There are over 4,700 taxing entities in Texas that assess property taxes which are then used to fund local services. The primary driver of property taxes in Texas is the real estate market, which over time tends to rise in value. Tax rates can go up as well, but often require voter approval.

The total amount of property tax a property owner owes is calculated using this formula:

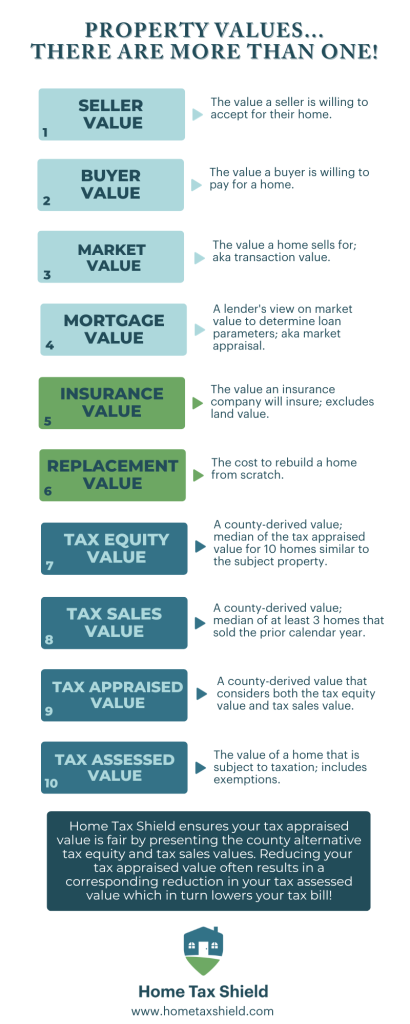

Different Types Of Property Tax Values

There are many different values that your home can have, a taxable value, market value, replacement value, mortgage value, tax equity value, etc. Each value is calculated differently and used for different purposes.

Tax Appraised Value

The county’s reasonable estimate of the value your property would sell for on the open market.

This is not the same as the market value a Realtor might use to determine where to buy or sell a home, which considers interior improvements, landscaping and other aesthetics that the county does not consider. So it’s important to note that taxing authorities calculate their market values very differently than most people value a home. Counties examine over 40 different data points and weight each value to come up with the market/appraised value. This approach to determining value often produces errors, and this is especially true in non-disclosure states, such as Texas where counties don’t have access to actual market transaction data.

Tax Assessed Value

This value is determined by taking your tax appraised value and subtracting exemptions. This is the value of your home that you actually pay taxes on.

Tax Equity Value

This value is determined by examining the county’s appraised values for ALL other homes in your area.

Tax Sales Value

The value is determined by looking at sales comparables and comparing your home to other homes in your area that sold last year.

Values And Protesting Your Property Taxes

By law, protesting your property taxes focuses on the county’s tax appraised value, NOT the assessed value which is created after tax appraised values are set and exemptions are applied. That’s how the Texas property tax system is set up. In most years, appraised value = assessed value so lowering appraised value in a protest lowers your assessed value which saves you money. When the appraised value is higher than the assessed value, that means exemptions are helping keep your assessed value low. In these cases, reducing your appraised value BELOW your assessed value will save you money. By protesting every year, you keep the county’s appraised values in check. Plus, it forces the county to start with a lower value next year when they want to raise your market value again.

To learn more about what types of exemptions are available click here.

Property Tax Rates

Texas has the seventh-highest property tax in the United States. However, property taxes are not administered or collected by the state. Instead over 4,700 different local taxing entities and their elected officials set local property tax rates. These taxes are the primary source of revenue for local governments, schools, water systems, roads, law enforcement and other public services. After each county has certified the value of each property, the values are multiplied by the local tax rates. Tax rates are set in October of each year and any significant increases require voter approval.

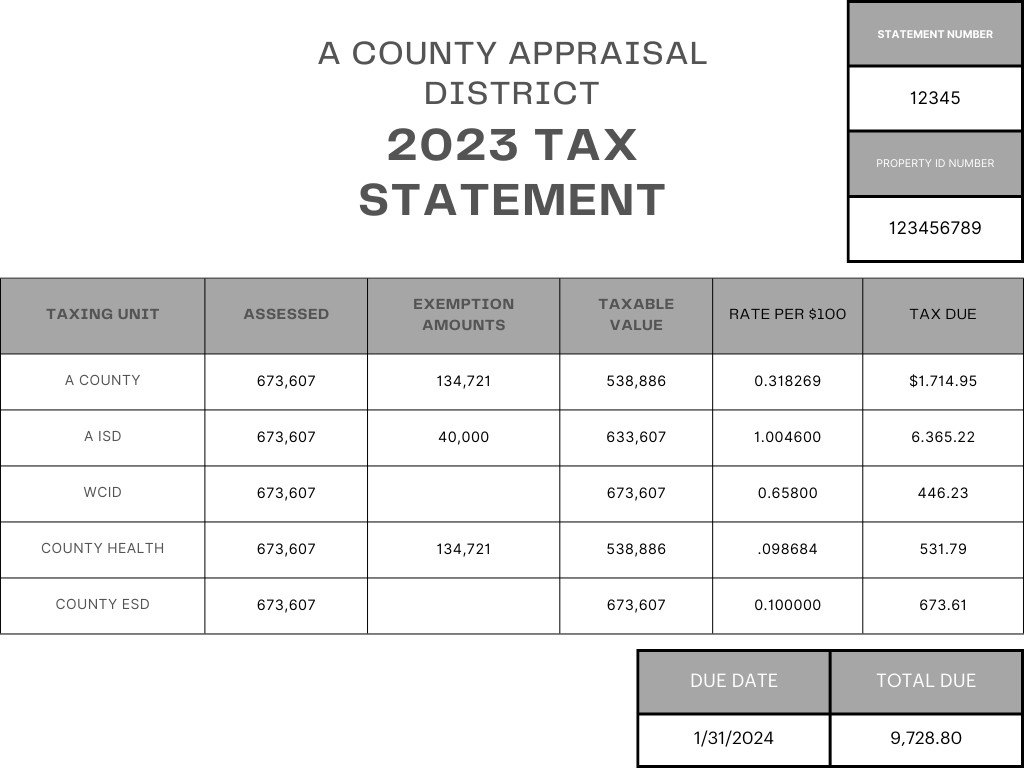

How Are the Tax Bills Calculated

Multiple taxing units like your school district, county, water provider and city tax each property. Most taxpayers will get only one bill from the local county tax assessor-collector that outlines the taxes owed to each taxing unit. For property owners with a mortgage, the tax bill is often sent to your mortgage company who will then pay your property tax bill from your escrow account.

How Property Tax Rates Can Change

By law, taxing units must hold public hearings on changes in their proposed budget and tax rates so that the public is informed. Each taxing unit is required, by law, to generate the same amount of revenue from the previous year if the same rate was applied to the same amount of properties. This means that tax rates can fluctuate every year as the real estate market goes up (or down).

Voter-approval tax rate: Taxing units need to get voter approval before they increase the tax rate beyond a certain amount. The maximum rate varies based on the type of jurisdiction:

- Cities and counties can increase the tax rate by three and a half percent for operating expenses.

- Junior college districts, hospital districts, and special taxing units can increase their tax rates up to eight percent for operating expenses.

- School district funding calculations and the debt tax rate influence the voter-approval tax rate for school districts.

In 2019 the Texas Legislature passed legislation to help Texans better understand tax rates and provide timely information and tax rates. The Texas Property Tax Transparency website is a great resource for discovering future public hearings, proposed budgets and tax rates, and additional information about your county.

Tax Rates And Protesting Your Property Taxes

Your property tax rates are set by your local taxing authorities and you can’t change them without a public vote. It’s important to be aware of any upcoming tax rate votes to vote accordingly and to protest your property taxes every year. Your property value is set by the county appraiser each year and you can challenge that value each and every year.