Texas homeowners seeking property tax relief should prioritize protest companies that take every property through the full process rather than cherry-picking easy wins.

- The best property tax protest companies in Texas combine local expertise, transparent pricing, and a commitment to completing every protest through formal hearings if necessary

- Fee structures matter: hybrid models with modest upfront fees create accountability that contingency-only arrangements cannot match

- New 2026 exemptions now remove up to $200,000 of taxable value for seniors and disabled homeowners, making professional guidance more valuable than ever

- Only the complete protest process can definitively answer whether you’re paying a fair amount on your property taxes

Choosing the right property tax protest company can mean the difference between years of overpaying and finally knowing your valuation is accurate and fair.

Texas property owners face a difficult reality: the state’s heavy reliance on property taxes means local governments have strong incentives to appraise homes at the highest defensible values. With Texas ranking seventh in the nation for property tax burden and the average effective rate at 1.63% according to SmartAsset, homeowners need every advantage when challenging their tax appraised values. Finding the best property tax protest companies in Texas has become essential for those who want to ensure they’re paying only what they actually owe.

The protest process exists because mass appraisal methods cannot accurately value millions of properties. County Appraisal Districts group similar homes together and apply broad valuation models, inevitably missing the unique characteristics that affect individual property values. Professional representation can level the playing field, but the quality of that representation varies dramatically across the industry. Understanding what separates effective property tax firms from those that overpromise and underdeliver helps homeowners make informed decisions.

How Do the Best Property Tax Protest Companies in Texas Operate?

The role of property tax protest companies extends far beyond simply filing paperwork. Licensed professionals analyze your property’s specific characteristics, research comparable sales data, and present compelling evidence before the Appraisal Review Board to challenge your tax appraised value. The best firms understand that each property tells a unique story requiring individualized attention.

When County Appraisal Districts determine your tax appraised value, they rely on automated systems that evaluate thousands of properties simultaneously. These systems consider over 40 different data points but cannot fully account for foundation issues, roof conditions, environmental factors, or neighborhood characteristics that genuinely affect what buyers would pay for your home. Property tax professionals bridge this gap by conducting detailed analyses that mass appraisal cannot replicate and building cases that demonstrate why your tax appraised value should be lower.

The Complete Protest Process

Understanding what top property tax firms offer requires examining the full protest journey. After filing the initial Notice of Protest, most cases proceed to an informal meeting with appraisal district staff. Many companies settle cases at this stage, which can benefit homeowners with obvious overvaluations. However, stopping here leaves money on the table for properties where the evidence requires a formal hearing.

The Appraisal Review Board hearing represents where experienced representatives truly earn their value. Board members evaluate competing evidence from both the property owner’s representative and the appraisal district. Consultants who attend these hearings regularly understand what arguments resonate, which evidence carries the most weight, and how to present cases effectively within time constraints.

Beyond the formal hearing, additional appeal options exist through binding arbitration or district court proceedings.

What Should You Look for in a Property Tax Protest Company?

Evaluating property tax firms requires examining several critical factors beyond simple promises of savings. The following characteristics distinguish truly effective companies from those who may leave value unrealized.

Licensed professionals with verified credentials. Texas requires property tax consultants to hold licenses from the Texas Department of Licensing and Regulation. This licensing ensures education and experience standards. Ask potential companies about their licensing status and experience. The most effective firms employ seasoned local professionals with decades of experience in your specific county.

Documented success rates based on actual data. Many companies claim impressive success rates without providing context or verification. Request specific information about how they calculate success rates and whether those rates apply to properties similar to yours. A company that achieves reductions on 83% of properties provides more useful information than one claiming vague percentages.

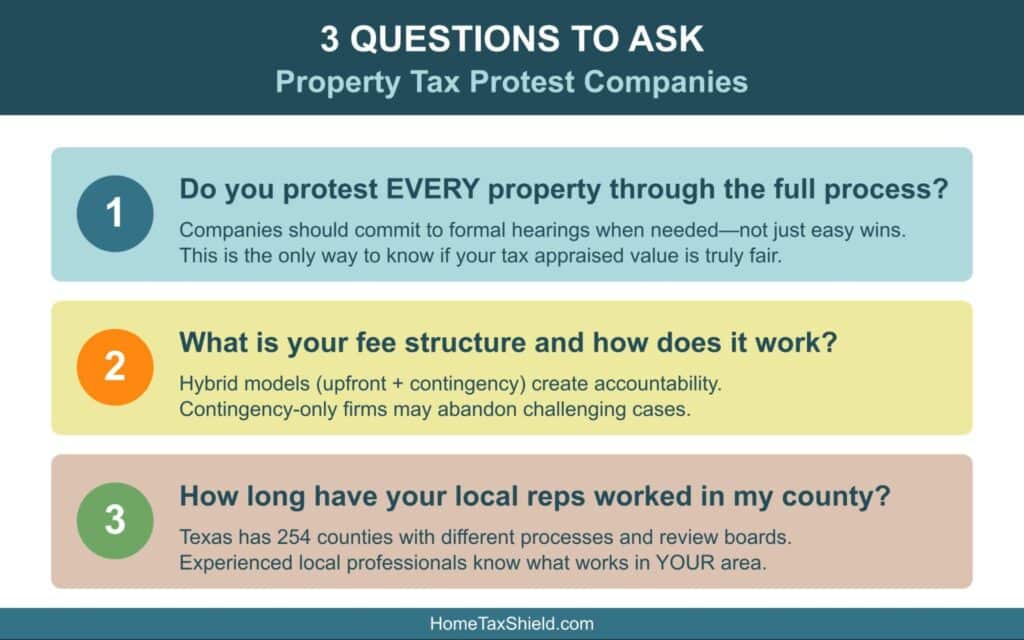

Commitment to protesting every property through the full process. This distinguishes the best property tax protest companies in Texas from competitors who cherry-pick cases. Some firms only pursue protests where data suggests an obvious reduction, abandoning other properties before formal hearings. This approach leaves homeowners without the only definitive answer about whether their tax appraised value is actually fair: completing the entire protest process.

Transparent communication throughout the process. Property tax protests span several months from filing through final resolution. Companies should provide regular updates, explain each stage of the process, and remain accessible when questions arise. Technology platforms that allow homeowners to track their protest status demonstrate a commitment to transparency.

Local market expertise in your specific county. Texas has 254 counties, each with its own appraisal district, processes, and review board tendencies. Companies with deep experience in your county understand local valuation methods, comparable property adjustments, and effective strategies for your specific market. Generic approaches that work in Houston may not succeed in rural East Texas or growing suburbs.

How Do Property Tax Protest Companies Structure Their Fees?

Fee structures reveal much about a company’s business model and whether their interests align with yours. Understanding these structures helps homeowners identify who can help lower property tax bills while maintaining accountability.

Contingency-Only Fees

Many property tax firms advertise that homeowners pay nothing unless the company achieves a reduction. While this sounds attractive, contingency-only arrangements create problematic incentives. Companies operating this way only generate revenue when they achieve reductions, which means they have no financial reason to pursue cases that appear challenging on the surface.

Under contingency-only models, firms may not file protests for properties where data doesn’t suggest an obvious win. They might settle quickly at informal meetings rather than pursuing potentially larger reductions through formal hearings. Most importantly, they cannot tell homeowners definitively whether their tax appraised value is fair because they never complete the full process for challenging cases.

Contingency percentages in the industry can vary significantly, with some firms charging a substantial portion of first-year savings. For a modest reduction, homeowners might pay more than they expect when the percentage is applied.

Hybrid Fee Structures

The best property tax protest companies in Texas combine modest upfront fees with contingency components. This structure creates accountability: paying an upfront amount, even a nominal one, establishes a contractual and financial commitment requiring the company to protest every property through the complete process.

Hybrid arrangements benefit homeowners in several important ways. The upfront fee ensures your property receives professional attention regardless of how the data initially appears. The contingency component maintains alignment between the company’s success and yours. Most importantly, completing every protest through formal hearings when necessary provides the only definitive answer about whether your tax appraised value is accurate and fair. Without going through the entire process, no one can tell you with certainty whether you’re being overtaxed.

Companies charging upfront fees typically offer lower contingency percentages than contingency-only competitors, often resulting in lower overall costs for homeowners who achieve reductions.

Flat Fee Arrangements

Some property tax firms charge flat fees regardless of outcome. This model eliminates uncertainty about costs but removes the incentive for companies to maximize reductions. Flat fees may make sense for commercial properties or complex situations where contingency calculations become unwieldy, but most residential homeowners benefit more from hybrid structures that ensure accountability while aligning incentives.

What 2026 Exemptions Should You Know About Before Hiring Help?

Texas voters approved significant property tax relief measures in the November 2025 election. Understanding these changes helps homeowners evaluate what professional assistance can provide beyond what exemptions already offer.

Enhanced Homestead Exemption

The general residence homestead exemption increased from $100,000 to $140,000 for school district taxes, according to the Texas Comptroller. This exemption applies to all homeowners whose property serves as their primary residence. For a home with a tax appraised value of $400,000, the exemption reduces the taxable value for school district purposes to $260,000.

This change provides meaningful relief, but exemptions alone cannot address whether your underlying tax appraised value is accurate. A $400,000 appraisal that should be $350,000 remains overvalued regardless of exemptions applied.

Senior and Disabled Homeowner Benefits

Proposition 11, also passed in November 2025, increased additional exemptions for homeowners 65 and older or those with qualifying disabilities from $10,000 to $60,000 for school district taxes. Combined with the general homestead exemption, qualifying homeowners now receive up to $200,000 in total exemptions from school district taxation, as reported by Houston Public Media.

For many seniors with modest home values, this combined exemption eliminates school district property taxes entirely. However, other taxing entities like cities, counties, and special districts continue to levy taxes on the full value after any applicable local exemptions.

Why Exemptions Don’t Replace Protests

Exemptions and protests serve different purposes in managing your property tax burden. Exemptions reduce the taxable portion of your property’s value using fixed dollar amounts or percentages. Protests challenge whether the underlying tax appraised value itself is accurate and fair.

Consider a home where the appraisal district assigns a $500,000 tax appraised value. The $140,000 homestead exemption reduces the taxable value to $360,000 for school district purposes. But if comparable sales data supports a $450,000 value instead, the homeowner pays taxes on $50,000 more than they should, and that overvaluation compounds year after year as future assessments build on the inflated baseline.

The best property tax protest companies in Texas help homeowners leverage both tools: ensuring all applicable exemptions are filed correctly while challenging tax appraised values that don’t reflect actual market conditions.

Frequently Asked Questions

Can property tax protest companies guarantee specific savings?

No reputable company can legally guarantee specific savings amounts. Texas law prohibits property tax firms from promising particular results before reviewing your property and completing the protest process. Companies making such promises should raise red flags, as they may be overpromising to win business rather than providing honest assessments. The desired outcome is savings, but the fundamental question underneath is whether you’re being overtaxed, and only the complete protest process can answer that.

Should I protest even if my tax appraised value didn’t increase much?

Yes. Annual protests serve purposes beyond immediate savings, and every homeowner should consider protesting regardless of whether their tax appraised value seems reasonable. The only way to know with certainty that your valuation is fair is to go through the protest process and have the evidence reviewed. Each successful protest also establishes a lower baseline that benefits you in future years. The compounding effect of consistent protests can save thousands over the time you own your home.

How much do property tax protest companies charge?

Fee structures vary widely across the industry. Contingency-only firms typically charge a percentage of first-year savings with no upfront cost. Hybrid models combine modest upfront fees with lower contingency percentages. The total cost depends on your specific situation and the reduction achieved. The key consideration is whether the fee structure ensures your property receives a complete protest through the full process.

What if a property tax protest company doesn’t achieve a reduction?

This depends on their fee structure. Contingency-only firms charge nothing if they don’t achieve a reduction, but they may not have pursued your case through the full process. Companies with hybrid fee structures keep the upfront portion but don’t charge contingency fees if no reduction occurs. The crucial difference is whether you receive a definitive answer about your tax appraised value’s fairness. A company that completes the full protest can tell you with certainty that your valuation is accurate, even if no reduction was achieved.

How do I verify a property tax protest company’s credentials?

The Texas Department of Licensing and Regulation maintains a database of licensed property tax consultants. You can verify licensing status directly on their website. Additionally, ask companies about the experience level of the specific professionals who will handle your case, not just company-wide statistics. Local expertise matters significantly, so inquire about how long their representatives have worked in your particular county.

Take Control of Your Texas Property Taxes

Finding the right property tax protest company requires looking beyond marketing claims to understand what truly matters: commitment to completing every protest through the full process, transparent fee structures that create accountability, local expertise in your county, and licensed professionals who will represent your interests through formal hearings when necessary.

For homeowners seeking professional assistance, Home Tax Shield combines sophisticated technology with experienced local representatives who know your county’s appraisal practices. With an 83% success rate, a commitment to protesting every property through the full process, and fees 40% below industry average, signing up takes just minutes and provides peace of mind that your property taxes reflect what you actually owe.