Understanding the intricacies of property taxes is crucial for homeowners and investors alike, especially in a state like Texas where property tax rates can significantly impact financial planning.

As the first step of the property tax process in Texas, each year the county appraisal district office calculates your home’s “market” or appraisal value. Sometimes, they directly appraise your home, and sometimes, it’s through calculations based on the market activity of comparable homes in your area.

Property owners then receive a Notice of Appraised Value from the county appraisal district. This notice includes the appraised value of the property and information on how to protest the assessment if the owner disagrees with it. The timing for when Texas property taxes by county preliminary values come out can vary slightly from one county to another. Generally, these preliminary values are released by the county appraisal districts in the spring, beginning in early April. However, it’s essential to check with your specific county’s appraisal district for the exact release date, as it may vary depending on local procedures and timelines. Staying informed about when these preliminary values are available can help property owners plan and prepare for the upcoming tax cycle.

From there property owners have the opportunity to review the appraisal and file a protest if they believe the assessed value is incorrect. This typically involves providing evidence to support their claim, such as recent sales of comparable properties or documentation of property damage.

If the property owner files a protest, they may have a hearing before the local Appraisal Review Board. During the hearing, both the property owner and the appraisal district present evidence supporting their respective positions. After considering the evidence presented at the hearing, the ARB makes a final determination regarding the property’s assessed value. The property owner will receive written notice of the ARB’s decision.

General trend of values over recent years

Just last year, the median property tax bill across Texas stood at $2,275 statewide (with figures exceeding $6,000 in popular counties like Collin, Fort Bend, and Travis). Over the years, property tax bills have consistently surged, prompting the implementation of an increased homestead exemption in late 2023, now totaling $100,000. However, despite this adjustment, homeowners across the state remain uncertain about the trajectory of their tax burdens, unsure whether prevailing market forces will continue to drive up bills or if policy shifts and a potential market cooldown will provide much-needed relief.

H2: How do values impact homeowners?

Ensuring your property gets a fair appraisal is super important to avoid overpaying taxes. Sometimes, though, the value they give your property is way too high. Usually, county appraisal districts use a quick method to value lots of homes at once because they don’t have enough people to look at each one individually. Texas property tax appraisal values have a direct impact on homeowners in several ways:

- Tax Burden: Higher appraisal values typically lead to higher property tax bills for homeowners. The appraised value of a property is used to calculate the amount of property taxes owed to local taxing authorities, such as school districts, cities, and counties. Thus, an increase in the appraised value usually results in an increase in property taxes.

- Financial Planning: Fluctuations in property tax appraisal values can affect homeowners’ financial planning. Higher appraised values may necessitate budget adjustments to accommodate increased property tax bills, potentially impacting other aspects of household finances.

- Equity and Affordability: For homeowners, accurate property tax appraisal values are essential for maintaining equity and affordability. Overvaluation of properties can lead to homeowners paying more than their fair share of property taxes, potentially straining household budgets and affecting affordability.

- Home Sales and Refinancing: Property tax appraisal values also influence home sales and refinancing decisions. Overvaluation may deter potential buyers or affect the terms of financing arrangements, while undervaluation could lead to discrepancies in property valuations during sales transactions or refinancing processes.

- Investment Considerations: Property tax appraisal values can impact homeowners’ perceptions of their property’s investment value. Accurate and fair appraisals contribute to informed decisions regarding property investments, while overvaluation may raise concerns about the property’s long-term financial viability.

2024 Preliminary Values

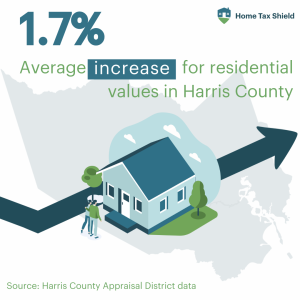

Harris County

- 2024: 1.7% increase

- 2023: 15.70% increase

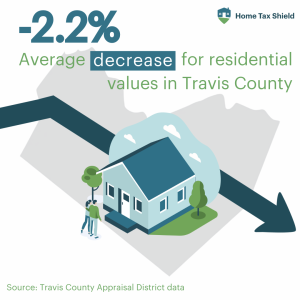

Travis County

- 2024: -2.20% decrease

- 2023: 4.20% increase

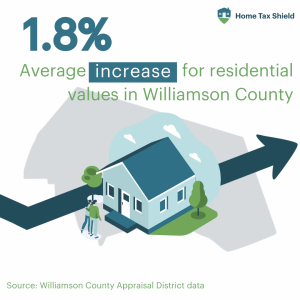

Williamson County

- 2024: 1.8% increase

- 2023: -10.80% decrease

Rockwall County

- 2024: 3.40% increase

- 2023: 14.40% increase

Comal County

- 2024: 0.80% increase

- 2023: 13.20% increase

Aransas County

- 2024: 6.3% increase

- 2023: 26.10% increase

Denton County

- 2024 : 0.60% increase

- 2023: 23.60% increase

Hays County

- 2024: -3.40% decrease

- 2023: 14.40% increase

Lubbock County

- 2024: 4.40% increase

- 2023: 12.2% increase

Coryell County

- 2024: -1.5% decrease

- 2023: 23.0% increase

Dallas County

- 2024: 14.4% increase

- 2023: 12.1% increasse

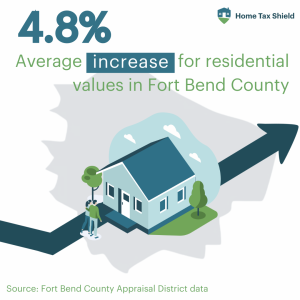

Fort Bend County

- 2024: 4.8% increase

- 2023: 14.1% increase

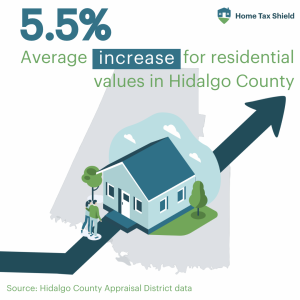

Hidalgo County

- 2024: 5.5% increase

- 2023: 19.3% increase

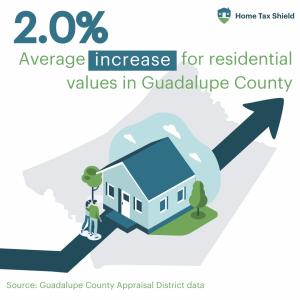

Guadalupe County

- 2024: 2.0% increase

- 2023: 7.7% increase

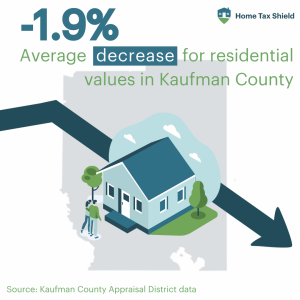

Kaufman County

- 2024: -1.9% decrease

- 2023: 13.4% increase

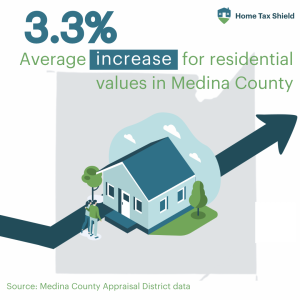

Medina County

- 2024: 3.3% increase

- 2023: 22.7% increase

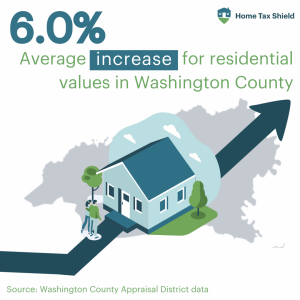

Washington County

- 2024: 6.0% increase

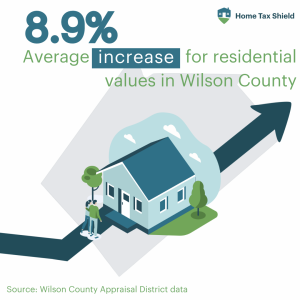

Wilson County

- 2024: 8.9% increase

- 2023: 10.3% increase

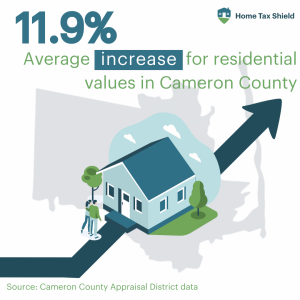

Cameron County

- 2024: 11.9% increase

- 2023: 15.6% increase