Property tax protest companies deliver proven value for Texas homeowners, but the decision depends on your property value, available time, and protest complexity.

- Professional companies achieve 80-83% success rates with specialized expertise and local market knowledge

- The best companies use hybrid fee structures (modest upfront + percentage of savings) ensuring complete protests while maximizing homeowner savings

- DIY protests require 10-15 hours annually plus technical knowledge of valuation methods

- The most cost-effective approach varies by circumstances, but delegating saves time and often yields better results

Rising property values across Texas have homeowners questioning whether their tax bills are fair. With the average Texas property tax burden among the highest in the nation, many property owners are asking: are property tax protest companies worth it in 2025?

The answer depends on several critical factors that determine whether property tax protest companies provide genuine value for your specific situation. When evaluating whether these companies are worth it in 2025, understanding these variables helps homeowners make informed decisions about managing their annual tax burden effectively.

What Are Property Tax Protest Companies and How Do They Work?

Property tax protest companies specialize in challenging property valuations on behalf of homeowners who believe their assessments are too high. These firms employ licensed tax consultants who understand local appraisal processes, market conditions, and effective protest strategies.

The typical process involves several key steps. First, the company analyzes your property’s market value and compares it with similar properties in your area. They then file the necessary paperwork with your county’s appraisal district before the May 15th deadline. Throughout the process, they gather evidence to support your case, including comparable sales data adjusted by over 40 key factors, property condition reports, and market analysis.

Most companies handle the entire protest process, including attending informal meetings with appraisers and formal hearings before the Appraisal Review Board (ARB). Their licensed professionals present evidence on your behalf, negotiate with appraisal district staff, and work to achieve the maximum possible reduction in your property’s market value.

Professional Expertise vs DIY Challenges: Understanding Your Options

Understanding your options is crucial when evaluating different approaches to property tax protests. When homeowners ask “are property tax protest companies worth it,” understanding what each approach actually involves is essential. The complexity gap between professional services and DIY attempts often surprises property owners who initially assume protesting is simply a matter of disagreeing with their assessed value.

What Makes Professional Companies More Effective?

Leading property tax protest companies consistently report success rates between 80-83%, meaning the vast majority of clients see some level of reduction in their property’s market value. However, reputable companies cannot and should not predict the size of any reduction, as this depends entirely on the specifics of each property and the protest process outcome.

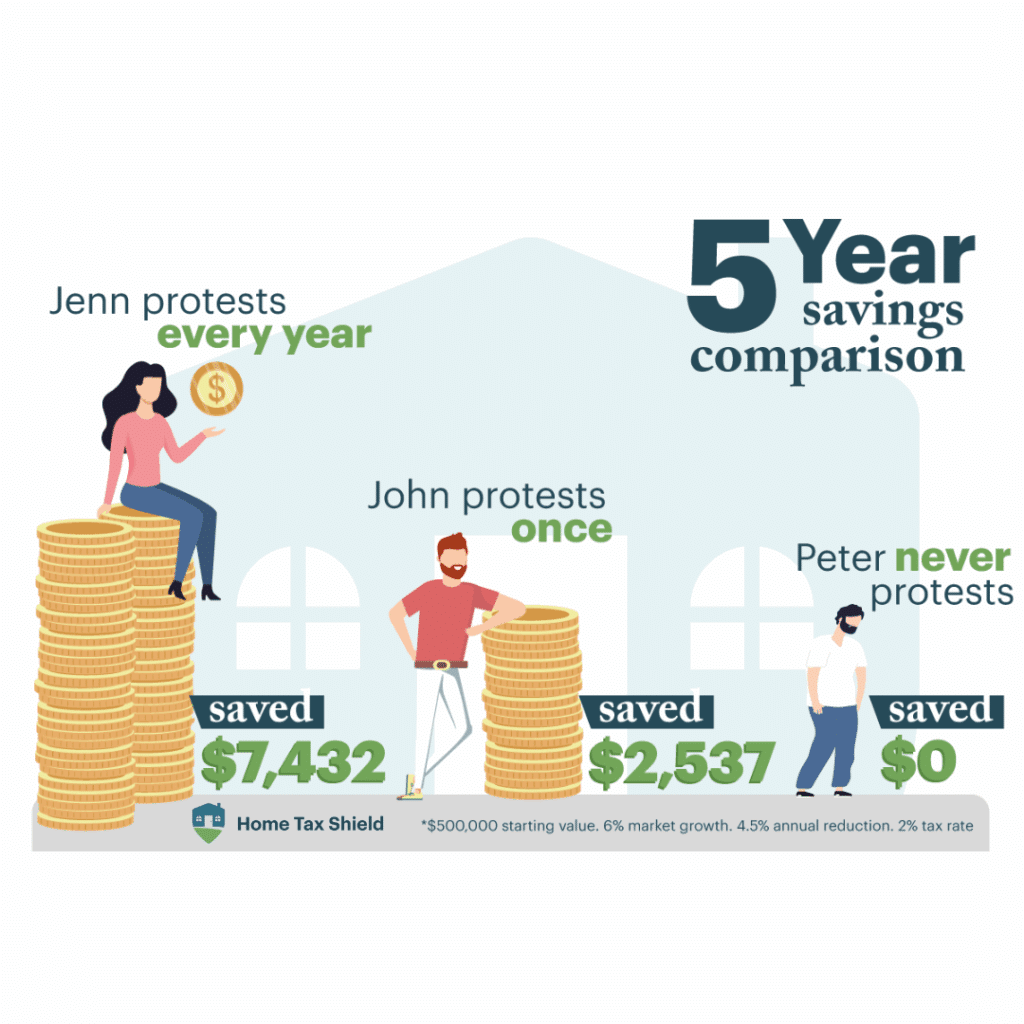

What matters more than the size of immediate savings is ensuring your property’s tax assessment is fair and at its lowest possible level. Even modest reductions create compounding value over time, as lower assessments become the baseline for future years.

This compounding effect makes annual protesting essential, as each year’s reduction builds upon previous years’ gains. Many successful protest strategies focus on long-term fairness rather than promising immediate large savings.

What Does Effective DIY Protesting Actually Require?

Homeowners who properly prepare their cases can achieve good results, but the preparation requirements are extensive. To meet Appraisal Review Board expectations, well-prepared DIY protesters must master several elements:

- Access reliable comparable sales data from MLS or verified sources (not Zillow or county websites). For example, Zillow often shows estimated values rather than actual sale prices, and county records may lack crucial details like property condition, exact sale terms, or whether sales were between related parties. ARBs routinely reject evidence from these sources, while professional companies access MLS data that includes verified sale prices, days on market, and detailed property characteristics.

- Understand appraisal methodologies used by county appraisal districts for residential properties. This includes learning cost, sales, and income approaches to valuation, plus understanding how mass appraisal systems work differently than individual property appraisals.

- Make proper adjustments to comparable properties for over 40 differences in size, condition, location, and features. Each adjustment must be mathematically justified and documented, as ARBs will challenge any adjustments that appear arbitrary or unsupported.

- Learn ARB procedures and evidence standards including presentation formats and documentation requirements. Different counties have varying rules about exhibit formats, time limits, and acceptable evidence types that must be followed precisely.

- Research valid protest grounds beyond simple disagreement with assessed value. You must understand legal basis such as unequal appraisal, incorrect property characteristics, or market value disputes with supporting methodology.

- Prepare professional evidence packages with properly formatted exhibits and supporting documentation. This includes creating organized binders, proper exhibit labeling, and clear summary sheets that ARB members can easily follow during hearings.

- Understand timing requirements for filing deadlines, hearing schedules, and follow-up procedures. Missing any deadline results in forfeiting your right to protest until the following year, with no exceptions for late filings.

- Navigate county-specific processes that vary significantly across Texas appraisal districts. What works in Dallas County may be completely different from procedures in Harris, Travis, or smaller counties throughout the state.

The key distinction lies in mastering these technical requirements while investing 10-15 hours annually per property. However, the specialized expertise, data access limitations, and ongoing commitment requirements often make professional representation more practical and effective for most homeowners.

Key Variables That Impact Protest Outcomes

Several important factors influence protest results regardless of whether you choose professional representation or DIY approaches. Market conditions play a crucial role, with rapidly appreciating markets often providing more protest opportunities due to assessment lag times. County-specific policies and procedures also affect outcomes, as some appraisal districts are more receptive to protests than others.

Property type may also impact the complexity and likelihood of achieving reductions. Standard residential properties with abundant comparable sales generally present clearer cases than unique or complex properties requiring specialized analysis and expertise.

Given these complexities and variables, professional representation provides consistent expertise across all property types and market conditions, while DIY approaches require homeowners to master technical skills that most find impractical to develop and maintain annually.

Cost Analysis and Fee Structures

Understanding the financial implications helps determine whether property tax protest companies are worth it for your situation. With property tax bills continuing to rise across Texas, homeowners need clear information about costs versus potential savings when choosing between professional representation and DIY approaches.

Three Main Fee Structures in 2025

Property tax protest companies typically use one of three pricing models, each with distinct advantages and limitations:

Contingency-Only Fees might range from 25-50% of tax savings achieved. These companies only get paid when they secure reductions, which sounds risk-free but can create problematic incentives. Companies may cherry-pick only the easiest or most lucrative cases or settle for minimal reductions to ensure quick payments rather than pursuing maximum savings.

Flat Fee Models charge predetermined amounts based on property value, typically ranging from $179 for homes under $200,000 to $999+ for high-value properties. While this provides cost certainty, homeowners pay the full fee regardless of outcome, and companies have less incentive to pursue aggressive negotiations since payment isn’t tied to results.

Hybrid Fee Structures combine modest upfront fees with success-based percentages, typically charging $50-150 upfront plus 25-30% of savings achieved. This model ensures companies complete thorough protests for every client while keeping total costs reasonable and aligned with homeowner interests.

Real-World Cost Analysis

Consider a typical Texas home with a $400,000 market value and effective tax rate of 2.5%. If a professional company achieves a $20,000 reduction in appraised value, the annual tax savings would be approximately $500.

With different fee structures, homeowner costs vary significantly:

- 50% contingency model: $250 fee, homeowner keeps $250

- Flat fee model: $329 upfront regardless of outcome

- Hybrid model: $50 upfront + 30% of savings ($150) = $200 total, homeowner keeps $300

These savings continue to compound over time, as lower assessments become the baseline for future years’ valuations. Over five years with consistent savings, the hybrid approach often provides the best value while ensuring complete service delivery regardless of individual case difficulty.

Hidden Costs in DIY Approaches

While DIY protests appear free, several hidden costs affect the true value equation. Quality comparable sales data requires MLS access, which individual homeowners cannot obtain. Free sources like Zillow or county websites provide unreliable information that Appraisal Review Boards routinely reject.

The time investment typically exceeds 12-15 hours annually, including research, evidence preparation, and hearing attendance. For professionals earning $30+ per hour, the opportunity cost alone approaches what many companies charge. Additionally, procedural mistakes or inadequate evidence preparation can result in missed savings opportunities that also compound over multiple years.

Evaluating Total Value Proposition

When determining whether property tax protest companies are worth it, consider factors beyond immediate fees. Professional services provide access to proprietary data, established relationships with appraisal districts, and specialized expertise that typically produces higher success rates than DIY approaches.

The most effective fee structures align company incentives with homeowner outcomes while ensuring complete service delivery. Models that combine reasonable upfront commitments with success-based payments tend to produce the best results, as they guarantee thorough protests while keeping costs proportional to actual savings achieved.

Smart homeowners evaluate the total cost of ownership rather than just upfront fees, considering time savings, expertise value, and long-term success rates when making their decision.

When Are Property Tax Protest Companies Worth It? The Short Answer: Always

The reality is that property tax protest companies provide value in virtually every situation, but certain circumstances make their services particularly beneficial. Given the complexity of the Texas property tax system and the expertise required for maximum success, most homeowners benefit from professional representation.

All Property Types Benefit from Professional Expertise

Rather than limiting professional services to high-value properties, the reality is that virtually all Texas properties benefit from expert representation. The specialized knowledge required for effective protests applies regardless of property value, and the time savings alone often justify the investment.

Annual Protests Are Essential

Every Texas homeowner should protest their property taxes annually, as market conditions and assessments change frequently. Professional companies make this yearly process seamless, ensuring you never miss opportunities for savings due to forgotten deadlines or inadequate preparation.

Limited Time Availability

Busy professionals, business owners, and others with demanding schedules often find professional services cost-effective. The time saved allows focus on income-generating activities that may exceed the cost of professional fees.

Multiple Properties

Landlords and investors with multiple properties benefit significantly from professional services. Managing protests for several properties simultaneously requires extensive coordination and expertise that companies handle efficiently.

Complex Property Characteristics

Unique properties, those with special features, or homes in areas with limited comparable sales benefit from professional analysis. Companies have access to broader data sources and specialized valuation techniques for challenging situations.

How to Choose the Right Property Tax Protest Company

If you decide professional representation makes sense, selecting the right company requires careful evaluation of several key factors.

Success Rate and Track Record

Look for companies that provide transparent data about their success rates and average reductions achieved. Reputable firms willingly share this information and provide references from satisfied clients.

Fee Structure and Transparency

Understand exactly how fees are calculated and when payments are due. Avoid companies with hidden fees or complex payment structures. The best companies operate on simple hybrid models with clear explanations.

Local Expertise and Relationships

Choose companies with specific experience in your county and appraisal district. Local knowledge of procedures, staff, and successful strategies significantly impacts outcomes.

Technology and Resources

Modern protest companies leverage technology for data analysis and case preparation. Ask about their tools for identifying comparable properties and building evidence packages.

Communication and Service

Evaluate how companies communicate throughout the process. Regular updates, accessible customer service, and clear explanations of progress indicate quality service.

Top 5 Benefits of Hiring Professional Property Tax Companies

Understanding the specific advantages helps clarify the value proposition of professional services.

1. Specialized Market Knowledge

Professional companies maintain extensive databases of property sales, market trends, and valuation methods. This knowledge enables them to identify opportunities and build stronger cases than most homeowners can develop independently.

2. Established Relationships

Experienced companies have working relationships with appraisal district staff and understand local procedures. These relationships can facilitate more productive negotiations and efficient resolution of protests.

3. Comprehensive Evidence Preparation

Professional companies excel at gathering and presenting evidence effectively. They understand what types of evidence appraisal review boards find most compelling and how to present it professionally. For homeowners wondering if property tax protest companies are worth it, this expertise often makes the difference between success and failure.

4. Risk-Free Financial Structure

Contingency-based fee structures eliminate financial risk for homeowners. You only pay when companies achieve actual reductions, aligning their interests with your financial benefit.

5. Annual Monitoring and Service

Many companies provide ongoing monitoring of your property’s assessed value and automatically file protests when beneficial. This service ensures you don’t miss opportunities for savings in future years. Since Texas homeowners should protest annually to maintain fair assessments, this automated approach provides significant value.

Stop Overpaying on Property Taxes: Take Your Next Step

Property tax protest companies provide substantial value for Texas homeowners in 2025, with success rates consistently above 80% and risk-free fee structures that align company interests with homeowner savings. For most property owners, the question of whether property tax protest companies are worth it has a clear answer: yes.

The complexity of the Texas property tax system, combined with the specialized knowledge required for effective protests, makes professional representation the practical choice for virtually all homeowners. While DIY approaches are possible, the time investment, learning curve, and ongoing requirements make professional services the more efficient option.

Whether you own a modest home or a high-value property, taking action to challenge potentially inflated property values remains crucial for managing your tax burden effectively. Home Tax Shield combines experienced, licensed tax professionals with transparent pricing to help homeowners maximize their property tax savings efficiently. Contact us today to get started and start saving.

Frequently Asked Questions

Are property tax protest companies worth it for homes under $300,000? Even for lower-value properties, professional companies often provide value through their expertise and time savings. While the absolute dollar savings may be smaller, the success rates and stress reduction typically justify the investment for most homeowners.

How much do property tax protest companies typically charge in Texas? Most companies charge 25-50% of the tax savings achieved through successful protests. Some use hybrid models with small upfront fees plus percentage-based charges. Always verify what you’ll be charged and confirm there are no hidden fees.

Can I switch from a DIY protest to hiring a company mid-process? Legally, yes. Texas Tax Code Section 1.111 allows property owners to “designate a lessee or other person to act as the agent of the owner for any purpose under this title” by filing the appropriate paperwork with the appraisal district. However, most professional companies choose not to take on mid-process cases due to practical limitations—insufficient time to properly prepare evidence, research comparable properties, and build a strong case. The timing and preparation requirements make it extremely difficult to provide effective representation when jumping into an active protest. Contact companies immediately if you’re considering this option, but be prepared that many may decline mid-process cases to ensure quality representation.Do property tax protest companies guarantee results? Reputable companies cannot guarantee specific results due to the subjective nature of property valuation. Doing so is illegal. However, hybrid fee structures keep protest services extremely affordable, ensuring you pay a small amount up front to cover a full protest and an additional percentage only if you achieve actual reductions in your property’s tax appraised value.