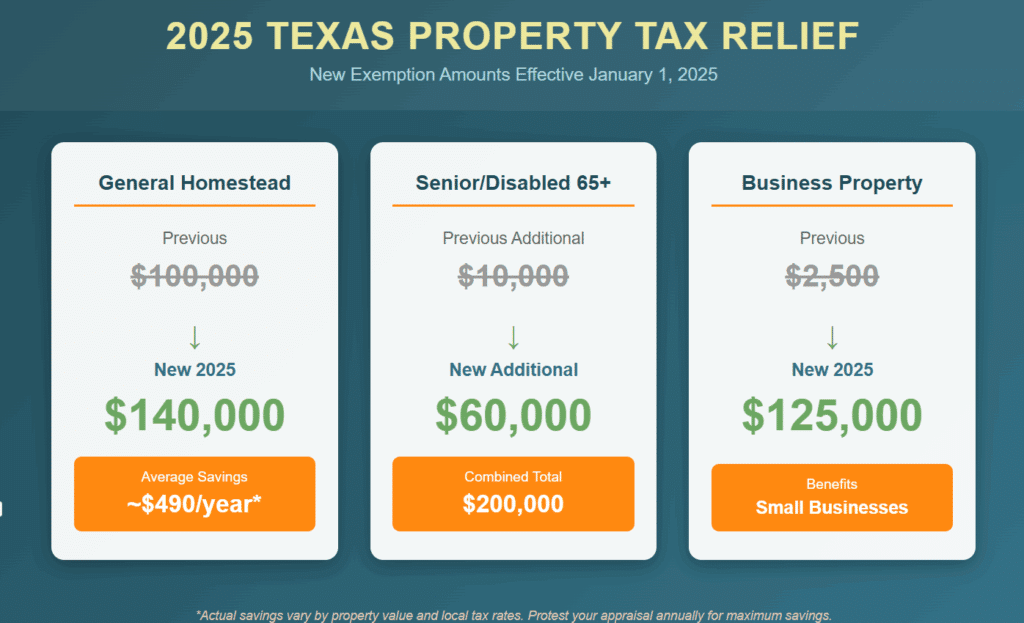

Texas voters approved historic property tax relief measures that increase exemptions and could lower tax bills starting in 2025.

- Homestead exemption rises from $100,000 to $140,000, with estimated average savings of approximately $490 annually according to state lawmakers

- Senior and disabled exemption jumps from $10,000 to $60,000, potentially totaling up to $200,000 in combined exemptions

- Business personal property exemption increases from $2,500 to $125,000

- While these changes provide exemption relief, protesting your tax appraised value remains a separate and essential strategy for ensuring you pay only what’s fair

On November 4, 2025, Texas voters overwhelmingly approved all 17 constitutional amendments on the ballot, including several property tax propositions in Texas that directly impact property tax relief for homeowners. The results mark one of the most significant property tax reform efforts in recent Texas history, with homestead exemption increases and expanded relief for seniors, disabled homeowners, veterans’ families, and small businesses.

According to reporting from the Texas Tribune, these amendments passed with comfortable margins, each receiving at least 83% voter approval. Understanding what these changes mean for your specific situation requires looking beyond the headlines to examine how each provision works, when you might see potential benefits, and why exemptions alone don’t guarantee you’re paying a fair property tax bill.

What Is the Property Tax Proposition in Texas That Voters Just Approved?

The centerpiece of the November 2025 ballot measures is Proposition 13, which raises the mandatory homestead exemption for school district property taxes from $100,000 to $140,000. This amendment builds on the relief package passed in 2023, when voters increased the exemption from $40,000 to $100,000.

The property tax proposition in Texas received widespread bipartisan support, with state lawmakers emphasizing the need to help homeowners manage rising tax burdens. According to statements from Lieutenant Governor Dan Patrick’s office following the Senate’s passage of the enabling legislation, approximately 492 school districts across Texas (about 49% of Texas school districts) have average home values under $140,000, meaning homeowners in those districts could potentially see their school property taxes eliminated entirely.

The passage of this amendment represents more than just a numerical increase. By embedding these exemption levels into the Texas Constitution, voters ensured that future legislatures cannot easily reduce these protections. This permanence provides homeowners with long-term certainty about their exemption levels, though it also raises questions about how the state will continue funding public education as more property value becomes exempt from taxation.

How Will the Increased Homestead Exemption Affect Your Tax Bill?

Understanding the $140,000 Exemption

The $140,000 homestead exemption works by removing that amount from your home’s taxable value when calculating school district taxes. This means you pay school taxes as if your home were worth $140,000 less than its tax appraised value. For a home valued at $400,000, the school district would only tax $260,000 of that value. Since school district taxes typically account for a significant portion of a homeowner’s total property tax bill, this exemption can deliver meaningful savings for qualifying homeowners.

The actual dollar amount any individual homeowner might save depends on several factors, including their local school district’s tax rate and whether the exemption was already in place. According to Senator Paul Bettencourt, the author of the legislation, the average homeowner could see estimated annual savings of approximately $363 from the exemption increase alone. When combined with school tax rate compression measures also funded by the state, the Texas Tribune reported that total savings could reach approximately $490 annually for the average Texas homeowner.

However, these are averages based on statewide calculations. Your individual savings will vary based on your home’s value, your specific school district tax rate, and other local factors. Homeowners in districts with higher tax rates may see greater savings, while those in lower-rate districts might see less.

What Do the Texas Property Tax Breaks Mean for Seniors and Disabled Homeowners?

Proposition 11 represents an equally significant change for qualifying homeowners, raising the additional school property tax exemption for those aged 65 or older or living with disabilities from $10,000 to $60,000. This sixfold increase delivers targeted relief to populations most likely to be on fixed incomes. When combined with the general homestead exemption increased by Proposition 13, eligible seniors and disabled homeowners could receive up to $200,000 in total exemption value from school district taxes.

The New $60,000 Additional Exemption

Consider what this might mean in practical terms. A 68-year-old homeowner with a home valued at $350,000 would have their school district taxable value reduced to $150,000 after applying both exemptions.

The actual tax savings would depend on that homeowner’s specific school district tax rate. For seniors whose homes are valued at $200,000 or less, the combined $200,000 exemption could potentially eliminate school district property taxes entirely, though they would still owe taxes to other local entities such as counties, cities, and special districts.

These Texas property tax breaks also maintain the tax ceiling provision, which freezes school district taxes at the amount owed in the year the homeowner qualified for the over-65 or disabled exemption. This means seniors not only receive larger exemptions but also protection from future school tax increases, regardless of how much their property value rises. The expanded exemptions for seniors represent a substantial commitment to helping elderly Texans age in place without being forced from their homes by property tax burdens.

It’s worth noting that while these exemptions provide valuable relief, they address the taxable value portion of the property tax equation. They don’t affect whether the county’s appraised value of your home is accurate. Even with generous exemptions, a homeowner with an inflated tax appraised value still pays more than they should.

Which Other Property Tax Propositions Passed in November 2025?

Beyond the major homestead exemption increases, several other property tax measures received voter approval:

Proposition 7 extends property tax exemption eligibility to surviving spouses of veterans who died from service-connected conditions or diseases presumed related to their service. Previously, the exemption required the veteran to have died while on active duty. This expanded definition provides relief to families who lost loved ones to conditions that developed after their service ended.

Proposition 9 dramatically increases the business personal property exemption from $2,500 to $125,000. This change benefits small businesses by exempting equipment, inventory, and other tangible business property from taxation by all local entities. According to CBS Texas, this measure impacts how businesses calculate their property tax obligations, though actual savings will vary based on the value of business property and local tax rates.

Proposition 10 creates a temporary property tax exemption for homeowners whose residences are completely destroyed by fire. To qualify, the home must be uninhabitable for at least 30 days following the fire. This provision prevents homeowners from paying taxes on property that no longer exists while they work to rebuild.

Proposition 17 addresses a unique situation along the Texas-Mexico border, preventing property tax increases that result from the installation of border security infrastructure on private property. Homeowners whose land is affected by such construction won’t see their tax bills increase due to improvements they didn’t choose or benefit from directly.

Each of these measures reflects the Texas Legislature’s response to specific constituent concerns and demonstrates ongoing efforts to address various property tax scenarios.

When Do These Texas Constitutional Amendment Property Tax Changes Take Effect?

One of the most important aspects of Texas’ 2025 homestead exemption changes is their retroactive application. According to the ballot language and implementing legislation, the increased exemptions take effect for the tax year beginning January 1, 2025, meaning homeowners should see benefits on tax bills due in early 2026. This retroactive implementation provides more immediate relief rather than making homeowners wait another full year for potential savings to materialize.

For homeowners who have already paid their 2025 property taxes through escrow accounts or direct payments, the exact mechanism for receiving credits or adjustments will vary by county. Most appraisal districts should automatically adjust exemption amounts for homeowners who already have homestead exemptions on file. If you’ve filed for your exemption previously, you typically shouldn’t need to reapply to receive the increased benefits. However, verifying that your exemption is active and correctly applied remains important.

The Texas property tax proposition timeline works as follows:

- County appraisal districts are currently recalculating taxable values to reflect the new exemption amounts.

- These adjusted values will appear on property tax bills, which are typically mailed in November for payment by January 31 of the following year.

- Homeowners should expect to see the exemption changes reflected on their next tax bill.

Why Property Tax Protests Remain Essential Even With New Exemptions

The new exemption increases are valuable, but they address only one part of the property tax equation. Exemptions reduce your taxable value by automatically subtracting a set amount from your home’s tax appraised value. Property tax protests, on the other hand, challenge whether that underlying tax appraised value is accurate and fair in the first place. These are two completely separate mechanisms that work independently of each other.

Here’s the critical distinction: your county appraisal district determines your home’s market value each year through mass appraisal processes. That appraised value becomes the starting point for all tax calculations. Exemptions then reduce your taxable value by subtracting the exemption amount from the tax appraised value. If your tax appraised value is inflated, you’re still paying taxes on an amount higher than what’s fair, even after exemptions are applied.

Consider this example: Your county appraises your home at $450,000, but based on actual comparable sales and your property’s specific conditions, a fair value might be $400,000. With the $140,000 homestead exemption, your school taxable value is $310,000 on the inflated appraisal versus $260,000 on the accurate appraisal. That $50,000 difference affects not just school taxes but potentially other taxing entities that may offer smaller or no exemptions.

The relationship between exemptions and protests is complementary, not overlapping. Exemptions provide automatic, guaranteed reductions to your taxable value. Protests give you the opportunity to challenge and potentially correct an inaccurate appraised value.

When you successfully protest and the appraisal review board agrees that your property should be valued lower, you create benefits that compound over time because each year’s appraisal uses previous years as a baseline.

Additionally, your home’s tax appraised value stays on record regardless of exemptions. If you ever lose your homestead exemption through sale, inheritance, or change in residence status, your property taxes immediately jump to the full tax appraised value. Years of unchallenged appraisal increases can result in significant tax bill increases. Annual protests help keep that tax appraised value aligned with actual market conditions, protecting you both now and in potential future scenarios.

The homestead cap limits annual taxable value increases to 10% for qualifying homeowners, but this cap only affects taxable value, not tax appraised value. Your tax appraised value can increase by any amount each year. Protesting keeps that appraised value in check, which ultimately affects your long-term tax burden regardless of exemption status.

Frequently Asked Questions About the New Property Tax Laws

How do I apply for the increased homestead exemption amount?

If you already have a homestead exemption on file with your county appraisal district, the increased exemption amount should be automatically applied to your account. However, you must respond to any verification notices your county sends you. According to Texas Senate Bill 1801, which took effect in 2023, appraisal districts now must verify homestead exemption eligibility at least once every five years. If you receive a verification letter from your county appraisal district, you must respond by the deadline stated in the letter or risk losing your exemption. If you’ve never filed for homestead exemption, you’ll need to submit an application to your county appraisal district. Texas law allows you to apply at any time during the year, though filing by April 30 ensures the exemption applies to the current tax year. Visit your county appraisal district’s website or office to obtain Form 50-114.

Will my property taxes automatically decrease with these new exemptions?

Your school district property taxes should decrease due to the increased exemption amount, assuming you have a qualifying homestead exemption in place. However, your total property tax bill includes taxes from multiple entities such as counties, cities, hospital districts, and special districts. These other entities may have their own exemption policies, and their tax rates could increase independently. The school portion typically represents a significant share of your bill, so you should see some benefit there, but other factors can affect your overall tax obligation. Additionally, if your tax appraised value increased significantly, those increases could offset some exemption savings.

What if I’m already over 65 and have existing exemptions?

Homeowners who already qualify for the over-65 exemption should automatically receive the increased $60,000 amount without needing to reapply. Your county appraisal district should update your records to reflect the new exemption level. Combined with the general homestead exemption increase to $140,000, you could receive a total of $200,000 in school district tax exemptions. Your tax ceiling, which froze your school taxes at the amount when you first qualified, may be recalculated based on these new, lower values.

Do these exemptions affect my property’s tax appraised value?

No. Exemptions only affect your taxable value, which is the number used to calculate your tax bill. Your property’s market value and tax appraised value remain unchanged by exemptions. This distinction is crucial because the tax appraised value stays on record and affects future calculations. Only through the property tax protest process can you challenge and potentially lower your home’s tax appraised value. Exemptions and protests are separate tools that each serve different purposes in managing your property tax burden.

Take Action to Maximize Your Property Tax Benefits

The 2025 property tax proposition in Texas delivers meaningful exemption relief to homeowners across the state, with increased exemptions that could provide savings for qualifying homeowners. Seniors and disabled homeowners see even greater potential benefits through the expanded additional exemptions. However, these exemptions represent just one tool in managing your property tax burden effectively.

A comprehensive approach to property taxes requires attention to both exemptions and tax appraised value accuracy. Exemptions provide automatic reductions to your taxable value, but only protests address whether your county’s appraisal of your home reflects actual market conditions. The two strategies work independently: exemptions reduce what portion of your value gets taxed, while protests challenge whether that value is correct to begin with.

Ensuring you have all qualifying exemptions properly filed is an important first step. Equally important is understanding that your home’s tax appraised value deserves scrutiny each year. Appraisal districts use mass appraisal techniques that can miss property-specific factors affecting value. Errors happen, market conditions change, and properties have unique characteristics that generic calculations might overlook.

For Texas homeowners who want professional representation in challenging their tax appraised values, Home Tax Shield offers experienced, licensed, and local tax professionals who understand property valuation complexities and represent homeowners at hearings to help ensure fair assessments. We handle the entire protest process, from gathering evidence to presenting cases before appraisal review boards, providing homeowners with knowledgeable advocacy in a process that can be time-consuming and complex to navigate alone. Sign up today to effortlessly ensure your tax appraised value is fair, year after year.