Texas property owners pay billions of dollars a year in property taxes. Texas does not have a state income tax so property taxes support local government services like police, fire departments and schools. fdsfdsfs

The amount of property taxes you pay is determined by two numbers:

Both your property’s market value and tax rates are set by local authorities. Tax rates can be changed every year but any large increases have to be voter-approved. The value of your property is set by the county appraiser and can be challenged by file a protest. The primary driver of property values in Texas is the real estate market, which tends to rise in value over time.

County Appraisal Process

Texas law requires your property to be appraised at market value as of January 1st by the county assessor. The market value is the price at which the property would transfer on the open market. County appraisers are required to reappraise all properties at least once every three years, but some do it every year. Most county appraisal offices use a mass appraisal approach, which rely on a standard appraisal methodology and real estate market data to come up with a market value. The counties must abide by the Uniform Standards of Professional Appraisal Practice if a mass appraisal is used. These mass appraisals are imperfect and often lead to incorrect values being assigned to many properties.

There are two main methods for appraising residential properties:

- The sales argument compares your home to other homes in your area that sold last year. When the real estate market is hot, the sales argument is often not very helpful.

- The equity argument compares your home to the county’s value for ALL other homes in your area, not just the ones that sold. When the county values your home in an unequal manner, the error can be fixed which reduces your market value and often your taxes due.

Every data point that the county uses for a given property must be adjusted to make it comparable to other, similar properties. There are 30-40 different data points that are used to compare residential properties. Cosmetic improvements, landscaping, and HVAC issues are not included in the tax valuation of a property.

For commercial properties counties often use a third approach…income. This valuation approach uses income and expense data to determine the present of the property. It aims to determine what an investor would pay for a property based on its anticipated revenue stream.

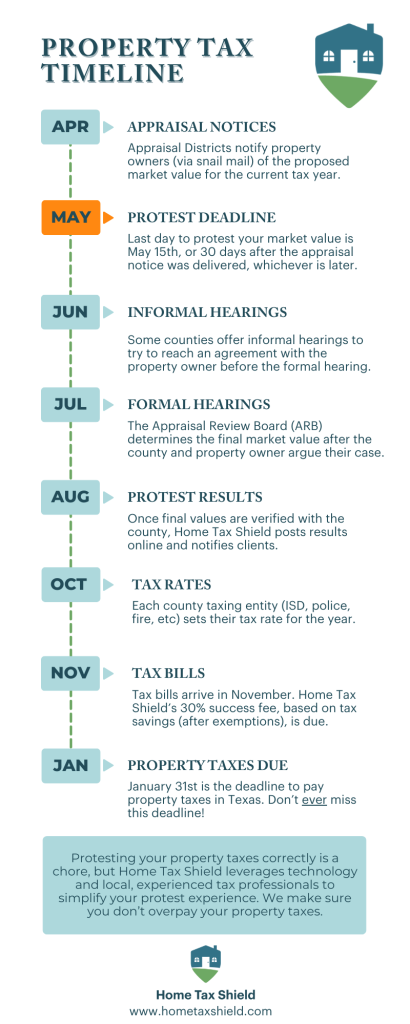

The Texas Property Tax Protest Timeline

By law, every Texan has the right to protest the county’s appraisal each year. The process starts in early April when property owners receive the notice of preliminary value. This value is what the county assessor thinks your property is worth. In that notice, there are instructions on how to protest if you believe that value is incorrect.

There are two critical deadlines in the Texas property tax system. (1) The deadline to file a protest is typically around May 15th, or 30 days after you receive your preliminary appraised value notice. Unlike filing your income tax return which allows for late filings, the deadlines in the Texas property tax system are non-negotiable. (2) The deadline to pay your property tax bill is January 31st, and there are stiff penalties for late payments so be sure to pay on time.

Understanding Texas Property Values

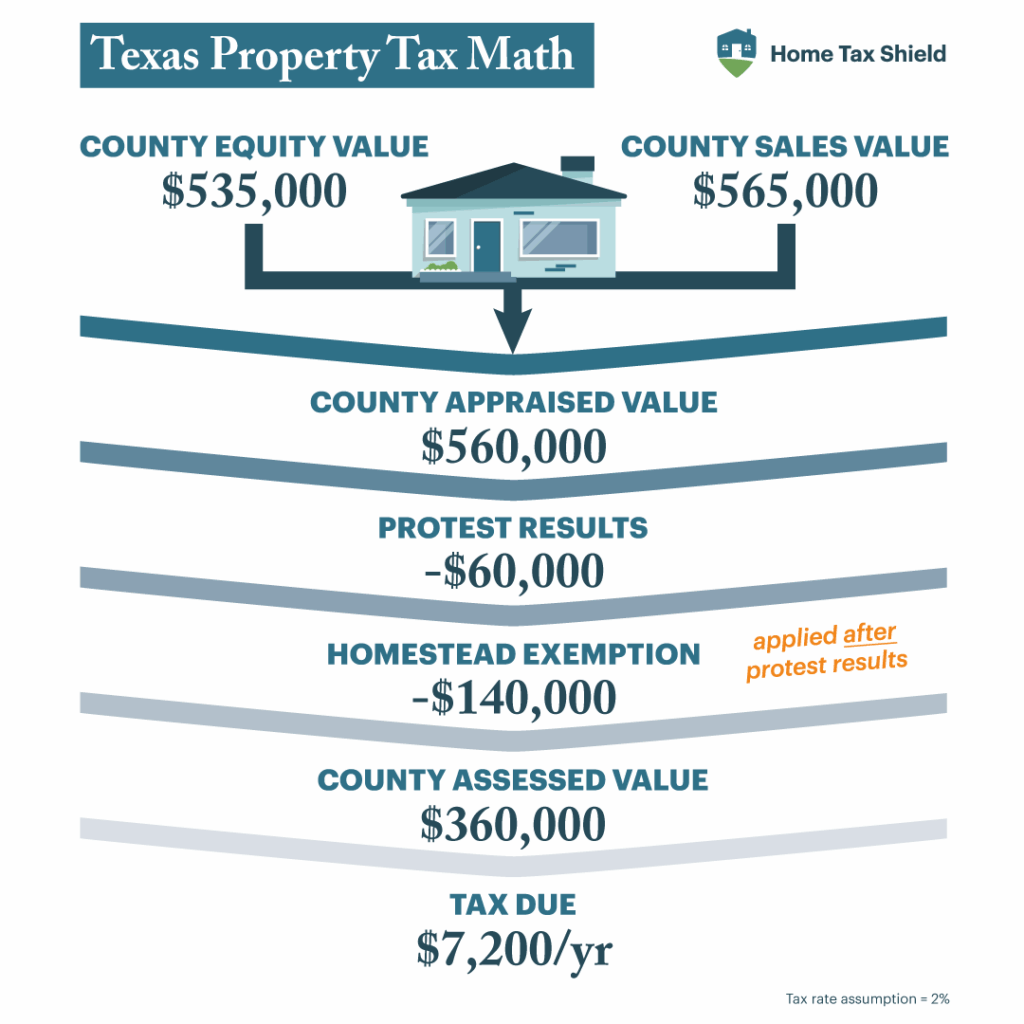

Each residential property has ten different values and they are all correct! Each value is calculated differently and used for a different purpose. The two most important property values for property taxes are your tax appraised value and tax assessed value. The tax appraised value (also called your market value) is what the county thinks your home is worth. The tax assessed value is the value you pay taxes on and is influenced by your property tax exemptions. If an appraised value is higher than the assessed value, that means your exemptions are helping you pay less tax.

By law, protesting focuses on lowering the appraised (or market) value, not the assessed value. But in most cases, when you lower your appraised value you will also see a corresponding reduction in your assessed value. The only exception is when the real estate market is hot, hot, hot and your value has increased by more than any exemption caps you have been approved for.

To learn more about Property Tax Values and Tax Rates click here.

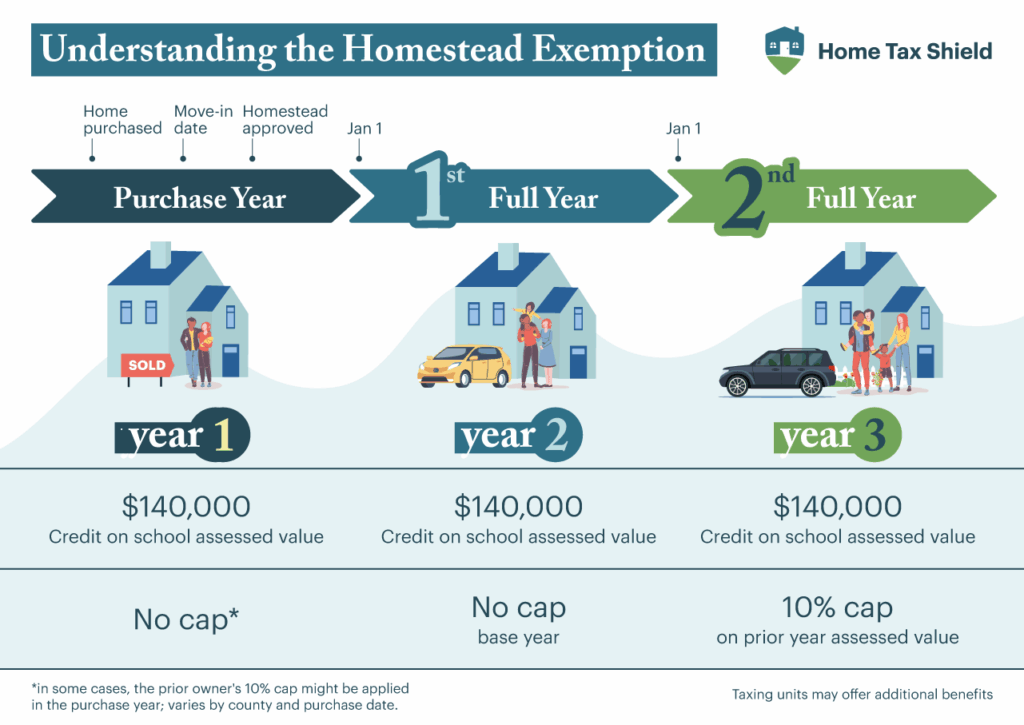

Lowering Property Taxes With Exemptions

An exemption can help remove a portion of the value of your property from taxation. There are many different exemptions, including homestead, agricultural, over-65 years and disabled veterans exemptions and more. These exemptions are removed from the appraised value of your home before taxes are calculated.

The most common exemption, the homestead exemption, reduces your property tax in two ways:

Exemptions are not a part of the protest process but can significantly reduce your property tax burden.

To learn more about what types of exemptions are available click here.

Lowering Property Taxes By Protesting

Every Texas property owner has the right to protest the preliminary appraised value provided by the county. Historically on average, protesting can reduce your property taxes by 3-5% depending on the errors that are associated with the county’s preliminary valuation. There are two ways to protest your property taxes, hiring a professional firm to represent you and doing the protest yourself.

If you elect to protest yourself here are the steps you must take

- File paperwork with the county before the protest deadline to inform the county you intend to protest

- Acquire non-public and public data from multiple sources

- Adjust the 30-40 data points for your home to meet the sales and/or equity method of valuing your property

- Attend an informal hearing (optional)

- Attend the formal hearing and argue your case in front of the appraisal review board

- Negotiate with experienced appraisers

The entire protest process can take 3 to 4 months and requires 8-15 hours of research and case preparation to be successful.

Hiring a professional can help you avoid the time commitment to protest your taxes on your own. Tax agents with decades of experience have relationships with the county appraisers and can often negotiate a lower value. This process a tax professional pursues can often take longer but is necessary to ensure the homeowner is not overpaying their taxes.

Texas Tax Rates

Tax rates, set by local taxing entities, play a significant role in calculating the amount of taxes each property owner owes. Taxing entities like schools, police, and fire departments, create a budget and adopt a property tax rate to support that budget.

Each taxing entity is required, by law, to generate the same amount of revenue from the previous year if the same rate was applied to the same amount of properties. This means that tax rates can fluctuate up or down each year depending on the total market value of properties in the jurisdiction.

When increasing the tax rate, taxing units need to get voter approval for the following increases:

- If the increase for cities and counties is over 3.5%

- If the increase for Hospitals, special tax units, and junior college districts operating expenses is over 8%

- School district funding calculations and the debt tax rate influence the voter-approval tax rate for school districts.

In 2019 the Texas Legislature passed legislation to help Texans better understand tax rates and provide timely information and tax rates. The Texas Property Tax Transparency website is a great resource to learn about future public hearings, proposed budgets and tax rates, and additional information.

Paying Your Property Tax Bill

Tax bills are mailed each November/December and are due by January 31st of the following year. Each tax bill will use the property value, tax rates and any exemptions on the property to calculate the total property tax owed for the calendar year.

If you are a homeowner who elected to allow your mortgage company to pay your property taxes via an escrow account, your mortgage company will pay the property taxes. Any shortage or excess will be rolled into your future monthly mortgage payments. Additionally, each year your mortgage company estimates the amount of property tax needed to pay your next property tax bill. When your mortgage company estimates your taxes to rise next year, your mortgage payment will go up, and vice versa.