Texas homeowners can decrease property taxes through strategic exemptions, annual protests, and legislative relief programs, potentially saving hundreds or thousands of dollars each year.

- Property tax exemptions can reduce taxable value by $100,000-$110,000 depending on eligibility

- Annual protests help ensure fair market value assessments and prevent overpayment

- 2025 legislative relief could potentially increase homestead exemptions to $140,000 for all homeowners and to $200,000 to seniors

- Professional representation achieves higher success rates than self-representation

Texas property taxes rank among the highest in the nation, with the average effective rate reaching 1.80% compared to the national average of 1.07%. Recent legislative proposals aim to provide $6 billion in property tax cuts, but homeowners don’t need to wait for government action to reduce their tax burden. Learning how to decrease property taxes requires understanding both immediate strategies and long-term planning approaches that compound savings over time.

Understanding how to decrease property taxes starts with recognizing that effective property tax protests can yield significant savings for homeowners who take action. Whether through strategic use of exemptions, challenging inflated appraisals, or taking advantage of new legislative relief, Texas homeowners have multiple pathways to meaningful savings.

How Do Property Tax Calculations Work?

Before exploring methods to lower Texas property taxes, it’s essential to understand the basic calculation that determines your annual tax bill. Your property taxes result from a simple formula: Property Market Value – Exemptions × Tax Rate = Annual Tax Bill.

The County Appraisal District (CAD) determines your property’s market value each January 1st using mass appraisal methods that evaluate thousands of properties simultaneously. This market value represents what your property would theoretically sell for on the open market under normal conditions.

However, mass appraisal systems can’t account for every unique characteristic of individual properties, creating opportunities for homeowners to protest to decrease taxes when appraisals exceed actual market conditions.

Tax rates are set by local entities including school districts, cities, counties, and special districts. Texas homeowners considering how to decrease property taxes effectively should focus on the controllable elements: reducing their property’s taxable value through exemptions and ensuring their tax appraised value accurately reflects current conditions through the protest process.

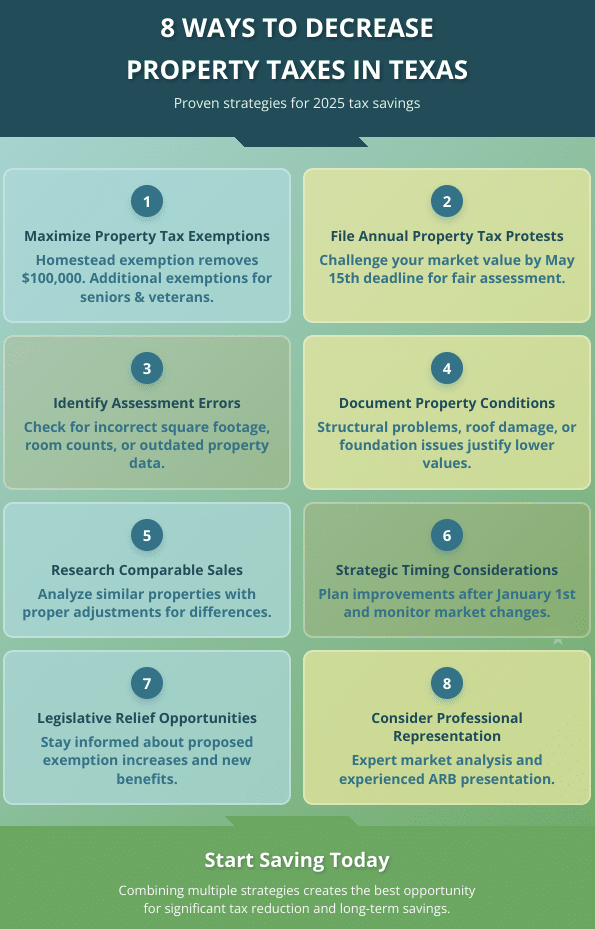

8 Proven Methods to Decrease Property Taxes

1. Maximize Property Tax Exemptions

Property tax exemptions provide the most straightforward path to reduce tax appraisal burden. The homestead exemption removes $100,000 from your home’s taxable value and caps annual increases at 10%. Unlike previous restrictions, homeowners can now apply for homestead exemptions immediately upon purchasing their primary residence rather than waiting until the following January.

Additional exemptions can dramatically reduce tax obligations:

- Over-65 exemption: Provides an additional $10,000 reduction for school taxes

- Disabled veteran exemptions: Range from partial reductions to complete exemptions based on disability rating

- Disability exemptions: Available for individuals meeting Social Security Administration criteria

- Agricultural exemptions: Apply to properties with qualifying agricultural use

2. File Annual Property Tax Protests

The most effective strategy to lower Texas property taxes involves challenging your property’s tax appraised value each year. Texas lawmakers estimate that homeowners could see significant annual savings through various tax relief measures, but homeowners shouldn’t wait for legislative action when immediate relief may be available through protests.

Every homeowner should consider protesting annually because market conditions change, neighborhood values fluctuate, and appraisal districts may rely on outdated information. The protest process allows homeowners to present evidence that their property’s tax appraised value exceeds fair market conditions, potentially reducing their tax burden for the current year and establishing a lower baseline for future assessments.

3. Identify and Correct Assessment Errors

County appraisal districts maintain detailed records about each property, but these records can contain errors that inflate taxable values. Common mistakes include incorrect square footage measurements, wrong number of bedrooms or bathrooms, or outdated property characteristics that no longer reflect current conditions.

Review your property’s appraisal card carefully each year, checking for:

- Accurate square footage measurements

- Correct number of rooms and bathrooms

- Proper classification of property improvements

- Updated information reflecting any property damage or deterioration

Note that simple data corrections aren’t part of the formal protest process – contact your CAD directly to fix obvious errors in property records.

4. Document Property Condition Issues

Properties with condition issues, deferred maintenance, or damage may qualify for reduced market values. Unlike interior renovations (which typically don’t affect appraisals), structural problems, roof damage, foundation issues, or other significant problems can justify lower valuations.

Effective condition documentation includes:

- Professional repair estimates for structural issues

- Supporting photographs showing damage or deterioration

- Engineering reports for foundation or structural problems

- Documentation of flooding, fire, or storm damage

5. Research Comparable Property Sales

Market value determinations rely heavily on comparable sales data, but appraisal districts may use properties that aren’t truly comparable to your home. Research recent sales in your area, focusing on properties with similar characteristics, but remember that raw comparisons aren’t sufficient – each property must be properly adjusted for differences in size, condition, location, and features.

Professional-grade comparable sales analysis requires access to Multiple Listing Service (MLS) data and expertise in making a wide range of appropriate adjustments for property differences. This complexity explains why many homeowners achieve better results working with experienced property tax professionals who have access to comprehensive market data.

6. Understand Strategic Timing Considerations

Property improvements completed after January 1st won’t affect that year’s market value determination, providing strategic opportunities for homeowners planning major renovations. Additionally, market conditions that develop throughout the year may not be reflected in appraisal district valuations, creating opportunities to present evidence of changing neighborhood conditions or market trends.

7. Take Advantage of Legislative Relief Opportunities

Texas homeowners have already benefited from recent exemption increases; the homestead exemption jumped from $40,000 to $100,000 in 2023 after voters approved Proposition 4. Now, additional relief may be on the horizon as lawmakers consider further increases to $140,000 for general homeowners and $200,000 for seniors and disabled homeowners. Stay informed about legislative developments that could affect your property tax burden, but don’t delay taking action on current opportunities while waiting for potential future relief.

8. Choose Professional Property Tax Protest Representation

Property tax protest success rates vary significantly based on the quality of evidence presented and expertise in navigating the formal hearing process. Professional representation typically achieves higher success rates because experienced, licensed representatives understand appraisal district procedures, have access to comprehensive market data, and can effectively present complex valuation arguments within strict hearing time limits.

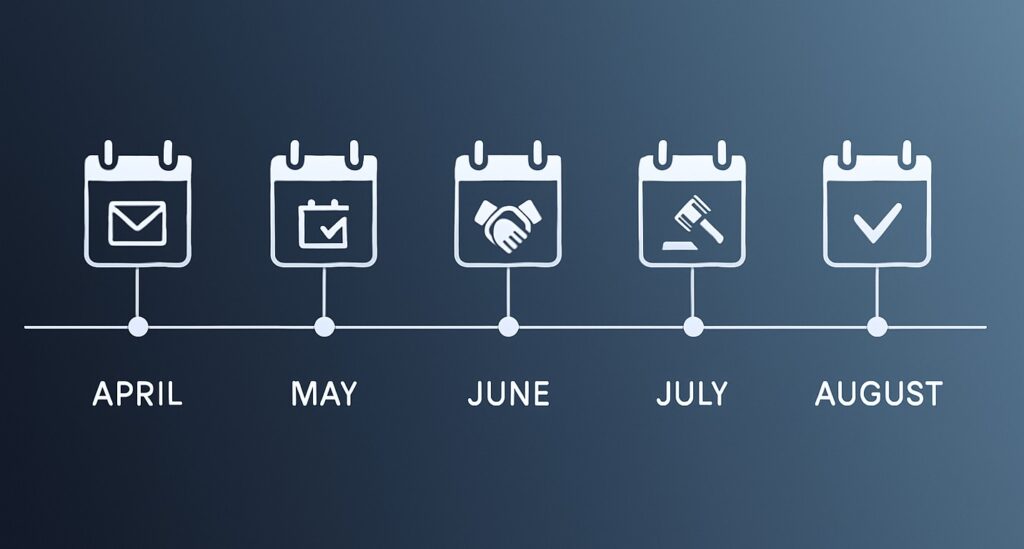

A Step-by-Step Guide to Tax Protests to Decrease Taxes

April: Review Your Appraisal Notice

County appraisal districts typically mail notices of appraised value to property owners by April 1st for residential homesteads. Review this notice carefully, comparing the proposed market value to your understanding of current market conditions and recent sales in your neighborhood.

May: File Your Protest by the Deadline

The protest deadline is May 15th or 30 days after your appraisal notice was mailed, whichever is later. Missing this deadline eliminates your opportunity to challenge your property’s market value for that tax year. File your protest notice even if you plan to pursue informal resolution options.

June: Participate in Informal Hearings

Many counties offer informal meetings with appraisal district staff before formal hearings. These meetings can resolve protests efficiently and may result in value reductions without proceeding to formal hearings.

July: Prepare for Formal Hearings

If informal discussions don’t resolve your concerns, formal hearings before the Appraisal Review Board (ARB) provide your opportunity to present evidence supporting a lower market value. The ARB operates independently from the appraisal district and makes final value determinations based on evidence presented by both parties.

August-September: Receive Final Determinations

ARB decisions become final property values used for tax calculations. Successful protests result in reduced taxable values that lower your annual tax bill and establish lower baselines for future years.

5 Common Mistakes That Will Cost You Money

1. Missing Critical Deadlines

This is worth mentioning again: property tax protest deadlines are absolute – late filings are automatically rejected regardless of the merit of your case. Mark May 15th on your calendar and file your protest promptly upon receiving your appraisal notice.

2. Inadequate Evidence Preparation

Successful protests require compelling evidence, not just opinions about property values. Gathering professional repair estimates, comprehensive market data, and proper documentation takes time and expertise that many homeowners underestimate when learning how to decrease property taxes effectively.

3. Comparing Properties Without Proper Adjustments

Simply pointing to lower-valued neighboring properties isn’t sufficient evidence for protests. Property valuations consider dozens of factors, and meaningful comparisons require mathematical adjustments for differences in size, condition, location, and features.

4. Focusing Only on Tax Bills Instead of Appraised Values

Property tax protests challenge the tax appraised value your county assigned to your property, not tax calculations or tax rates. Focus your protest on proving that your property’s appraised value is too high for current market conditions rather than arguing about tax rates or total bill amounts.

5. Attempting Complex Protests Without Professional Help

While property tax protests may appear straightforward, effective cases require detailed market analysis, proper evidence preparation, and strategic presentation that many homeowners underestimate. Even seemingly simple protests benefit from comprehensive comparable sales research, mathematical adjustments, and professional presentation techniques. The time investment required for thorough protest preparation can exceed 12-16 hours over several months.

2025 Legislative Updates and Relief Opportunities

Texas lawmakers have proposed spending at least $6 billion on property tax cuts, with potential changes including increased homestead exemptions and additional relief for seniors and disabled homeowners. Proposed legislation could increase the homestead exemption to $140,000 and $200,000 for homeowners age 65 and older.

However, legislative relief requires voter approval and may not take effect immediately. Homeowners should pursue current opportunities to reduce tax appraisal burdens rather than waiting for potential future relief that may face implementation delays or modification during the legislative process.

Key proposed changes include:

- Increased homestead exemptions from $100,000 to $140,000 for all homeowners

- Enhanced senior exemptions potentially increasing from $110,000 to $200,000

- Business property relief through increased exemption thresholds

- School tax rate compression funded by state budget surpluses

DIY vs Professional Representation: Making the Right Choice

Deciding whether to handle property tax protests personally or hire professional representation depends on several factors including time availability, expertise requirements, and your commitment to the complete process. Consider professional representation when:

- You want comprehensive market analysis and proper evidence preparation

- The value of fair assessment confirmation and long-term tax baseline protection justifies professional fees

- You lack time for extensive research and hearing preparation

- You want experienced representation familiar with ARB procedures

- Previous DIY attempts were unsuccessful

Professional property tax services offer several advantages including access to comprehensive market data, expertise in ARB procedures, and established relationships with appraisal district staff. However, evaluate service providers carefully, focusing on:

- Transparent fee structures that align your interests with theirs

- Experienced local representatives familiar with your county’s procedures

- Commitment to represent every client through the complete process, regardless of immediate savings potential

- Track record of consistent representation and fair value confirmation

Take Control of Your Property Tax Burden

Learning how to decrease property taxes requires a multifaceted approach combining strategic use of exemptions, annual market value challenges, and staying informed about legislative developments. Whether pursuing DIY protests or working with professional representation, Texas homeowners have numerous opportunities to reduce their annual tax burden and ensure they’re paying their fair share.

The key to long-term property tax management involves taking action annually rather than waiting for dramatic market changes or legislative relief. Small reductions compound over time, and establishing fair market values creates lower baselines for future tax calculations.

Ready to take control of your property tax situation? Get started with Home Tax Shield today and let experienced professionals handle the complex process of ensuring your property taxes reflect fair market conditions, year after year.

Frequently Asked Questions

How much can I realistically save by protesting my property taxes?

While successful protests may achieve reductions in property values, it’s important to note that no company can legally promise specific savings amounts. The only way to determine if you’re paying a fair tax amount is to go through the entire protest process. Even modest reductions ensure your property is fairly valued and help keep your baseline value lower for future years, creating long-term benefits that compound over time.

Can I protest my property taxes if my home value didn’t increase this year?

Yes, you should consider protesting annually regardless of whether your appraised value increased. Market conditions change, and your property may be overvalued relative to current market conditions even if the appraisal remained stable from the previous year.

What’s the difference between homestead exemptions and property tax protests?

Homestead exemptions reduce your property’s taxable value through legislative programs, while protests challenge the market value determination made by your county appraisal district. Both strategies can reduce your tax bill, and most homeowners should pursue both opportunities.

How long does the property tax protest process take?

The protest process typically spans 3-4 months from filing in May through final ARB hearings in July or August. Most of this time involves waiting for hearing dates rather than active participation, though preparation requires significant time investment for DIY protesters.

Will protesting my property taxes affect my home’s sale value?

No, successful property tax protests don’t affect your home’s market value or sale price. Appraisal district valuations serve tax calculation purposes and don’t influence real estate market transactions, which depend on actual buyer demand and current market conditions.

What happens if I miss the May 15th protest deadline?

Missing the protest deadline eliminates your opportunity to challenge that year’s market value determination. However, you can still apply for exemptions if eligible, and you’ll have another opportunity to protest the following year when new appraisal notices are issued.