Many Texas property tax protests fail due to preventable mistakes rather than legitimate market value disputes.

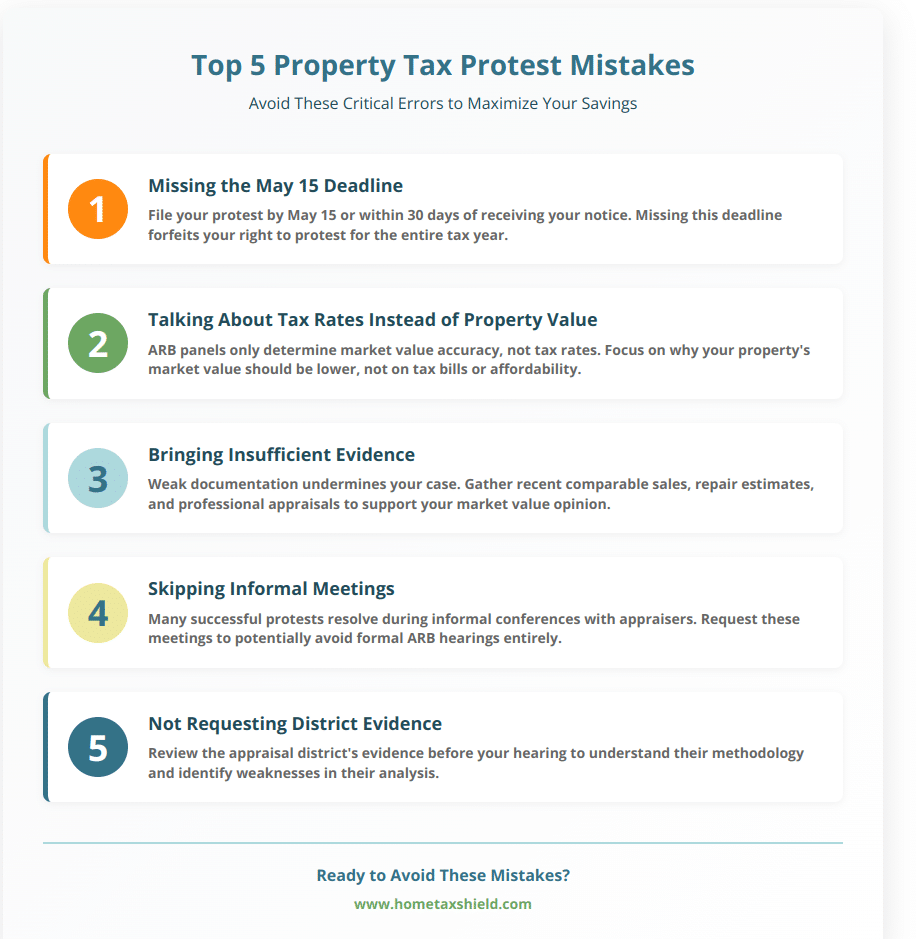

- Missing the May 15th deadline is the most costly error—file protests early to avoid forfeiting your rights

- Talking about taxes instead of property value confuses ARB panels who only determine market value, not tax rates

- Using insufficient or improper evidence weakens your case. Gather recent comparable sales data (properly adjusted) and repair estimates

- Skipping informal meetings eliminates your best chance for quick resolution before formal hearings

- Failing to document damage, deferred maintenance, or condition issues means missing legitimate value reductions. Property problems existing as of January 1st should lower your market value if properly documented with photos and repair estimates

Bottom line: Professional preparation and understanding ARB procedures dramatically improve your odds of reducing your property’s tax appraised value.

Texas homeowners received a collective shock in 2025 as property values continued climbing across major counties. The median Texas homeowner’s tax bill rose nearly 30% from 2010 to 2023, nearly three times as fast as the country as a whole. With recent legislative changes including the increased homestead exemption to $140,000 for school district taxes, many property owners still find themselves facing higher appraisals that outpace these relief measures.

Understanding common protest property taxes mistakes can mean the difference between thousands in property tax savings and a missed opportunity. Roland Altinger, the chief appraiser for the Harris Central Appraisal District (HCAD), said in recent years it has settled more than 500,000 protests on an annual basis. While this number is promising, many protests fail due to avoidable errors rather than legitimate disputes over market value.

What Are the Biggest Property Tax Protest Mistakes?

Property tax professionals and ARB members consistently see the same errors year after year, many of which are entirely preventable with proper preparation and understanding of the process.

When homeowners protest property taxes, mistakes range from simple procedural oversights to fundamental misunderstandings about what ARB panels actually evaluate. Learning to avoid these common pitfalls can dramatically improve your chances of achieving a successful protest outcome.

1. Missing Filing Deadlines

Why this is critical: In most cases, you have until May 15 or 30 days from the date the appraisal district notices are delivered — whichever date is later, according to Texas Comptroller guidance. Missing this deadline forfeits your right to protest for the entire tax year, regardless of how overvalued your property might be.

How to avoid it: Mark your calendar immediately upon receiving your Notice of Appraised Value, typically sent by April 1 for homestead properties. Set multiple reminders and file early to avoid last-minute technical issues with mail or online systems.

2. Talking About Tax Rates Instead of Property Value

The mistake: The mistake: Many homeowners arrive at ARB hearings complaining about high tax bills or unaffordable increases. This immediately derails the process because ARB panels have no authority over tax rates or tax policy—they only determine whether your property’s market value is accurate.

What ARBs actually decide: The Appraisal Review Board only determines whether your property’s tax appraised value is accurate and fairly assessed compared to similar properties. They have no authority over tax rates, exemptions, or your ability to pay.

The fix: Focus your presentation entirely on market value evidence. Avoid phrases like “my taxes are too high” or “I can’t afford this increase.” Instead, present data showing why your property’s market value should be lower.

3. Insufficient or Improper Evidence

Many homeowners arrive at hearings with weak documentation that undermines their case. Property tax professionals emphasize keeping evidence and arguments strictly focused on facts supporting your opinion of your home value. These property tax appeal errors often stem from misunderstanding what constitutes compelling evidence to ARB panels.

What doesn’t work:

- Screenshots from real estate websites

- Comparing to neighbor properties without proper adjustments

- Personal financial hardship stories

- Complaints about previous year’s increases

Strong evidence includes:

- Recent sales of truly comparable properties within your area

- Professional repair estimates for structural issues

- Independent appraisals from certified appraisers

- Documentation of property condition problems affecting value

4. Skipping Informal Meetings

Not all central appraisal districts (CADs) offer informal review. If you receive a settlement offer that is acceptable, it is typically best to sign it before the ARB hearing date and forego the formal hearing. Many successful protests can be resolved during these preliminary discussions.

Why informal meetings matter: County appraisers have settlement authority and can adjust values without the formality of ARB hearings. These meetings also give you insight into the district’s evidence and methodology.

Best practice: Always request an informal conference when filing your protest. Prepare as thoroughly for this meeting as you would for a formal hearing.

5. Not Requesting Appraisal District Evidence

Property tax experts recommend reviewing the district’s evidence before preparing your case, in order to see what you’re up against. A property owner is entitled to see a copy of the information the appraisal district plans to introduce at your appraisal review board hearing.

The oversight: Many homeowners prepare their case in a vacuum without understanding how the district determined their property’s value.

Strategic advantage: Reviewing the district’s comparable sales, adjustments, and methodology helps you identify weaknesses in their analysis and strengthen your counter-argument.

6. Improper Property Comparisons

Critical error: Attempting to use neighboring properties as comparables without understanding how appraisal adjustments work. Property tax appraisal considers 40 different data points and adjusts each one for differences between properties.

Why this fails: What appears to be a “similar” house may have significant differences in square footage, lot size, age, condition, or features that justify different values.

Better approach: Use properly adjusted sales data from certified appraisers or understand how to make accurate adjustments for differences in property characteristics.

7. Poor Hearing Presentation

ARB panels evaluate current market value, not historical changes or trends. Focusing on how much your value increased from last year distracts from the core question: what should your property be worth as of January 1 of the current tax year. The board’s job is determining accurate current market value, regardless of previous assessments.

Presentation mistakes:

- Getting emotional or argumentative

- Overwhelming the board with irrelevant information

- Failing to bring sufficient copies of evidence

- Not practicing your 15-minute presentation

Effective presentation: Be concise, factual, and organized. Bring copies for each board member plus the district representative. Lead with your strongest evidence.

8. Filing Frivolous Protests

What doesn’t qualify: Minor increases consistent with market trends, personal disagreement with tax policy, or inability to afford current taxes are not valid grounds for reducing market value.

Valid grounds for protest:

- Market value exceeds what your property would actually sell for

- Unequal appraisal compared to properly adjusted comparable properties

- Errors in property characteristics that affect value

- Failure to account for property damage or deterioration

Understanding what constitutes good reasons to protest helps homeowners focus their efforts on legitimate valuation issues rather than policy disagreements.

9. Not Understanding the Process Timeline

Common confusion: While everyone calls the process ‘protesting your property taxes,’ it’s important to draw back the curtain and understand that that’s not quite what’s happening. The process actually protests the appraisal district’s determination of your property’s market value. This market value becomes the foundation for calculating your final tax bill, which is why the protest must happen long before you receive your actual tax statement.

Timeline awareness: As discussed earlier, the protest filing deadline of May 15th occurs months before you receive your actual tax bill in October. You’re protesting the proposed market value, not the final tax amount. By the time you get your October tax bill, the protest window has long closed and you’re locked into whatever market value was determined during the spring protest period.

10. Choosing the Wrong Professional Service Model

The oversight: Many homeowners assume all property tax services operate the same way, but fee structures significantly impact the quality of representation you receive.

Percentage-only problems: Companies that charge only a percentage of savings may cherry-pick cases with obvious large returns while providing minimal effort to properties with less apparent potential. They have no financial incentive to pursue comprehensive protests and ensure a fair taxable value for every client.

Hybrid model advantage: The most effective approach combines a modest upfront fee to cover a full protest, with a percentage of achieved savings. This ensures your protest receives full professional attention through the entire process, since determining true savings potential requires completing the full protest procedure. The upfront commitment guarantees comprehensive representation regardless of initial prospects.

How Can You Avoid These Property Tax Appeal Errors?

Research Thoroughly

Successful protests require understanding your local market conditions and recent sales activity. The May 15th protest deadline gives you several weeks to gather compelling evidence after receiving your notice. Experience consistently shows the importance of thorough preparation over rushed submissions.

Verify property records first: Before protesting, check the appraisal district’s records to ensure your property description, square footage, lot size, and features are accurate. While record errors aren’t part of your protest, they should be corrected by contacting your CAD directly to ensure accurate baseline data for your case.

Professional property tax consultants have access to Multiple Listing Service (MLS) data and understand how to make proper adjustments for property differences. This expertise often proves valuable for complex cases or high-value properties.

Prepare Professional Documentation

ARB members review dozens of cases daily and appreciate well-organized, factual presentations. Create a clear summary of your position supported by relevant evidence and avoid emotional appeals or irrelevant information.

Key documentation:

- Recent comparable sales within your area

- Professional repair estimates for any property issues

- Photographs documenting property condition to support estimates

- Independent appraisals if available

Practice Your Presentation

The ARB can consider the effect general economic and environmental factors may have on your property value, but it cannot take into account your personal economic situation. Focus on market-based arguments and practice delivering them concisely.

Most hearings allow 15 minutes for your presentation, so practice staying within time limits while covering your essential points. Avoiding these common mistakes when protesting property taxes and presenting your case can significantly improve your outcome.

Consider Professional Help

The complexity of property tax law and appraisal methodology can overwhelm even educated homeowners. Professional property tax consultants understand local procedures, have relationships with appraisal staff, and know how to present compelling cases.

The best professional services use a hybrid approach with a modest upfront fee plus a percentage of savings achieved. This model ensures your protest receives full attention through the entire process, since you can’t determine potential savings without completing the full protest—and every protest counts, keeping your tax bill at its lowest and compounding your savings over time. Learn more about how to file a successful protest to understand the full scope of what’s involved.

What Should You Know About ARB Hearings?

Hearing Procedures

Property owners or their authorized representatives are not required to use the notice of protest form to request a protest hearing. A notice of protest is sufficient if it identifies the property, property owner and any subject that indicates a level of dissatisfaction with a decision made by the appraisal district in writing.

The hearing follows a structured format where you present evidence first, followed by the appraisal district’s response. Board members may ask questions to clarify technical aspects of your case.

What ARB Members Look For

ARB panels consist of local citizens trained in property tax law who evaluate whether the appraisal district followed proper procedures and reached reasonable conclusions about market value. They expect factual evidence supporting your opinion of value and want to understand specific reasons why the district’s appraisal may be incorrect or unfair.

Making Your Case

Present your evidence logically, starting with your opinion of correct market value and supporting it with comparable sales data, property condition issues, or other relevant factors affecting value.

Be prepared to answer questions about your evidence and explain how it supports your conclusions about appropriate market value.

Take Control of Your Property Taxes

Understanding and avoiding common protest property tax mistakes can save Texas homeowners thousands of dollars annually. The key lies in proper preparation, understanding ARB procedures, and presenting factual evidence supporting your market value opinion.

Remember that the deadline each year is May 15, and preparation should begin immediately upon receiving your Notice of Appraised Value (or earlier, by gathering data early in the year). Whether you choose to handle the process yourself or work with professionals, proper procedure and avoiding these critical mistakes significantly improves your chances of achieving a fair property valuation. Appraisal districts must use standardized procedures for property valuations, making understanding the overall process crucial for successful protests.

Don’t let preventable errors cost you money on your property taxes. Learn more about the protest process and ensure you’re paying only your fair share. Ready to get started with professional property tax protest services? Contact Home Tax Shield to learn how our experienced professionals can help you navigate the protest process and maximize your potential savings.

Frequently Asked Questions

What happens if I miss the May 15th deadline?

Missing the deadline essentially forfeits your right to protest for the entire tax year. While the ARB technically can grant late protests for “good cause,” these are extremely rare and almost never approved in practice. Once you miss the May 15th deadline, you’re locked into paying taxes on the tax appraised value until the following year’s protest period. This makes meeting the deadline absolutely critical.

Can I protest if my property value seems reasonable?

Yes. Homeowners should protest annually regardless of whether their value appears reasonable, as the protest process is the only way to ensure fair and accurate assessments each year. Avoiding protest property taxes mistakes becomes routine when you understand the annual process.

Should I hire a professional or handle the protest myself?

While you can represent yourself, professional services typically achieve significantly better results due to their expertise in appraisal methodology, sales data and adjustments, local market knowledge, and established relationships with appraisal districts.

What if the ARB doesn’t reduce my value enough?

Any ARB decision can be appealed to the state district court in the county in which the property is located. Depending on the facts and the property type, you may be able to appeal to the State Office of Administrative Hearings (SOAH) or to regular binding arbitration (RBA).