Property taxes represent the largest tax burden for most Texans, but understanding how the system works can save you hundreds or thousands of dollars annually.

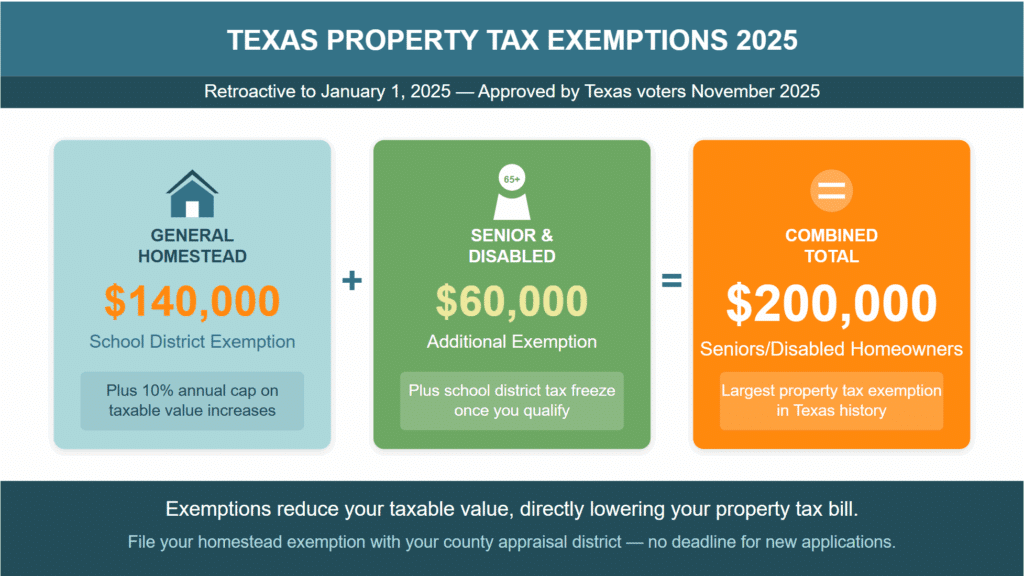

- The November 2025 constitutional amendments raised the homestead exemption to $140,000, with seniors and disabled homeowners now receiving $200,000 in total exemptions.

- Your property tax bill is calculated by multiplying your taxable value (after exemptions) by local tax rates set by school districts, cities, counties, and special districts.

- Filing a protest can reduce your tax appraised value even when exemptions are already in place, creating compounding savings over time.

Every Texas homeowner should understand their exemption options and protest annually to ensure they’re paying only their fair share.

Texas relies heavily on property taxes to fund public services, including schools, fire departments, roads, and local government operations. According to the Texas Comptroller’s Biennial Property Tax Report, property taxes remain the single largest revenue source for local governments, making up nearly half of all tax collections statewide. As long as you own residential property, you’re required to pay homeowner taxes in Texas.

The good news? Texas voters approved significant property tax relief in November 2025. These changes were retroactively applied to 2025, creating unprecedented savings opportunities for homeowners who understand how the system works.

How Do Homeowner Taxes in Texas Work?

Homeowner taxes in Texas are levied on all properties, and the process involves multiple government entities working together. Unlike states with income taxes, Texas relies almost entirely on property taxes to fund local services.

Your property tax bill depends on two primary factors: the appraised value of your property and the combined tax rates set by local taxing entities. The appraised value is determined by your county appraisal district, while tax rates are established by school districts, cities, counties, and special purpose districts.

What’s the Difference Between Appraised Value and Taxable Value?

The appraised value represents what your county appraisal district believes your home would sell for on the open market as of January 1 each year. Your taxable value is calculated by subtracting any exemptions from your appraised value.

For example, if your home’s appraised value is $400,000 and you have a $140,000 homestead exemption for school district taxes, your taxable value for school purposes would be $260,000. This distinction matters because lowering your taxable value directly reduces your tax bill.

How Do Tax Rates Vary Across Texas?

Tax rates differ substantially depending on where you live. Each taxing entity sets its own rate, and when combined, they create your total tax rate. According to SmartAsset, the average effective property tax rate in Texas is approximately 1.63%, compared to the national average of 0.90%.

School districts typically represent the largest portion of your tax bill, often accounting for more than half of the total amount. While you cannot protest your tax rates, understanding them helps you budget for annual expenses.

What Are the Key Property Tax Dates Every Homeowner Should Know?

The Texas property tax calendar follows a predictable annual cycle. Knowing these dates helps you take advantage of protest opportunities and avoid costly penalties.

- January 1: Official appraisal date. Your property’s value is assessed based on its condition and market conditions as of this date.

- April through early May: County appraisal districts mail Notices of Appraised Value to homeowners whose properties have increased significantly.

- May 15 (or 30 days after receiving your notice, whichever is later): Deadline to file a property tax protest with the Appraisal Review Board.

- Late May through July: The Appraisal Review Board conducts hearings to resolve protests.

- September: Local taxing entities finalize and adopt tax rates.

- October and November: Tax bills are mailed to property owners.

- January 31 of the following year: Property taxes are due. According to Williamson County Tax Office, taxes unpaid by this date become delinquent on February 1, triggering penalties and interest.

How Are Texas Property Taxes Calculated?

The formula for calculating homeowner taxes in Texas is straightforward. Your tax bill equals your property’s taxable value multiplied by the combined tax rate from all applicable taxing entities.

Property Appraised Value – Exemptions = Taxable Value

Taxable Value × Tax Rate = Property Tax Bill

Consider a home with an appraised value of $450,000. If the homeowner qualifies for the $140,000 homestead exemption and their combined tax rate is 2%, here’s the calculation:

$450,000 – $140,000 = $310,000 taxable value

$310,000 × 0.02 = $6,200 annual property tax

Without the homestead exemption, that same homeowner would pay $9,000, representing savings of $2,800 from a single exemption. This demonstrates why understanding property tax basics matters so much.

What Exemptions Can Lower Your Property Tax Bill?

Texas offers several property tax exemptions that can substantially reduce what you owe. The November 2025 constitutional amendments, including Proposition 13 and Proposition 11, significantly increased these amounts effective January 1, 2026.

General Homestead Exemption

The homestead exemption is available to any homeowner who owns and occupies their residence as their primary home:

- School district exemption: $140,000 (increased from $100,000)

- Cities and counties may offer additional exemptions up to 20% of your home’s value

- Counties collecting farm-to-market or flood control taxes must provide a $3,000 exemption

The homestead exemption also triggers a 10% cap on annual taxable value increases. Even if your home’s market value jumps 20% in one year, your taxable value can only increase by 10% plus the value of any new improvements.

Senior and Disabled Homeowner Exemptions

Homeowners who are 65 or older or have qualifying disabilities now receive dramatically enhanced benefits:

- Additional $60,000 exemption for school district taxes (increased from $10,000)

- Combined with the general homestead exemption, qualifying homeowners receive $200,000 in total exemptions

- School district tax freeze that locks in your school tax amount once you qualify

According to Kiplinger’s analysis, qualifying senior and disabled homeowners could see annual savings exceeding $900 when combining all available exemptions with tax rate compression.

Veteran and Survivor Exemptions

Disabled veterans may qualify for partial or complete property tax exemptions based on their disability rating. Veterans with 100% disability receive complete exemption from all property taxes on the homestead. Surviving spouses of veterans who died from service-connected conditions may also qualify for exemptions.

Other Home Tax Tips Texas Homeowners Should Know

- Circuit breaker limitation: Non-homestead properties valued at $5 million or less are capped at 20% annual increases through 2026

- Fire reconstruction exemption: Temporary exemption for rebuilt home value when completely destroyed by fire

- Temporary disaster exemption: Properties damaged by at least 15% may qualify for temporary relief

What Happens If You Don’t Pay Property Taxes on Time?

Failing to pay your Texas property taxes by the January 31 deadline triggers serious consequences. According to the Texas Property Tax Code, penalties and interest accumulate monthly beginning February 1:

- February: 7% penalty plus 1% interest

- March: 8% penalty plus 2% interest

- July 1: An additional 20% collection fee may be added

By midsummer, a delinquent tax bill can grow by 40% or more from penalties, interest, and collection costs alone. When property taxes remain unpaid, the taxing authority places a lien on your property that takes priority over virtually all other claims, including mortgages.

Homeowners 65 or older or disabled can defer taxes indefinitely while occupying the property, and many counties offer installment plans for those facing hardship.

How Can You Protest Your Property Taxes?

Even with generous exemptions, protesting your property’s tax appraised value remains one of the most effective strategies for reducing your tax bill. The tax appraised value is the market value your county appraisal district assigns to your property, and it directly impacts what you owe.

Why Should You Protest Every Year?

County appraisal districts use mass appraisal methods to value thousands of properties simultaneously. These methods cannot capture every unique characteristic of your property or account for factors that affect its true market worth. Issues that could justify a lower tax appraised value include:

- Foundation or structural problems that diminish value

- Needed repairs

- Non-public data

- Incorrect sales and equity comps

The key insight is this: you should protest your property taxes every year, even if your tax appraised value doesn’t seem obviously high. The only way to know whether you’re being taxed fairly is to go through the entire protest process. Looking at your neighbor’s value or making assumptions based on limited data won’t give you that answer. Property tax law considers over 40 different data points, and each must be adjusted properly to determine fair value.

Every time you successfully argue down your property’s tax appraised value, you establish a lower baseline for future years. This compounds over time, potentially saving thousands of dollars.

The Protest Process Overview

If you decide to protest your property taxes, the process follows these steps:

- Review your Notice of Appraised Value carefully when it arrives

- File a Notice of Protest by May 15 or 30 days after receiving your notice, whichever is later

- Attend an informal meeting with the appraisal district to discuss your tax appraised value

- If unresolved, present your case to the Appraisal Review Board (ARB)

- The ARB decides whether your property’s tax appraised value should be adjusted

According to the Texas Comptroller’s Taxpayer Assistance Pamphlet, the appraisal district generally bears the burden of proving the value is correct. Presenting a well-prepared case with proper comparable sales analysis and adjusted market data can effectively shift negotiations in your favor.

What to Look for in Professional Help

Many homeowners choose to work with professional property tax protest companies to make the entire process stress-free, but not all services operate the same way. Be cautious of any company that promises specific savings amounts before reviewing your property. No one can guarantee a particular reduction, and in Texas, making such promises is actually against the law. Instead, look for companies with experienced, local representatives who understand your specific county’s appraisal methods and ARB procedures.

The fee structure matters too. Companies that charge only if they save you money might sound appealing, but consider what that incentive creates. If there’s no upfront commitment, a company may only pursue cases where reduction seems easy, potentially skipping yours entirely.

A hybrid model with a modest upfront fee plus a contingency component ensures the company is contractually and financially committed to taking your protest through the entire process, giving you a definitive answer about whether your tax appraised value is fair. That peace of mind has real value.

Frequently Asked Questions

Do I need to reapply for exemptions to get the increased amounts?

No. If you already have valid homestead or over-65 exemptions on file, the increased amounts apply automatically for the 2026 tax year.

Can protesting my property taxes ever increase my value?

No. By law, a property tax protest can only result in your value staying the same or decreasing. There’s no downside risk to filing.

How do I know if my property is overvalued?

Signs include significant differences between your appraised value and recent comparable sales, errors in property records, physical problems affecting condition, or negative features near your property. However, avoid simply comparing to neighbors without understanding that adjustments for different features significantly affect these comparisons.

Take Control of Your Texas Property Taxes

Understanding homeowner taxes in Texas empowers you to take action. Between the increased exemptions approved in November 2025 and the annual opportunity to protest your property’s tax appraised value, Texas homeowners have more tools than ever to keep their tax bills fair.

Exemptions provide the foundation, but annual protests ensure your tax appraised value reflects reality rather than mass appraisal estimates. Even if your value doesn’t seem obviously wrong, the only way to confirm you’re paying fairly is to go through the process. The two strategies work together to compound savings year after year.

Home Tax Shield helps Texas homeowners navigate the property tax protest process with licensed, experienced representatives who know their counties inside and out. Their hybrid fee model means a real professional is committed to taking your protest through the entire process, not just cherry-picking easy cases. With an 83% success rate and fees 40% lower than many competitors, homeowners trust Home Tax Shield to fight for fair tax appraised values. Get started today and let the experts handle your property tax protest.