Key Takeaways

Texas homeowners can challenge their property’s tax appraised value through the formal protest process, and with historic exemption levels now in place, understanding your rights remains critical for 2026.

- The $140,000 homestead exemption for school taxes continues for 2026, with a combined $200,000 exemption available for seniors and disabled homeowners

- May 15, 2026, remains the primary deadline for filing a protest (or 30 days after your notice is mailed)

- Strong evidence with properly adjusted comparable sales is the foundation of an effective protest

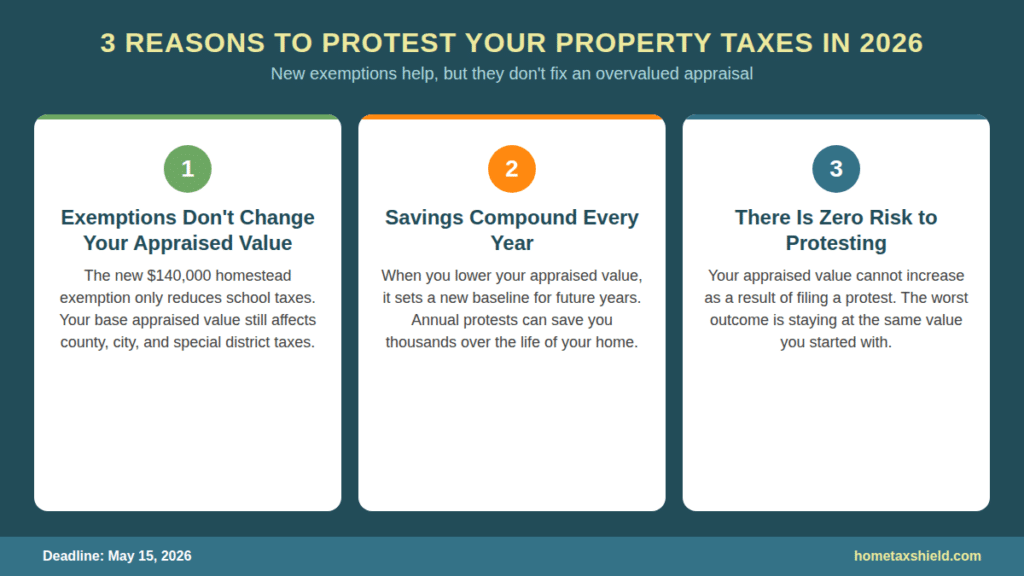

- Annual protesting lowers the baseline value used in future appraisals, building long-term fairness into your tax bill

If your tax appraised value doesn’t reflect your home’s true market value, filing a protest is the only way to find out whether you’re paying more than your fair share.

Texas homeowners now benefit from the highest property tax exemption levels in state history, following constitutional amendments that voters approved in November 2025 and backdated to January 1, 2025. These exemptions continue into the 2026 tax year, providing meaningful relief. But even with this expanded protection, your property tax bill still hinges on one foundational number: your home’s tax appraised value. If that number is wrong, you could be overpaying. The Texas property tax protest process exists to ensure every homeowner has a fair shot at correcting overvaluations.

According to the Tax Foundation, Texas carries an effective property tax rate of 1.36% on owner-occupied homes, placing it among the highest in the nation. With no state income tax, local governments depend on property taxes to fund schools, roads, and emergency services. That reliance means your tax appraised value directly determines thousands of dollars on your annual tax bill.

What Changed for Texas Property Taxes in 2026?

Two voter-approved constitutional amendments reshaped the Texas property tax relief framework, delivering the largest property tax cuts in state history.

The New Homestead Exemption: $140,000

Proposition 13, passed with 79% voter approval, increased the mandatory school district homestead exemption from $100,000 to $140,000, effective January 1, 2025. For the average Texas homeowner, this translates to roughly $484 in annual savings on school district taxes alone. However, the exemption only applies to school district taxes on your primary residence.

Senior and Disabled Homeowners: $200,000 Combined

Proposition 11 raised the additional exemption for homeowners aged 65 and older or those with qualifying disabilities from $10,000 to $60,000. Combined with the $140,000 general homestead exemption, eligible seniors and disabled homeowners now enjoy up to $200,000 in total exemption from school district property taxes.

Why You Should Still Protest

These exemptions are significant, but they only reduce the taxable portion of your home’s value for school taxes. They do not change your underlying tax appraised value, and they do not apply to county, city, or special district taxes. If your home is appraised at $400,000 and its actual market value is $360,000, you’re still overpaying across every taxing entity. The only way to correct that base number is through a Texas property tax protest.

How Is Your Property Tax Bill Calculated?

Your annual property tax bill follows a straightforward formula. Your tax appraised value, minus any applicable exemptions, equals your taxable value. That taxable value is then multiplied by your combined tax rate to produce the amount you owe. Your county appraisal district determines the tax appraised value as of January 1 each year, using mass appraisal methods that evaluate thousands of properties at once. Because mass appraisal cannot account for every property’s unique circumstances, overvaluations happen regularly.

Tax rates are set by local taxing entities, including school districts, county governments, cities, and special districts. You cannot protest your tax rate. The Texas Comptroller confirms that the protest process is your mechanism for challenging your tax appraised value.

When Should You File Your 2026 Property Tax Protest?

Timing is critical. County appraisal districts begin mailing notices of appraised value by April 1 for homestead properties. The Dallas Central Appraisal District confirms that for residential properties, protests must be filed by midnight on May 15, 2026. The general Texas deadline is May 15, 2026, or 30 days after your notice was mailed, whichever is later.

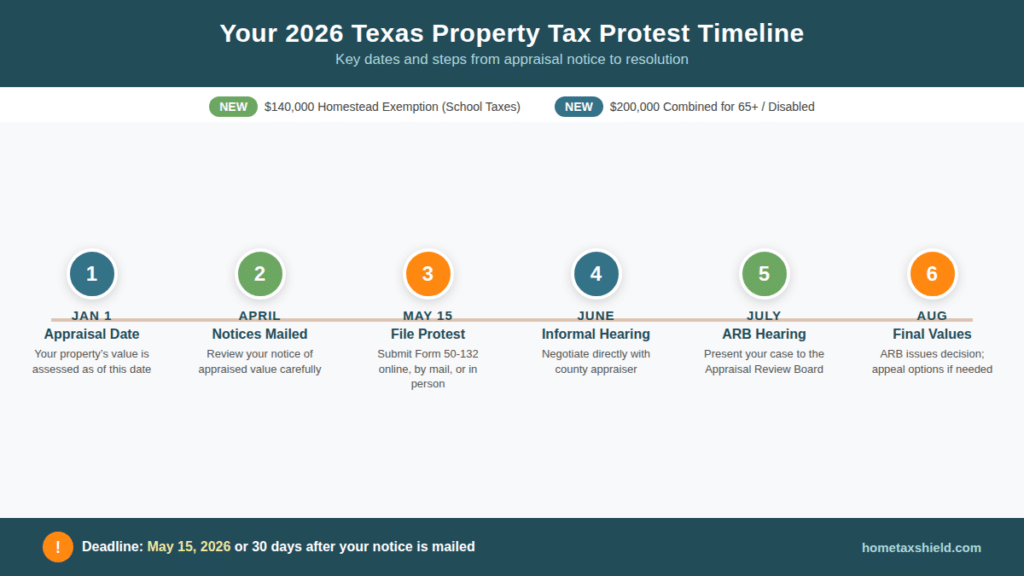

Key 2026 Dates Every Texas Homeowner Should Know

- January 1, 2026: Effective appraisal date for all Texas properties

- April 1: Appraisal districts begin mailing notices of appraised value to homestead property owners

- May 15, 2026: Primary protest deadline (or 30 days after your notice is mailed, whichever is later)

- June through July: Informal and formal Appraisal Review Board (ARB) hearings

- August: Final appraised values certified

- October/November: Tax rates finalized and bills mailed

- January 31, 2027: Property tax payment due

What Are Valid Grounds for a Property Tax Protest?

When you file a protest, you are challenging whether your tax appraised value is accurate and fair. Two primary arguments form the basis of most residential property tax protests.

Market value too high: The tax appraised value does not reflect what your home would actually sell for in the current market. This is the most common protest basis and requires comparable sales data.

Unequal appraisal: Your property’s tax appraised value is higher than similar properties in your area, violating the constitutional requirement for equal and uniform taxation.

One important distinction: if the appraisal district has incorrect information about your property, such as wrong square footage or the wrong number of bedrooms, those corrections should be submitted directly to your County Appraisal District. Factual data corrections are handled administratively and do not require a formal protest.

Step-by-Step: How to File a 2026 Texas Property Tax Protest

The protest process has several stages. Whether you handle it yourself or hire professional help, knowing each step will help you make informed decisions.

Step 1: Review Your Notice of Appraised Value

When your notice arrives in April, review every line carefully. Confirm that the property description is accurate, verify your exemptions are in place, and compare your current tax appraised value to the previous year. Do not rely on a simple comparison to your neighbor’s tax appraised value. Property tax appraisals consider more than 40 individual data points and apply specific adjustments for each one. Two homes on the same street can have legitimately different tax appraised values based on condition, age, improvements, and lot characteristics.

Step 2: Gather Strong Evidence

The strength of your protest depends almost entirely on the quality of evidence you present. Focus on two types of arguments recognized by appraisal review boards. Market value evidence uses recent sales of similar properties to demonstrate that your tax appraised value exceeds what the market supports. Every comparable property must be adjusted for differences in square footage, lot size, age, condition, and features. Unadjusted comparisons carry little weight. Effective property tax protest strategies often include access to MLS data and proprietary databases.

Unequal appraisal evidence compares your property’s tax appraised value to similar properties currently on the rolls. If your per-square-foot value is significantly higher than comparable properties, that’s an equity argument worth presenting. You should also document condition issues like foundation problems or roof damage, supported by written contractor estimates and professional repair assessments. Be aware that photographs alone are generally not effective evidence in ARB hearings and can sometimes work against your case.

Step 3: File Your Protest

Most Texas counties now offer online protest filing, which is the fastest method. You can also submit Form 50-132 by mail or in person. When filing, check both “incorrect appraised value” and “unequal appraisal” as your reasons. This preserves your right to present the widest range of evidence and maintains full appeal options after the hearing.

Step 4: Attend the Informal Hearing

After filing, most appraisal districts schedule an informal meeting between you and a county appraiser. This one-on-one conversation is your first opportunity to present evidence and negotiate. Many disputes are resolved at this stage, making thorough preparation essential. If the appraiser offers a value you consider fair, accept the settlement. If you disagree, you retain the right to proceed to a formal ARB hearing.

Step 5: Present Your Case at the Formal ARB Hearing

The Appraisal Review Board is an independent panel of citizens appointed to resolve disputes between property owners and the appraisal district. Both you and the appraisal district representative present evidence, and the board makes its determination based on the strongest case. Organize your evidence clearly, bring copies for each panel member, and practice your presentation. Stick to facts and data. The board will not consider emotional arguments about high taxes or personal financial circumstances. Following proven tips for protesting property taxes helps ensure you present the strongest possible case to the board.

Step 6: Understand the ARB Decision and Your Options

After deliberation, the ARB issues a written order delivered by certified mail. If you’re satisfied, the new value becomes final. If you disagree, you can pursue binding arbitration (for properties under certain value thresholds) or a district court appeal. Regardless of the outcome, document everything. If your tax appraised value was lowered, the appraisal district carries the burden of proof the following year, giving annual protesters a meaningful procedural advantage.

For homeowners who find the process time-consuming, working with a professional can simplify the experience considerably. Look for local, licensed tax professionals with extensive county-level experience who understand your specific appraisal district’s methods. Be cautious of any company that promises a specific savings amount before examining your property, as no firm can legally guarantee a particular outcome. A fee structure that includes a modest upfront commitment often reflects a company’s dedication to taking every property through the full protest process, rather than only pursuing cases with obvious reduction potential.

Frequently Asked Questions About Texas Property Tax Protests

Can my property taxes increase as a result of filing a protest?

No. A protest cannot result in a higher tax appraised value. The worst-case outcome is that your current value remains unchanged. There is no financial risk to filing a Texas property tax protest.

Should I still protest if my tax appraised value decreased this year?

Yes. Even if your tax appraised value dropped, it may still be higher than what the market supports. Filing a protest is the only way to verify that your value is truly fair. Protesting annually, regardless of whether the number seems reasonable, keeps your tax appraised value as accurate as possible and builds a lower baseline for future appraisals.

Can I file a protest if I already have a homestead exemption?

Absolutely. Exemptions and protests address different components of your tax bill. Your homestead exemption reduces your taxable value, while a protest challenges the underlying tax appraised value. Both work together to lower your final bill.

Do I have to attend hearings in person?

Not necessarily. Many counties offer telephone or video conferencing options for ARB hearings. You can also submit your case through a written affidavit. Check with your local appraisal district for available options.

Protect Your Investment: Start Your 2026 Protest Today

Filing a Texas property tax protest is one of the most direct actions you can take to ensure you’re paying a fair amount on your home. With the 2026 exemption changes providing additional relief and the protest deadline of May 15 approaching each spring, there is no reason to accept a value that may not reflect your home’s true market position. Every year you protest, you’re building a lower baseline that affects every future tax bill.

For homeowners who want professional representation throughout the entire protest process, Home Tax Shield provides experienced local tax professionals who handle everything from evidence gathering to formal hearings. Sign up today and let the experts ensure your 2026 property taxes are as fair as they should be.