Texas homeowners face some of the highest property tax rates in the nation, but there’s significant relief following the November 2025 constitutional amendments. Voters approved Proposition 13, increasing the homestead exemption from $100,000 to $140,000, with qualified homeowners saving approximately $484 annually on school district property taxes. Senior and disabled homeowners benefit even more under Proposition 11, with their additional exemption jumping from $10,000 to $60,000, bringing their combined exemption to $200,000 and average savings of over $900 per year.

However, many homeowners continue to see their property tax bills rise despite these enhanced exemptions, due to increasing property values and growing demands on municipal budgets. While filing for a homestead exemption is essential, it’s just the beginning of your tax-saving journey.

Many savvy homeowners complement these exemptions with annual property tax protests, which can further reduce your taxable value and maximize your exemption benefits. Taking an active approach through both exemptions and strategic protests can create compounding tax savings that grow year after year.

What Is a Texas Homestead Exemption and Cap?

The Texas Property Tax Code provides several measures designed to offer property tax relief to homeowners with a primary residence in the state. These primarily include exemptions for qualifying homeowners, with four common types:

General Homestead Exemption

By filing a homestead exemption, you receive a $140,000 exemption on your property’s taxable value for school district tax calculations. This represents a $40,000 increase from the previous $100,000 exemption amount, following Proposition 13 which Texas voters approved in November 2025. These changes apply retroactively to the 2025 tax year and will be reflected in tax bills due January 31, 2026. You also receive a 10% cap on annual increases to your home’s taxable value (excluding improvements you’ve made to the property).

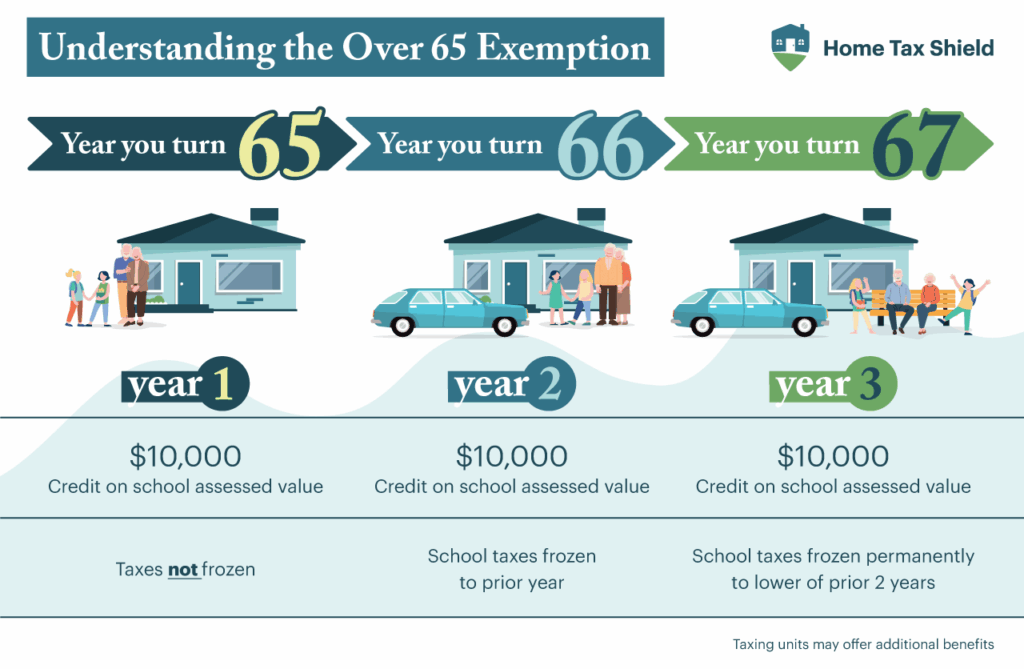

Over-65 Exemption

This powerful tax-saving provision supplements the general homestead exemption for seniors. For homeowners age 65 or older, Texas law now requires school districts to provide an additional $60,000 residence homestead exemption beyond the standard $140,000 exemption, following the passage of Proposition 11 in November 2025. This brings your total school district exemption to $200,000, which means most seniors will pay zero school district property taxes. These changes apply retroactively to the 2025 tax year.

Even more valuable is the tax ceiling benefit, often called a “tax freeze.” When you qualify for the over-65 exemption, your school district taxes become capped at the amount you pay in the year you turn 65. This ceiling doesn’t limit your home’s value, which may still increase with market conditions, but it prevents school tax amounts from rising above your established ceiling.

Disabled Exemption

This provides the same supplemental exemption as the over-65 exemption, but homeowners can only claim one of these two exemptions. For those who qualify, this exemption now provides an additional $60,000 off your home’s value for school district taxes, just like the over-65 exemption, bringing your combined exemption to $200,000.

To be eligible, you must either qualify for disability benefits under the Federal Old-Age, Survivors and Disability Insurance Program administered by the Social Security Administration, or have a physician’s statement confirming you’re unable to engage in gainful employment due to your disability.

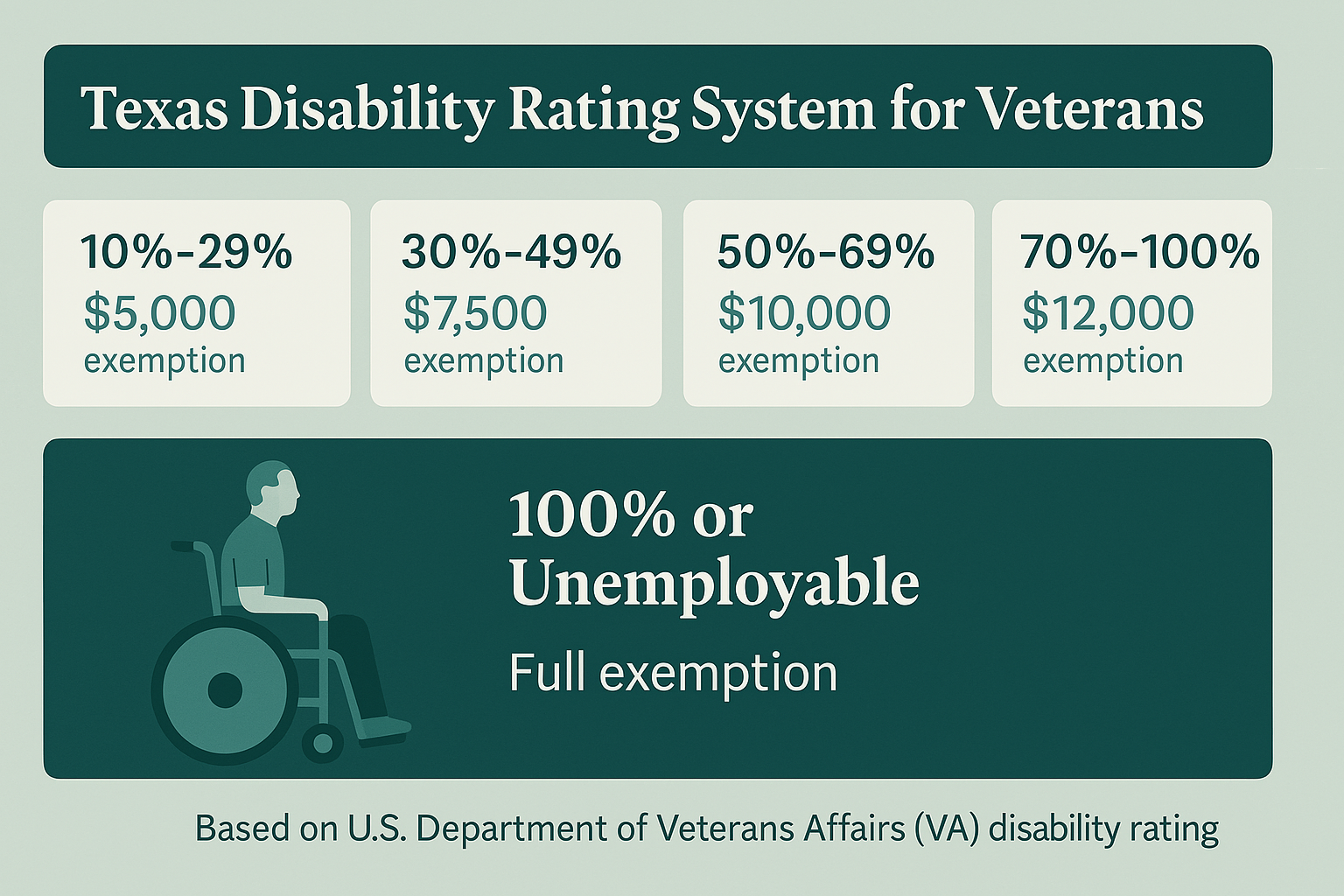

Like the over-65 exemption, this benefit establishes a valuable tax ceiling that freezes your school taxes at the amount you pay in the year you qualify for the exemption. If you purchase a new home after qualifying, you can transfer this tax ceiling through a “ceiling transfer” process, preserving your tax savings. There are enhanced protections for disabled veterans, with exemptions ranging from $20,000 to full exemption depending on the disability rating.

Another significant advantage for disabled homeowners is the ability to defer or postpone paying property taxes on your homestead for as long as you own and live in it—simply file a tax deferral affidavit with your appraisal district.

To learn more about qualifying for this exemption, contact your local county appraisal district or visit their website for specific application requirements.

Agricultural Exemption

While technically not an exemption, this alternative tax calculation method can generate substantial savings for qualifying homesteads with agricultural uses. Unlike standard property tax calculations based on market value, agricultural properties are assessed based on their “productive agricultural value,” which is typically much lower than market value and results in significantly reduced property taxes.

To qualify, your land must be primarily used for agricultural activities such as crop production, livestock production, dairy farming, beekeeping, aquaculture, or horticulture. The property must have been used for agricultural purposes for at least five of the past seven years, and there are minimum acreage requirements that vary by county.

This valuation method is rooted in the Texas Constitution and offers substantial tax relief for agricultural landowners, who often face high operational costs. Be aware that if you lose this special valuation, you could face “rollback taxes” for several previous years plus interest.

Consult with your county appraisal district for specific requirements in your area and to understand the application process. Working with professionals familiar with agricultural exemptions is highly recommended to ensure you maintain compliance and maximize your tax savings.

Key Benefits of Having a Homestead Exemption in Place

Homestead exemptions provide a powerful defense against rising property taxes. Once in place, you’ll enjoy:

- A substantial reduction in school district tax obligations: With school district tax rates typically around 1% or higher in many counties, the $140,000 exemption translates to approximately $1,400 or more in annual savings on school taxes alone.

- Protection against dramatic value increases: Your taxable property value cannot increase by more than 10% annually unless you make improvements. For example, if your home has a taxable value of $300,000, it can only increase to $330,000 the following year, making your tax liability more predictable.

- Additional local exemptions: Some cities and counties offer additional homestead exemptions beyond the state-mandated ones, potentially increasing your savings even further. Check with your local taxing authorities to see what’s available in your area.

5 Expert Tips to Maximize Your Homestead Exemption and Cap Benefits in 2025

Navigating property tax savings can be complex, especially with procedures varying between counties. These five strategies will help you maximize your exemption benefits.

Tip 1: Ensure Your Homestead Exemption Is Filed Promptly

Homestead exemptions aren’t automatically applied—you must file the necessary paperwork and documentation with your local appraisal district. Texas law allows homeowners to apply for a homestead exemption as soon as they purchase their home, giving you the flexibility to secure your tax savings without waiting.

A homeowner-friendly change that took effect January 1, 2022, allows homebuyers to file for homestead exemption in the same year they purchase their new home, rather than waiting until the following year. This provides immediate tax savings from the date of purchase for qualifying homeowners.

Additionally, a Texas law (Senate Bill 1801) that went into effect September 1, 2023, now requires county appraisal districts to verify homestead exemption eligibility every five years. Under this verification program, if you receive a notice from your appraisal district requesting reapplication or verification of your exemption, you must respond by their specified deadline or risk losing your exemption.

Be sure to verify your exemption status annually on your county appraisal district’s website, as errors can occur in their databases, and failing to respond to verification requests could result in your exemption being removed.

Tip 2: Apply for All Additional Exemptions You May Qualify For

Beyond the general homestead exemption, you may be eligible for other tax-saving designations. As discussed above, homeowners with disabilities and those 65 and older now qualify for the standard $140,000 homestead exemption plus an additional $60,000 exemption, following voter approval of Propositions 11 and 13 in November 2025. This brings their total school district exemption to $200,000, retroactive to the 2025 tax year.

While some counties automatically apply the over-65 exemption once you reach eligibility, never assume this is the case. Proactively confirm your status and follow up if the appropriate exemptions don’t appear on your property profile.

Additionally, disabled veterans should ensure they’re receiving the correct exemption based on their disability rating. The exemption amount is determined by your service-connected disability percentage, ranging from $5,000 to $12,000 depending on your rating from the Veterans Administration. Veterans with a 100% disability rating may qualify for a complete property tax exemption on their homestead.

Tip 3: Leverage the Non-Homestead Property Value Cap

While your primary residence benefits from a 10% cap on annual taxable value increases, Texas property owners can now enjoy a 20% cap on non-homestead properties valued under $5 million. This includes second homes, rental properties, and other real estate investments.

This newer protection, implemented after recent legislative changes, helps investors and multiple property owners better manage their tax liabilities across their entire real estate portfolio. For investment properties, this predictability is particularly valuable for long-term financial planning.

Tip 4: Protest Your Property Taxes Annually to Control Tax Appraised Values

One of the most effective strategies for maximizing your exemption benefits is to protest your property’s tax appraised value each year. Every spring, your county appraisal district determines your home’s market value, and you have a limited window (by May 15th or within 30 days of receiving your notice, whichever is later) to file a protest form.

During the protest process, you can:

- Propose a lower market value for your property

- Present evidence supporting your valuation claim

- Pursue the matter through a formal hearing before an Appraisal Review Board (ARB)

This annual step is crucial to prevent your home’s tax appraised value from climbing too high. By keeping your market value assessment in check, you maximize the practical benefit of your exemption and cap. Even in years when your taxable value is below market value due to the 10% cap, protesting keeps your market value lower for future years, creating a compounding benefit over time.

Tip 5: Take Strategic Action Before the Spring Property Tax Season

The property tax timeline in Texas follows a consistent annual cycle.

- January-April: Apply for or verify your homestead and other exemptions

- April-May: Receive notices of appraised value and file protests

- May-July: Participate in informal settlements and formal ARB hearings

- October-January: Receive tax bills and make payments

By handling these tasks well ahead of deadlines, you’ll secure long-term, compounding benefits. Create calendar reminders or set up a document tracking system to ensure you never miss critical dates.

Additionally, consider using the early months of 2025 to gather evidence for your protest. Recent home sales in your neighborhood, documentation of property defects, or recent appraisals can all strengthen your case.

The Real Impact of Homestead Exemptions on Your Financial Health

The financial benefits of maximizing your homestead exemption extend far beyond your annual tax bill. School taxes typically account for over 50% of a homeowner’s property tax bill. With the increased exemption amount of $140,000, this translates to significant long-term savings.

According to state estimates, the typical Texas homeowner will save approximately $484 annually from the increased school district exemption. Over a 10-year period, that amounts to nearly $5,000 in savings from this single change alone, not accounting for compound benefits from lower appraisal growth or additional savings from combined 2023 and 2025 tax relief measures.

These savings become even more substantial for seniors and disabled homeowners, who save an average of over $900 per year. The combined effect of all available exemptions for these groups now totals $200,000, effectively eliminating school district taxes entirely for seniors with homes valued at or below that amount.

Why Expert Property Tax Protest Strategies Amplify Your Exemption Benefits

While homestead exemptions provide valuable automatic tax savings, they’re only the foundation of a comprehensive property tax reduction strategy. As we’ve discussed in Tip #4, annual property tax protests are crucial for controlling your home’s appraised value—but the effectiveness of these protests varies dramatically depending on your approach and expertise.

Many homeowners attempt the protest process independently but face significant challenges navigating the complex appraisal system. Common obstacles include:

- Limited access to comparable property data that appraisal districts use

- Insufficient knowledge of effective valuation arguments beyond basic market value claims

- Unfamiliarity with procedural requirements and ARB hearing protocols

- Time constraints during the busy spring protest season

This is why savvy property owners increasingly turn to professional representation. Expert protest services can analyze your property’s valuation from multiple angles—not just market value but also unequal appraisal compared to similar properties, which often yields better results. Licensed representatives also understand how to properly document and present evidence of property condition issues, neighborhood factors, and other value-reducing elements.

The compounding benefit is clear: each dollar of reduction achieved through expert protests enhances the relative impact of your homestead exemption. For example, if your $350,000 home receives a $50,000 reduction through a successful protest, your $140,000 homestead exemption now represents a larger percentage of your home’s taxable value—providing proportionally greater savings.

For busy homeowners, the best property tax protest companies offer a turnkey solution that handles the entire process from evidence gathering to representation at ARB hearings. This approach combines the automatic benefits of your exemptions with the strategic advantages of expert protest representation—creating a powerful, compound tax-saving strategy that grows in value year after year.

Maximize Your Property Tax Savings with a Dual Strategy

The path to truly minimizing your property tax burden in Texas requires a dual approach: securing all eligible exemptions while also aggressively protesting your property’s appraised value. As we’ve shown throughout this guide, homestead exemptions provide an essential foundation of tax savings, but their effectiveness is magnified when combined with strategic property tax protests.

For many homeowners, the complexity of the protest process can be daunting. The research required to build a compelling case, the time needed to attend hearings, and the expertise to effectively negotiate with appraisal districts present significant challenges. This is precisely why professional representation offers a compelling advantage.

At Home Tax Shield, we specialize in maximizing both aspects of this dual strategy. Our property tax experts can:

- Analyze your property’s valuation using both market value and unequal appraisal approaches

- Build evidence specific to your home and neighborhood

- Represent you throughout the entire process, from initial filing to ARB hearings

- Provide year-over-year representation so you know you’re always paying a fair tax

Sign up with Home Tax Shield today to ensure your 2025 property taxes are protested by licensed, experienced professionals who understand how to maximize your exemption benefits while aggressively reducing your property’s tax appraised value.

With no upfront costs and fees based only on actual tax savings achieved, our service offers a risk-free way to keep more of your hard-earned money where it belongs—in your pocket.