Protesting your property taxes every year remains essential for Texas homeowners, but doing it yourself comes with significant risks that can cost you money.

- DIY protesters may miss critical deadlines, submit weak evidence, or fail to properly adjust comparable properties

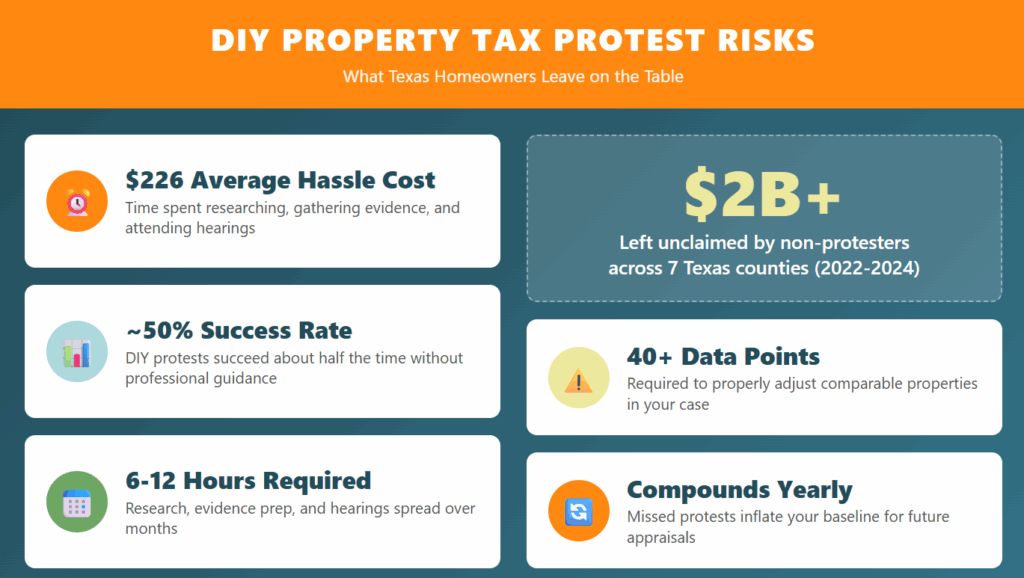

- Research shows the average “hassle cost” of a DIY protest is approximately $226 in time and effort, while success rates hover around 50%

- Texas homeowners who skip protesting left over $2 billion in potential savings on the table across seven major counties over three years

- Annual protesting creates compounding savings and prevents your market value from climbing unchecked

Even with new exemption increases taking effect in 2026, protesting your property’s market value remains your most powerful tool for keeping taxes fair.

Texas homeowners face some of the highest property tax burdens in the nation, making the annual protest process a critical opportunity to ensure you’re paying only your fair share. Yet many homeowners attempt to navigate this complex system without professional guidance, often discovering too late that DIY property tax protest risks can undermine their efforts and leave significant savings unclaimed.

The appeal of handling your own protest is understandable. Filing is free, and the process appears straightforward on paper. However, research from UC Berkeley’s Haas School of Business found that the average hassle cost of filing a protest yourself runs approximately $226 when you factor in time spent researching, gathering evidence, and attending hearings. When you consider that only about half of all protests succeed, the math becomes less favorable for DIY approaches.

What Are the Biggest DIY Property Tax Protest Risks?

The property tax protest process involves multiple steps, strict deadlines, and specific evidentiary requirements that trip up even well-intentioned homeowners. DIY property tax protest risks fall into several categories, from procedural missteps to fundamental misunderstandings about what the Appraisal Review Board actually considers.

Perhaps the most significant risk involves the complexity of building a proper case. County appraisal districts use mass appraisal methods to value thousands of properties at once, which is exactly why overvaluations occur. To effectively challenge your market value, you need to analyze over 40 different data points and make proper adjustments for factors like square footage, lot size, construction quality, and neighborhood characteristics. When homeowners attempt to argue their case without understanding this methodology, they often present evidence that weakens their position rather than strengthening it.

Why Do Texas Homeowners Attempt DIY Protests?

Several factors drive homeowners to handle protests themselves rather than seeking professional assistance. The most common motivations include cost concerns, a belief that the process is simple enough to manage independently, and general distrust of paying for services they think they can replicate.

Texas law makes filing a protest remarkably accessible. You can submit a Notice of Protest online, by mail, or in person at your county appraisal district. The filing itself costs nothing, and the Texas Comptroller’s office provides guidance on the process. This accessibility creates the impression that success is equally attainable without professional help.

However, accessibility and effectiveness are different things entirely. The same Berkeley Haas research mentioned above found that in Dallas County, only about 8% of households filed protests on their own. Among those who do file, success rates vary dramatically based on the quality of evidence presented and understanding of the system.

What Tax Protest Mistakes Lead to Failure?

Understanding where DIY protests commonly fail can help you avoid these pitfalls. The most damaging tax protest mistakes tend to fall into predictable patterns.

Missing the Filing Deadline

The most fundamental error is simply missing the deadline to file. In Texas, you must submit your protest by May 15 or within 30 days of receiving your Notice of Appraised Value, whichever comes later. This deadline is absolute. Miss it by even one day, and you forfeit your right to challenge your property’s market value for the entire tax year.

Many homeowners don’t realize that the 30-day countdown begins when the appraisal district mails your notice, not when you receive it. Setting calendar reminders and treating this deadline as non-negotiable is essential.

Presenting Weak or Irrelevant Evidence

Walking into an ARB hearing and simply stating that your taxes are too high accomplishes nothing. The Appraisal Review Board evaluates evidence, not opinions or emotional appeals. A DIY protest fail often occurs when homeowners show up with nothing more than frustration and a vague sense that their market value seems wrong.

Effective protests require recent sales data for truly comparable properties, properly adjusted to account for differences between your home and the comparables. The Texas Real Estate Research Center at Texas A&M emphasizes that arguments about tax rates, your ability to pay, or dissatisfaction with local services are completely irrelevant to the ARB’s decision. They only consider whether your property’s market value is accurate and fair.

Selecting Inappropriate Comparable Properties

One of the most technical aspects of protesting taxes alone involves identifying and properly adjusting comparable sales. Many homeowners make the mistake of looking at nearby homes that sold recently without understanding that these comparisons require mathematical adjustments.

A home down the street might have sold for less than your market value, but if it has fewer bedrooms, a smaller lot, or lacks features your home has, raw sales prices tell an incomplete story. When homeowners present unadjusted comparisons, they often inadvertently support the district’s valuation rather than challenging it. This is why experienced tax professionals who understand how to make these adjustments property by property consistently outperform DIY efforts.

Arguing About the Wrong Things

The ARB hearing is specifically about your property’s market value. It’s not a forum for complaining about rising tax rates or describing your personal financial circumstances. Tax protest mistakes frequently involve homeowners spending their limited hearing time on irrelevant issues while failing to present factual evidence that challenges whether their market value is fair.

Not Showing Up to the Hearing

Some homeowners file a protest and then fail to appear at their scheduled ARB hearing. In most cases, this results in automatic dismissal. This is one reason why working with local professionals who actually attend hearings on your behalf matters. If scheduling conflicts make attendance impossible and you’re representing yourself, Texas law allows you to designate a representative, submit a written affidavit, or request a telephone or video hearing in many counties.

The Hidden Costs of Protesting Taxes Alone

Beyond the obvious risks of an unsuccessful protest, DIY property tax protest risks include several hidden costs that homeowners often overlook.

- Time investment: Researching comparable sales, gathering evidence, and attending hearings typically requires 6 to 12 hours spread across several months

- Opportunity cost: Hours spent on protest preparation could be devoted to work, family, or other activities

- Learning curve mistakes: First-time protesters often make errors that compromise their case

- Compounding consequences: An unsuccessful protest allows a potentially inflated market value to become the baseline for future appraisals, potentially costing thousands over time

The compounding effect deserves special attention. When you successfully reduce your property’s market value, that lower figure becomes the starting point for next year’s appraisal. Over time, consistent protesting can dramatically reduce your cumulative tax burden compared to homeowners who accept whatever value the district assigns.

This is also why you should be cautious of any company that promises specific savings amounts before completing a protest. No one can guarantee a particular reduction, and making such promises is actually illegal in Texas. What matters is having experienced professionals who will take your case through the entire protest process every single year, giving you a definitive answer about whether your market value is fair.

Does Protesting Still Matter After the 2025 Exemption Changes?

Texas voters approved significant property tax relief measures in November 2025 that take effect January 1, 2026. Proposition 13 increased the homestead exemption for school district taxes from $100,000 to $140,000, while Proposition 11 raised the additional exemption for homeowners 65 and older or disabled from $10,000 to $60,000. Together, eligible seniors and disabled homeowners can now receive up to $200,000 in total exemptions.

These changes represent meaningful relief, with estimates suggesting the average homeowner will save approximately $490 annually from the increased homestead exemption alone. However, exemptions and protests serve different purposes in your property tax strategy.

Exemptions reduce your taxable value by a fixed amount regardless of your home’s market value. Protesting challenges whether that market value is accurate in the first place. If your home is overvalued by $50,000, you’re still overpaying even with generous exemptions applied. The two strategies work together, and both remain essential.

Additionally, exemptions only apply to your primary residence. Investment properties and rental homes don’t qualify for homestead protections, making protests even more critical for those properties.

Frequently Asked Questions

Can my property’s market value increase if I protest and lose?

No. Texas law prohibits the appraisal district from raising your value during the protest process. The worst outcome is that your market value stays the same as originally proposed. There is no penalty for filing a protest, which is why protesting annually makes sense every single year.

Should I only protest if my value increased significantly?

No. You should protest every year regardless of how much your value changed. Even if your market value seems reasonable, the only way to know for certain that it’s fair is to go through the full protest process. Small reductions also compound over time, and successfully lowering your value establishes a lower baseline for future appraisals.

What if I discover errors in my property records?

Errors in square footage, bedroom count, or other property characteristics should be corrected by contacting your county appraisal district directly. You can typically submit a form or call the CAD to fix factual errors without filing a formal protest. Protesting is specifically for challenging whether your market value is accurate and fair.

Protect Your Property Taxes the Right Way

DIY property tax protest risks are real, but they shouldn’t discourage you from protesting entirely. Annual protests remain the most effective way to ensure you’re paying only your fair share of property taxes, whether you file yourself or work with professionals who understand the system’s complexities.

The key is recognizing what you’re up against. Appraisal districts employ trained professionals who build cases using sophisticated methodologies and comprehensive data. Matching their preparation requires significant time, knowledge, and access to information that homeowners often lack. Some protest companies only pursue cases where they see obvious reduction potential, meaning your property might never actually get protested even if you signed up.

Home Tax Shield takes a different approach, combining technology and data science with experienced local tax professionals who protest every property, every year. Their hybrid fee structure ensures your case goes through the entire process, giving you a definitive answer about whether your market value is fair. With an 83% success rate and a commitment to representing you at every hearing, they ensure you never overpay while saving you the time and stress of navigating the system alone. Get started today and let the experts fight for a fair value on your property.