Texas now offers property tax relief for homeowners whose residences are completely destroyed by fire, plus new exemptions for border county landowners with security infrastructure on their property.

- Proposition 10 creates a temporary exemption so you won’t pay property taxes on a home that no longer exists after a fire

- You have 180 days from the date of the fire to file your application with your county appraisal district

- The exemption is prorated based on how many days remain in the tax year after the fire occurs

- Border county property owners can exempt value increases caused by border security construction under Proposition 17

If your home has been destroyed by fire or you have border security infrastructure on your land, contact your local appraisal district immediately to begin the application process.

A house fire ranks among the most devastating events a family can experience. Beyond the emotional trauma and physical loss, homeowners historically faced an additional burden: paying property taxes on a structure that no longer existed. Texas voters recognized this injustice and overwhelmingly approved Proposition 10 in November 2025. According to the Texas State Senate, the measure received the highest approval of all 17 constitutional amendments at 89%. This new fire damage property tax exemption, implemented through Senate Bill 467, took effect on January 1, 2026.

The timing of this relief couldn’t be more significant. Property values in Texas are assessed as of January 1 each year. Before this exemption existed, if your home burned down on January 2, you would still owe property taxes on the full assessed value for the entire year. As the Dallas Morning News editorial board explained when recommending the measure, this new exemption corrects that fundamental unfairness by ensuring homeowners aren’t taxed on homes that no longer exist.

This guide explains everything Texas homeowners need to know about the fire damage property tax exemption, including qualification requirements, application deadlines, and how the exemption amount is calculated. We’ll also cover Proposition 17, which provides property tax relief for landowners in border counties who have security infrastructure on their property.

What Is the Texas Fire Damage Property Tax Exemption?

The fire damage property tax exemption Texas lawmakers created through Proposition 10 provides temporary relief from property taxation when a residence homestead is completely destroyed by fire. This exemption specifically targets the appraised value of improvements to your property, meaning the structure itself rather than the land it sits on. The goal is straightforward: ensure homeowners aren’t paying taxes on a home that no longer provides them shelter.

According to Ballotpedia’s analysis of the amendment, this exemption differs from existing disaster relief programs because it applies to individual house fires regardless of whether the governor has declared a disaster area. This makes it uniquely accessible to homeowners who experience isolated fire events rather than widespread natural disasters.

Who Qualifies for This Exemption?

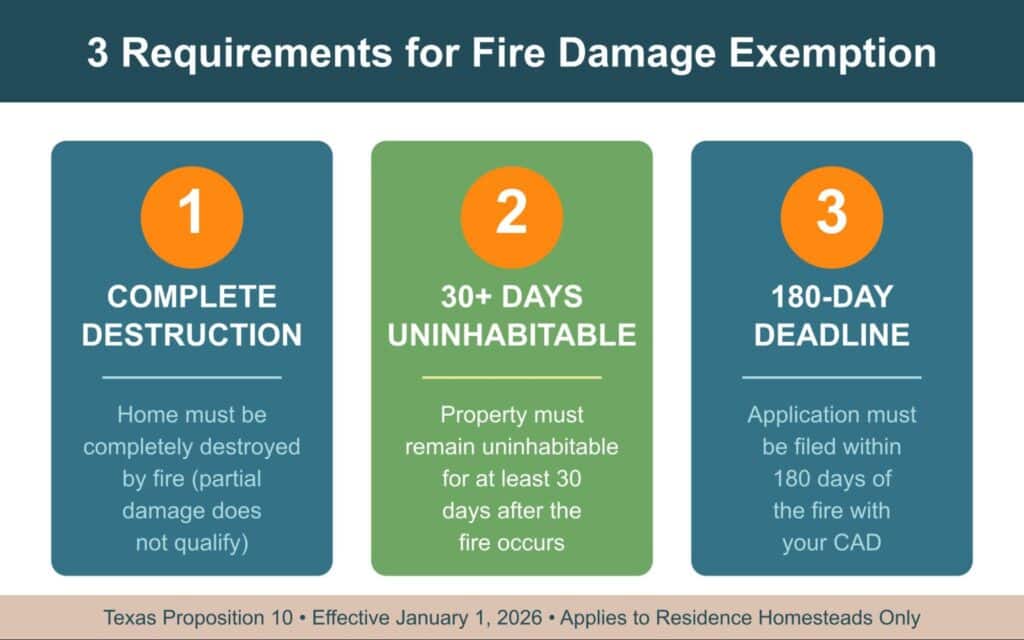

To qualify for the fire damage property tax exemption in Texas, your property must meet three specific conditions established by Senate Bill 467. First, the residence homestead must be completely destroyed by fire. Partial damage, no matter how severe, does not qualify under this provision. Second, the home must have been a habitable dwelling immediately before the fire occurred. Third, the property must remain uninhabitable for at least 30 days after the fire.

The exemption applies only to residence homesteads, which means this relief is available for your primary residence where you have already filed a homestead exemption. Investment properties, rental homes, and second residences do not qualify. If you haven’t yet filed for your homestead exemption, you should do so as soon as possible to ensure you’re protected.

You can only claim this exemption for the tax year in which the fire actually occurs. If your home burns down in December 2026, you would apply for relief on your 2026 property taxes, not the following year.

How Is the Exemption Amount Calculated?

The exemption amount uses a prorated calculation based on when during the tax year the fire occurs. According to the bill analysis from the Texas Legislature, the formula multiplies your home’s appraised improvement value by a fraction: the number of days remaining in the tax year after the fire divided by 365. Fires occurring earlier in the year result in larger exemptions, while fires late in the year provide smaller relief.

For example, if your home with an improvement value of $300,000 is destroyed by fire on March 1, there are 306 days remaining in the tax year. Your exemption would equal $300,000 multiplied by 306/365, or approximately $251,507. You would only owe property taxes on the remaining improvement value for that year, plus any taxes on your land.

If the same fire occurred on November 1 instead, with only 61 days remaining, the exemption would be approximately $50,137. The later timing significantly reduces the relief available, which is why prompt action after a fire is essential.

How Do You Apply for the Fire Damage Tax Exemption in Texas?

The application process requires you to file with the chief appraiser of your county’s appraisal district. You must submit your application no later than 180 days after the date of the fire. Missing this deadline means losing your opportunity for relief entirely, so mark your calendar and gather documentation as soon as safely possible after the event.

The chief appraiser will evaluate whether your property meets all qualification requirements. To make this determination, the appraiser may consult with various sources including county fire marshals, insurance adjusters, or other appropriate authorities. Having your documentation organized will help expedite the review process.

When preparing your application, gather the following materials:

- Fire department incident report documenting the date and extent of the fire

- Documentation showing the complete destruction of the structure

- Insurance claim records if available

- Proof that the property served as your residence homestead before the fire

- Any professional assessments confirming the home remains uninhabitable

Once approved, if you’ve already paid your property taxes for the year, the tax collector must refund the amount by which your payment exceeded the recalculated tax due. If you haven’t yet paid, the assessor will mail you a corrected tax bill reflecting the exemption.

How Does This Differ from Existing Texas Disaster Exemptions?

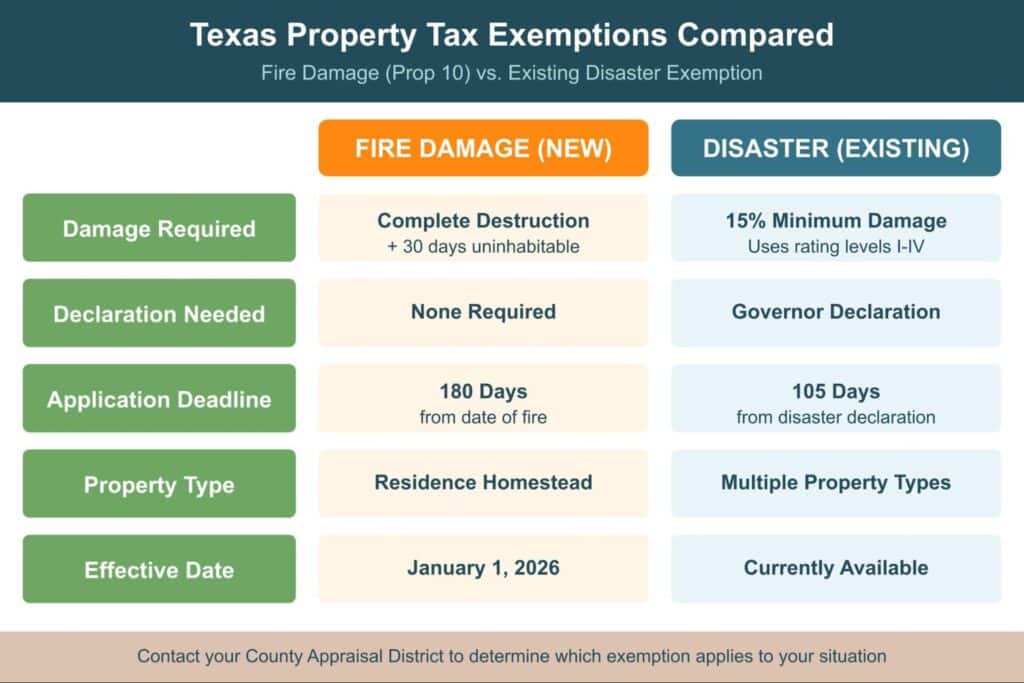

Texas already had property tax relief provisions for properties damaged in governor-declared disaster areas under Tax Code Section 11.35. Understanding the differences between these programs helps homeowners pursue the appropriate relief.

The existing disaster exemption requires your property to be located within a governor-declared disaster area and sustain at least 15% physical damage. The fire damage property tax exemption has no geographic restriction and requires complete destruction rather than partial damage. Here’s how the two programs compare:

Fire Damage Exemption (Proposition 10):

- Applies to any residence homestead completely destroyed by fire statewide

- Requires complete destruction with 30+ days uninhabitable

- 180-day application deadline from fire date

- No governor declaration required

Existing Disaster Exemption (Tax Code 11.35):

- Requires location in governor-declared disaster area

- Applies to properties with at least 15% damage

- 105-day application deadline from governor’s declaration

- Uses damage rating system (Levels I through IV)

The fire damage property tax exemption fills an important gap for homeowners whose fires occur outside declared disaster areas. According to Texas Law Help, the existing disaster provisions have helped many Texans, but individual house fires that don’t trigger emergency declarations left affected homeowners without recourse until now.

What Is the Border Security Property Tax Exemption?

Texas voters also approved Proposition 17 in November 2025, creating a property tax exemption for landowners in border counties whose property values increase due to border security infrastructure construction. This exemption, implemented through House Bill 247, took effect January 1, 2026.

Much of the Texas border with Mexico runs through private property. When the state or federal government installs border security infrastructure on private land, property values may increase. Before this exemption, landowners faced higher property tax bills as a result of cooperating with border security efforts. According to Ballotpedia’s coverage of Proposition 17, House Bill 247 defines border security infrastructure as walls, barriers, fences, roads, trenches, apparatus, or other improvements designed to surveil or impede border crossings.

The exemption applies only to the portion of increased property value attributable to the border security infrastructure. Your existing property value remains fully taxable.

Which Counties Qualify for the Border Exemption?

The border security property tax exemption applies exclusively to properties located in Texas counties that share a border with Mexico. Fourteen Texas counties qualify: El Paso, Hudspeth, Culberson, Jeff Davis, Presidio, Brewster, Terrell, Val Verde, Kinney, Maverick, Webb, Zapata, Starr, and Cameron. If your property is not located in one of these counties, you do not qualify regardless of any border-related activity in your area.

According to the Texas Comptroller of Public Accounts, active border infrastructure construction that could be subject to this exemption is occurring in Cameron, Starr, Zapata, Webb, Maverick, and Val Verde counties.

What Property Improvements Are Covered?

The exemption applies when border security infrastructure is installed under a qualified agreement between you and the state or federal government, or when your land is subject to a recorded easement granted for border security purposes. If you have recently granted an easement or entered an agreement allowing border security construction on your property, contact your county appraisal district to discuss how this exemption applies to your situation.

Frequently Asked Questions About These New Exemptions

Can I claim the fire damage exemption if my home was partially destroyed?

No. The exemption specifically requires that the residence homestead be completely destroyed by fire. Partial damage does not qualify. However, if your partial damage occurred within a governor-declared disaster area, you may qualify for the existing disaster exemption under Tax Code Section 11.35, which has a lower threshold of 15% damage.

Does the fire exemption affect my homestead exemption status?

The fire damage property tax exemption is separate from your general homestead exemption. However, you must have had a homestead exemption in place for the property to qualify. If you’re rebuilding on the same property, Texas law allows you to maintain your homestead exemption during reconstruction under certain conditions, provided you intend to occupy the rebuilt home as your primary residence.

What if I miss the 180-day deadline for the fire exemption?

Missing the deadline means losing your opportunity for this exemption for that tax year. The 180-day requirement is strictly enforced. If a fire destroys your home, prioritize gathering documentation and filing your application as early as possible.

Are these exemptions automatic or do I need to apply?

Neither exemption is automatic. You must proactively apply with your county appraisal district and provide supporting documentation. The chief appraiser will review your application and make a determination based on the evidence provided.

Protect Your Property Tax Bill Every Year

These new exemptions represent important protections for Texas homeowners facing specific hardships. The fire damage property tax exemption ensures families rebuilding after tragedy aren’t burdened with unfair tax obligations. The border security exemption protects landowners who cooperate with government security efforts.

However, exemptions are just one piece of lowering your property taxes. Every Texas homeowner should also consider protesting their property’s tax appraised value annually to ensure they’re paying a fair amount. This applies even when your tax appraised value doesn’t seem unreasonably high. The only way to truly know whether your property is fairly valued is to go through the entire protest process and have experienced eyes review your specific situation.

With the $140,000 homestead exemption now in effect and the additional $60,000 exemption available for seniors and disabled homeowners, combining exemptions with annual protests creates the most effective strategy for managing your property tax burden.

When choosing professional help for your property tax protest, look for a company with local, experienced representatives who will take your case through the entire process. Be cautious of firms that promise specific savings amounts before reviewing your property, as no one can guarantee results until they’ve completed a thorough analysis. The most transparent approach combines a modest upfront fee with a percentage of any savings achieved, ensuring the company is committed to representing you fully rather than cherry-picking only cases with obvious reduction potential.

Home Tax Shield employs local tax professionals with an average tenure of 18 to 22 years who protest every property through the complete process. This commitment to a 100% attempt rate means you’ll know with certainty whether your tax appraised value is fair. Get started today and let Home Tax Shield ensure you’re not paying more than you should.