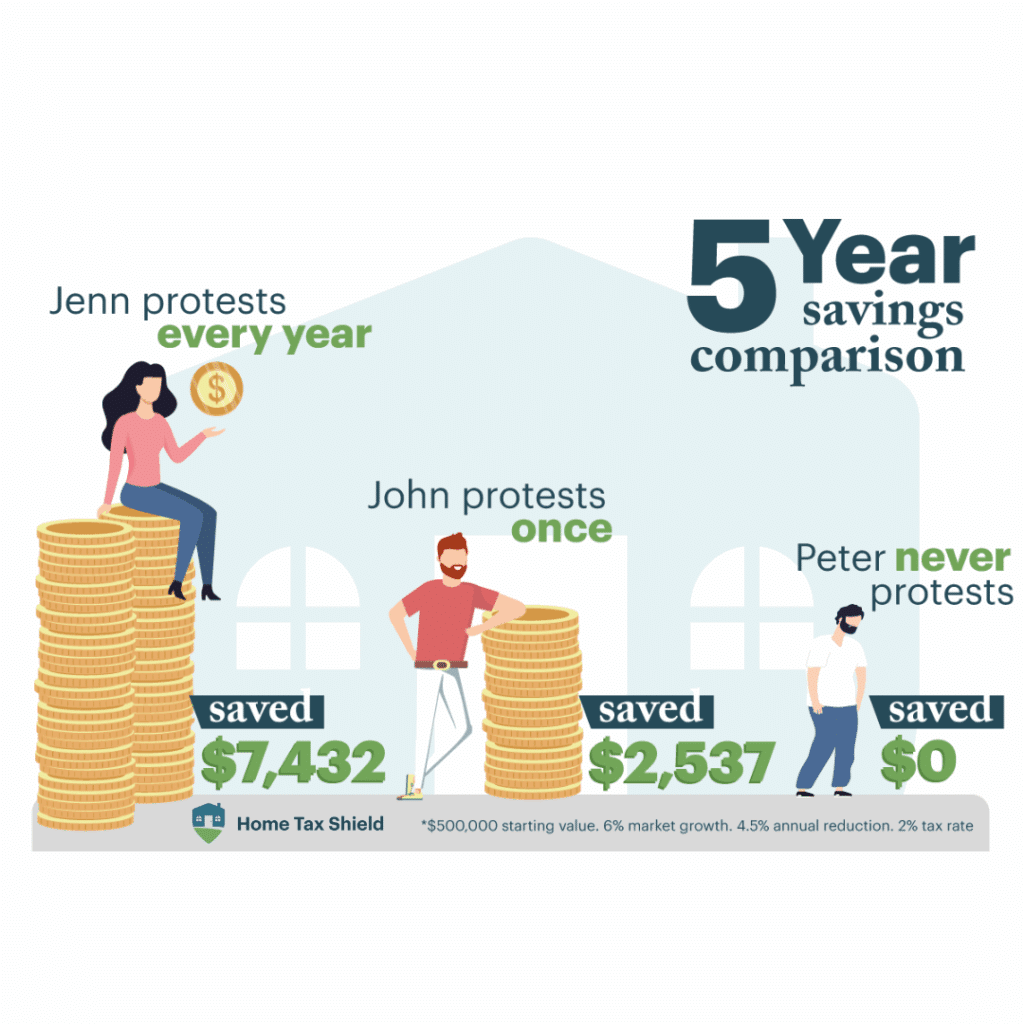

The annual nature of property tax assessments makes professional representation particularly valuable for long-term savings. Each successful protest establishes a lower baseline for future assessments, creating compounding savings over time. Professional companies understand this dynamic and structure their services to protect clients’ interests year after year.

Many firms also identify additional opportunities for savings, such as property tax exemptions that homeowners may have overlooked. This comprehensive approach to tax reduction often yields greater total savings than addressing assessment values alone, demonstrating the effectiveness of professional representation over isolated DIY efforts.

Understanding Fee Structures: Why the Hybrid Approach Works Best

The fee structure of companies that protest property taxes significantly impacts both the quality of service and the likelihood of success. Understanding these different approaches helps homeowners make informed decisions about professional representation.

Percentage-only fee structures represent the most common approach in the industry. Under this model, companies charge clients a percentage of the tax savings achieved, typically ranging from 25% to 50% of the first year’s savings. While this approach aligns company incentives with client outcomes, it creates potential conflicts when dealing with properties that may yield smaller savings.

Companies operating under percentage-only models may prioritize cases with higher potential returns while investing less effort in properties where significant savings seem unlikely. This approach can leave homeowners without comprehensive representation, particularly in cases where modest reductions are possible but may not justify extensive effort under a percentage-only compensation structure.

The hybrid fee approach addresses these limitations by combining a modest upfront fee with a percentage of achieved savings. This structure ensures that companies commit to completing the entire protest process regardless of the potential outcome. The upfront fee guarantees that clients receive full representation through all stages of the protest process, including formal hearings when necessary.

This comprehensive approach proves particularly important because determining a property’s true savings potential often requires completing the entire protest process. Only through accessing county evidence, analyzing comparable properties, and potentially attending formal hearings can the full scope of possible savings be accurately assessed. Companies committed to seeing the process through provide the only reliable way to know if homeowners are overpaying.

The annual nature of property tax assessments makes this comprehensive approach even more valuable. Each year’s protest outcome influences future assessments, creating cumulative benefits that extend well beyond the immediate savings. Properties that achieve reductions in one year often maintain those lower valuations in subsequent years, provided they continue to receive professional attention. This compounding effect means that thorough representation in each year’s protest can deliver significant long-term financial benefits, making companies that protest property taxes particularly valuable for homeowners committed to ongoing tax management.

When Is It Worth Using a Property Tax Protest Company?

Several factors help determine when hiring professional representation provides the greatest value for Texas homeowners. Understanding when it’s worth using a company versus self-representation can save both time and money. Property complexity, homeowner availability, and potential savings all influence whether companies that protest property taxes offer worthwhile benefits.

Properties with unique characteristics often benefit most from professional representation. Homes with unusual features, recent damage, or locations near negative influences require specialized knowledge to present compelling cases for reduced valuations. Professional companies understand how to document and present these factors effectively to appraisal review boards.

Homeowners with limited time or expertise in property valuation typically achieve better outcomes through professional representation. The protest process requires gathering evidence, understanding procedural requirements, and presenting arguments effectively. These tasks demand significant time investment and specialized knowledge that many property owners lack.

Geographic factors also influence the value of professional representation. Counties with rapidly changing market conditions, complex appraisal practices, or historically high assessment levels often present opportunities that professional companies can identify and pursue more effectively than individual homeowners.

Investment properties and rental properties particularly benefit from professional representation. These properties typically lack the homestead exemption protections available to primary residences, making them more susceptible to significant tax increases. Professional companies understand the specific challenges facing investment properties and can develop appropriate strategies for addressing them.

Even homeowners comfortable with self-representation may find value in professional services for ongoing annual protection. Property tax assessments change every year, and maintaining fair valuations requires consistent attention to market conditions and assessment practices. For busy homeowners, determining if it’s worth using a company often comes down to weighing the time investment against the expertise and outcomes that companies that protest property taxes can provide.

6 Signs a Property Tax Protest Company Is Worth Using

1. Transparent Success Rate Documentation

Reputable companies readily share their success rates and provide specific data about client outcomes. Look for firms that document their results with actual percentages and average savings rather than vague claims about effectiveness.

2. Comprehensive Market Knowledge

The best companies demonstrate deep understanding of local market conditions, comparable sales data, and county-specific appraisal practices. They should be able to explain how local factors affect property valuations in your specific area.

3. Licensed Professional Staff

Quality firms employ licensed professionals who understand Texas property tax law and appraisal procedures. These credentials ensure that your representation meets professional standards and legal requirements.

4. Clear Communication Practices

Reliable companies maintain regular communication throughout the protest process, providing updates on case status and explaining each step of the procedure. They should be accessible for questions and provide clear timelines for expected outcomes.

5. Commitment to Complete Process

The best companies guarantee they will see your protest through to completion, regardless of the potential outcome. This commitment ensures that you receive full representation, all possible avenues for savings are explored, and your tax appraised value this year is as low and fair as possible.

6. Annual Service Availability

Look for companies that offer ongoing annual representation rather than one-time services. Property tax assessments change every year, and consistent professional attention provides the best long-term protection against overvaluation. This ongoing relationship often makes it worth using a company for homeowners who want consistent results year after year.

Red Flags: When to Avoid Certain Companies

Several warning signs indicate companies that may not provide reliable or effective representation. Homeowners should be cautious of firms that make unrealistic promises, lack transparency about their processes, or demonstrate poor communication practices.

Companies that guarantee specific savings amounts or promise dramatic reductions should be avoided. Property tax protests depend on factual evidence and market conditions, making specific outcome guarantees impossible to honor honestly. Reputable firms discuss realistic expectations based on property analysis rather than making unrealistic promises.

Lack of transparency about fee structures, success rates, or procedural approaches indicates potential problems. Quality companies readily explain their methods, share performance data, and provide clear information about all associated costs.

Poor communication practices, including delayed responses, unclear explanations, or reluctance to answer questions, suggest companies that may not provide adequate service. Professional representation requires clear, ongoing communication throughout the protest process.

Companies that only pursue protests when they identify significant potential savings may not provide comprehensive representation. This approach can leave homeowners without protection in years when modest savings are possible but may not meet the company’s minimum thresholds for effort investment.

The Bottom Line: Property Tax Protest Companies Deliver Real Results

Companies that protest property taxes offer valuable services for Texas homeowners seeking to ensure fair property tax assessments. These professional firms combine market expertise, procedural knowledge, and dedicated resources to achieve outcomes that often exceed what individual homeowners can accomplish independently.

The effectiveness of professional representation stems from specialized knowledge, objective analysis, and commitment to comprehensive service. While fee structures vary among providers, the hybrid approach offers the best protection by ensuring complete representation regardless of potential outcomes.

For most Texas property owners, professional protest services provide an efficient, effective way to protect against overvaluation while avoiding the complexity and time investment required for self-representation. The annual nature of property assessments makes ongoing professional attention particularly valuable for long-term tax management.

Ready to discover if your property taxes are higher than they should be? Home Tax Shield’s licensed professionals combine advanced technology with local market expertise to protect your property tax rights every year, ensuring you never pay more than your fair share.

Frequently Asked Questions

How long does the property tax protest process typically take?

The property tax protest process generally spans 2-4 months from initial filing to final resolution. Informal negotiations may resolve cases within weeks, while formal hearings can extend the timeline into summer months. Professional companies manage all timing requirements to ensure deadlines are met.

Can property tax protest companies help with exemptions as well?

Many professional protest companies also assist with property tax exemptions, including homestead exemptions, over-65 exemptions, and disability exemptions. These additional savings opportunities often complement protest outcomes for maximum tax reduction.

What happens if a protest is unsuccessful?

Unsuccessful protests do not result in increased assessments, as Texas law prohibits raising property values during the protest process. Property owners may pursue additional appeal options, including binding arbitration or district court appeals, depending on their specific circumstances.

How do companies access the data needed for effective protests?

Professional companies maintain access to multiple listing services, county records, and proprietary databases that provide comprehensive market information. This data access allows them to identify comparable sales and market trends that individual homeowners typically cannot obtain independently.